Why low Bitcoin dominance doesn’t make altcoins immune to market falls

- Bitcoin dominance has dropped, causing altcoins to evolve into ‘safe havens’ during high-risk periods.

- However, full independence is still a long way off, as altcoins remain vulnerable to Bitcoin’s swings.

The past 20 days have been a rollercoaster for the crypto market, filled with wild swings and intense emotions.

It all kicked off with Bitcoin [BTC] blasting to a new all-time high of $99,317, propelling its market dominance to a commanding 61%.

But just as quickly as the excitement built, the market began to cool off, leaving everyone wondering: what’s next?

Bears have certainly made it clear that reaching $100K won’t be a walk in the park – patience will be tested.

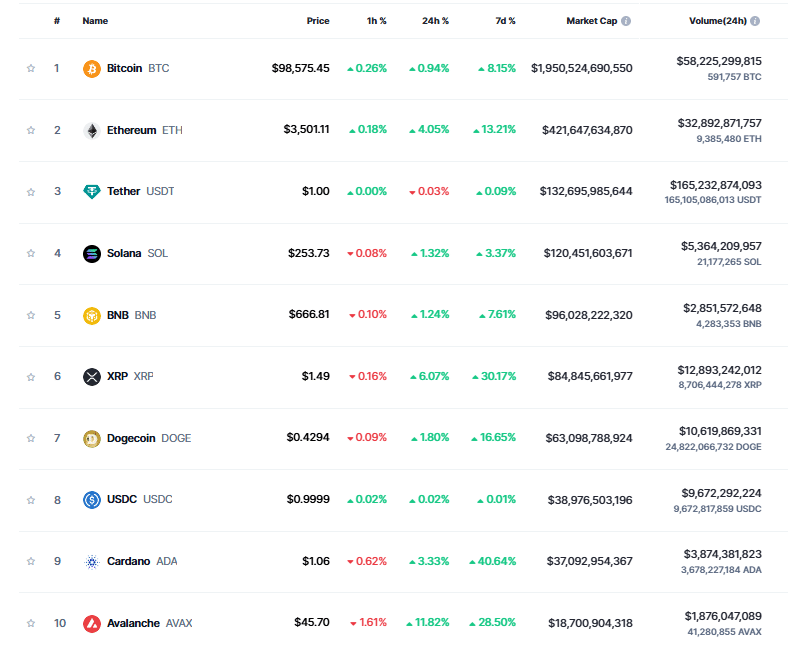

As a result, another day has passed with the target still out of reach, with Bitcoin now trading at $98,300, and its dominance slipping below 59%.

Amidst the uncertainty, altcoins have emerged as the biggest winners, with some achieving triple-digit gains in less than a week.

The high stakes tied to Bitcoin seem to have shifted investor focus toward more affordable assets.

Still, the fate of altcoins remains tethered to Bitcoin’s performance. While consolidation has allowed many to smash through key psychological resistance levels, a Bitcoin pullback could swiftly reverse these gains.

Altcoins must focus on ‘unique’ strengths

It is true that an underlying shift is gaining momentum in the market. Historically, altcoins closely followed Bitcoin’s movements.

However, in recent cycles, altcoins have been diverging, establishing themselves as a distinct asset class.

For instance, on the one-day timeframe, Ethereum has reclaimed the $3,500 resistance level, a target last seen in July.

In fact, ETH is just one among many altcoins achieving key price milestones in this cycle, including breaking the elusive $1 mark.

This shift aligns with a steady decline in Bitcoin dominance over the past four days. Contrary to popular belief, a drop in Bitcoin dominance doesn’t automatically indicate a bearish phase.

Instead, it reflects the growing traction of altcoins as they capture a larger share of the market.

As discussed, this is often driven by investors reallocating profits from Bitcoin’s rise into altcoins to diversify and seek higher returns.

However, achieving true independence from Bitcoin’s market swings requires focusing on the unique strengths of individual altcoins to distinguish them from broader market volatility.

Solana [SOL], for instance, has emerged as a standout, renowned for its high throughput and lightning-fast transaction speeds, positioning it as a promising contender.

That said, a full-scale decoupling of altcoins from Bitcoin remains in its infancy. Currently, only a handful of altcoins exhibit significant independence.

Therefore, until more altcoins demonstrate similar resilience, their correlation to Bitcoin’s performance remains largely unchallenged. Therefore,

If Bitcoin dominance falters, it could drag the market down

With Bitcoin stalling below $100K after 20 days of market excitement, analysts suggest a healthy retracement is due, as signs of overheating grow more apparent.

As per AMBCrypto, a pullback to the $96K–$98K range would likely maintain market confidence, given BTC’s week-long fluctuations within this band.

However, a dip below this range could spell trouble, particularly for altcoins.

In March, after Bitcoin reached its previous ATH of $73K, a 5% decline over the next two days triggered panic, causing Bitcoin to drop to $69K, and its dominance to fall to around 50%.

This led to a market-wide crash, with altcoins suffering even more severely. However, much has changed since then, with select altcoins now emerging as ‘safe havens’ during periods of high risk.

While a reaction as severe as last time may not unfold, a correction remains inevitable, as altcoin movements remain closely tied to Bitcoin’s.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Therefore, if Bitcoin’s dominance falters and it retraces below $95K, altcoins will likely follow suit.

Despite growing confidence in certain altcoins, their status as safe players won’t shield them from losses, as investors pullback, fearing broader market slippage.