Why Litecoin’s 2023 halving may not repeat its historical rally

- The Litecoin halving would happen later in the year, but there was no clear sign that there would be a repeat of previous cycles’ rally.

- Long-term LTC investors could be waiting for the event’s aftermath before selling for profit.

After undergoing two halving events in 2015 and 2019, respectively, Litecoin [LTC] would go through its third halving event by August 2023. The famed event, which occurs every four years, will end with a 50% reduction in newly minted Litecoins.

How many LTCs can you get for $1?

Historically, the event has been one to offer investors a breath of fresh air. With this year’s own fast approaching, holders would hope that LTC replicates its usual aftermath performance. But could this year produce a similar outcome, considering the market’s turbulent conditions?

A performance repeat for the two-time champion?

LTC itself had not done badly. In the last quarter of the previous year, it was one of the best performing cryptocurrencies. Over the past week, it has built on that legacy with a 7.25% increase.

In the lead up to the previous halving, LTC bottomed then picked up a price increase. In 2025, the coin rallied 820% before the event, whilst 2019 produced a 550% uptick in similar circumstances.

The previous cycles also saw LTC sharply lose value immediately after the halving then put up a wonderful performance afterwards. With over 200 days left for the next one, the technical outlook showed that there was less likelihood that the pre-halving events would be repeated.

Indications from the Exponential Moving Average (EMA) revealed that the mid-term LTC view might not be a buyers’ market. This was because the 50 EMA (blue) rose above the 200 EMA (yellow). Such situations usually end up with consolation or a price decline. However, that does not completely neutralize the projection for greens.

In the short term, however, LTC might continue to hold bullish grounds. This was because the Awesome Oscillator (AO) was far above equilibrium. Moreso, the AO set forth a bullish twin peak which could be enough to keep LTC in the upward momentum.

LTC holders remain steadfast in faith

However, there had been calls from analysts who opined that Litecoin could not escape the pre-halving and post-halving repetition. Renowned crypto trader and analyst Rekt Capital also shared the same views via his Twitter page on 8 January. However, he noted that there would be instances of compression and volatility prior to the event.

Are your holdings flashing green? Check the LTC Profit Calculator

Meanwhile, while Grayscale Bitcoin [GBTC] was busy with a few challenges, as its Litecoin Trust made an impressive start to the new year. At press time, LTC’s value was $82.08.

Interesting start to the year.. @Grayscale $LTCN #Litecoin Trust pic.twitter.com/4BB6gsgLP6

— Litecoin (@litecoin) January 10, 2023

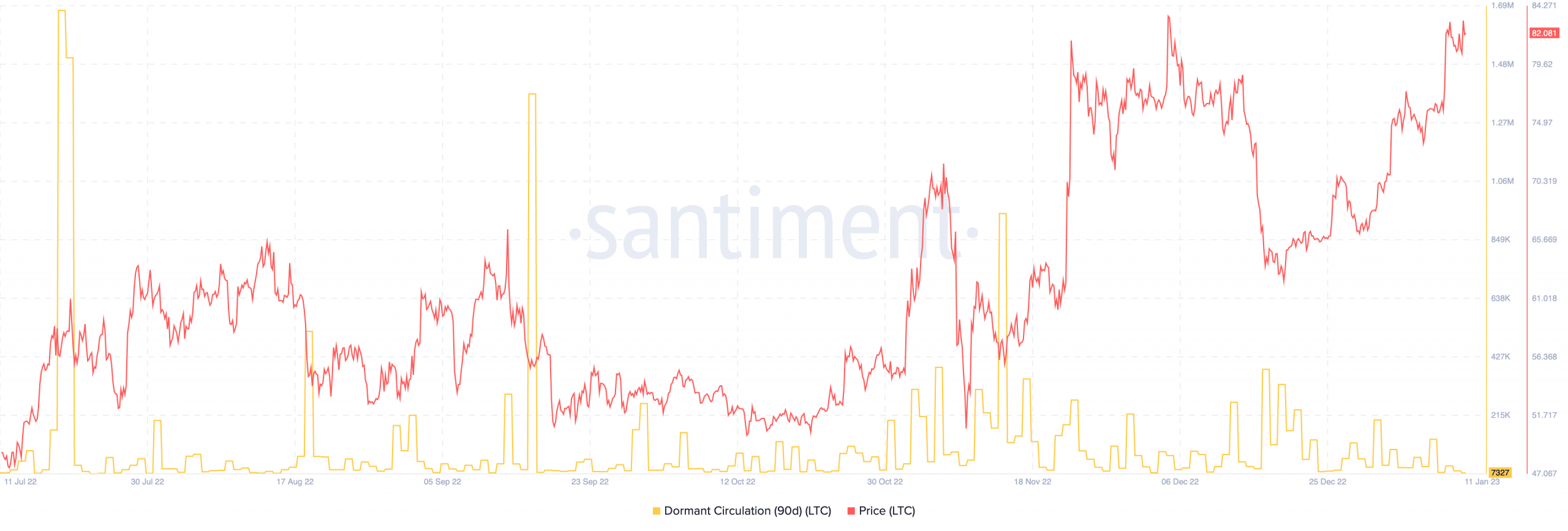

On the other hand, data from Santiment showed that the 90-day dormant circulation was down at 7237. This meant that a high number of long-term holders had not moved their LTC within the last three months. The resolve could also imply a commitment to hold till the outcome of the halving.

According to the Litecoin Halving website, the event is billed to take place on 3 August 2023, at exactly 9:59:24 UTC, barring any changes. This halving will also produce 6.25 LTC as a reward for miners. At press time, Litecoin’s hashrate was 631.56 TH/s, and is projected to increase as the halving draws closer.

![Litecoin [LTC] price action](https://ambcrypto.com/wp-content/uploads/2023/01/LTCUSD_2023-01-11_12-52-21.png)

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)