Why is XRP going up? Trump’s victory, Gensler’s exit fuel the surge

- XRP has rallied 370% after Trump’s victory and Gensler’s resignation statement.

- XRP hit a crossroads ahead of likely RLUSD approval and whales’ profit-taking.

Ripple [XRP] saw a massive upswing after Trump’s election victory in November. It was up 372% in the past month.

Over the same period, its market size expanded by nearly 5x, from $29 billion to $138 billion.

This tipped it to briefly flip Tether’s USDT for the third-largest cryptocurrency position by market cap. But what’s driving the rally and bullish market sentiment?

What’s driving XRP?

The first breakout rally was after the US Presidential elections. On the election week, the altcoin pumped 16% after pro-crypto Donald Trump was declared the winner.

In the second week of November, XRP extended its rally by nearly 80% upswing, tapping $1.2 for the first since 2021.

It briefly cooled off and triggered the second leg up on 21st November, which coincided with US SEC’s chair Gary Gensler’s statement on his resignation by 20th January 2025.

The announcement was crucial, as the market perceived it as a tailwind for the blockchain firm. It has been locked in a four-year lawsuit with the regulator on the security status of XRP.

The regulatory issue has kept XRP’s price muted since 2020. Gensler’s likely resignation was a breather for the altcoin. It rallied 35% after the announcement.

Interestingly, the altcoin soared even further in the last week of November, tapping an extra 60% and crossing $2 for the first time since 2018.

Last week’s pump also coincided with reports that the New York regulator would likely approve RLUSD by 4th December.

In August, Ripple announced that the stablecoin was in a private beta testing phase on Ethereum and other blockchains.

According to the firm, it will use RLUSD and XRP for the cross-border payments ecosystem for global reach. Part of the statement read,

“Once RLUSD is available, Ripple will use both RLUSD and XRP in its cross-border payments solution to serve its global customers and dramatically improve their experience.”

This has led to speculation that RLUSD would increase XRP adoption and drive its value, especially with its $1 billion tokens in escrow accounts. The altcoin surged even further to $2.49 amid elevated bullish market sentiment.

What’s next for XRP?

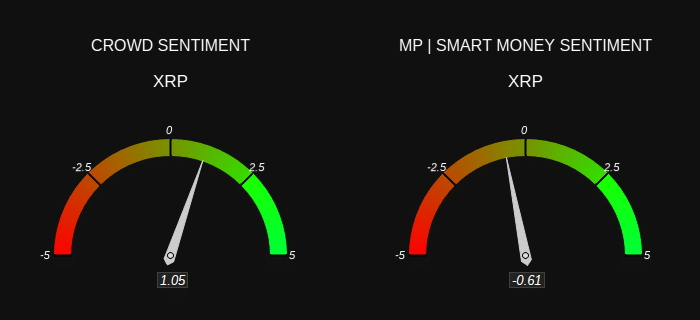

However, smart money turned bearish amid the overwhelming crowd’s bullish, per Market Prohit data.

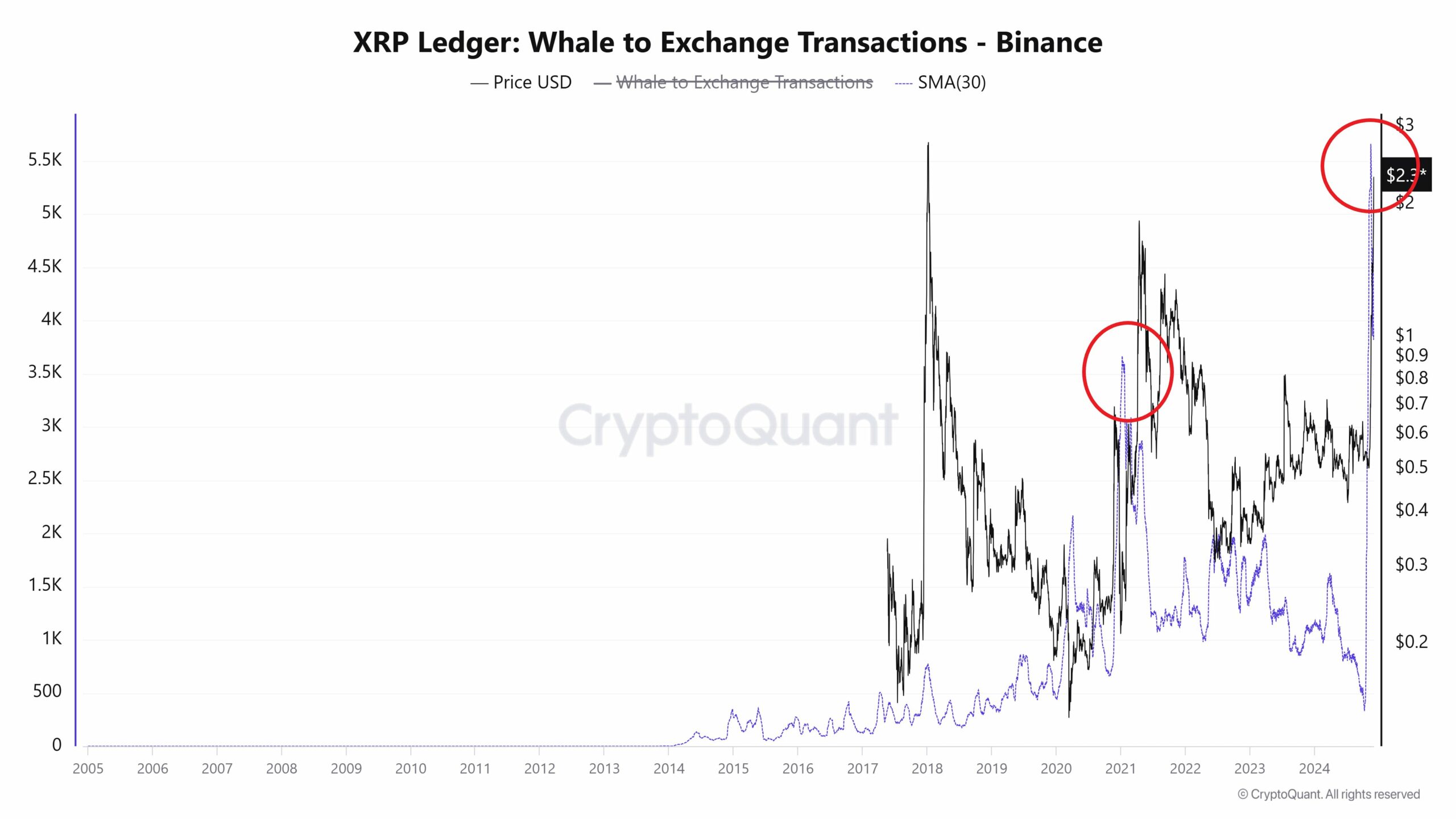

CryptoQuant’s data also supported a possible correction or short-term local top, as whale-to-exchange transactions spiked after XRP hit new cycle highs. This signaled likely profit-taking by large players.