Why LINK decoupled despite alts following Bitcoin’s lead

- Quite some amount of LINK could be liquidated near $20.3.

- Market indicators remained bearish on the token.

The entire crypto market was in a bullish phase, allowing most coins to register green, but Chainlink [LINK] has decoupled from the market.

So, AMBCrypto planned to take a closer look at the token’s state to understand what went wrong.

What caused the plummet?

The market gained bullish momentum thanks to Bitcoin’s [BTC] price action. The king of cryptos reached a new ATH, and the altcoins joined the party soon. However, the same was not true for LINK.

According to CoinMarketCap, Chainlink dropped by more than 2.5% in the last 24 hours.

At the time of writing, LINK was trading at $20.74 with a market capitalization of over $12.17 billion, making it the 14th-largest crypto.

AMBCrypto’s analysis of CryptoQuant’s data revealed quite a few factors that played their parts in the recent price correction. Notably, we found that LINK’s exchange reserve was increasing.

This meant that selling pressure on the token was high. Its number of active addresses and total transactions also declined during the same period.

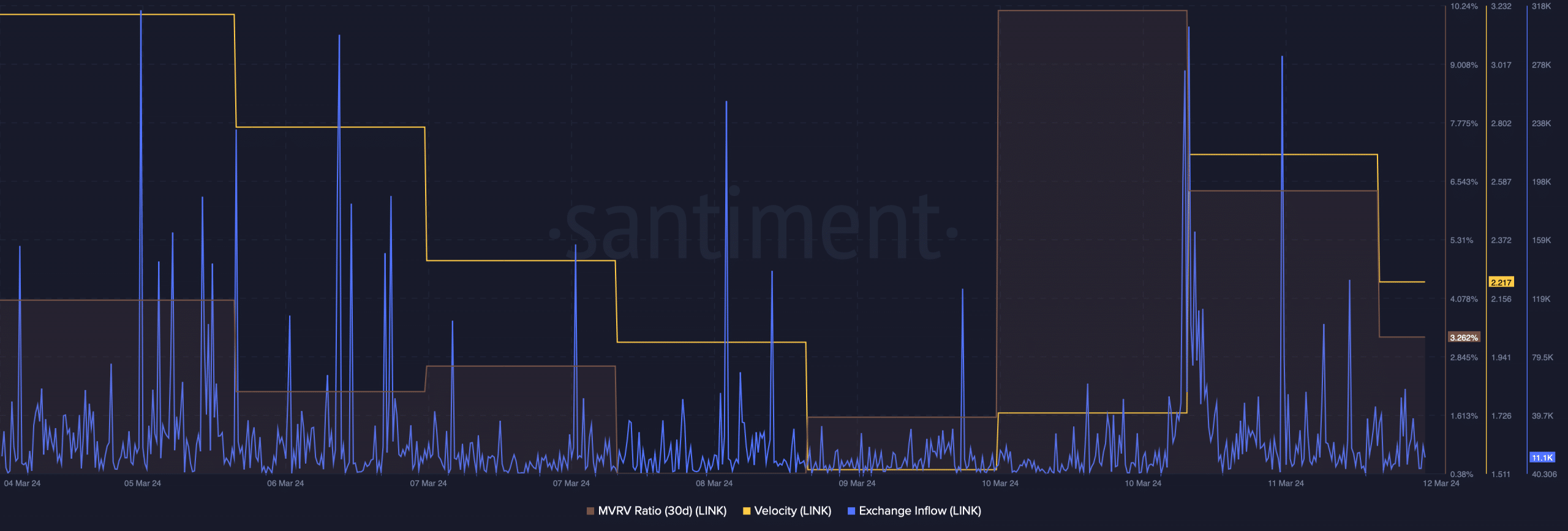

The fact that selling pressure was high was also proven by the spike in LINK’s Exchange Inflow. While the token’s price dropped, its MVRV ratio and Velocity followed a similar declining trend.

Can Chainlink recover anytime soon?

If the price drop continues, a substantial amount of LINK may get liquidated near the $20.39 mark. Generally, when liquidation rises, it exerts more pressure on a token, resulting in a further price drop.

Therefore, Chainlink must remain above that level to showcase a quick recovery. Looking northward, if LINK gains upward momentum, the first target should be $21.

A break above that might allow LINK to push its value further up in the coming days.

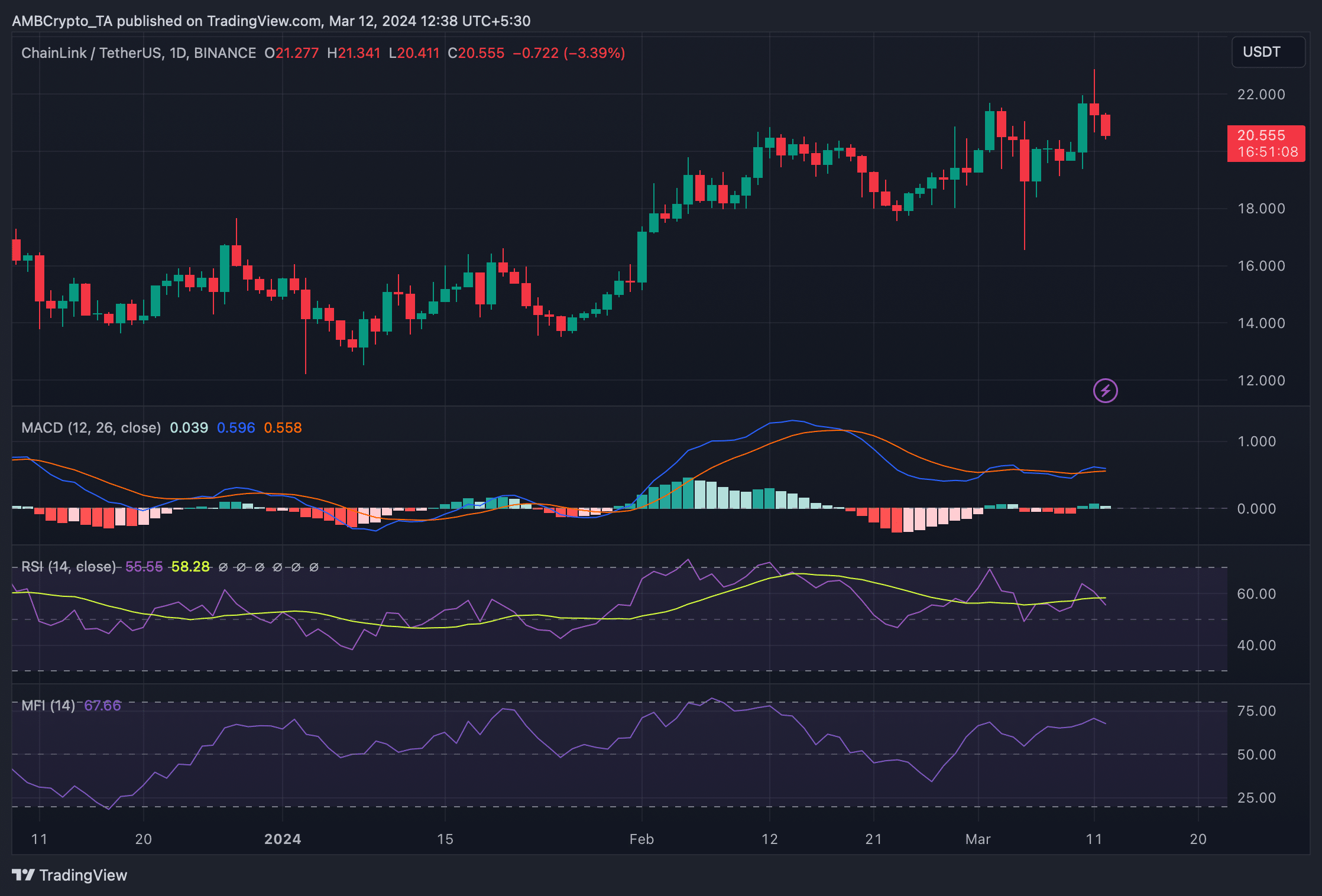

To check whether investors should expect a trend reversal for Chainlink, AMBCrypto then checked the token’s daily chart. As per our analysis, the MACD displayed the possibility of a bearish crossover.

Read Chainlink’s [LINK] Price Prediction 2024-24

LINK’s Relative Strength Index (RSI) registered a downtick and was headed towards the neutral mark. After a rise, the token’s Money Flow Index (MFI) also went down slightly.

These technical indicators suggested that LINK might witness a further drop in price in the days to come.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)