Why ‘struggling’ Bitcoin may be good news for market’s memecoins now

- Bitcoin discussions seem to be slipping, with traders now more focused on altcoins

- Memecoin mania going strong, but this could be a warning for traders

Bitcoin [BTC] has retraced almost all of its gains after breaking out past the $67k resistance level on 20 May. It extended upwards to $71.9k, but fell to test $67k again on 23 May.

This consolidation implies that Bitcoin’s bullish strength is not as high as investors would have hoped. In fact, a recent AMBCrypto report explored some relevant Bitcoin metrics, finding that many of them remained bearish.

Memecoins have succeeded in capturing the public interest

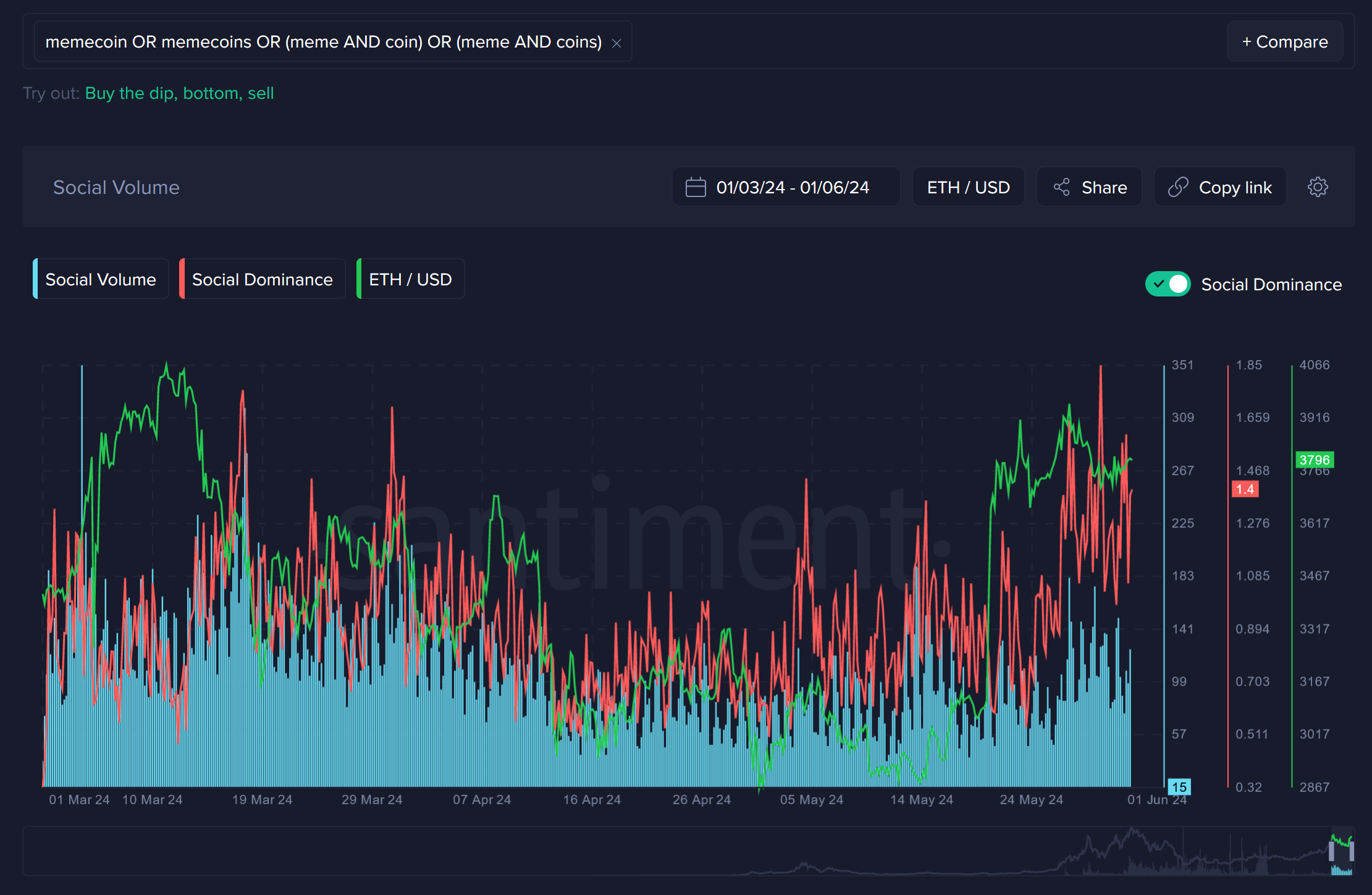

Source: Santiment Insights

In a post on X (formerly Twitter), Santiment shared some insights into the crypto trends on social media. Memecoins have captured more of the public’s attention since mid-April due to their superior performance as a sector.

Tokens like dogwifhat [WIF], FLOKI [FLOKI], and Shiba Inu [SHIB] registered good performances over the past week. Pepe [PEPE] also saw remarkable gains over the past two weeks, with the altcoin up by 63% since 20 April. This came at a time when Bitcoin tried to break past $67k, but did not see a strongly bullish result.

The heavy engagement with memecoins could be a sign that the market is greedy and speculative and not in a phase of organic development, one where the public pursues tokens with good tech and utility.

Now, the Bitcoin ETF inflows have been positive lately and the month of May ended well too. However, it remains to be seen if that is enough to begin another rally this week.

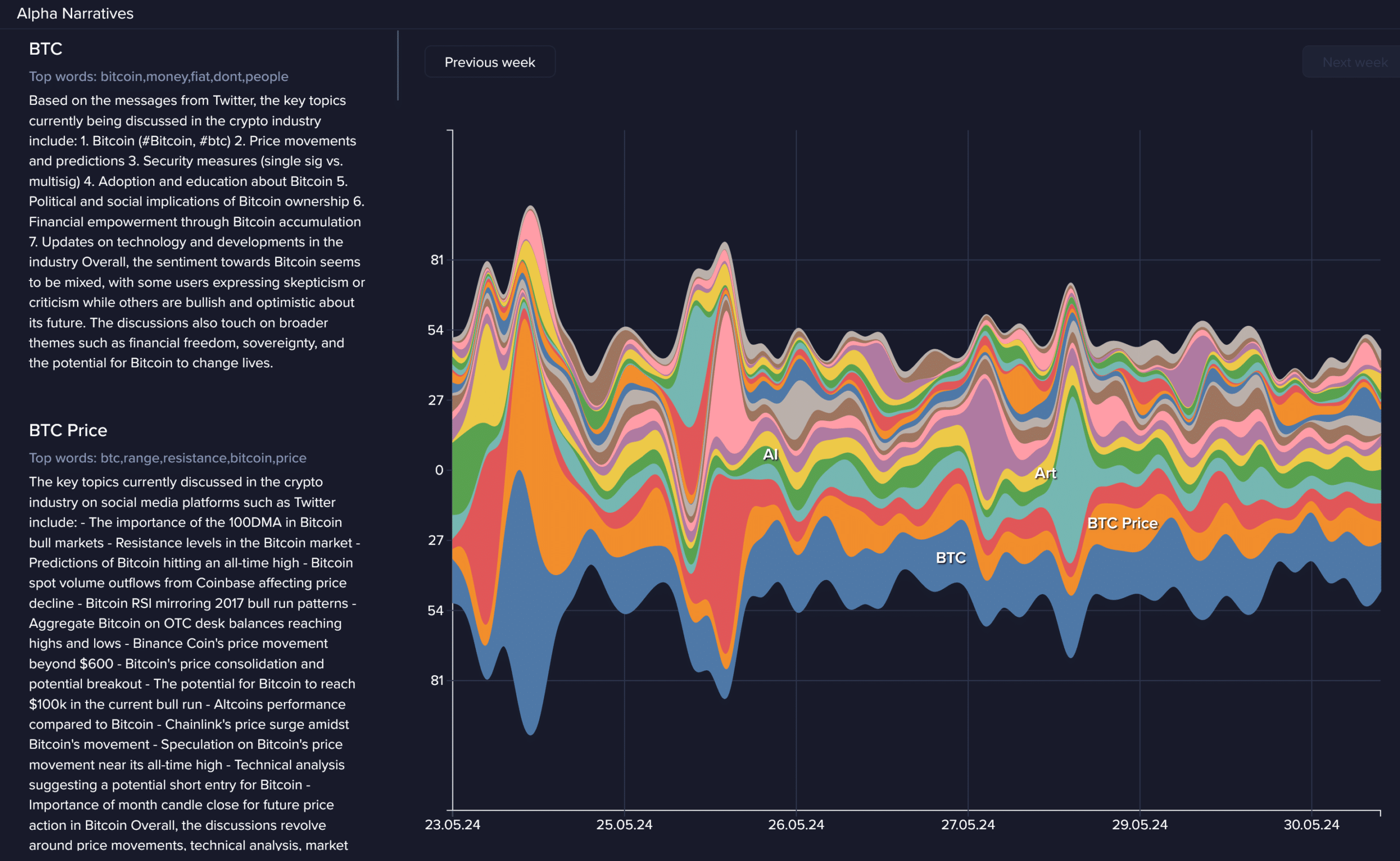

Source: Santiment Insights

The data also showed that Bitcoin discussions were sliding downward. According to Santiment, this was because traders have been increasingly fixated on altcoins for potential gains while Bitcoin dithered below the $70k resistance.

Large-cap momentum was bullish for the most part

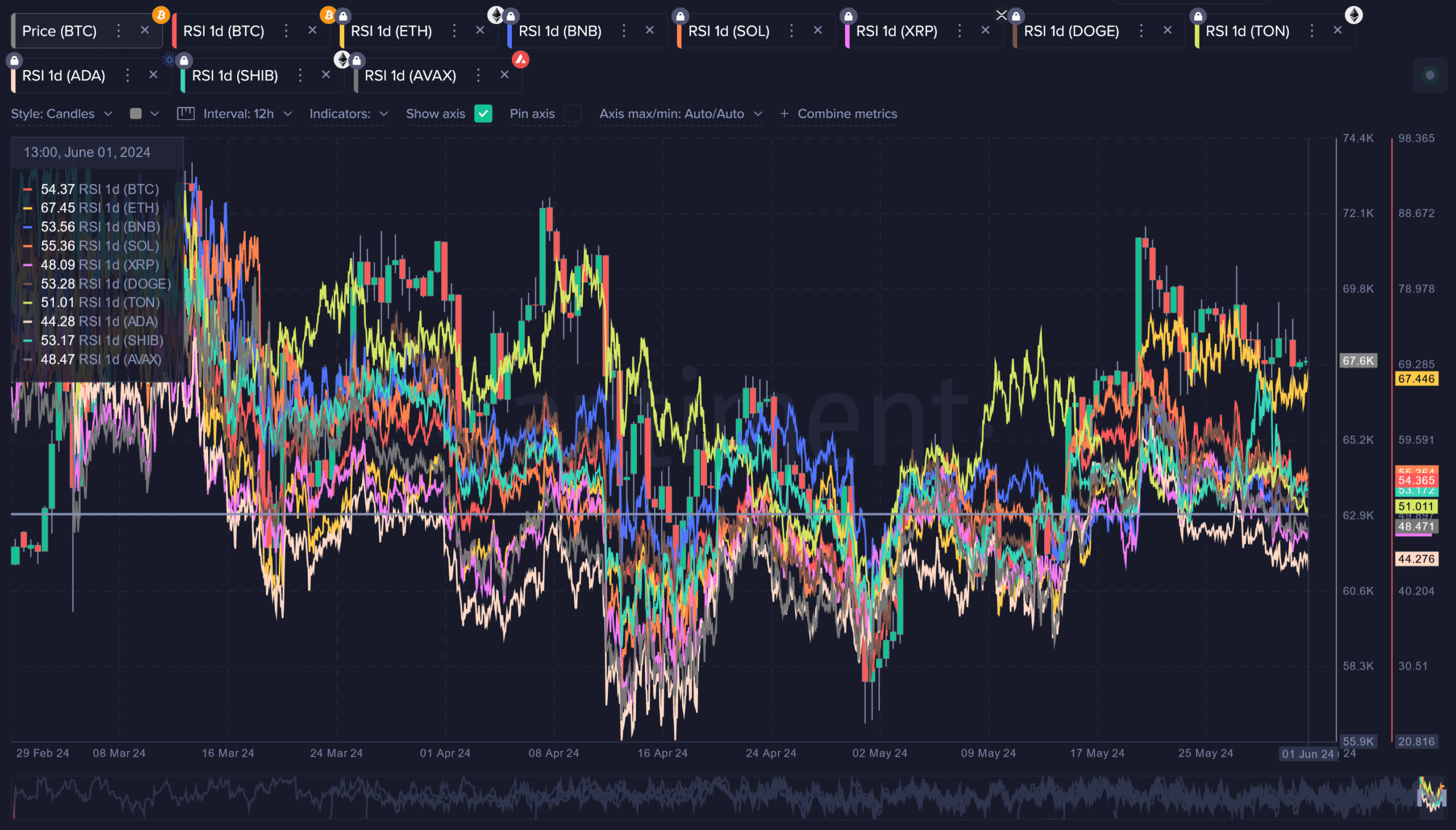

Source: Santiment Insights

The RSI on the 1-day interval revealed that most of the major tokens were near or above the neutral 50-mark, signaling bullishness. Ethereum [ETH] and Solana [SOL] were the strongest with readings of 67 and 55, respectively.

Meanwhile, Cardano [ADA], XRP, and Avalanche [AVAX] struggled to gain bullish traction on the charts.

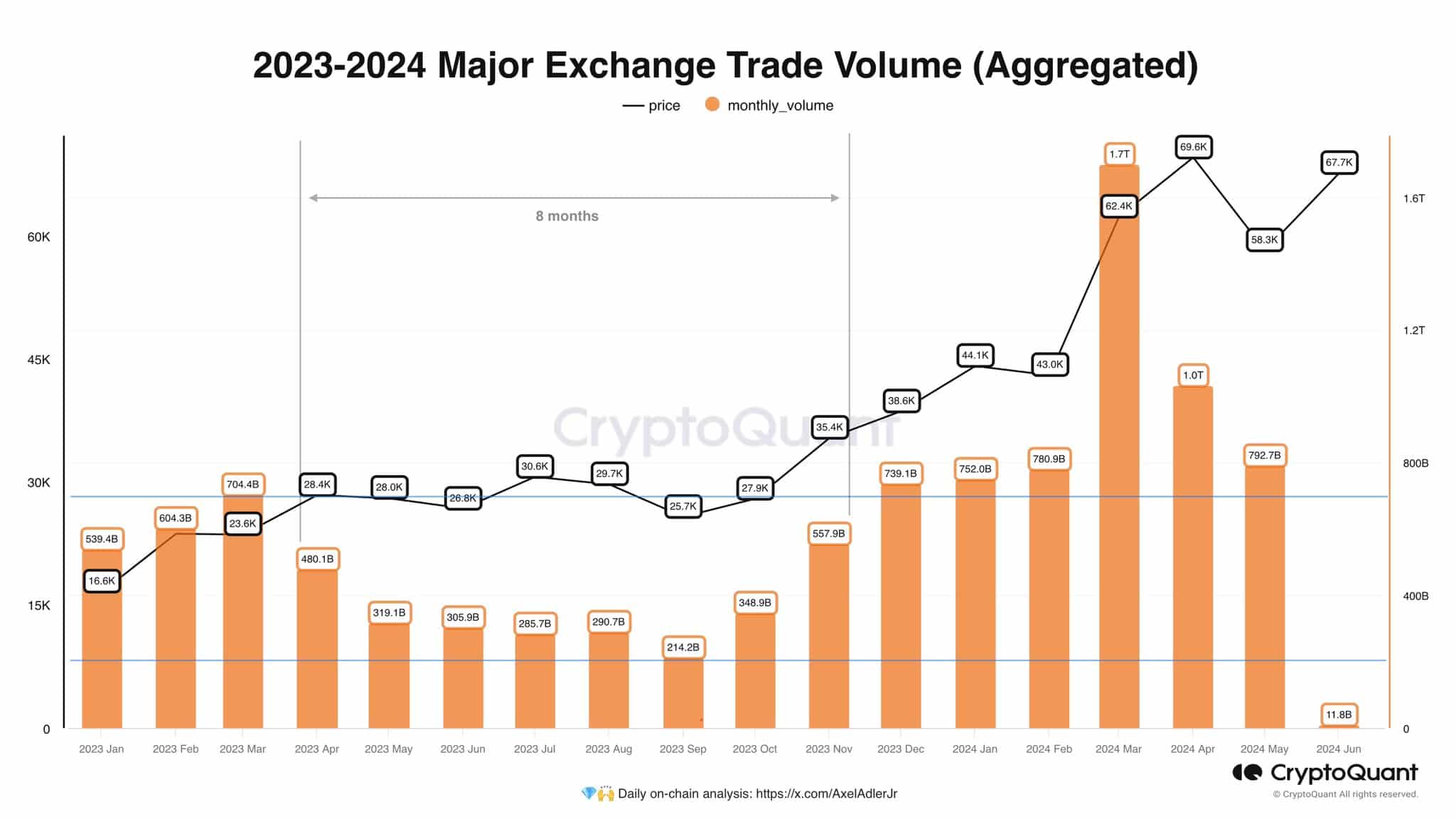

Source: Axel Adler on X

Here, it is also worth noting that the trading volume of major altcoins has fallen dramatically, when compared to March. Crypto analyst Axel Adler pointed this out in a post on X, claiming that Bitcoin’s lack of momentum has been affecting sentiment across the market.

Is your portfolio green? Check the Bitcoin Profit Calculator

The volatility and trading volume behind Bitcoin has declined since March, and the price continues to trade within the range of $60k-$72k. Investors need to be patient, while traders need to watch out for range formations and not get caught out by false breakouts.