Why is crypto down today? BTC derails, SOL, ADA, AVAX take major hits

- Bitcoin’s fluctuations saw altcoins extend price pullbacks

- AVAX and ADA have erased all 2024 gains and dropped to levels last seen in late 2023.

The crypto market was down today as it struggled to shake off last week’s bearish sentiment. According to CoinMarketCap data, the overall market cap was down 1.63% in the past 24 hours.

Notably, Bitcoin [BTC] led the market rout after hitting a monthly low of $64.5K, a level last seen in mid-May.

Why is crypto down today?

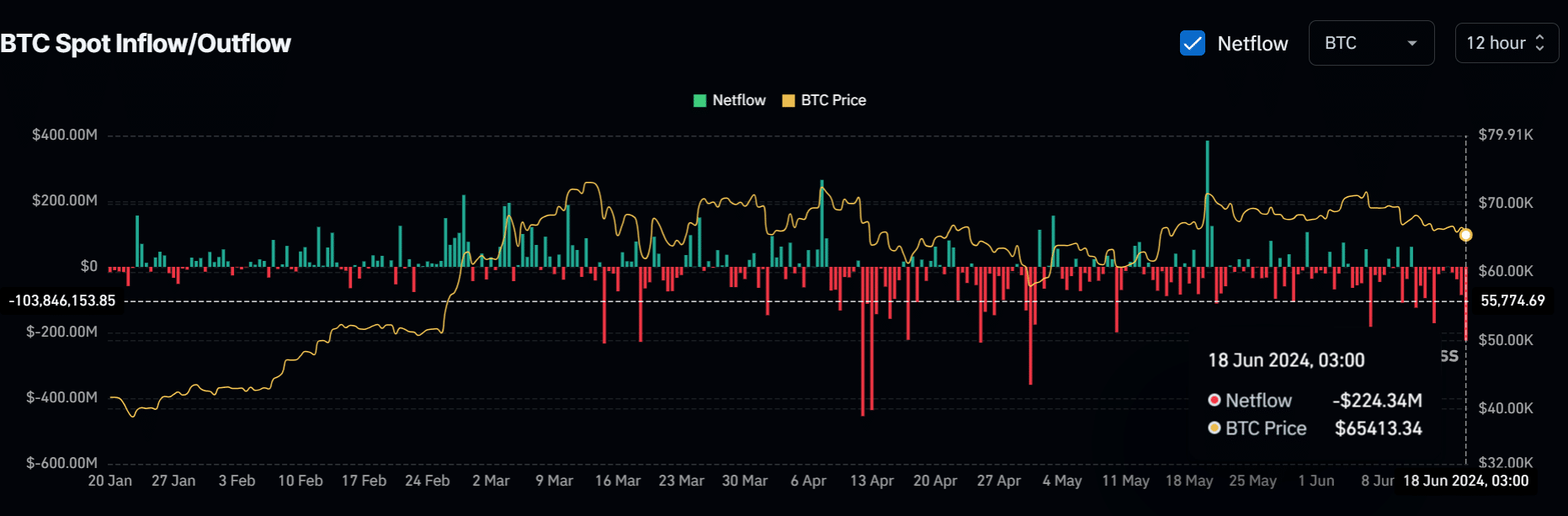

With the drop came massive outflows worth over $200 million, across BTC spot markets, in the past 12 hours alone.

Investors’ risk-off approach to the largest digital asset was also observed on the 17th of June in the U.S. spot BTC ETFs. According to Farside Investors data, the products saw a $145.9 million total outflow on Monday.

It meant that last week’s bearish sentiment was well sustained into the new week.

However, the market rout hit altcoins the hardest, as most of them extended price retracement above 50%. Compared to BTC, the drop to $65K was about a 10% retracement from its March record high of $73.7K.

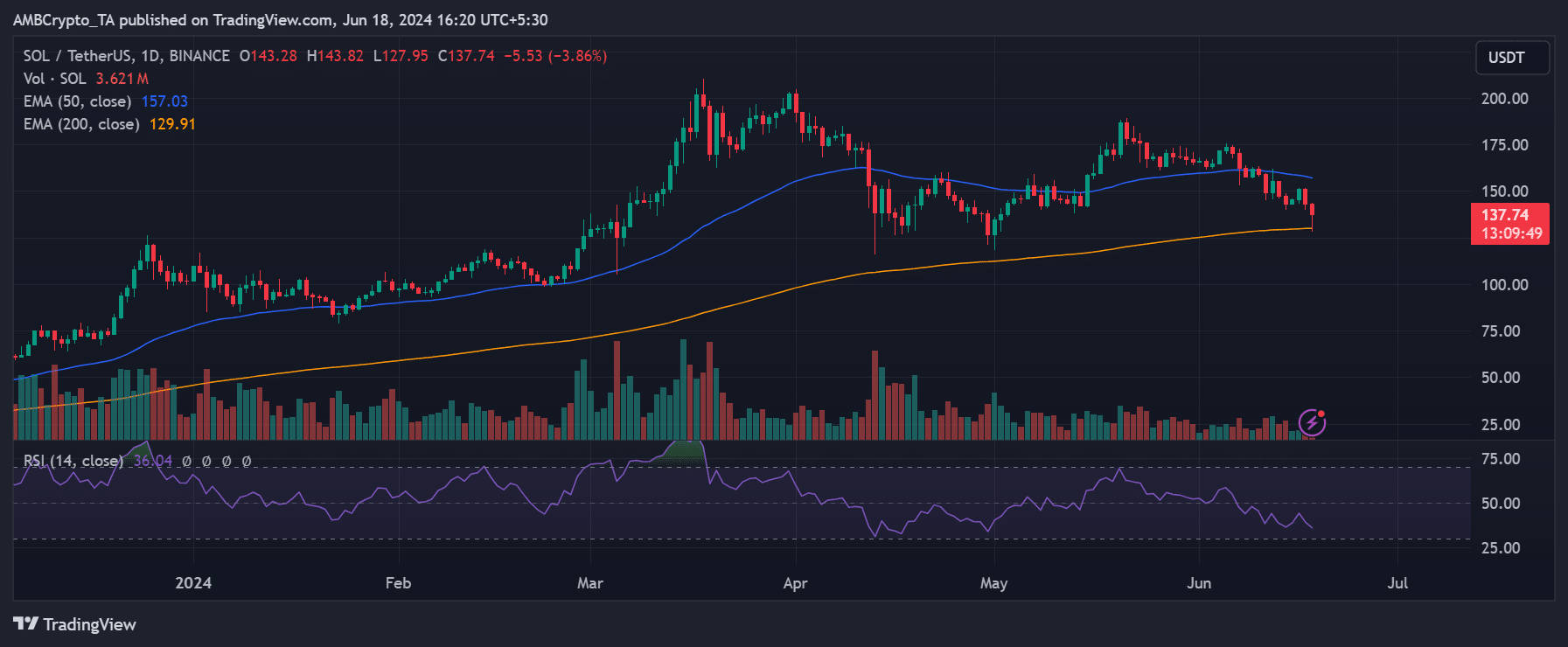

For the home of memecoins, Solana [SOL] was down about 4% in the past 24 hours. Based on its 2024 highs, the drop was about 38% as it traded at $137.

SOL was below its short-term trend (50-day EMA) but saw a slight relief above the 200-day EMA.

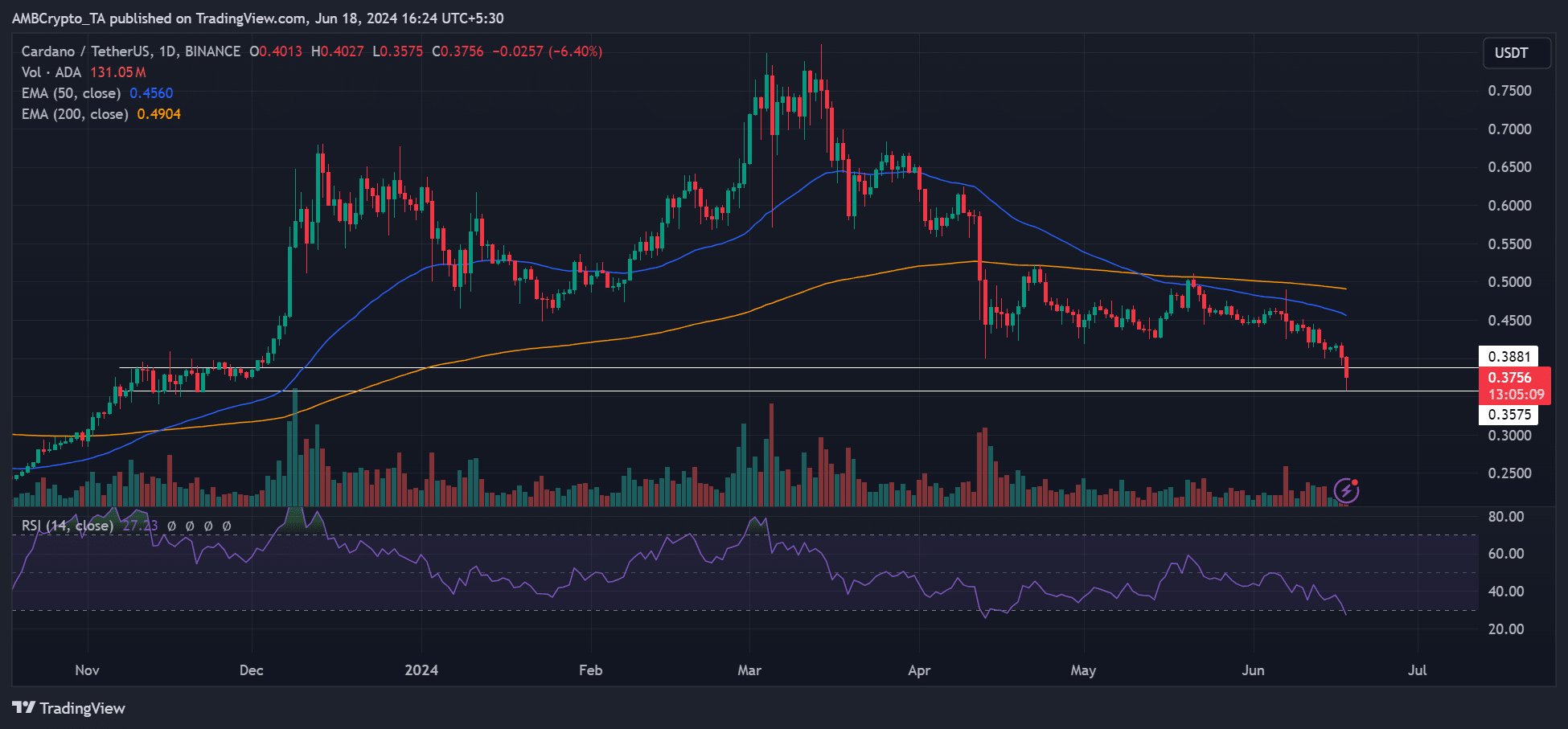

On the other hand, Cardano [ADA] was down 55% from its 2024 highs of $0.8 based on the press time value of $0.37. It retested some levels last seen in November 2023.

Its price had breached below short and long-term trends (50 and 200-day EMAs), reinforcing sellers had a run with the altcoin.

Similarly, Avalanche [AVAX] was down about 10% on the daily charts and hit levels last seen in December 2023. The massive bleedout across altcoins demonstrated that they were worst hit by the market drawdowns.

Is your portfolio green? Check out the BTC Profit Calculator

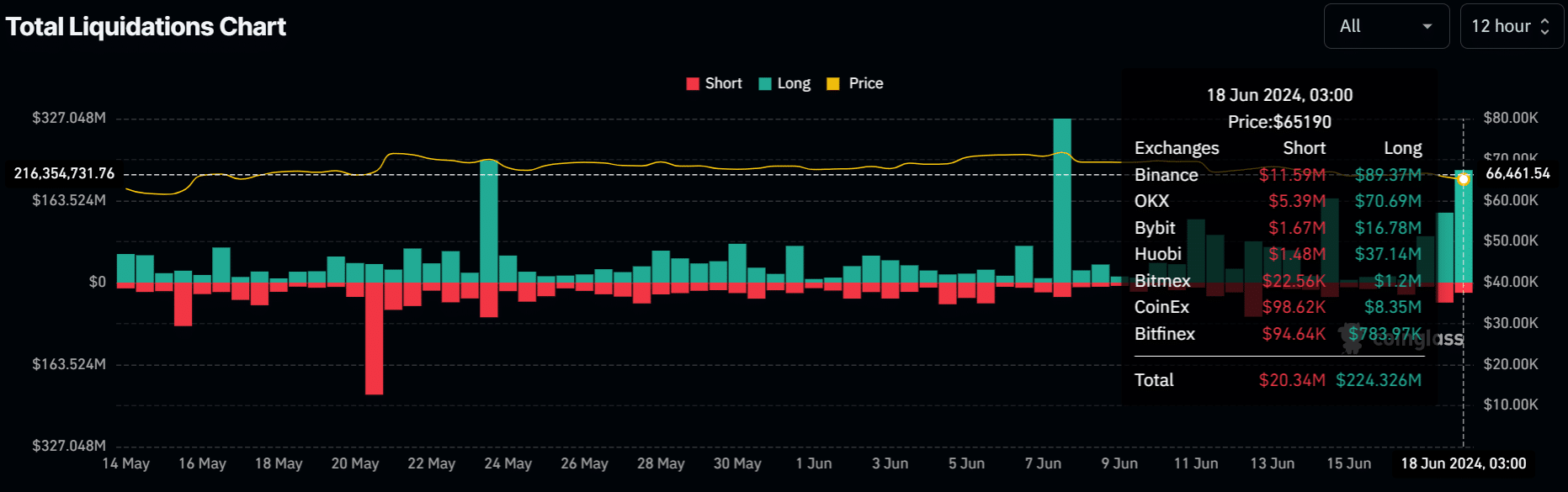

Unfortunately, long positions suffered the most. According to Coinglass data, overall liquidations hit over $240 million, with longs accounting for $224 million worth of rekt positions in the past 12 hours.

The 19th of June will be a U.S. holiday, and most federal banks will close shop. It remains to be seen whether the holiday will slow crypto trading and possibly reduce the bleeding.