Why Solana’s revisit to $200 may be right under your nose

- Decreasing volume alongside the price decline could activate a bounce.

- The divergence between the OI and Funding Rate might be bullish for SOL.

Solana [SOL] hinted at a move to $200 on the 26th of March, only for the cryptocurrency to decline to $185 later.

According to CoinMarketCap, the value of SOL decreased by 4.76% in the last 24 hours, indicating how the sustenance of an upward trajectory has been filled with struggles.

However, AMBCrypto was able to identify signals showing that the attempts to retest $200 might be successful soon. To do this, we engaged some on-chain metrics.

Bears’ weakness is bulls’ strength

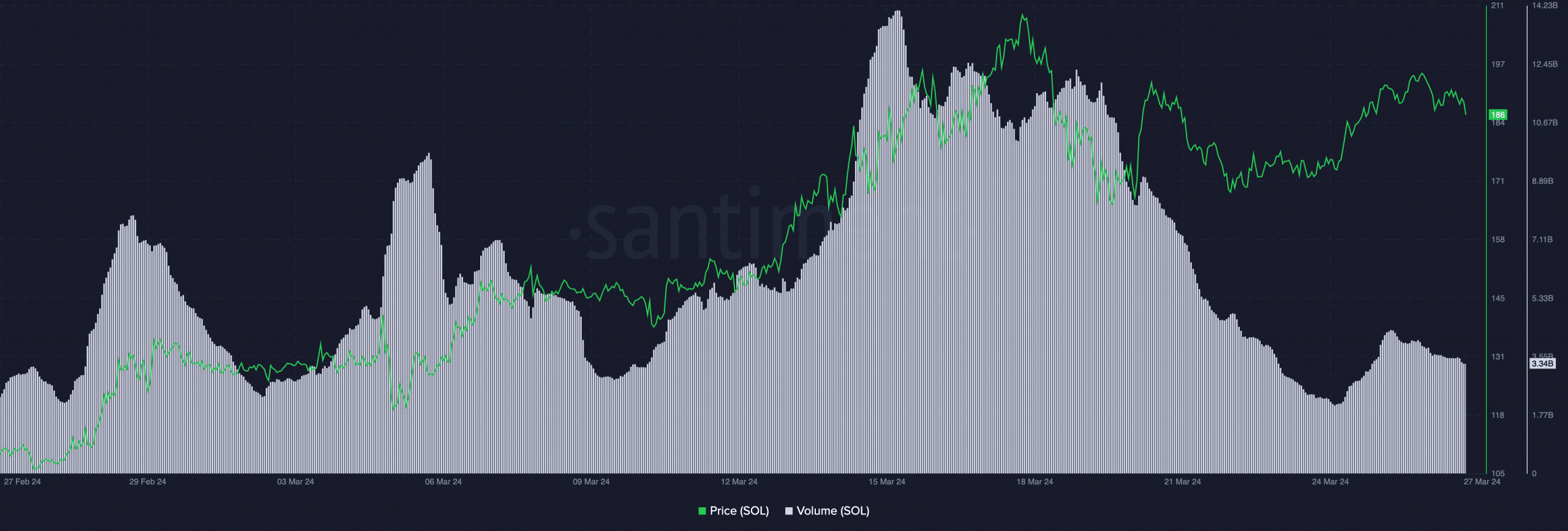

One of the metrics we started with was Solana’s volume. Two weeks ago, the volume was over 14 billion. This was around the same time, SOL rallied to 209.

But as of this writing, the volume had dropped to 3.34 billion, suggesting a massive decline in trading the token.

However, a decreasing volume is not entirely bad. Typically, rising volume on rising prices indicates that a rally might continue.

When volume decreases alongside price, it means that the downtrend is becoming weak. Hence, an upward reversal could be likely.

For SOL, it is possible to see a bounce in the value within the next few days. If this is the case, bulls might try to pull the price up to the $200 region.

If buying pressure increases, then the Solana native token might retest the price.

Despite the prediction, AMBCrypto admitted that the potential rally might not be smooth. But notwithstanding, SOL might hit the zone before March ends or in the first few days of April.

Reward is for the patient

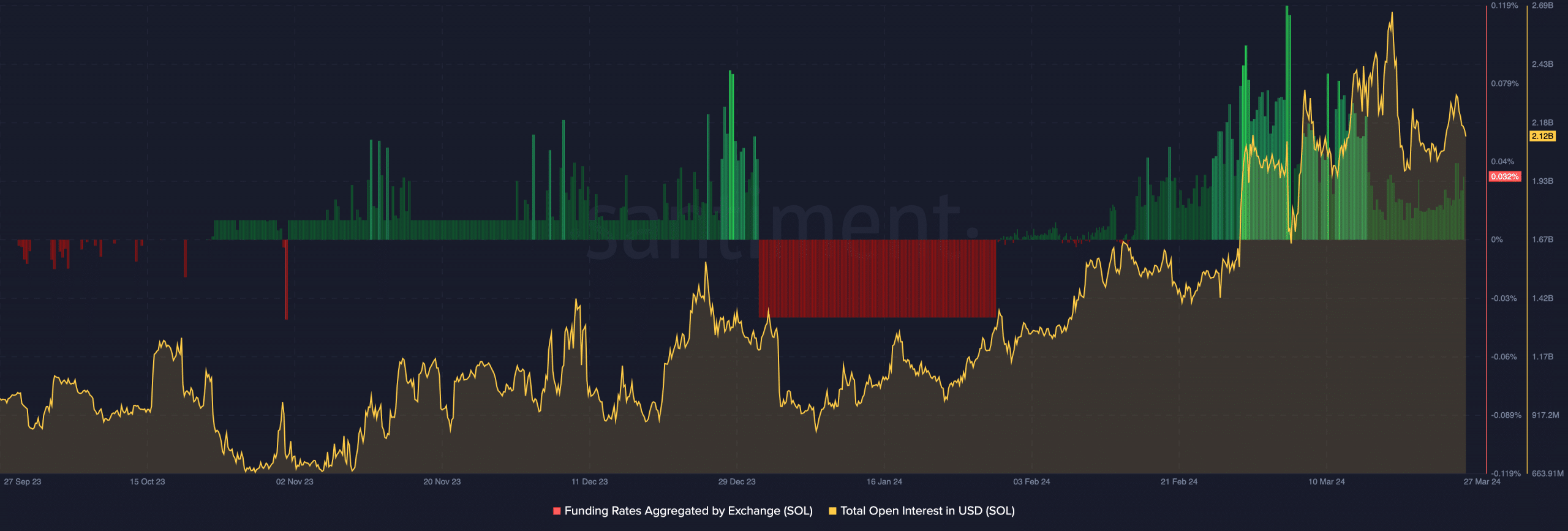

Apart from the volume and price action, we also analyzed Solana’s Funding Rate and Open Interest (OI). Funding Rate indicates if longs are paying a fee to short, or it is the other way around.

Positive funding means longs are paying shorts while a negative reading implies that longs receive the fees.

When Open Interest increases, it means net positions and liquidity added to the derivatives market have increased. On the other hand, a decrease in OI suggests a surge in closed contracts.

At press time, SOL’s Funding Rate increased, indicating that longs had more positions. However, the price decrease suggests that these positions were not being rewarded.

Typically, this gives a bearish inference. However, the OI decreased around the same period, indicating that shorts were aggressive.

From a trading perspective, the OI decrease alongside the price fall, combined with the funding, is a sign that SOL might break out.

Read Solana’s [SOL] Price Prediction 2024-2025

In essence, the short-term outlook could drive SOL to key into the overhead resistance. Should buying pressure increase within the next few days, the token might break past any hurdle.

From a bullish point of view, SOL might attempt to hit $209 again. However, traders might need to be on the lookout as changes in the metrics might invalidate the projection.