Why Notcoin holders should be cautious of NOT’s latest rally

- The RSI and the Bollinger bands showed NOT is set to jump higher soon

- The OI increase showed speculators are eager to go long, but this might also set up ideal conditions for a long squeeze

Notcoin [NOT] saw a 62% rally over the weekend after the 40% drop over the past week. The price of Notcoin is now higher than it was on Monday, the 1st of July.

Additionally, it was accompanied by a large increase in trading volume, with the daily volume soaring by just over 300% on Sunday, the 7th of July.

The effect of Bitcoin’s [BTC] bearish sentiment last week showed strong signs of wearing off. AMBCrypto took a closer look at the NOT charts to understand whether the bulls can take prices back to the $0.03 highs.

The NOT trendline breakout has been solidly bullish thus far

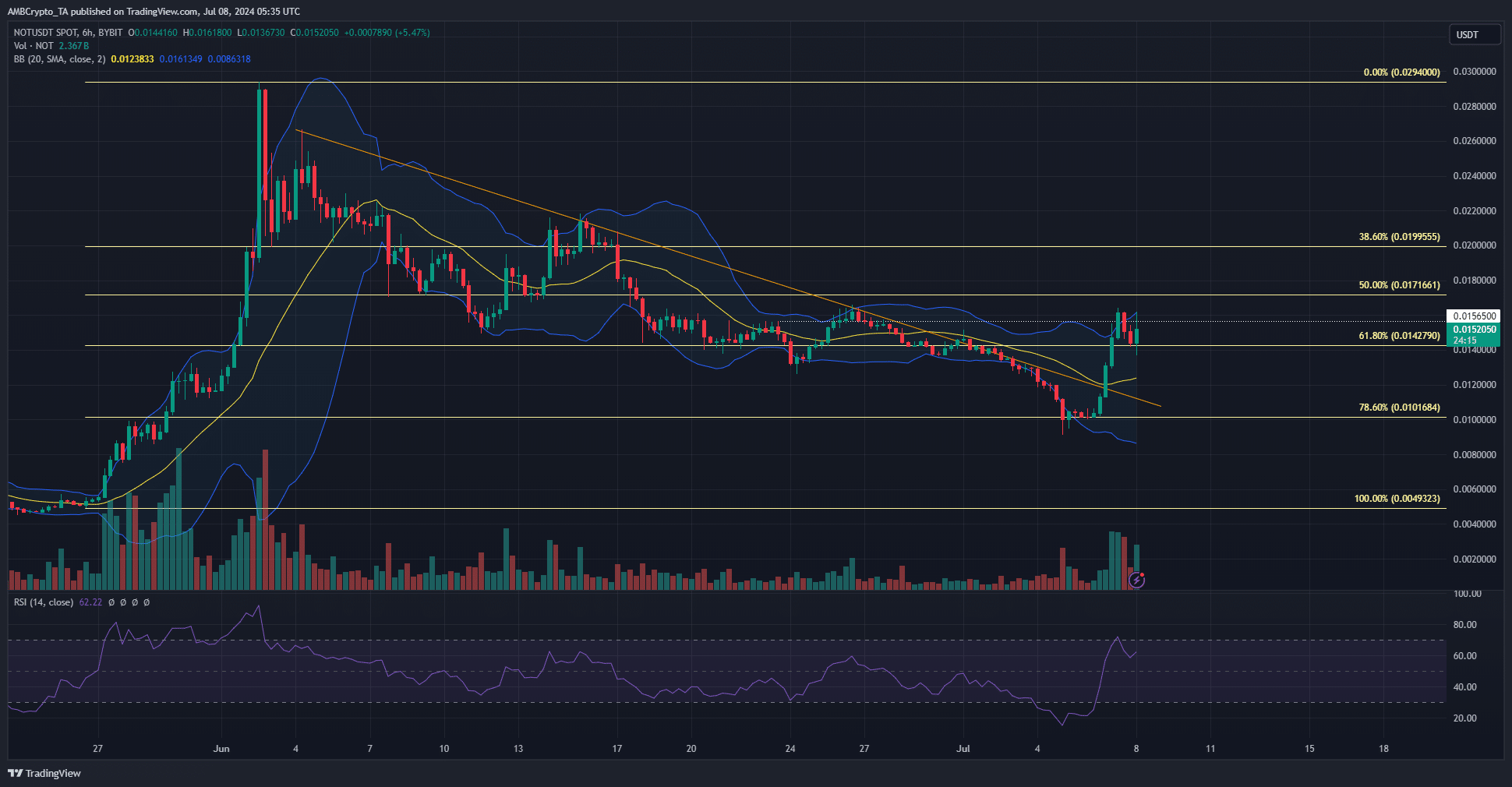

The 6-hour chart of Notcoin showed that the token has been in a retracement phase since the second week of June. The Fibonacci retracement levels saw the 50%, 61.8%, and 78.6% levels tested as support.

The final one was defended over the last few days even though the market-wide sentiment was bearish. The increased trading volume during the price bounce was also encouraging. This bounce saw Notcoin break the bearish market structure and also the trendline resistance.

The Bollinger bands began to expand to denote volatility, and the RSI was above neutral 50. It is expected that NOT can continue its uptrend to reach $0.03 in July, but this is dependent on BTC’s trend too.

Other metrics disagreed with the recent rally’s sustainability

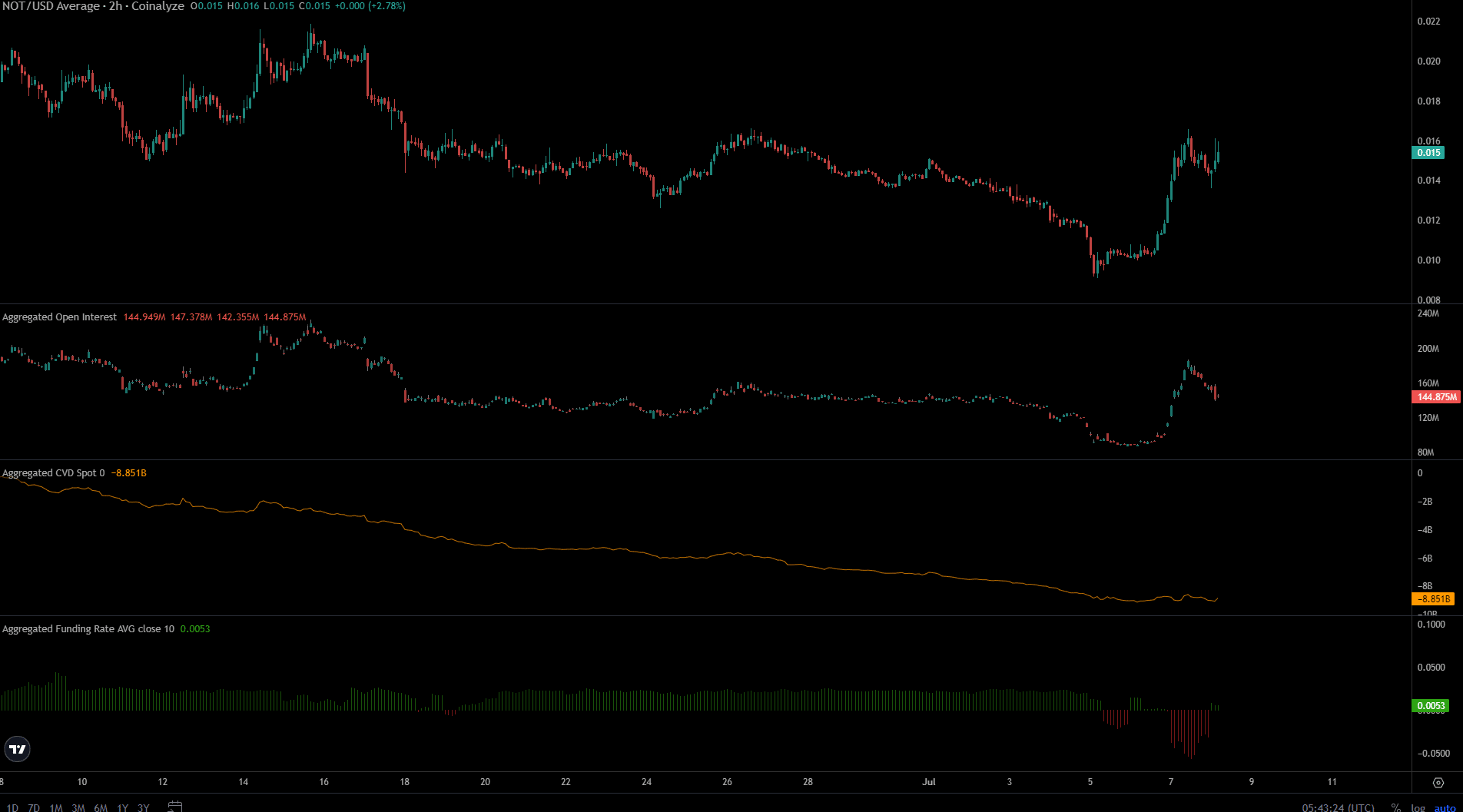

Source: Coinalyze

Even though the price action and volume were firmly bullish, the spot CVD has not climbed noticeably from its slump in June. This suggested that the selling pressure has been so high for so long that the bulls still have an uphill battle ahead to turn things around.

Read Notcoin’s [NOT] Price Prediction 2024-25

The Open Interest rose considerably to indicate short-term bullish sentiment. However, the funding rate was barely above zero.

Thus the two futures metrics did not agree on speculator conviction, but we can conclude that in the short-term, futures traders are getting more eager to go long on Notcoin.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.