Why is the crypto market down today? Bitcoin nosedives to $56K!

- Total crypto market cap falls below $2T for the first time since 4th August global markets crash.

- Historical data suggests September is an ideal month for accumulation in anticipation of gains in October.

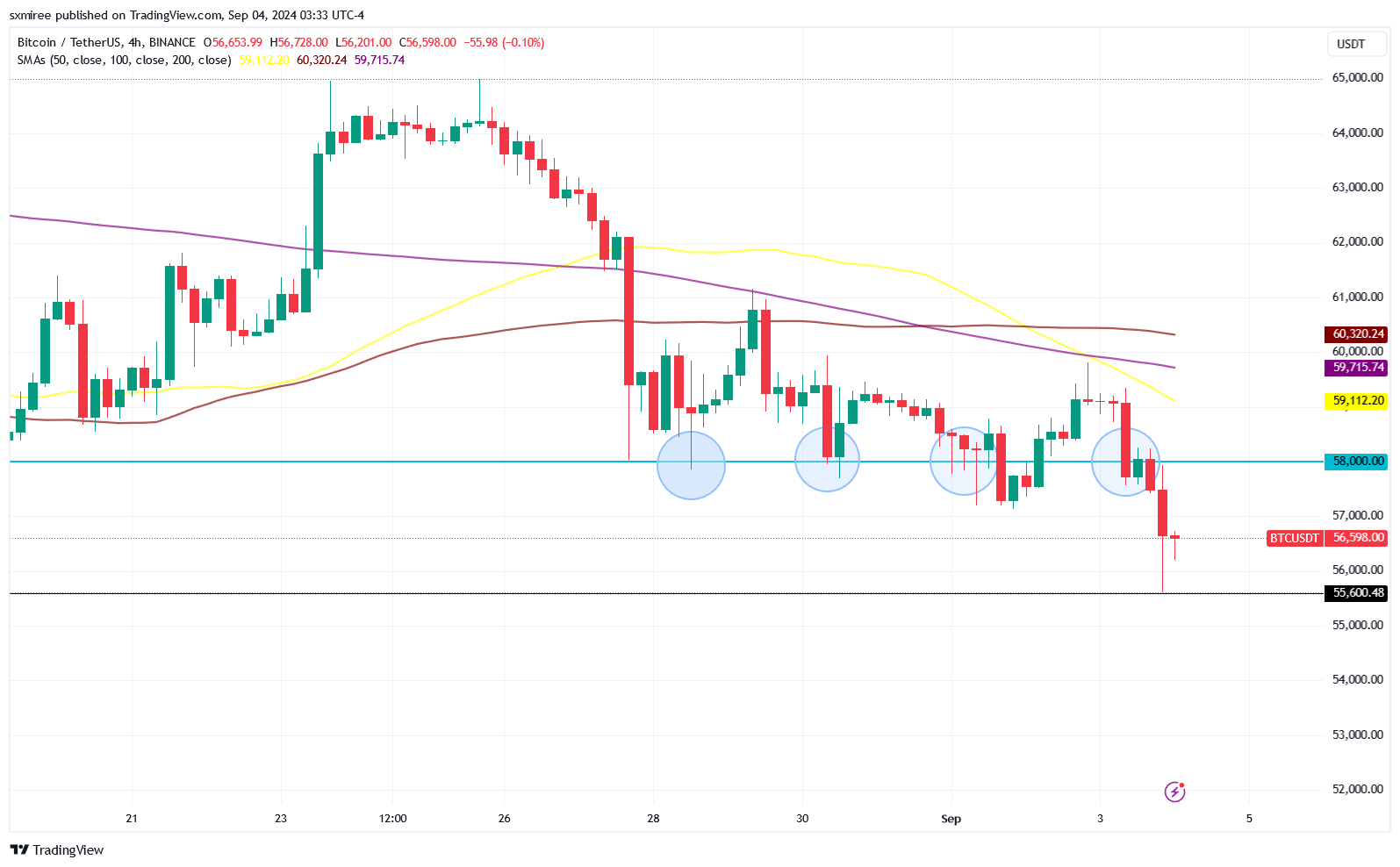

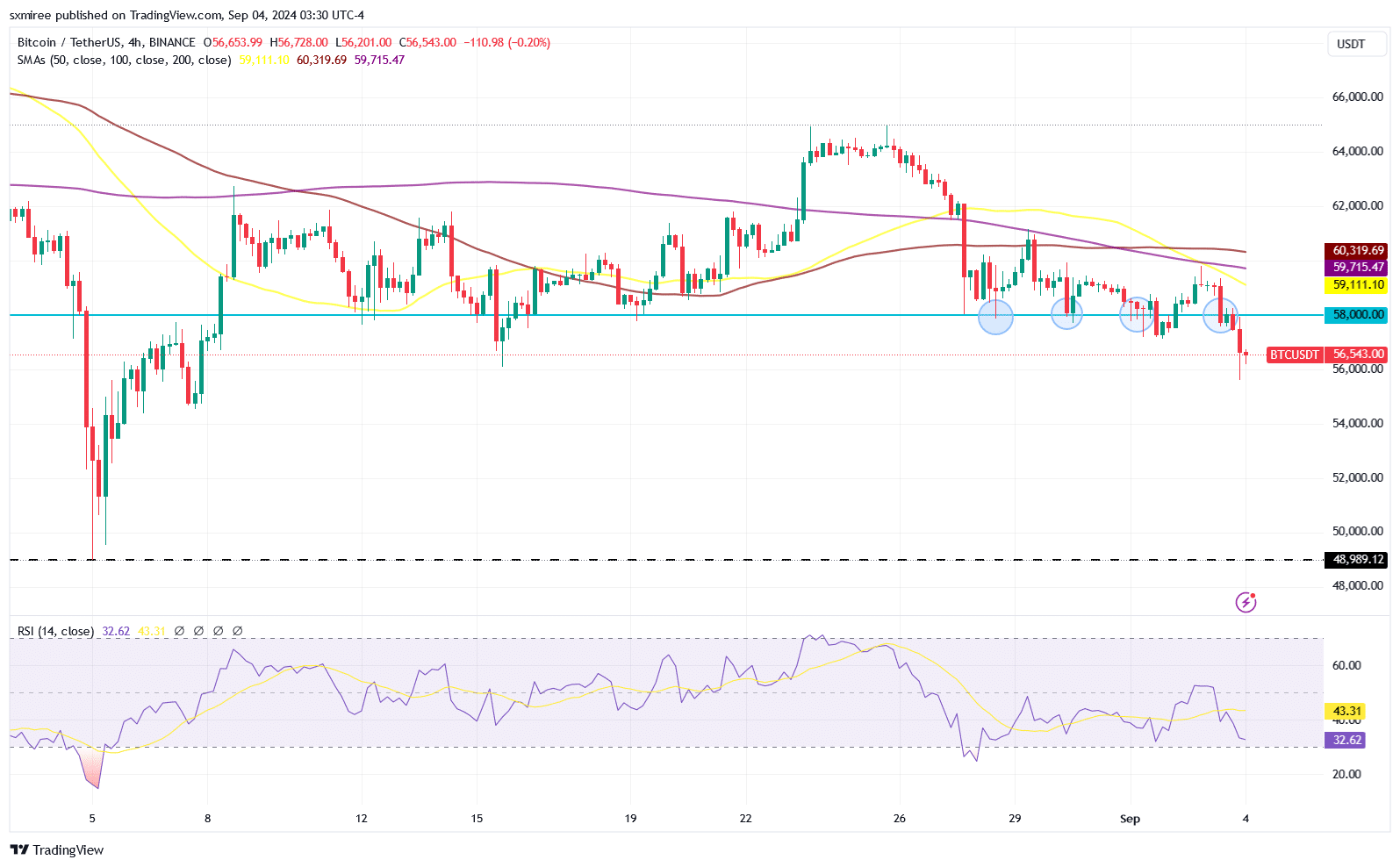

Bitcoin sank below $58,000 on 3rd September, marking the fourth slip below the crucial height in the last seven days on the BTC/USDT 4-hr chart.

The range-bound to bearish price action came on the back of an underwhelming performance in August in which Bitcoin shed 8.6%, per Coinglass data, erasing the mild gains from July.

The flagship cryptocurrency extended the decline early Wednesday, the 4th of September, trading as low as $55,673 on Binance amid a contagion from steep losses across U.S. and Asian equity markets.

“Magnificent 7 stocks have now erased $550 BILLION of market cap today. Nvidia, $NVDA, is on track for its largest daily drop since April 2024,” market commentary resources Kobeissi Letter wrote.

Meanwhile, the total crypto market dropped below $2 trillion at the height of the slump – for the first time since 4th August.

The broader market rout has been attributed to comments from the Bank of Japan (BoJ) Governor hinting at more interest rate hikes which rekindled fears regarding the health of the global economy.

Hauntingly identical crypto market decline

This week’s crypto and stock market sell-off mirrors the global market crash at the beginning of August due to a similar scare after the BoJ raised the benchmark borrowing cost in late July.

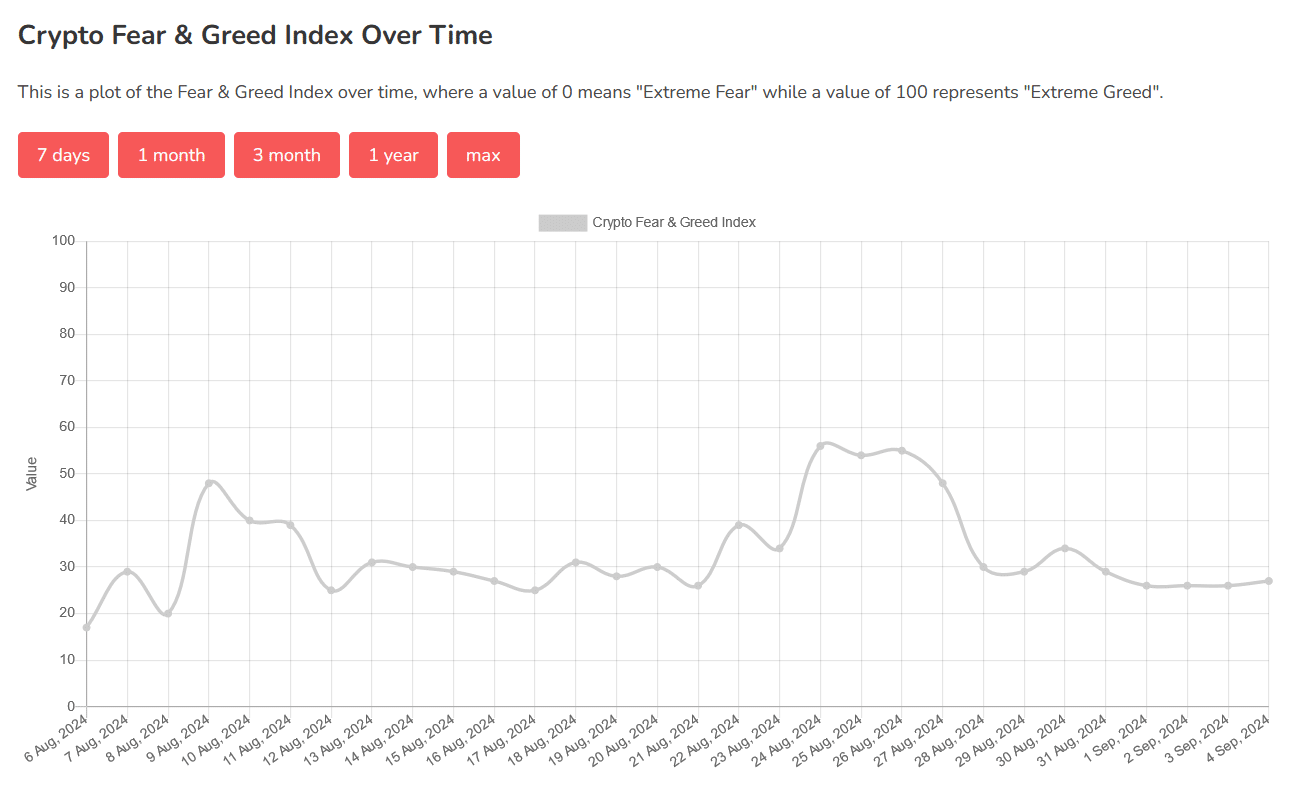

Interestingly, despite the market pullback, the Crypto Fear & Greed Index has moved up to 27 today after being unchanged at 26 points in the first three days of the month.

Though September is historically Bitcoin’s worst month, with an average downside of 4.5%, market participants are still betting on a return of upside movement-inspiring volatility.

Macro volatility: BoJ, Federal Reserve interest rate decisions

A fresh wave of US economic data releases this month, starting with the nonfarm payrolls data for August expected on 6th September, could strengthen or undermine the prevailing narrative of a slowing U.S. economy.

July’s NFP report in early August revealed a rise in the U.S. unemployment rate from 4.1% to 4.3% exerting downward pressure on global markets.

Outside the US, the Bank of Japan policy decision is another factor worth closely tracking. The BoJ’s decision to increase interest rate in late July, combined with a poor US jobs report for July, raised concerns about the Fed lagging in its rate-cutting efforts to the detriment of risk assets in early August.

Consequently, in his 23rd August speech on the US economic outlook, the Federal Reserve Chair asserted that the time for policy adjustment had come.

Expectations are for a 25-basis point cut at the upcoming Federal Open Market Committee (FOMC) meeting on 18th September. An outcome in line with this projection would birth a potentially favorable monetary environment for riskier assets like crypto.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

That said, a weak August US jobs report could compel an aggressive 50-basis point cut, which might escalate recession concerns and lead to a correction.

On the other hand, a strong report could entirely influence the Fed’s decision on whether or not to start cutting rates. Nonetheless, both outcomes present an avenue for volatility.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)