Why SushiSwap’s [SUSHI] 2023 revenue has potential to floor 2022

![Why SushiSwap’s [SUSHI] 2023 revenue has potential to floor 2022](https://ambcrypto.com/wp-content/uploads/2023/01/po-2023-01-31T124000.002.png)

- The SushiSwap 2023 revenue could surpass 2022 by $15 million.

- The token’s likely direction could end up in a price decrease, but HODLing could cause gains.

In 2022, SushiSwap [SUSHI] recorded a revenue of $16.75 million, according to Token Terminal. However, compared to protocols like MakerDAO [MKR] and Lido Finance [LDO], Sushiswap fell short.

14/ SushiSwap:

– Total revenue (FY2022): $16.75m

– Annual expenses (2022-2023): $5.22m

– Annual salaries, incl. in expenses (2022-2023): $4.74m

– Number of FTEs: 18.5

– Annual expenses per FTE: $282.0k

– Annual salaries per FTE: $256.3k pic.twitter.com/sGFWUmltEX— Token Terminal (@tokenterminal) January 30, 2023

Is your portfolio green? Check out the SushiSwap Profit Calculator

Ready to add sauce to the SUSHI

Well, all that could be behind the 2022 Uniswap [UNI] fork. This is because the project’s CEO, Jared Grey, proposed to switch SUSHI’s 100% revenue to its treasury. Before it was approved earlier in January 2023, it was usually distributed to the token holders.

For this reason, SushiSwap could make another extra $15 million. Additionally, full implementation of its roadmap could also contribute to achieving the objective.

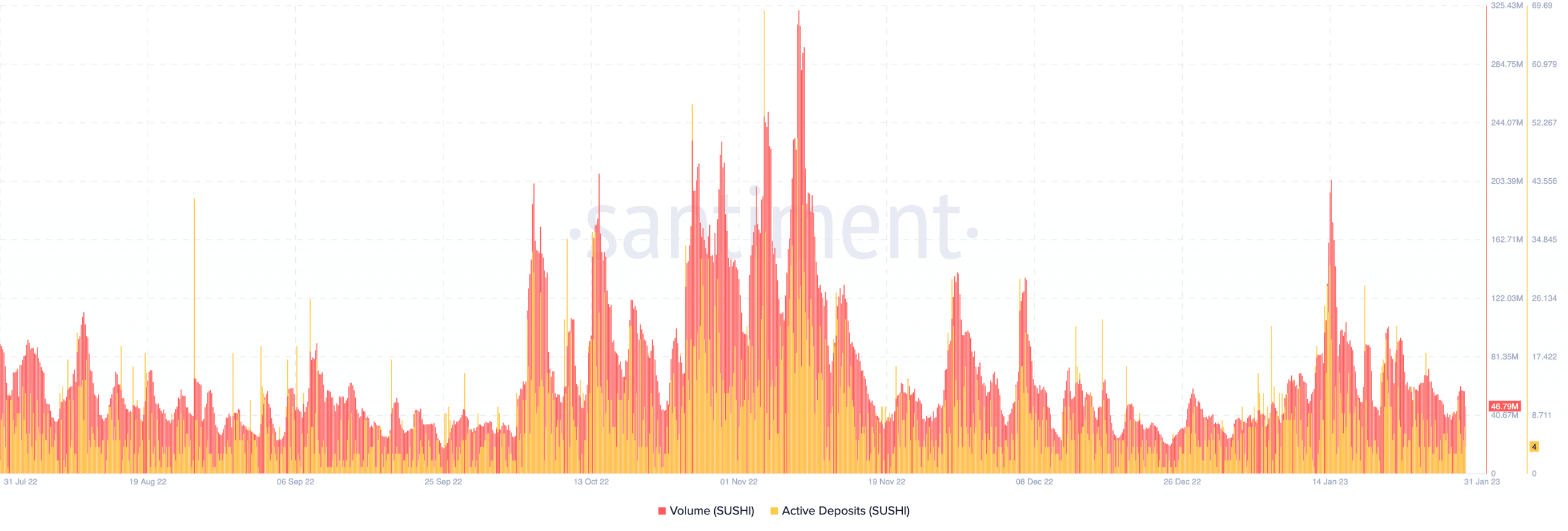

In the last 30 days, SUSHI holders have made about 35.59% gains and were able to sustain the trading volume to 57 million until 30 January. The increase reflects improved traders’ attempt to own the tokens because of price changes. However, the momentum had dropped at the time of writing to 46.96 million.

Active deposits on exchanges have slowed down, according to Santiment. The metric measures the number of unique addresses on the SushiSwap network. Consequently, selloffs might not be imminent.

Keep HODLing for long?

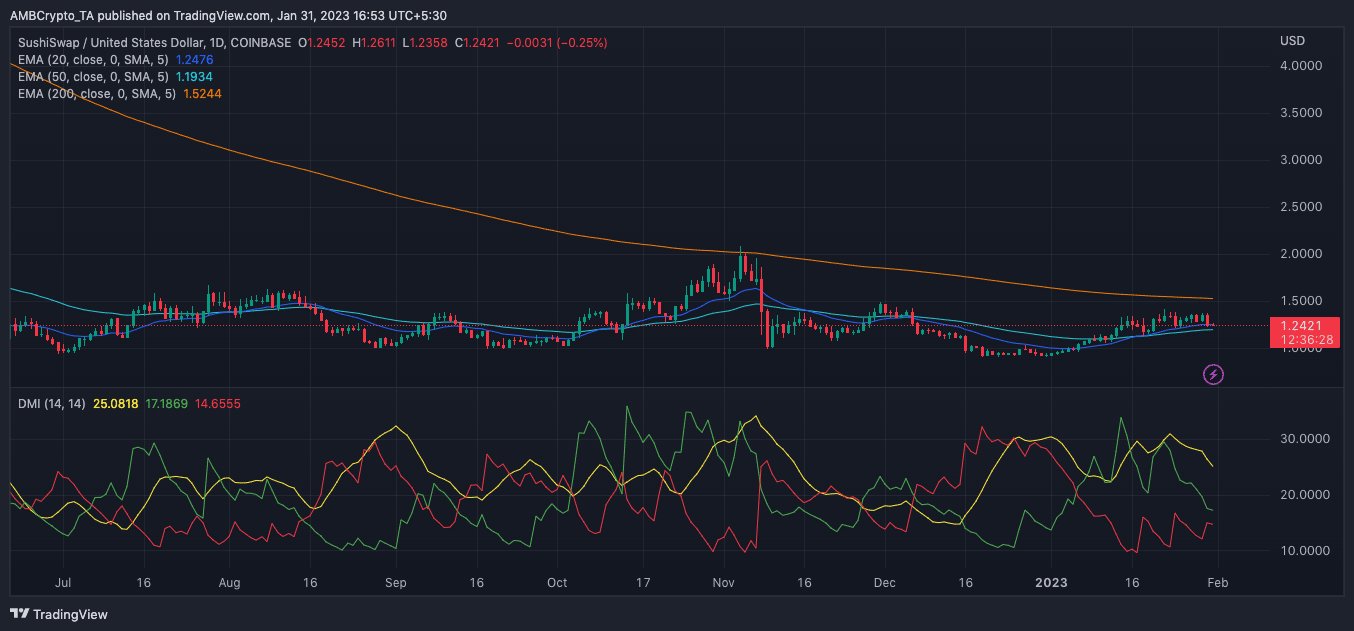

According to the daily chart, holders of the token could benefit more from sticking to the project. This was due to the Exponential Moving Average (EMA). At press time, the 200 EMA (orange) was above the 20 (blue) and 50 (cyan) EMAs. This indicated that the long-term view of SUSHI was potentially bullish.

In the short term, SUSHI’s projection was most likely consolidation, since the 20 and 50 EMAs were within reach of each other.

With respect to the Directional Movement Index (DMI), SUSHI might find it difficult to revert to greens. An assessment of the DMI showed that the positive DMI (green) was 17.18. The negative DMI (red), in contrast, was 14.65.

Conversely, the positive and negative exhibited downward pressure on the SUSHI pressure. But there was no large spread between both. So, the price trend was not solid.

Read Sushiswap’s [SUSHI] Price Prediction 2023-2024

The optional third dynamic line, called the Average Directional Index (ADX), also forms a part of the DMI. It is used to gauge directional strength.

At press time, the ADX (yellow) was 25.08. This value signaled a strong directional movement. However, the downward trend displayed by the ADX meant that it could lose hold of power. Therefore, it could result in a bearish move.