Why the figure of 54.5% is important for a Bitcoin HODLer today

Bitcoin, the largest cryptocurrency dropped to a more than two-week low given the fears of a possible Russian invasion of Ukraine. Some predicted that the flagship cryptocurrency could slide toward the key $30,000 level. Bitcoin on-chain analysis highlighted a few concerns related to the selling pressure.

Weakness in mainstream

An Analytics report on 21 February, on-chain metrics firm Glassnode showcased that Bitcoin bulls “face a number of headwinds” This meant increasingly bearish network data. It ranged from dwindling demand on-chain, to over 4.7M BTC held at an unrealized loss.

Weakness in both Bitcoin and traditional markets reflected the persistent risk and uncertainty. Fed rate hikes in March, fears of conflict in Ukraine, as well as growing civil unrest in Canada and elsewhere can all come into play. The report stated:

“As the prevailing downtrend deepens, the probability of a more sustained bear market can also be expected to increase, as recency bias and the magnitude of investor losses weighs on sentiment.”

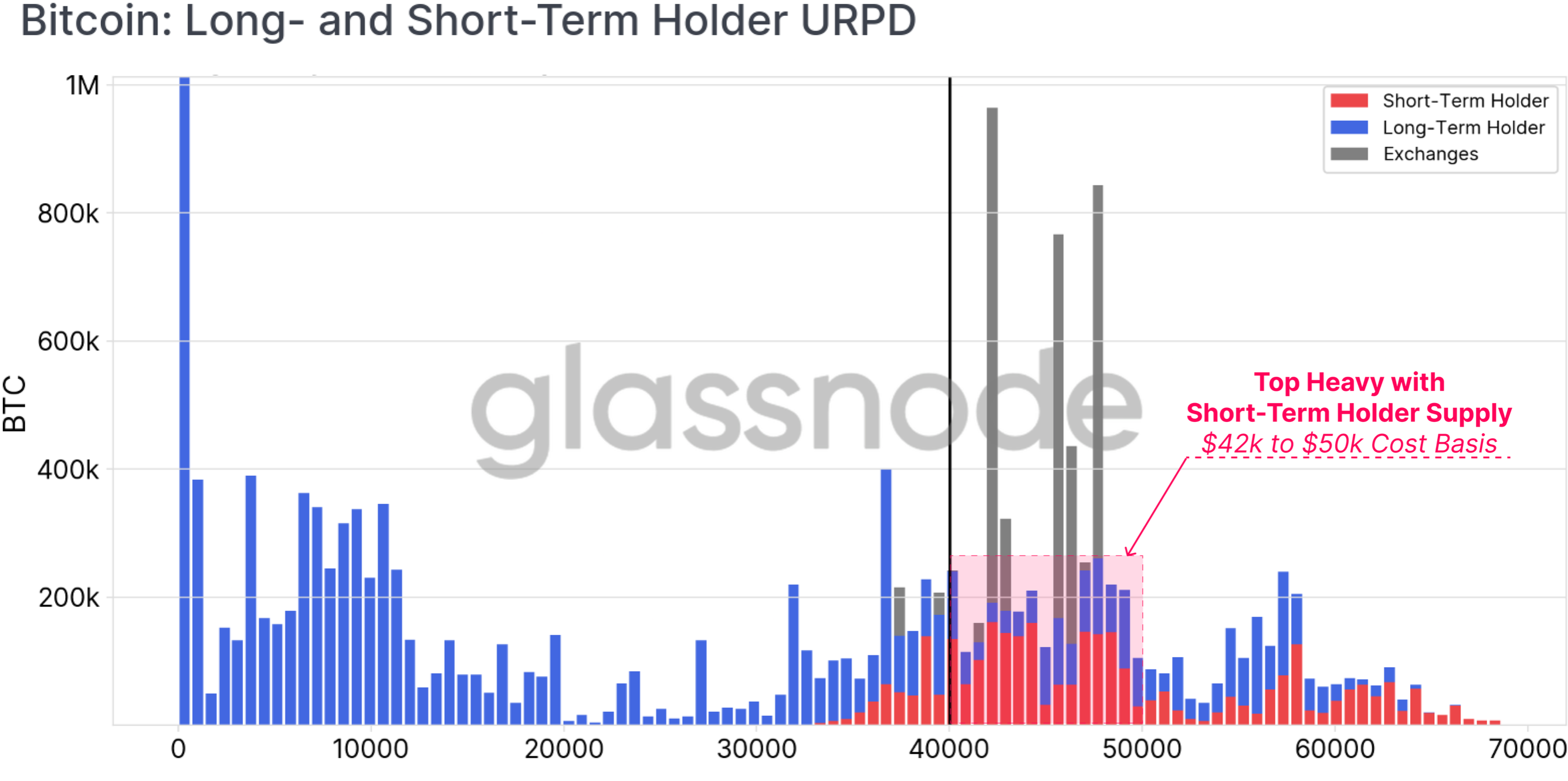

Here’s a peek at a few metrics. The data, which illustrates UTXO Realized Price Distribution, or URPD (unspent transaction outputs at different prices) hinted at a bearish narrative.

Source: Glassnode

BTC Short-Term Holders owned 54.5% of all coins held at an unrealized loss (2.56M $BTC). Ergo, creating sell-side headwinds for price as per the aforementioned plot.

“With prices currently trading underneath the lower end of this range, and alongside dwindling on-chain activity, the coins held by this price sensitive cohort market represent a likely source of sell-side pressure, unless balanced by an equivalent influx of demand.”

STHs were most likely cohort to spend their coins in response to volatility. They appear to be the most fearful in the current market, holding underwater BTC, and spending coins at a loss. The STH-NUPL metric presented unrealized losses held by STHs to 17.9% of Bitcoin’s Market Cap. This has supplemented the fear.

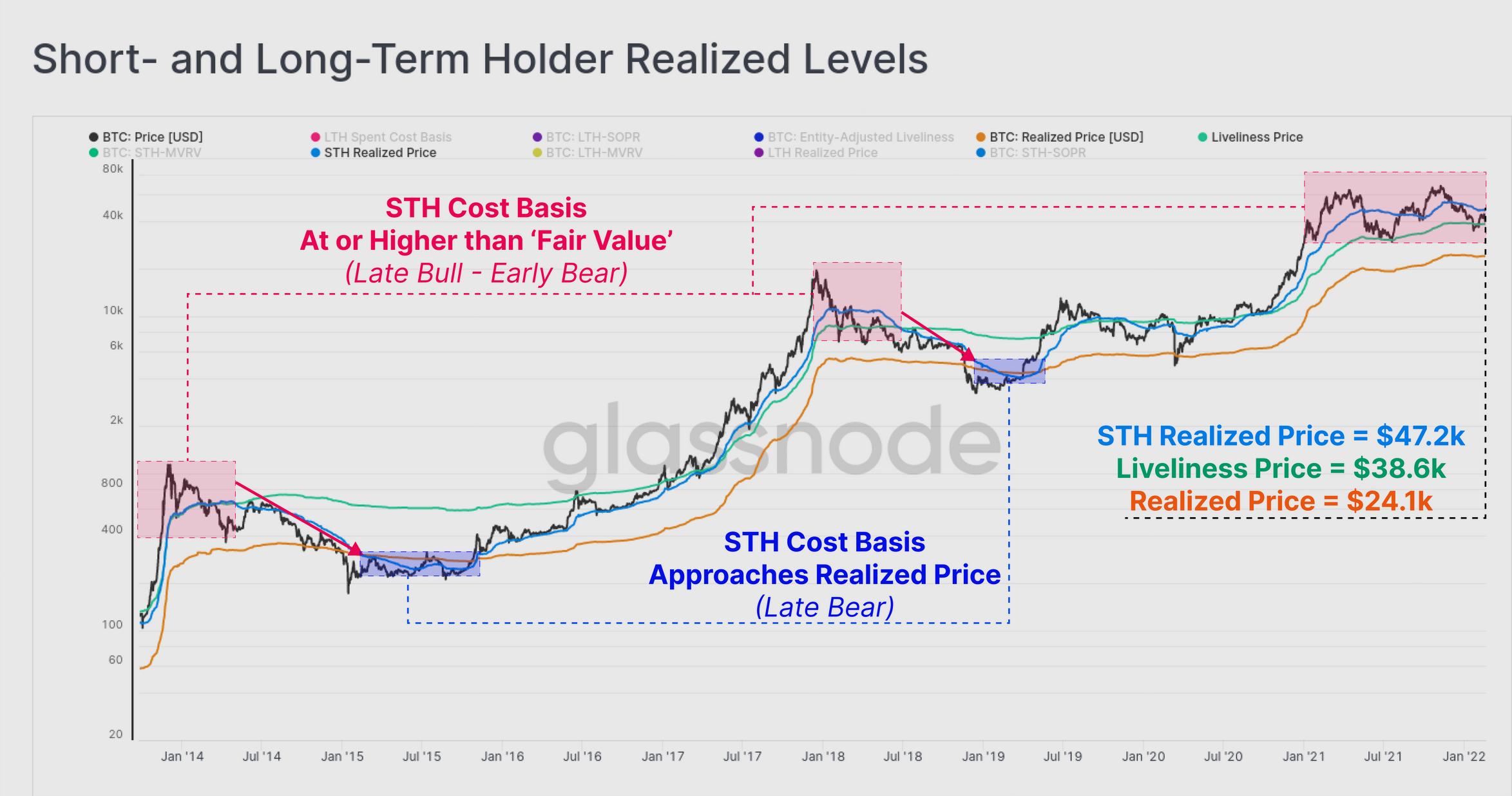

Considering the graph below, STHs had an average on-chain cost basis of $47.2k. This at the time of writing was an average unrealized loss of -19.3%.

Source: Glassnode

A setback for HODLers

Over the last year, the graph highlighted a rising Liveliness metric with long-term holders distributing more coins. However, that wasn’t the case here. Looking at the previous cycles, the report added:

“In both the 2013-14, and 2018 bear markets, when STHs hold coins well above this fair value estimate, it has signalled that the bearish trend has some time left in it to reestablish a price floor.”

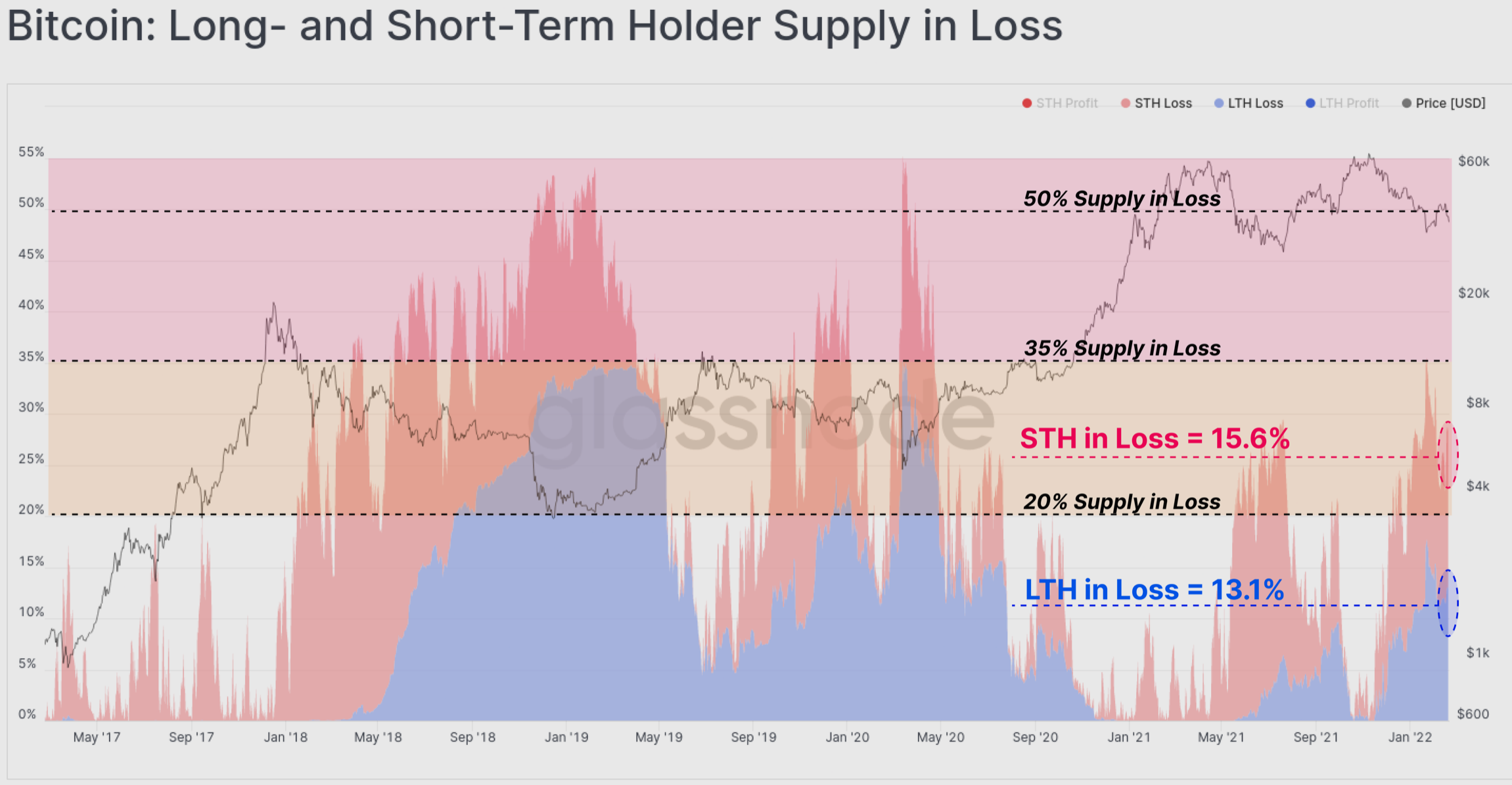

Overall, looking at the complete picture, both HODLers faced setbacks in terms of coin supply held as seen in the graph below.

Source: Glassnode

Bitcoin bulls face a rising headwind from different metrics. To establish a compelling market recovery, Bitcoin investors appear far more likely to HODL, used derivatives to hedge risk, rather than selling spot to reduce exposure.