Why Ripple CEO thinks an XRP ETF ‘makes sense’

- Garlinghouse said ETFs would make sense for the XRP community.

- XRP whale holdings have dipped sharply in the last month.

The crypto market was reverberating with everything “ETF” these days. With the surging popularity of spot Bitcoin [BTC] ETFs, the prospect of investment funds tied to other key tokens has gained traction.

XRP ETFs a possibility?

Amidst this developing narrative, Ripple [XRP] CEO Brad Garlinghouse has welcomed the possibility of an XRP ETF. “We think it makes sense for the XRP community overall,” the CEO remarked while speaking to Bloomberg TV.

On a question regarding potential talks with asset management giant BlackRock, Garlinghouse declined to comment.

Recall that around mid-November 2023, a fake news on the launch of an XRP ETF by BlackRock caused a 12% spike the coin’s price, liquidating millions in futures market.

That being said, the endorsement coming straight from the horse’s mouth would certainly bolster the spirits of the XRP community.

Time for reality check

The discussions around XRP ETFs have been building for some time now. In fact, last month Ripple posted a job description where the company was hunting for a resource who could “drive cryptocurrency-related ETF initiatives.”

However, experts in the space have aired their apprehensions about such a possibility. Fox Business journalist Eleanor Terrett argued that in order to launch an XRP spot ETF, a futures ETF would first need to be in place.

XRP fails to excite

Meanwhile, XRP was in the red at press time, having dropped 4.85% in the 24-hour period, per CoinMarketCap.

The sixth-largest crypto’s woes have been ongoing for some time. As of this writing, XRP was the only major asset with monthly losses of more than 1%.

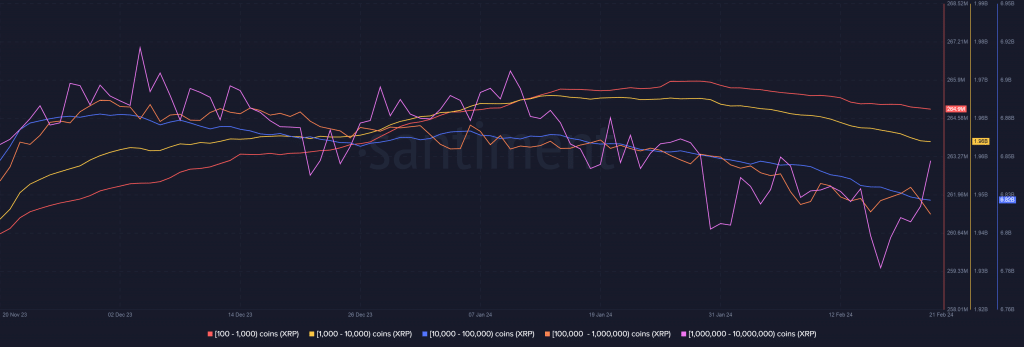

The negative price action was enough to put off wealthy investors. According to AMBCrypto’s analysis of Santiment’s data, holdings of addresses in the 1,000 – 10 million cohort fell dramatically over the month. This suggested that whales were not too keen on accumulating XRP at this stage.

Is your portfolio green? Check out the XRP Profit Calculator

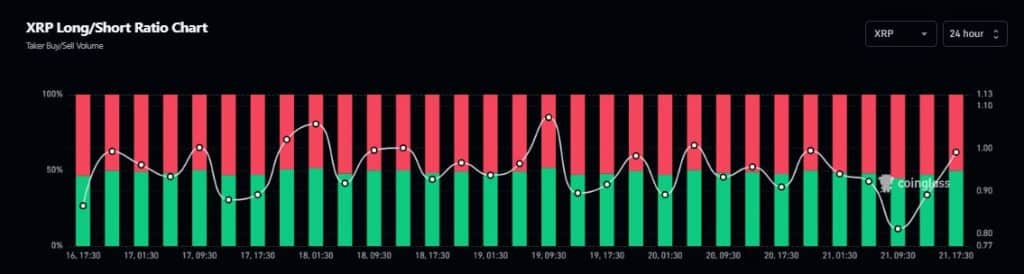

Moreover, the number of bearish bets taken by XRP derivatives traders increased in the last 24 hours, as per Coinglass’ Longs/Shorts ratio. This lent credence to the optimistic sentiment in the market.