Why Toncoin may soon place 100% of TON holders in profits

- The number of TON addresses across all levels increased, indicating high demand.

- While Open Interest fell, data showed that bulls might soon break past the $8.17 resistance.

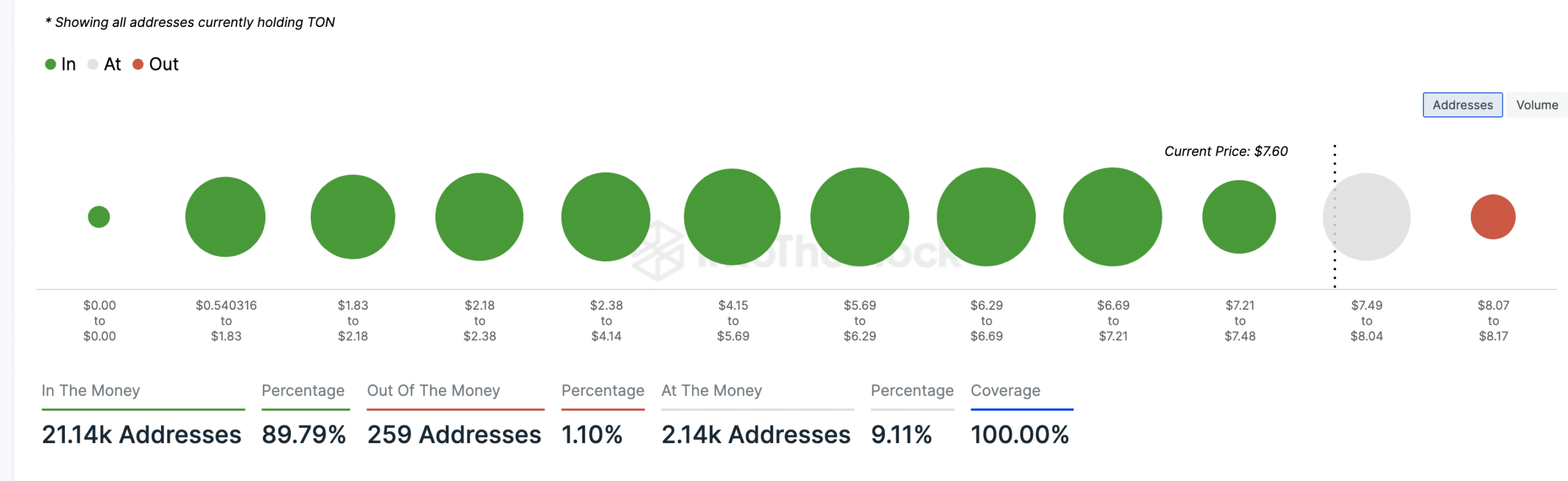

According to IntoTheBlock, only 1% of Toncoin [TON] holders are at a loss. The blockchain analytics platform also showed that 90% are in profits while the rest, are at the break-even point.

The large number of holders out of the red region could be linked to TON’s price. As of this writing, the value of TON was $7.65. Before that, the altcoin had reached a peak of $8.23. But that’s not all.

TON accumulation continues

AMBCrypto’s on-chain analysis shows that it is possible for 100% of TON holders to be in profits soon. This was evident from the indications from the Holdings Distribution.

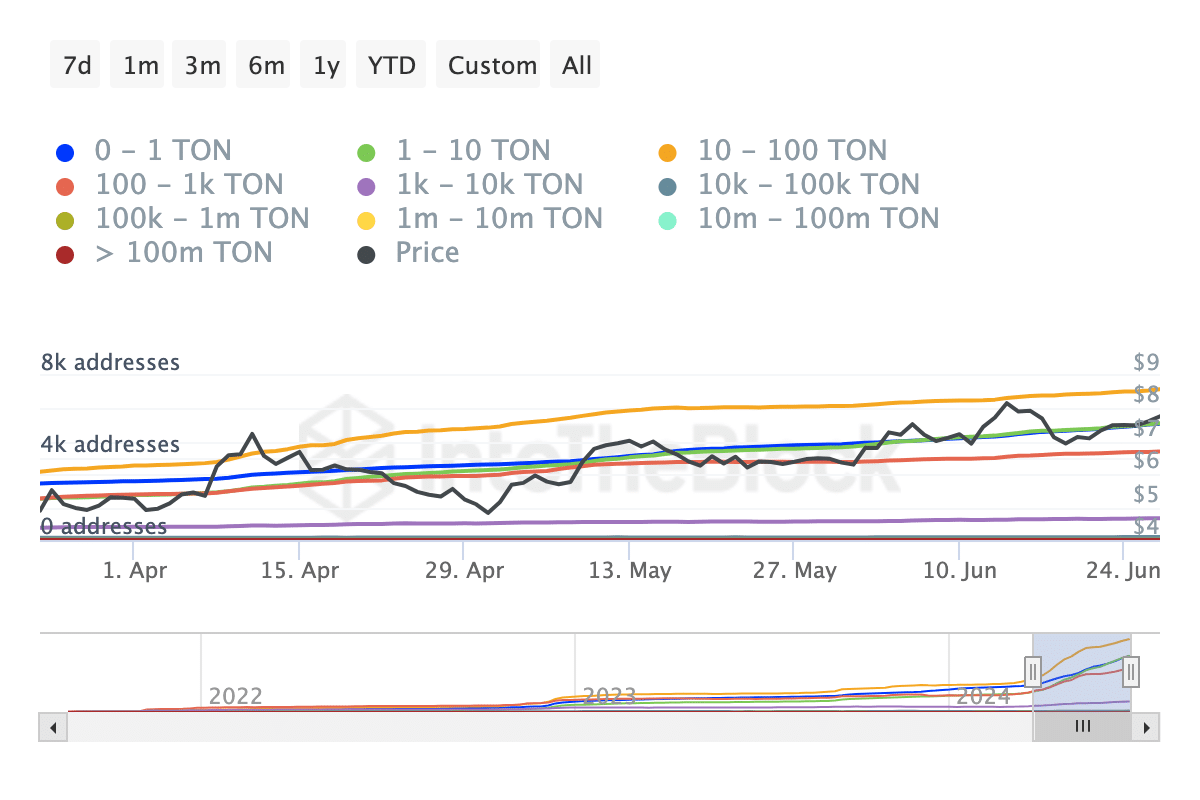

This indicator breaks down ownership of an asset into groups. It also tells if a specific group are buying, selling, or more market participants are adopting a token.

At press time, we noticed that the number of addresses across the 1 TON to 10 million TON group has been increasing. An increase like this suggests confidence in the potential of a token.

Besides that, it implied more traction on Toncoin’s network and increased demand for the cryptocurrency. If this continues into the coming week, TON could build on its 8.15% seven-day increase, and a jump beyond $8 could be likely.

Another indicator supporting this prediction is the GIOM. This stands for Global In/Out of Money. It is a metric that looks at addresses that purchased volume at a certain price range while it acts as support and resistance.

Strong support lies at $7.48

Notably, the higher the number of addresses at a point, the more support or resistance it can provide. As of this writing, we observed that 259 addresses accumulated 117,180 TON between $8.07 and $8.17.

However 1,310 addresses bought 476,270 tokens between $7.21 and $7.48. The large number of addresses in the region suggests strong support for TON.

As such, if demand increases, breaking through the $8.17 barrier might not be exactly challenging. If this happens, Toncoin’s price might retest $8.32, putting 100% of holders in the money.

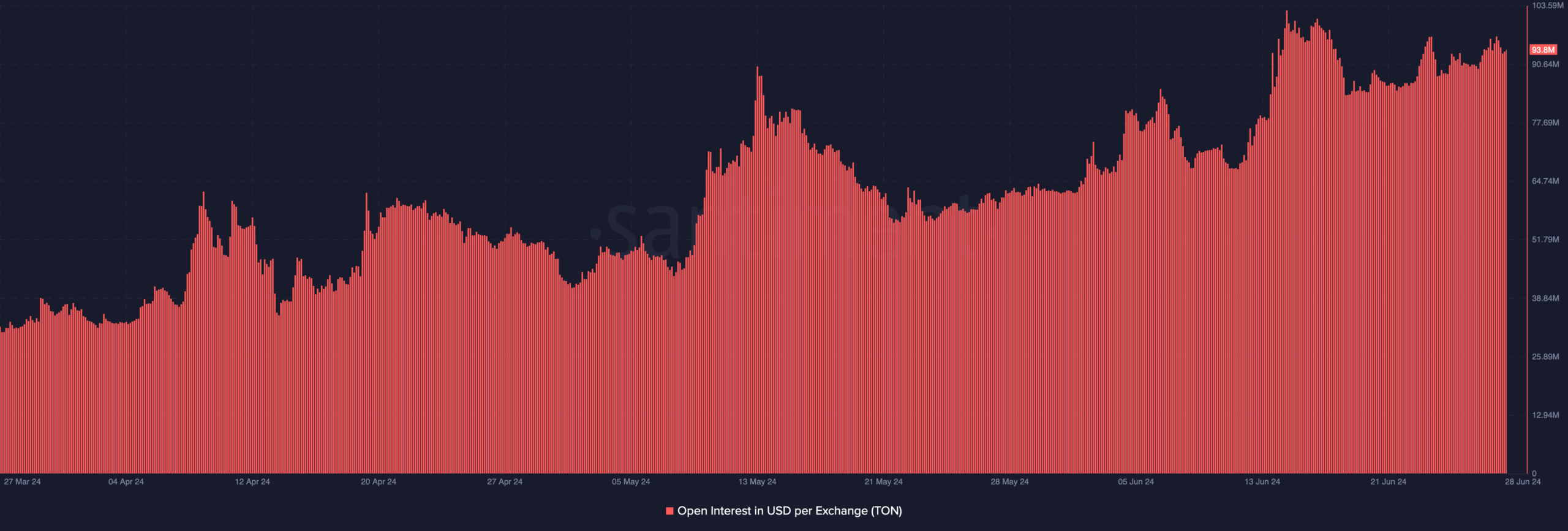

Meanwhile, the Open Interest (OI) is one indicator that could be a stumbling block to this forecast. OI measures the value of open contracts in the market. If it increases, it means that traders are putting new money into the market

However, a decrease in OI, indicates that traders are exiting positions and taking liquidity out of the market. At press time, Toncoin’s OI had dropped from $96.54 million to $93.80 million.

Realistic or not, here’s TON’s market cap in ETH terms

For the price, this indicates weakenss in the uptrend. If the OI had increase from its previous peak, then TON to $8 would be almost certain.

However, as things stand, it could take some time before more holders reach the profit zone.