Fabriik Exchange: Three benefits of a centralized exchange

If you’re just getting started in the world of digital currency, or even if you have some experience already, you may be wondering why many traders use a centralized over a decentralized exchange to buy and sell digital assets.

First, let’s explain what each type of exchange is in the lens of digital assets.

What is a centralized exchange?

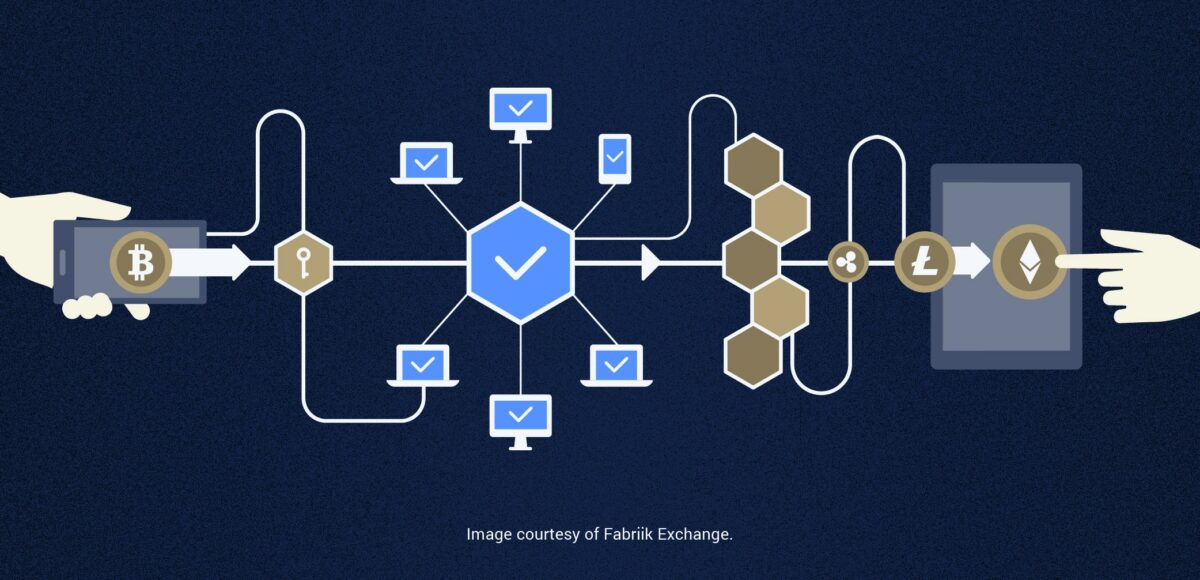

A centralized digital asset exchange acts as an intermediary, matching supply and demand between a buyer and seller, and often acts as custodian – storing and protecting their digital assets – throughout the transaction process. This is often a favorable model for traders because it can offer a regulated environment, providing increased security of their assets and customer protection.

“A centralized exchange creates broader access to digital currencies for everyone because it removes the barrier of understanding or working with blockchain technology.”

-Daniel Skowronski, General Manager at Fabriik Exchange

What is a decentralized exchange?

By contrast, a decentralized exchange for digital currencies does not involve a third-party holding custody during a transaction. The exchange is peer-to-peer. Instead of the centralized exchange verifying the trade, the transaction is automatically verified by the individual parties and their observance of the transaction.

This is what experts mean when they talk about “consensus-based verification.” Let’s use the analogy of a wedding: even if there was no certificate of the ceremony, the marriage would be verified by the crowd of attendants.

Three benefits of using a centralized exchange

1. Breadth of available trading opportunities

Centralized exchanges tend to offer hundreds or thousands of trading pairs. Someone with a certain amount of asset value can convert it to a wide range of choices – Bitcoin and Ethereum, various altcoins, and other products.

2. High liquidity

Liquidity is how quickly and easily a digital currency can be converted to another currency in the exchange. High liquidity indicates there are many buyers and sellers, which can help create a stable marketplace and potentially reduce price fluctuations.

Centralized exchanges tend to have higher liquidity due to narrow “bid-ask spreads.” This small spread can help drive further volume, which increases liquidity. High liquidity exchanges may also reduce the possibility for market manipulation in that fraudulent orders would be much harder to place and transact since there are more observers of market activity assisting in detection, and market forces can help deter such illicit behavior and actors.

3. Transaction security

Centralized exchanges tend to be regulated and compliant with necessary laws, such as money laundering and counter-terrorism, providing customers with greater security. In contrast, decentralized exchanges tend not to be regulated.

Choosing a centralized exchange

These are all considerations to think about when choosing where to buy, sell, or trade digital assets. It always makes sense to look at the regulatory environment of a given exchange.

According to Corporate Finance Institute, approximately 99% of all digital currency transactions go through a centralized exchange. Examples of centralized exchanges include:

- Fabriik Exchange – the new kid on the block. Fabriik says its Exchange is “a unique, fresh, and intuitive trading experience, to help you buy and sell digital currencies faster in a regulated environment.” Fabriik Exchange is part of the organization’s full network of digital financial services, which offers customers the ability to transform, hold, trade, and grow every asset they own, all in one accessible place.

- Coinbase and Coinbase Pro

- Kraken

- Gemini

Disclaimer: This is a paid post and should not be considered news/advice

![Why Chainlink [LINK] and Polygon [MATIC] are more similar than you realise](https://ambcrypto.com/wp-content/uploads/2024/04/Chainlink_and_Polygon-1-400x240.webp)