Why Solana-based WIF whale’s $24M dump could spur 15% price drop

- WIF could fall by another 15% in the coming days

- Major liquidation levels were near $1.579 on the lower side and $1.758 on the upper side

At press time, the prevailing market sentiment looked bearish, with top crypto assets noting massive downside momentum. This included the likes of Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Amidst this downturn, however, a whale was found dumping a notable 14.53 million SOL-based dogwifhat (WIF) tokens worth $24 million.

Whale’s sell-off creates ripples

In a post on X (previously Twitter), Lookonchain revealed that five wallets, possibly belonging to the same person, sold 14.53 million WIF tokens. However, these massive dumps came on the back of the crucial $157- support level breaking down for Solana.

Lookonchain also noted that this whale purchased the WIF tokens on 30 November 2023 for only $5,340. With this sell-off, the whale has generated a return of over 4,500x. Meanwhile, if he had sold all of his WIF holdings at the highest price, he would have made a profit of over $69 million, equivalent to 12,927x returns.

Amid this selling pressure, investors and traders believe that this SOL-based memecoin may soon fall to the $1-level. While this could be bad news for existing hodlers of the altcoin, for others, this could also be a perfect buying opportunity. If a lot of investors dive in, buying pressure might pull WIF back up the price charts.

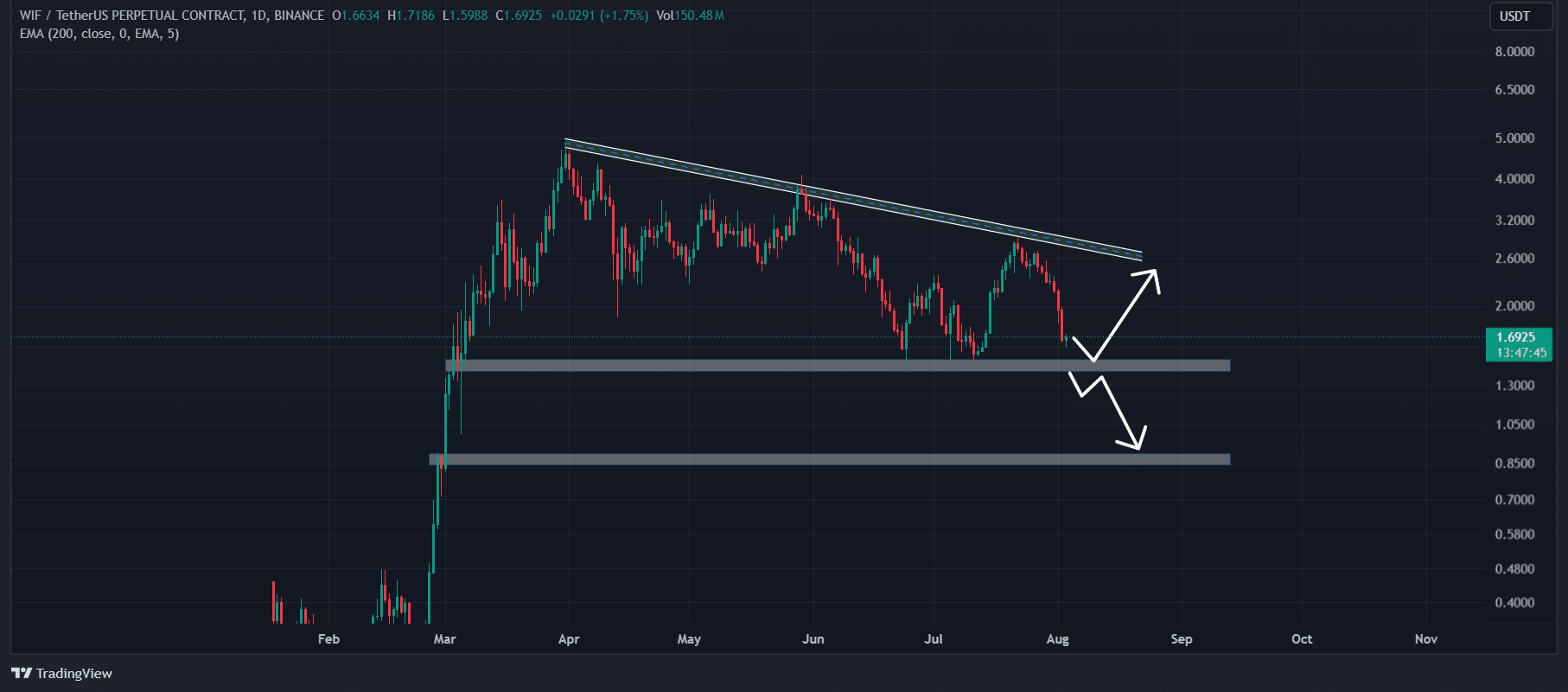

Dogwifhat (WIF) price analysis

At press time, WIF was trading near the $1.69-level following a fall of 11% in 24 hours. Additionally, WIF’s Open Interest (OI) also dropped by 5.5% during the same period – A sign of low interest from the crypto-community amid this bearish outlook.

Meanwhile, the memecoin’s trading volume rose by 10%, indicating greater participation from investors and traders.

WIF technical analysis and key levels

On the price charts, WIF looked bearish, with the crypto moving towards the crucial support level of $1.40.

Also, there seemed to be a high chance that WIF could fall by another 15% in the coming days until it hits this support level.

If it maintains itself above this crucial support level, there is a high possibility of a price reversal. Conversely, if it fails and gives a daily candle closing below the $1.4-level, we could see a massive sell-off to the $0.90-level.

At the time of writing, the major liquidation levels were near $1.57 on the lower side and $1.758 on the upper side.

If market sentiment remains unchanged and WIF falls to the $1.57-level, nearly $6.04 million worth of long positions will be liquidated. Conversely, if sentiment shifts and WIF soars to the $1.75-level, nearly $5.56 million of short positions will be liquidated.