Notcoin – Examining Bitcoin and Telegram’s role in altcoin’s fall

- The price can be attributed to different factors, including panic selling and declining trader interest.

- NOT was oversold, and might soon begin a recovery toward $0.012.

Notcoin [NOT], the token of the Telegram-based play-to-earn project, experienced one of its darkest days since its launch on the 4th of July. On the mentioned date, NOT’s price traded at $0.011 in the early hours.

But an unanticipated 18.38% decline in the last 24 hours caused the price to trade lower. At press time, Notcoin changed hands at $0.098.

This was the lowest the price had reached since the sell-off it experienced during the first week of its introduction and airdrop.

What’s behind Notcoin’s plunge?

There are several reasons why Notcoin is dropping. But one factor we cannot take away is Bitcoin [BTC]. Over the past few days, defunct Bitcoin exchange Mt.Gox has been planning to distribute BTC to its creditors.

On the 4th of July, the firm moved some billions of dollars out of cold storage to begin the payouts.

The consequence of that development was panic in the market, as many crypto holders decide to liquidate some of their holdings — Notcoin included.

This decline was in contrast to the fanfare the project built via Telegram adoption. However, the drop in NOT’s price did not end at the spot market’s table.

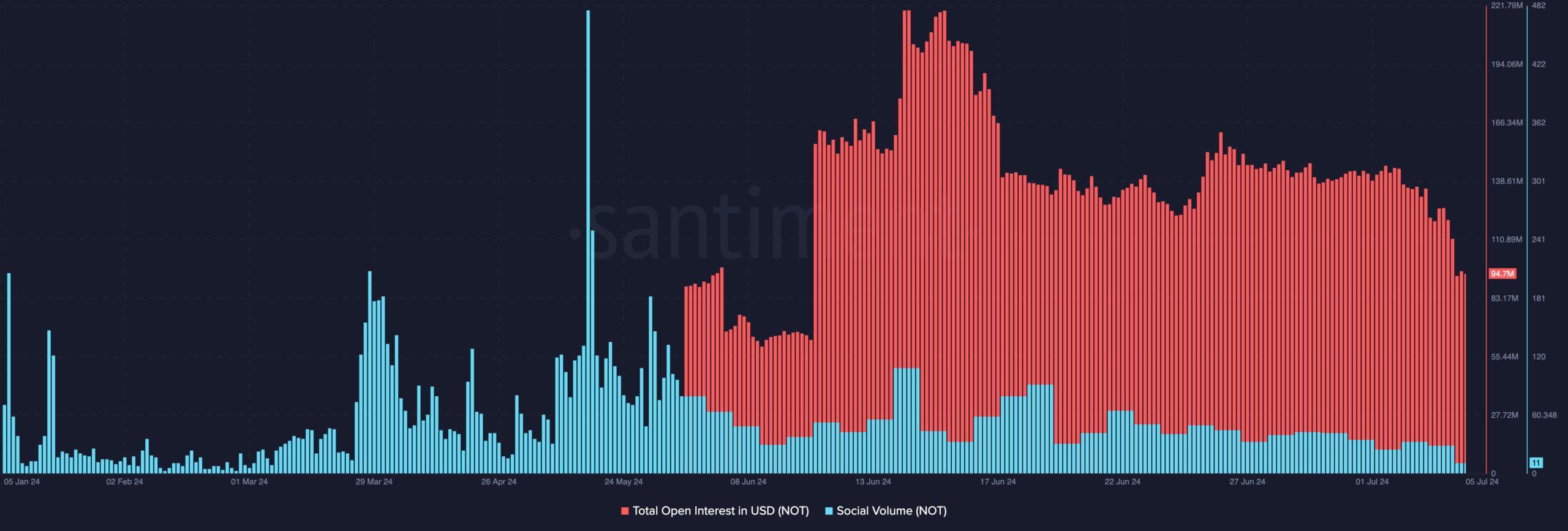

From AMBCrypto’s findings, activities in the derivatives market also played a key part. One crucial indicator that kept Notcoin price at previous high levels was Open Interest (OI).

As of this writing, Notcoin’s total OI has fallen below the $100 million mark. OI measures the value of open contracts in the market.

When it increases, it means that traders are adding more liquidity to the market. However, a decrease, like it was in NOT’s case, imply an increase in closed positions as traders also seem to be moving money out.

If this continues, it could be difficult for Notcoin to erase some of its recent losses. Another notable decline that fueled the drop in NOT price is the Social Volume.

The Social Volume tracks the number of text documents or search for a cryptocurrency. If this increases, the price of an asset, most times, jump. But at press time, Social Volume was down to an extremely low point.

As such, demand for NOT was nowhere close to the selling pressure experienced, eventually leading to a price fall.

On-chain indicators

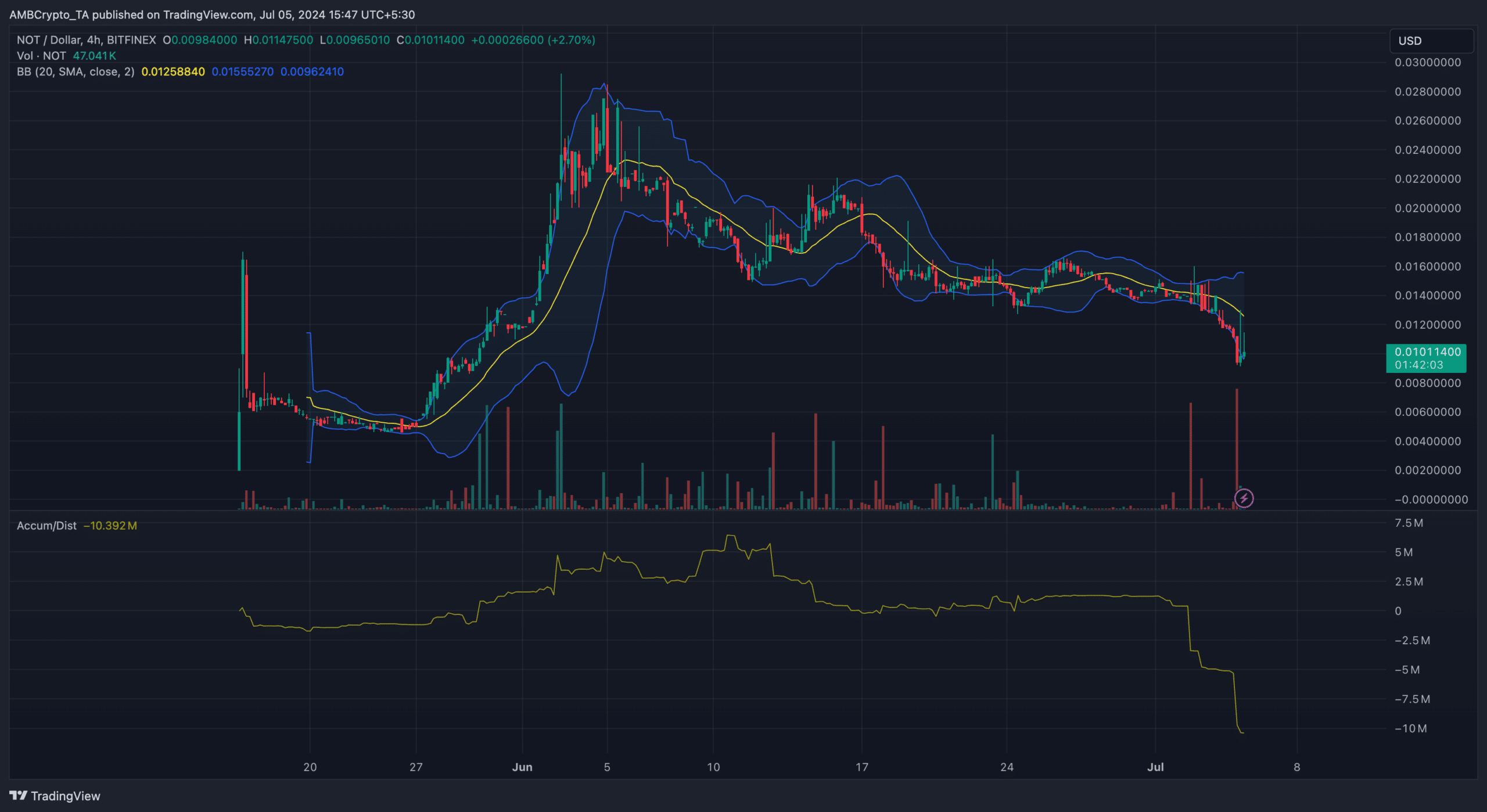

From a technical perspective, AMBCrypto looked at the NOT/USD 4-hour chart. According to our analysis, the Accumulation/Distribution (A/D) line was down to-10.38 million.

This implied that many holders of the cryptocurrency have been selling the token since the 2nd of July. A look at the Bollinger Bands (BB) showed increasing volatility as the bands expanded.

Realistic or not, here’s NOT’s market cap in TON’s terms

Meanwhile, the lower bands of the BB touched Notcoin at $0.093, indicating that the token was oversold. If buying pressure comes into play at this point, NOT could begin a move that takes it toward $0.012.

But if the broader market remains in a fearful state, the forecast might not come to pass. Instead, Notcoin might drop to $0.086.