Why Solana traders remain divided even as SOL eyes $249

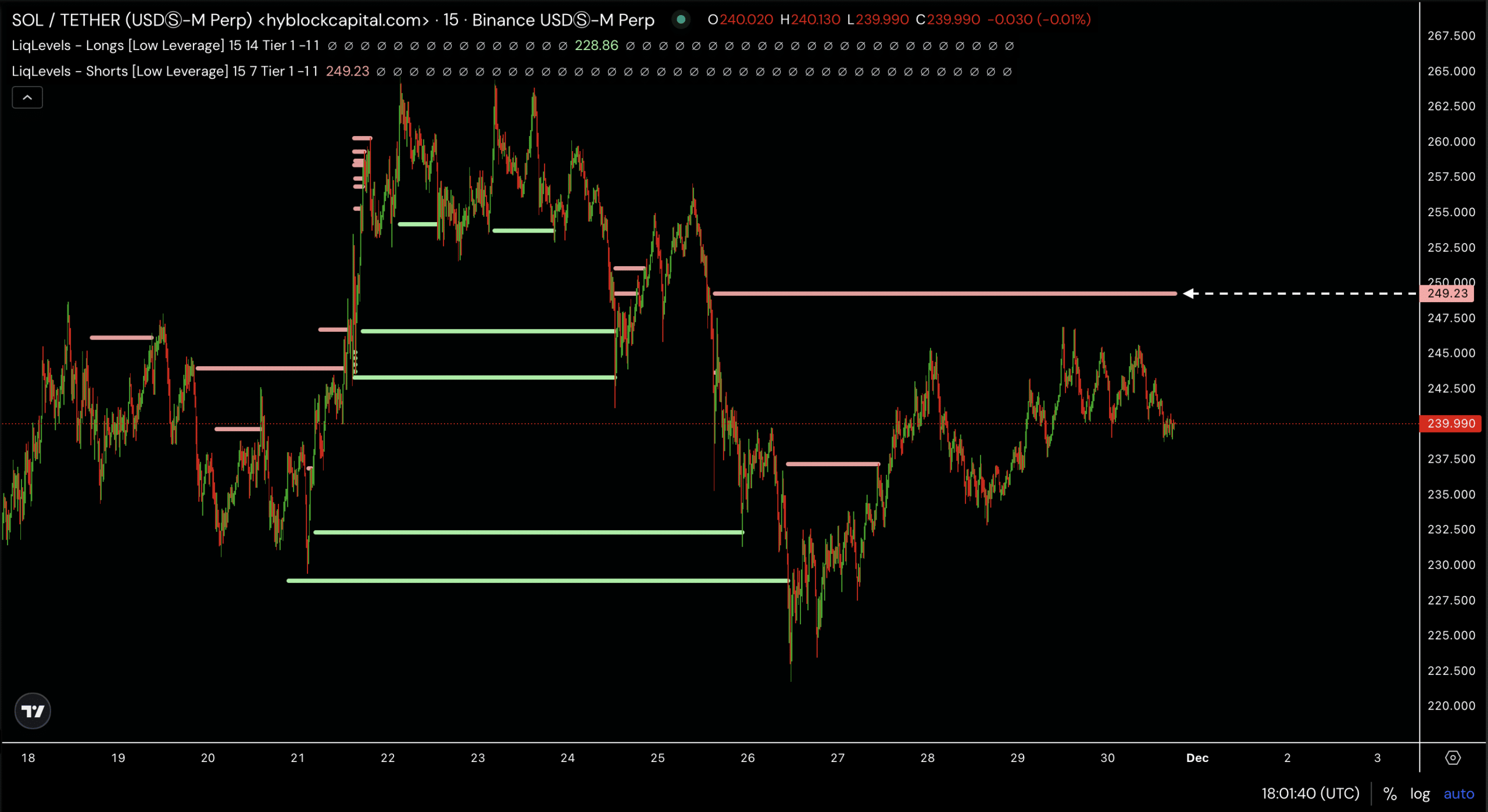

- Analysis from Hyblock highlighted $249 as a critical level for a potential upward move.

- Yet, some traders are positioning for a rally, while others are betting on further declines.

The weekend brought choppy price action for Solana [SOL]. Following a 7.22% drop over the past week, the token slid another 3.22% in the last 24 hours, settling at $235.

The recent downturn pointed to signs of fatigue in the market. Buyers seemed to be stepping back, awaiting clearer signals.

While some see the pullback as a routine correction, others warn it could mark the beginning of a deeper slide.

SOL clears low leverage liquidity, eyes key target

According to Hyblock, SOL appeared to be navigating a low-leverage liquidity phase as its price trended lower on the charts.

This behavior often suggests that SOL is clearing out low-leverage liquidity levels, potentially setting the stage for an upward move.

If this scenario plays out, Hyblock’s chart indicates the next key target for SOL lies above $249, where a significant liquidity cluster could fuel a price rally.

However, the outlook remains uncertain. Various market metrics are sending mixed signals—some pointing to further downside, while others suggest that SOL may be primed for a rebound.

Market sees heavy selling—Is this a retracement?

On-chain metrics revealed a surge in selling activity, as price and trading volume decline. Volume has dropped by 9.75%, now sitting at $3.72 billion.

Coinglass’s Long-to-Short Liquidation model indicated a bearish tilt in the derivatives market. The long-to-short ratio stood at 0.8681, well below 1, signaling that short (sell) contracts significantly outnumbered long (buy) contracts.

The farther this ratio moves below 1, the more dominant short positions become.

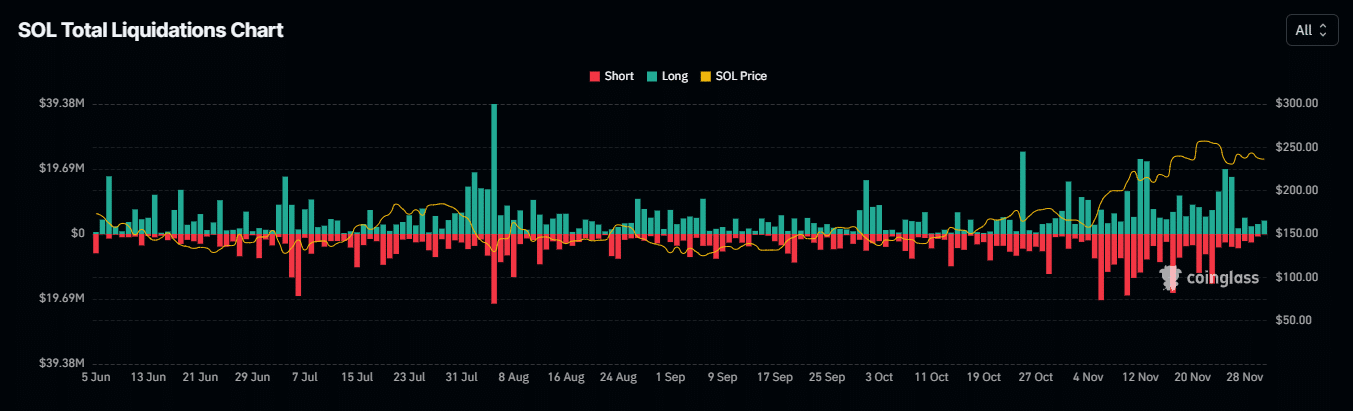

This sentiment is reflected in liquidation data over the past 24 hours. Long positions worth $6.4 million have been liquidated, compared to just $348,600 in short liquidations.

The stark disparity highlighted a market favoring downside momentum.

Given these dynamics, SOL remains at risk of further declines, as bearish sentiment appears to outweigh any signs of a potential recovery.

Bulls show signs of life amid market volatility

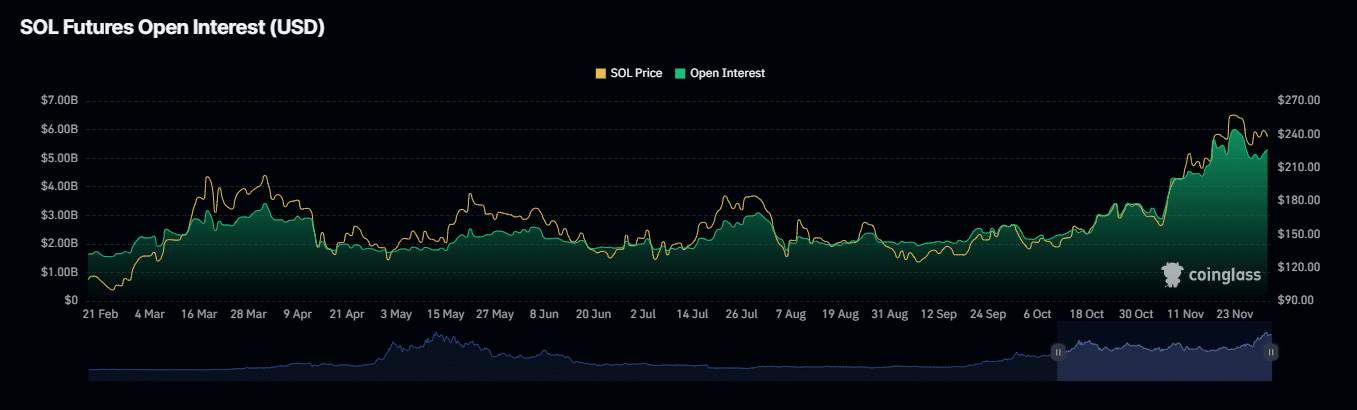

Despite recent bearish sentiment, bullish activity has surfaced, marked by a 2.89% increase in Open Interest, bringing its total value to $5.28 billion.

Open Interest measures the volume of unsettled derivative contracts in the market. An uptick typically signals renewed trader confidence and hints at a market primed for a rally.

Read Solana’s [SOL] Price Prediction 2024–2025

Additionally, Exchange Netflow data revealed a shift favoring bulls, with significant liquidity—primarily SOL—moving from exchanges to private wallets.

This outflow creates a potential supply squeeze, adding upward pressure to prices and increasing the likelihood of a rally, and the drop being a retracement.