Shiba Inu

Why Shiba Inu’s fall to $0.000020 may be inevitable if this happens…

Market cap is outpacing the transaction volume, suggesting that SHIB is not yet at a good discount price.

- Volume increased, while exchange inflows were double the outflows

- If SHIB rebounds, it could face resistance at $0.000025

Shiba Inu’s [SHIB] price could be set to record another drawdown, despite the 103% hike in volume. At the time of writing, SHIB was valued at $0.000024 on the charts, after the altcoin depreciated by over 4.8% in the last 24 hours.

The fall in price plus the increase in volume, together, are evidence that selling pressure has been high. However, apart from these, AMBCrypto also found other metrics indicating that the price might slip further on the charts.

Is SHIB overvalued for now?

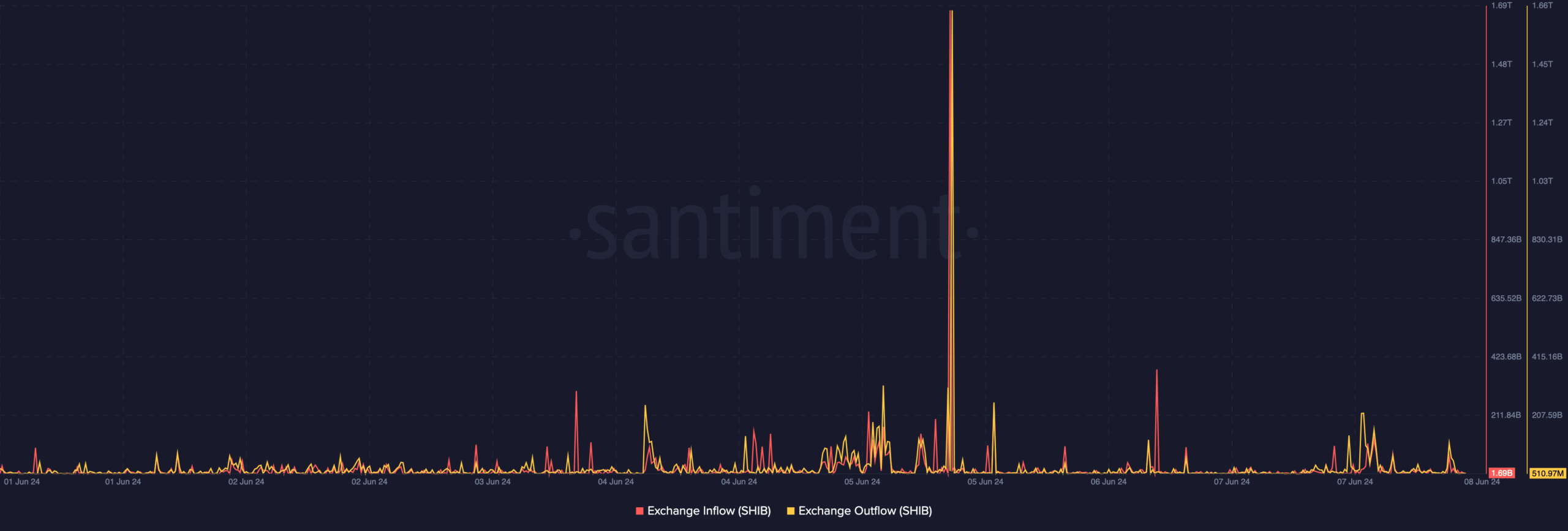

For starters, it’s worth looking at the exchange flows. At press time, data from Santiment revealed that exchange outflows from the Shiba Inu network were 510.97 million. This metric tracks the number of tokens moving out from exchanges.

Most of the time, exchange outflows indicate that holders are not willing to sell soon. On the other hand, the exchange inflows were more than double at 1.69 billion. Unlike the outflows, this metric measures the number of tokens sent to exchanges.

Therefore, the difference implies that there have been more participants willing to let go of their SHIB tokens. If this modus operandi continues, the price of the token might drop to as low as $0.000020.

This, contrary to the speculation that SHIB could be in line to break out after whales bought in big numbers. While the uptrend might still happen, the value of Shiba Inu might tank first.

Additionally, AMBCrypto looked at the Network Value to Transaction (NVT) ratio, and noticed that it had started to hike again.

A decrease in the NVT ratio suggests that the transaction volume is growing faster than a project’s market cap. This is a sign that investor sentiment is bullish and the price could appreciate.

However, the NVT ratio on the Shiba Inu network at press time was 91.56. This indicated that the network value was relatively high, and investor sentiment was bearish.

From the chart below, it can be seen that a hike in the ratio has coincided with the price falling. As such, SHIB’s predicted decline could be valid.

A sell wall puts the token in trouble

However, if buying pressure rises on the charts, SHIB could head towards $0.000025. A look at the In/Out of the Money indicator revealed that 31.940 addresses purchased a total of 11.84 trillion tokens between $0.000024 and $0.000025.

This large cluster of addresses were losing money. As such, this zone could be resistance for the token due to the high number of potential selling positions on-chain.

Therefore, a hike in price might not validate a rally for SHIB. Instead, some holders of the token could pull the price back as a lot of profit-taking might occur at the spot.

Going by the indicators above, SHIB could be looking at a decline to $0.000022. In a highly bearish condition, the value of the cryptocurrency could plummet to $0.000020 too.

Realistic or not, here’s SHIB’s market cap in DOGE terms

However, traders need to watch out for what’s happening in the broader market. For example, if Bitcoin’s [BTC] price rebounds, SHIB’s bearish prediction could be invalidated.