Analysis

Why Polkadot has potential to rebound from this defending level

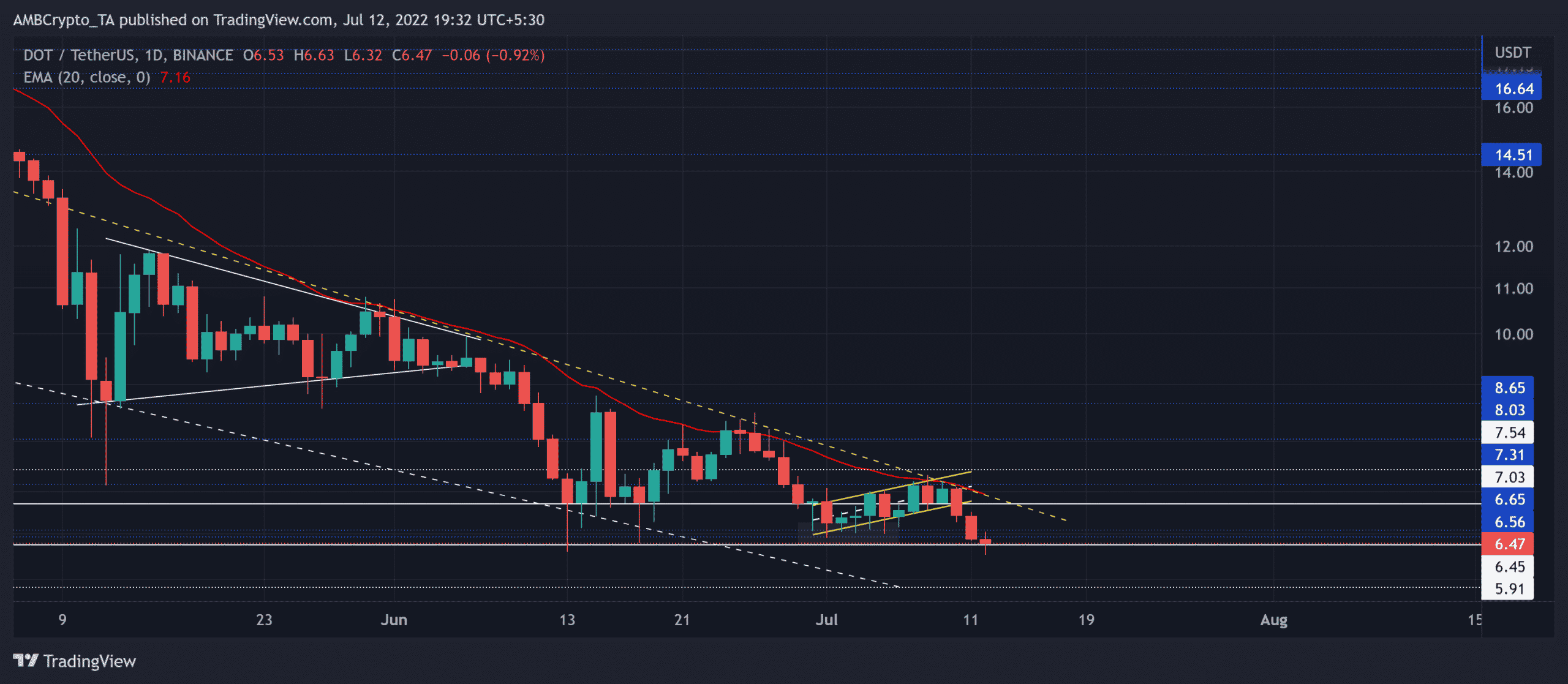

Polkadot [DOT] continued its downward movement below its four-month trendline resistance (yellow, dashed). The current structure found immediate grounds in the $6.45-zone. A rebound from its long-term support can position the alt for near-term revival.

While the long-term tendencies played out in favor of the sellers, DOT needed to topple the 20 EMA (red) to reignite the chances of a strong comeback. At press time, DOT traded at $6.47, up by 4.13% in the last 24 hours.

DOT Daily Chart

The recent liquidations pulled DOT toward its 17-month low on 13 June after an over 66% 51-day decline. Post this, the buying pressure seemingly saw a spike after a bullish hammer. But the trendline resistance and the 20 EMA visibly kept control of the buying rallies.

Should the current candlestick close above the immediate support, it would affirm the chances of a near-term revival on the chart.

After breaking down from the recent bearish flag, the alt lost nearly 10% of its value while approaching the $6.4-baseline. Traders/investors should watch for the close beyond the $6.45-$6.5 range to test the effectiveness of the buying vigor. In this case, the potential targets would lie in the $7-zone near the 20 EMA.

An inability to close beyond this range could position the alt for an undesired decline in the coming sessions. Any retracements below the $6.4-mark would expose DOT to a further 8-10% downside.

Rationale

After endeavoring to break the limitations of the midline, the RSI fell back into bearish territory. To change this narrative, the buyers had to find a position above the midline.

However, the Accumulation/Distribution saw higher peaks over the last two weeks and affirmed a bullish divergence with price. But the ADX displayed a substantially weak directional trend for the alt.

Conclusion

Given the immediate support at the $6.45-mark alongside a bullish divergence on A/D, DOT could see a near-term recovery before falling back into the bearish track. The targets would remain the same as above.

Finally, an overall market sentiment analysis becomes vital to complement the technical factors to make a profitable move.