Ripple

Why XRP is on the verge of breaking out, according to…

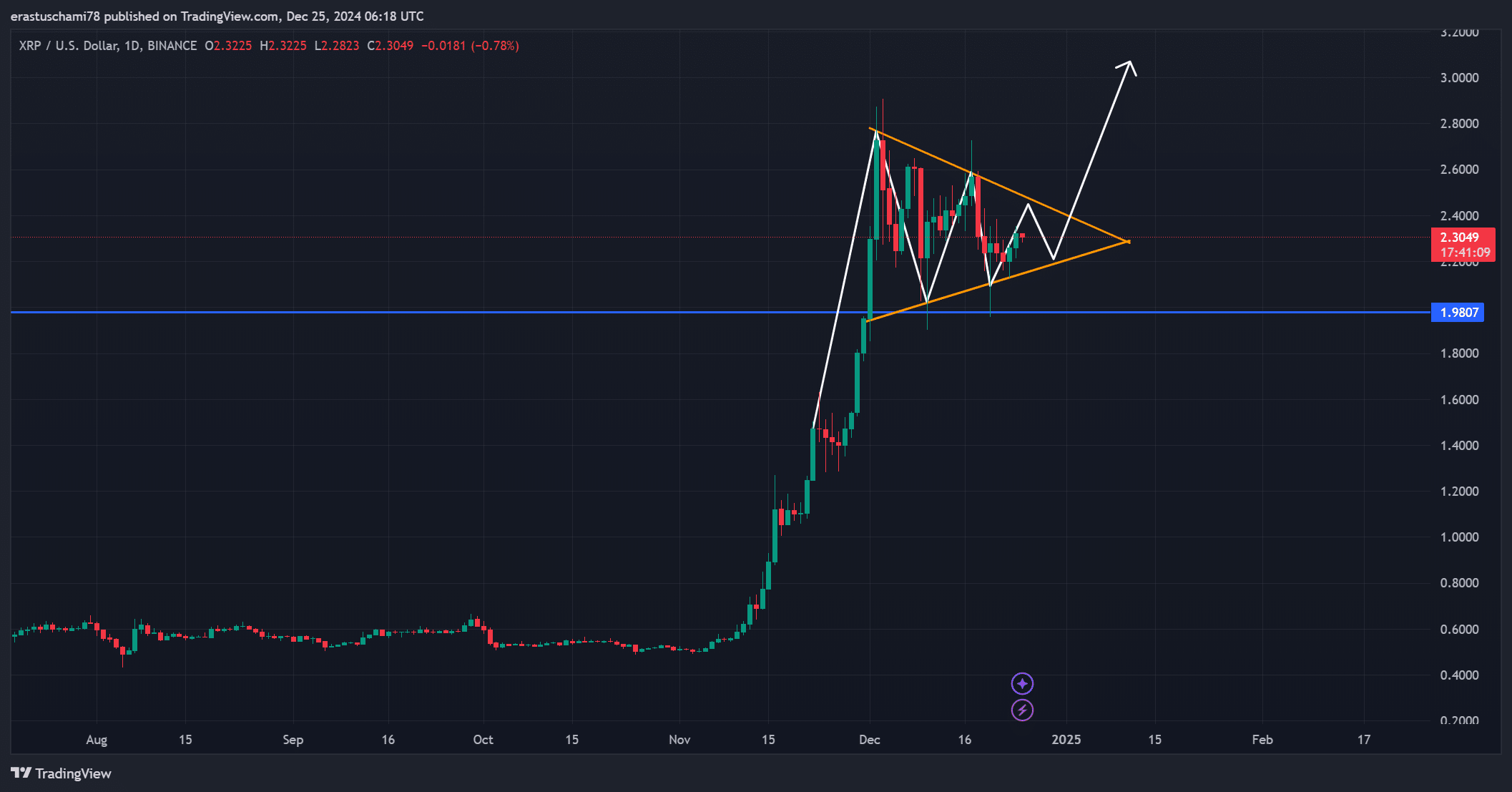

XRP consolidates near $2.30, forming a bullish pennant that indicates potential upward momentum.

- XRP’s bullish pennant pattern suggests a potential breakout, with $3.00 as the next target.

- Market sentiment has surged, with Open Interest up 47.57% and active addresses increasing 1.37%.

XRP is attracting significant market attention, with bullish sentiment dominating across both Crowd and Smart Money indicators.

According to Market Prophit’s analysis, this optimism aligned with strong technical patterns, suggesting that the cryptocurrency might be poised for a significant move higher.

At press time, XRP was trading at $2.30, up 2.22% in the past 24 hours, sitting just below a critical resistance level.

What’s driving XRP’s momentum?

XRP’s price movement showed the formation of a bullish pennant flag at press time, which typically signals a period of consolidation before a potential breakout.

This pattern, combined with the recent steady price action, is drawing attention from traders.

Importantly, $2.30 has emerged as a pivotal resistance level. A decisive break above this could pave the way for XRP to target $3.00, a key psychological milestone.

However, failure to clear this level may lead to further consolidation within the pennant, delaying any significant upside move.

Active addresses: a bullish on-chain signal?

Additionally, on-chain data revealed encouraging signs of growing network activity. The number of active XRP addresses rose by 1.37%, reaching 31K.

This increase indicates heightened user engagement and transactional activity, both of which often precede price rallies.

Therefore, the rise in active addresses may signal growing confidence among market participants, strengthening the case for a bullish breakout.

Technical indicators show mixed signals

From a technical standpoint, the Stochastic RSI (STOCH RSI) was at 21.68, firmly in the oversold zone. This reading suggested that XRP might be nearing a reversal as buying pressure builds.

Moreover, the MACD was at -0.0631, indicating bearish momentum, but the narrowing gap between the MACD line (0.1883) and the signal line (0.1252) suggested convergence.

This could hint at weakening selling pressure.

Together, these indicators present a mixed outlook, but lean toward an eventual upward price move if momentum shifts positively.

Market sentiment and Open Interest surge

Market sentiment is further reinforced by a massive surge in Open Interest, which has increased by 47.57% to $2.90 billion.

Such a spike suggests heightened trader participation, reflecting growing expectations for significant price movements. Coupled with the bullish pennant and rising active addresses, this surge supports the bullish narrative.

Read XRP’s Price Prediction 2024–2025

Is a rally imminent?

XRP’s bullish sentiment, rising on-chain activity, and promising technical patterns suggest a breakout above $2.30 could propel prices higher.

With the right momentum, XRP may target $3 in the near term, making this a critical moment for traders to watch.