Why this crypto VC is bullish on Ethereum despite ETH trailing Solana, Bitcoin

- A crypto VC projected a positive outlook for ETH in the long run.

- Large players expected $2.7K-$4K price swings before the end of 2024.

Chris Burniske, a partner at Placeholder, has reiterated a positive outlook for Ethereum [ETH] despite its current challenges and FUD.

According to the VC, Ethereum has lagged behind Solana [SOL] and Bitcoin [BTC] but still had a formidable lead in disrupting traditional Finance (TradFi). He said,

“Solana & others will come for the IFS, too (already are), but Ethereum has a solid foundation as it’s over a decade old, with brand awareness 2nd only to #Bitcoin, deep liquidity, and implementations like @base drawing corporate eyes.”

Burniske urged the Ethereum community to learn and cement the network as the centre of the next IFS (Internet Finance System) in the next five years.

New ETH/BTC yearly low

Burniske’s comment followed recent mixed views on the network’s 2029 roadmap, which proposed significant changes to the consensus layer to elevate its competitiveness against Solana and other layer 1 solutions.

However, opponents viewed the 2029 target as too long to effect fundamental changes on Ethereum.

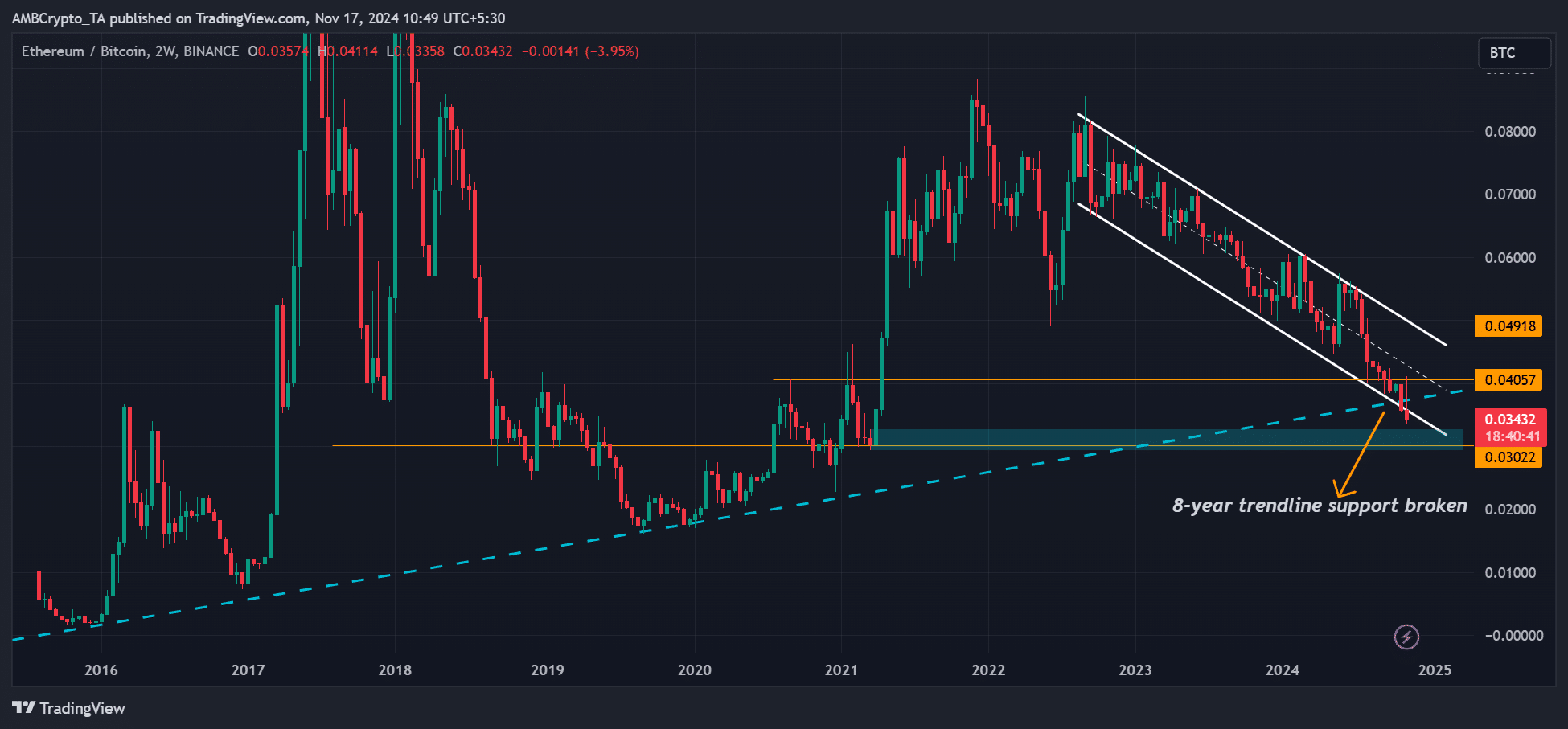

This lack of consensus has dented ETH’s market sentiment to a yearly low against BTC. In fact, the ratio, which tracks ETH’s relative performance to BTC, dropped below an 8-year trendline support.

Commenting on the same, Lyn Alden, a renowned macro analyst, showed her reservations about ETH.

“An administration that is open for crypto securities wins the election. ETHBTC jumps, then falls. New lows after good news. Oof!!”

What does this mean for traders and short-term investors eyeing ETH returns after the US elections?

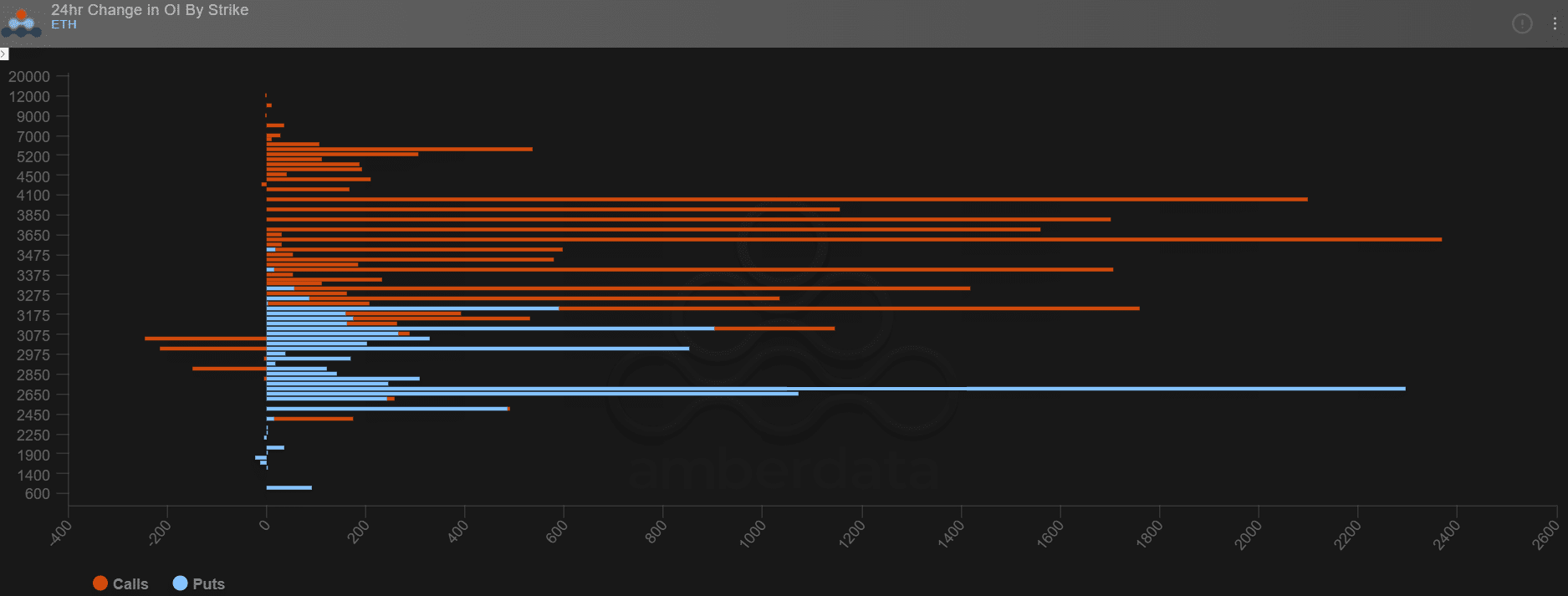

A look at the options market showed that large ETH players were cautiously optimistic.

According to Amberdata, the most significant change in OI (open interest) rates in the past 24 hours was concentrated on calls (bullish bets, orange lines) at $3.6K and $4K targets.

On the downside, there were also massive puts (bearish bets, blue lines) on the $2.7K and $3K targets. In short, large funds expected a wild price swing between $2.7K to $4K, but with a bullish bias.

Read Ethereum [ETH] Price Prediction 2024-2025

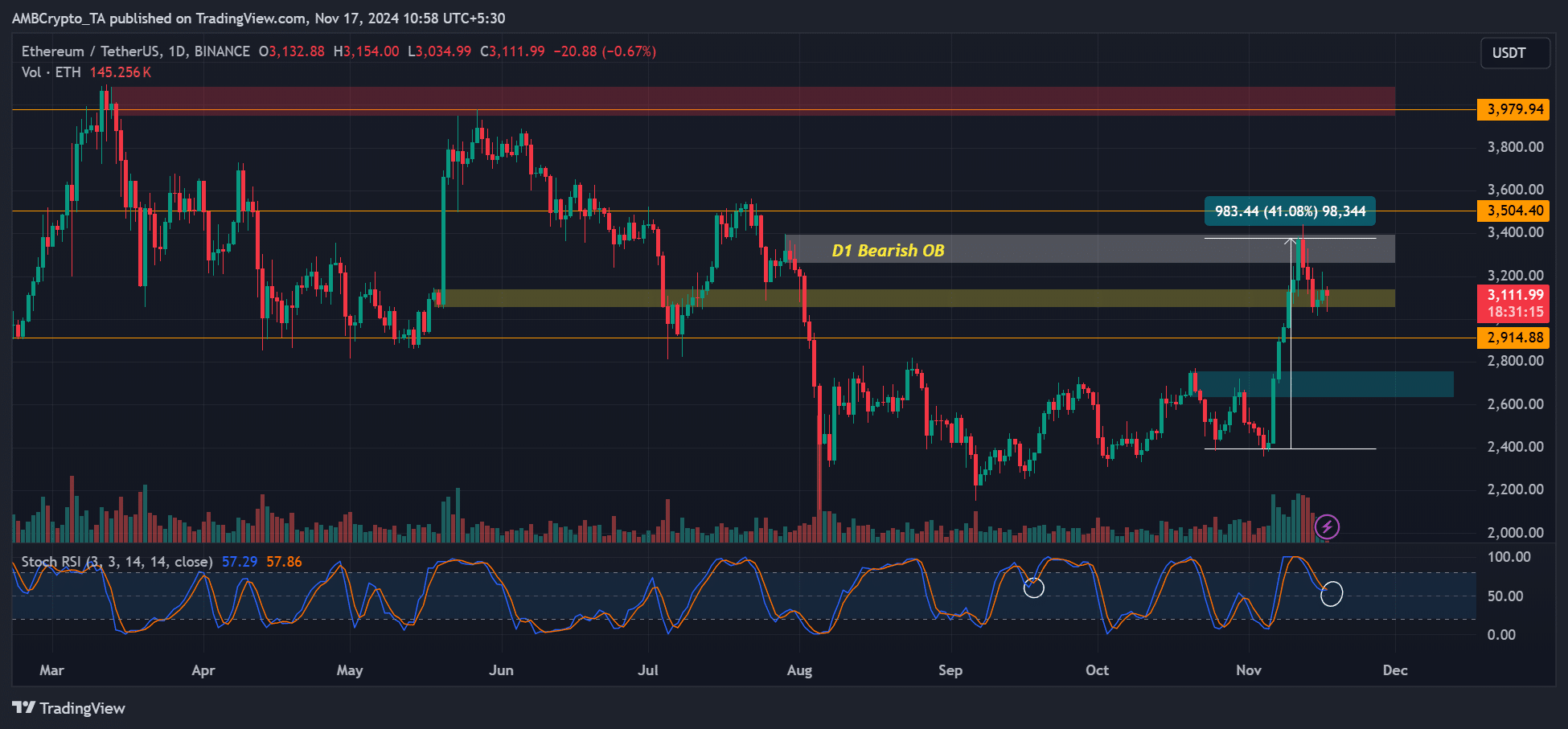

Daily charts revealed a similar story and targets. After rallying over 40% since October, ETH faced a price rejection and cool-off at $3.3K. At press time, the price struggled to hold above the psychological $3K level.

Should the altcoin drop lower, the $2.9K and $2.7K levels will be the next key supports. However, on the upside, the $3.5K and $4K were bullish targets to keep tabs on.