Polygon’s latest ‘win’ – What it means after MATIC’s 21% drop

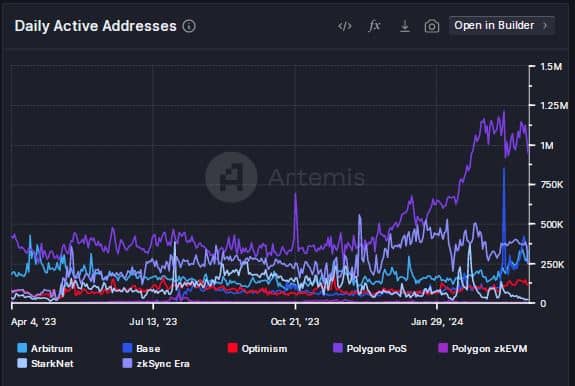

- Polygon comprehensively surpassed other ETH scaling networks in daily active user count.

- MATIC was in the red, plunging more than 12% over the week.

The bull market has brought users back to Polygon [MATIC], and how!

Polygon sees high user interest

The proof-of-stake (PoS) network recorded more than a million daily active addresses on average last month, with just two days experiencing less than 1 million users, according to AMBCrypto’s analysis of Artemis’ data.

In fact, Polygon comprehensively surpassed other Ethereum [ETH] scaling networks in user engagement.

To get a sense of the dominance, the second-best chain on the list, zkSync Era, recorded roughly a third of Polygon’s daily active user count last month.

Since the beginning of 2024, the number of users interacting with Polygon has more than doubled.

This was a sharp turnaround from the drought of last year’s bear market, when daily active addresses fluctuated between 300k and 400k.

Liquidity spike on Polygon

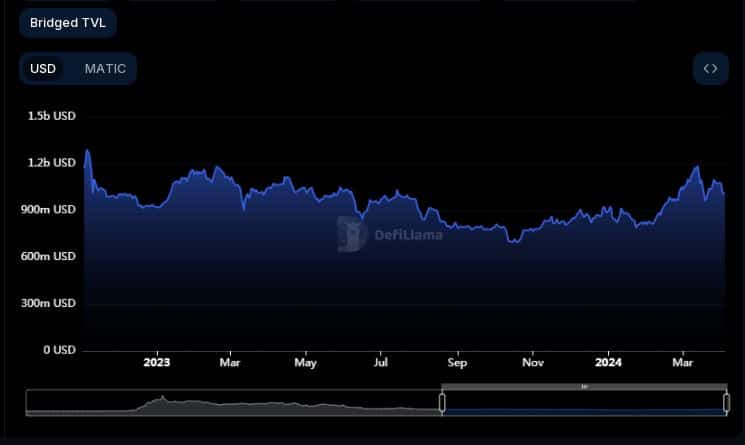

The onboarding of users also caused a significant spike in Polygon’s liquidity. As per AMBCrypto’s analysis of DeFiLlama‘s data, the total value locked (TVL) broke past $1 billion last month, a first since June 2023.

The current levels were closer to 2023 peaks, meaning that losses made last year have been effectively erased.

The next target would be the $2 billion-mark hit in August 2022, and subsequently the all-time high (ATH) of $9.8 billion in June 2021.

MATIC still in the red

But despite Polygon’s exploits on the network front, the native token MATIC continued to trend lower.

The 17th largest cryptocurrency plunged 12% over the week, and more than 21% in the last 30 days, according to CoinMarketCap.

Is your portfolio green? Check out the MATIC Profit Calculator

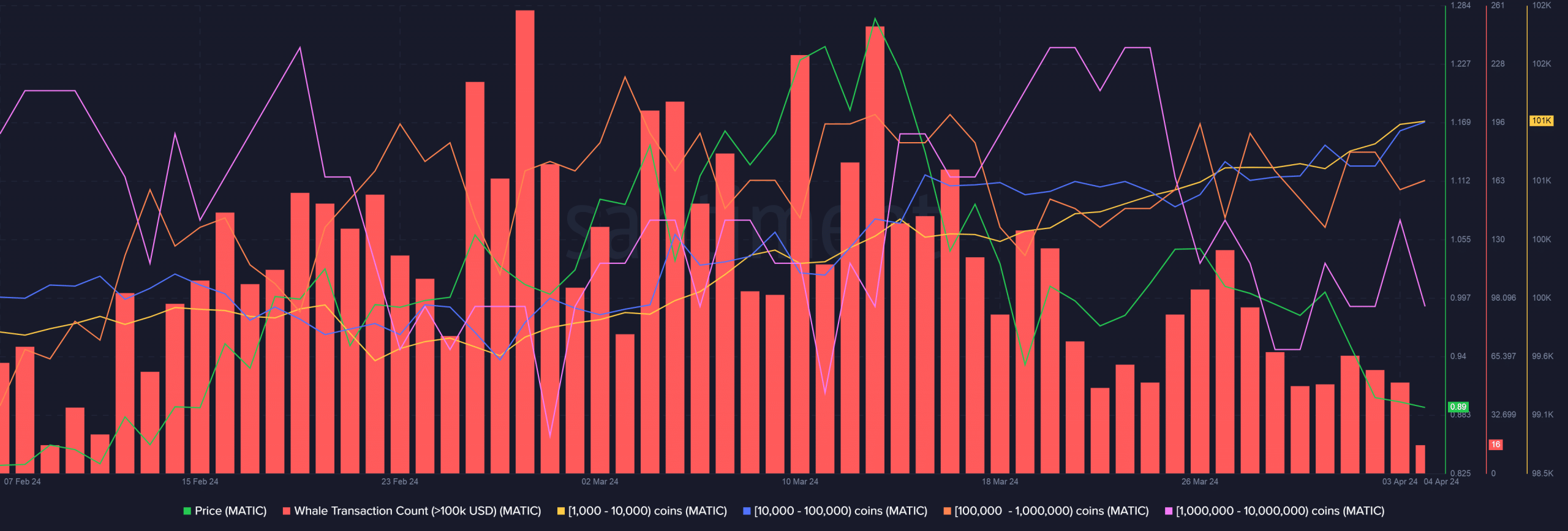

Whales interaction dropped significantly since mid-March, as evidenced by drop in large transactions worth more than $100,000.

Interestingly, large whales, i.e, those with holdings of more than 100,000, sold their MATICs in this period. These were likely scooped by smaller whales with wallet size between 1,000–100,000.