Bitcoin

Why is crypto down today? Mt. Gox, $250M liquidations, ETH ETFs and…

It might be a while before Bitcoin hits a new ATH on the charts again.

- Bitcoin fell below $60K as ETF outflows and Options expiry sparked market-wide liquidations

- Analyst Ali Martinez warned against a potential liquidation of $1 billion if Bitcoin rebounded to $62,600

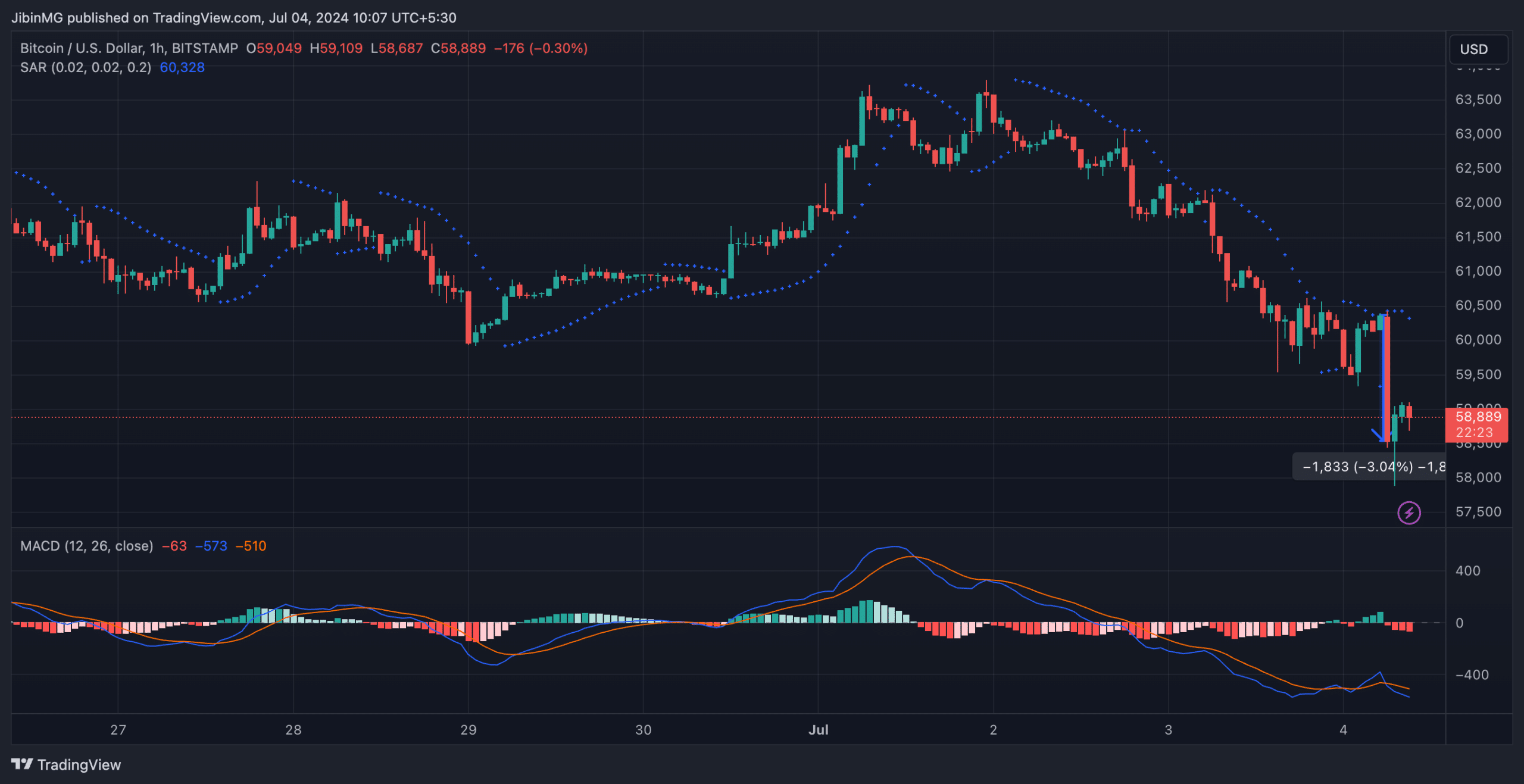

Bitcoin (BTC) is falling again, with the crypto dropping below $60,000 on the price charts. This represented a 4% decline in just 24 hours. In fact, this bout of depreciation marked BTC as the most affected crypto amidst a broader downturn across the market.

This decline coincided with the crypto market’s retreat of over 4% within the last 24 hours, affecting major assets like Bitcoin, Ethereum, DOGE, BNB, and LINK.

It’s worth noting, however, that the Fear & Greed Index had a reading of just 48 at press time, indicating a neutral sentiment among market participants. Simply out, investors are neither overly fearful nor excessively greedy right now, but uncertainty remains prevalent.

This is especially so in light of the fact that Mt. Gox is expected to start repaying its creditors this month. BTC worth over $9 billion is owed to over 127k creditors, many of whom will look to cash in on their unrealized profits – An invitation for selling pressure.

Bitcoin ETF outflows and investor concerns

The outflows from U.S Spot Bitcoin ETFs have contributed significantly to the ongoing market situation. Following five consecutive days of inflows amounting to $129.5 million through 1 July, the trend reversed itself with an outflow of $13.7 million on 2 July.

Source: X

$14.1 million and $5.4 million inflows were recorded from BlackRock IBIT and Fidelity’s FBTC, respectively. However, a significant outflow of $32.4 million from GrayScale mitigated these gains. This shift in ETF movements, consequently, have raised concerns among investors regarding Bitcoin’s price trend.

Concurrently, the impending expiration of substantial BTC and ETH options have also contributed to market volatility. In fact, data from Deribit revealed that BTC options worth over $1.04 billion, with a put/call ratio of 0.80, are set to expire on Friday, 5 July.

The maximum pain price for these options is $63,000, indicating a critical threshold that may influence investor behavior and market dynamics. Consequently, anticipating this expiry has led to cautious trading and increased uncertainty among market participants.

Liquidations intensify market sell-offs

According to CoinGlass, the recent sell-offs triggered over $260 million in liquidations within just 24 hours. Over 100,000 traders were liquidated during this period, with the largest single liquidation involving an ETH-USDT-SWAP on OKX.

Bitcoin faced liquidations totaling $67 million, while Ethereum saw $63 million in liquidations.

Source: Coinglass

Despite the current downturn, however, some analysts remain optimistic about the market’s future. They anticipate potential gains linked to forthcoming regulatory decisions.

That being said, analyst Ali Martinez has warned against the potential for further liquidations. According to him, if Bitcoin rebounds to hit $62,600 again, the market could see over $1 billion in liquidations.

Source: X

Ethereum ETF launch delay

Finally, the delay in the launch of Spot Ethereum ETFs has further contributed to the market’s current pessimism. The SEC has set a new deadline of 8 July for form submissions, delaying the anticipated approval process.

The community is yet to receive this well, with ETF Store President Nate Geraci among those expressing frustration over the prolonged process. Many are now hoping that BTC and the rest of the crypto-market will continue their bull run as soon as these ETFs go live.