Why whales are holding on to SHIB as scam fears hit Shiba Inu’s price

- Scam alerts rattled ShibArmy as technical indicators flashed mixed signals for SHIB

- Whale addresses now control over 60% of SHIB’s supply

Shiba Inu (SHIB) saw some downward pressure on the price charts on 15 August, reflecting the broader crypto market’s decline.

At press time, Shiba Inu was trading at $0.0000137, down by 1.74% in the last 24 hours. Worth pointing out though that on a weekly basis, SHIB registered a minor hike of just over 3% – A sign of resilience in the face of the market’s downturn.

That’s not all though as the Shiba Inu community is now on high alert due to growing concerns about potential scams. In fact, according to Shibarmy Scam Alerts, an X account dedicated to Shiba Inu, scammers are impersonating Shiba Inu’s lead developer, Shytoshi Kusama, on social media.

🚨SHIBARMY WARNING:🚨

Watch out for scammers on socials impersonating@ShytoshiKusama and asking you to click links . Shy will never request you to do such things.

Stay SAFE #Shibarium #SHIBARMYSTRONG pic.twitter.com/7lPDWY5mN2

— Shibarmy Scam Alerts (@susbarium) August 14, 2024

These bad actors are attempting to deceive users into clicking on malicious links, potentially leading to phishing attacks and other fraudulent activities.

This heightened awareness and concern among the ShibArmy’s members may have contributed to the recent downtick in SHIB’s price.

A mixed bag on the charts?

An analysis of SHIB, at press time, revealed mixed signals, with key indicators suggesting both potential risks and opportunities. The Bollinger Bands, for instance, indicated a period of low volatility for SHIB. The altcoin’s price seemed to be near the middle band, with the bands tightening – A sign of potential consolidation.

This setup suggests that a breakout or breakdown could occur in the near term. A move above the upper band may signal bullish momentum, while a drop below the lower band could indicate further downside risk.

The Chaikin Money Flow (CMF) indicator had a reading of 0.26, pointing to strong buying pressure in the market. What this means is that capital inflows are exceeding outflows, leading to a potential upside if this trend continues.

Source: SHIB/USDT, TradingView

However, the Relative Strength Index (RSI) stood at 38.36, indicating that SHIB was in a bearish to neutral zone.

The RSI was not yet in oversold territory, which would be below 30, but it is also far from the 50 mark that typically indicates a shift towards bullish momentum.

Whales tighten grip on SHIB

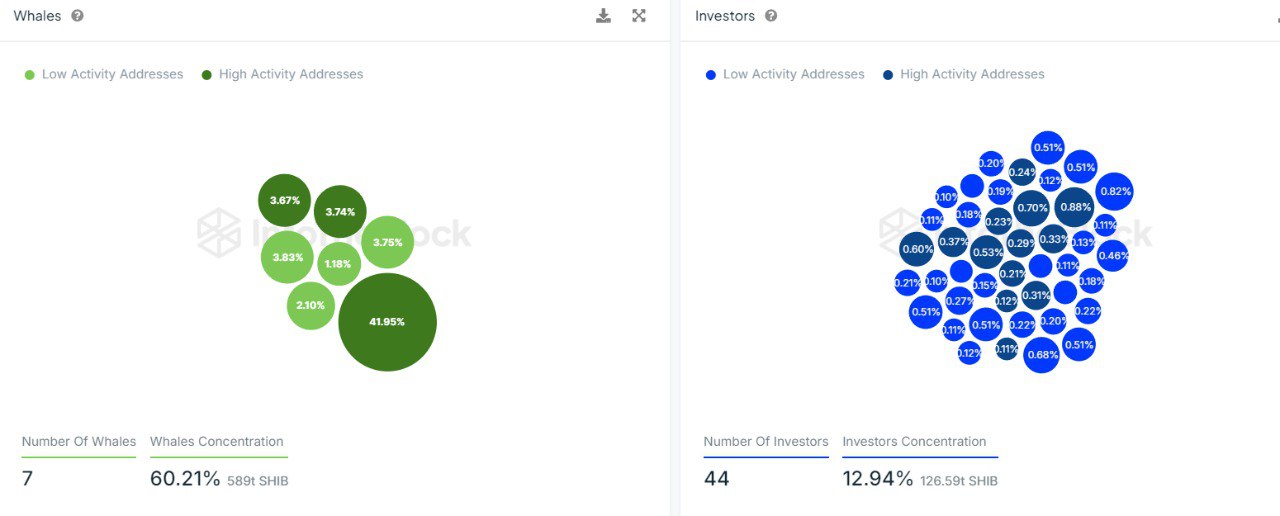

According to IntoTheBlock, ownership data revealed that whale addresses, though few in number, have dominated SHIB’s market. There are currently 7 whale addresses holding 60.21% of SHIB’s total supply, approximately 589 trillion tokens. This concentration gives these large holders significant influence over the market.

In comparison, 44 investor addresses hold 12.94% of the supply, or roughly 126.59 trillion SHIB. The broader investor base, while more distributed, still plays a crucial role in SHIB’s market dynamics, with varying levels of activity among both low and high engagement addresses.

Source: IntoTheBlock

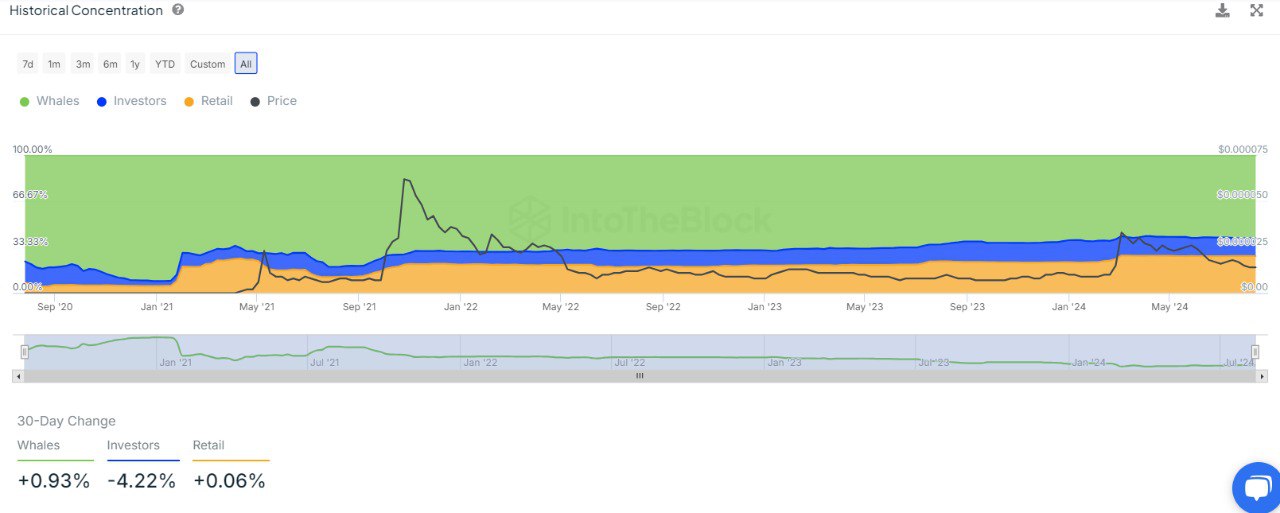

Historical concentration data also showed that whale activity has risen by 0.93% over the past 30 days, indicating a consolidation of positions among large holders.

On the contrary, investor ownership has fallen by 4.22% during the same period, suggesting a reduction in smaller investor activity. Retail investor participation has remained stable though, with a slight hike of 0.06% – Sign of sustained interest from this group.

Source: IntoTheBlock

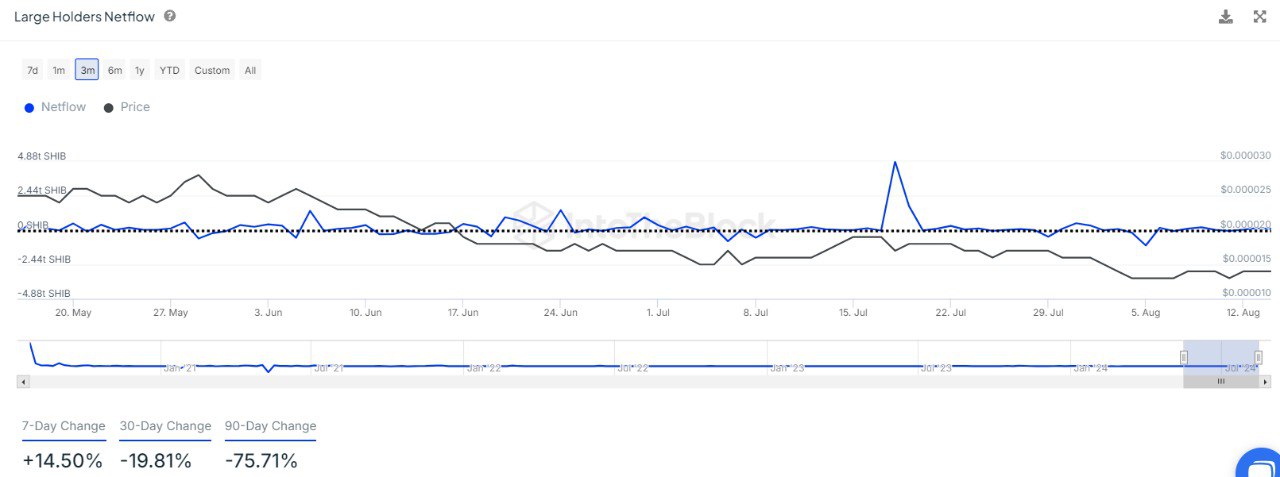

Finally, the netflow of large holders, which measures the net amount of SHIB entering or leaving major wallets, has seen mixed trends lately. Over the past seven days, there has been a 14.50% hike in netflow, indicating recent accumulation by large holders.

However, this short-term gains contrast with broader declines over 30-day and 90-day periods, where netflow dropped by 19.81% and 75.71%, respectively. Despite these fluctuations, SHIB’s price has remained relatively stable, suggesting that the market has absorbed these changes without significant price volatility.

Source: IntoTheBlock