Why XRP’s recent price surge failed to break its bearish trend

- XRP has reported a price rise in the last 24 hours.

- The bearish trend persisted even with the current price rise.

Ripple [XRP] has experienced a 3.24% surge in the last 24 hrs. At press time, the altcoin, was trading at $0.49. In the last seven days, it has experienced a price rise of 0.04.

In fact, it was also reporting a 1.1% increase in the last hour. According to Coinmarketcap, XRP’s market cap has surged by 3.08% to $27.4b. However, its volume has declined by 18.6% in the last 24 hrs to $813M.

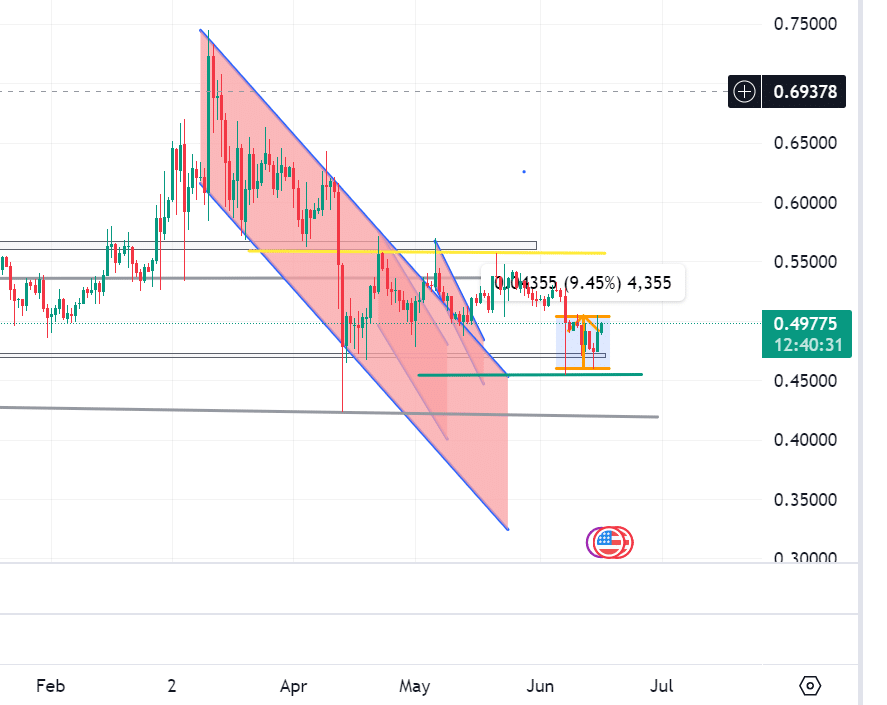

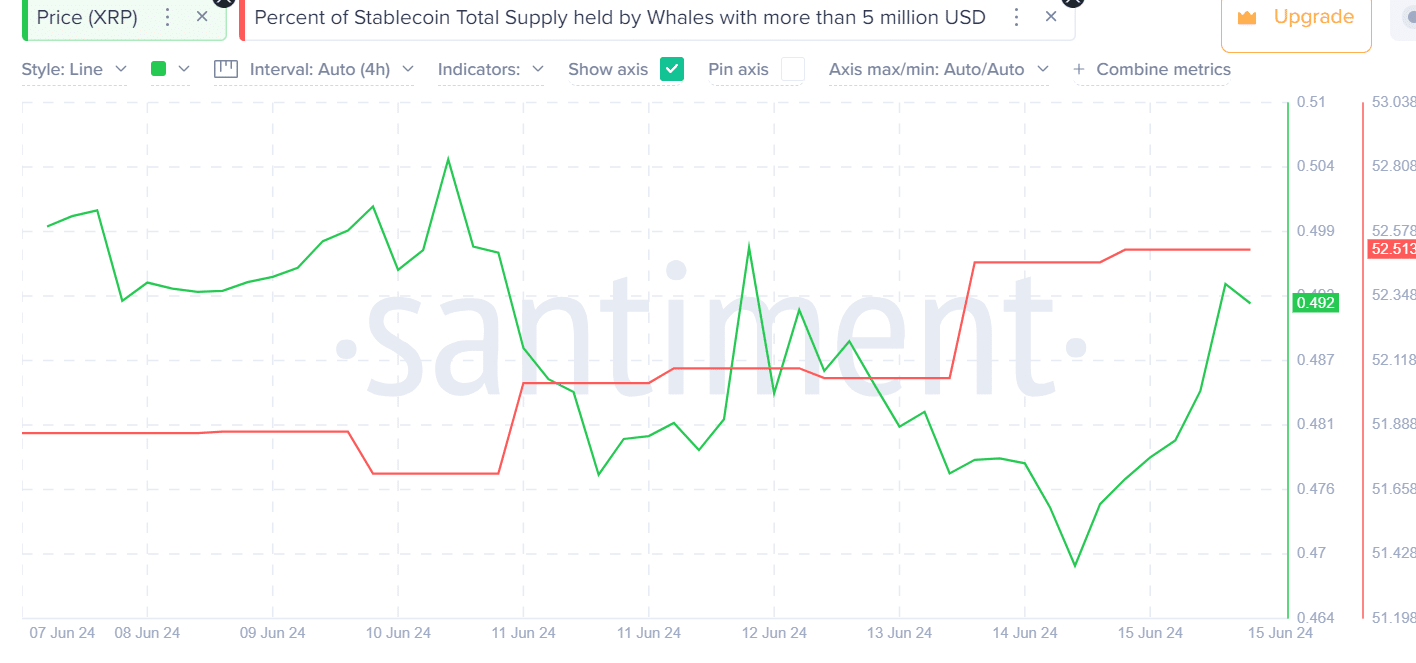

AMBcrypto’s analysis shows that XRP increased to $0.51 on the 15th of June from a previous low of $0.46, which was a 9.45% price increase.

The price increase followed a downward correction from the recently recorded price of $0.45. Thus, after the support managed to hold the downtrend, the price increased in the last 24 hours.

The current increase sets XRP for a further rise if it breakouts out the resistance level of around $0.53.

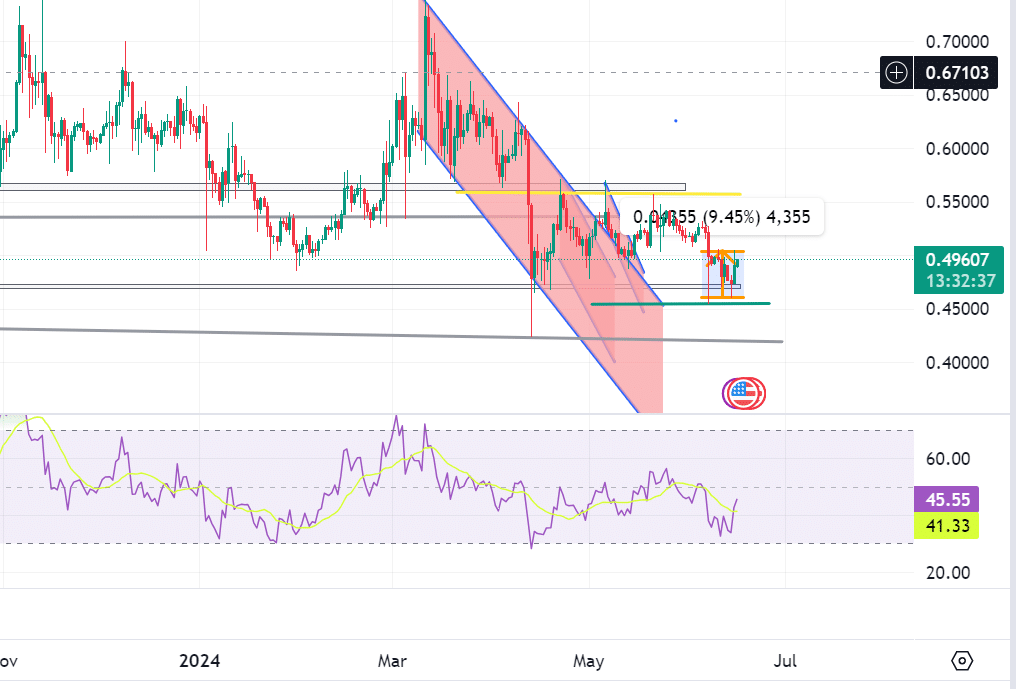

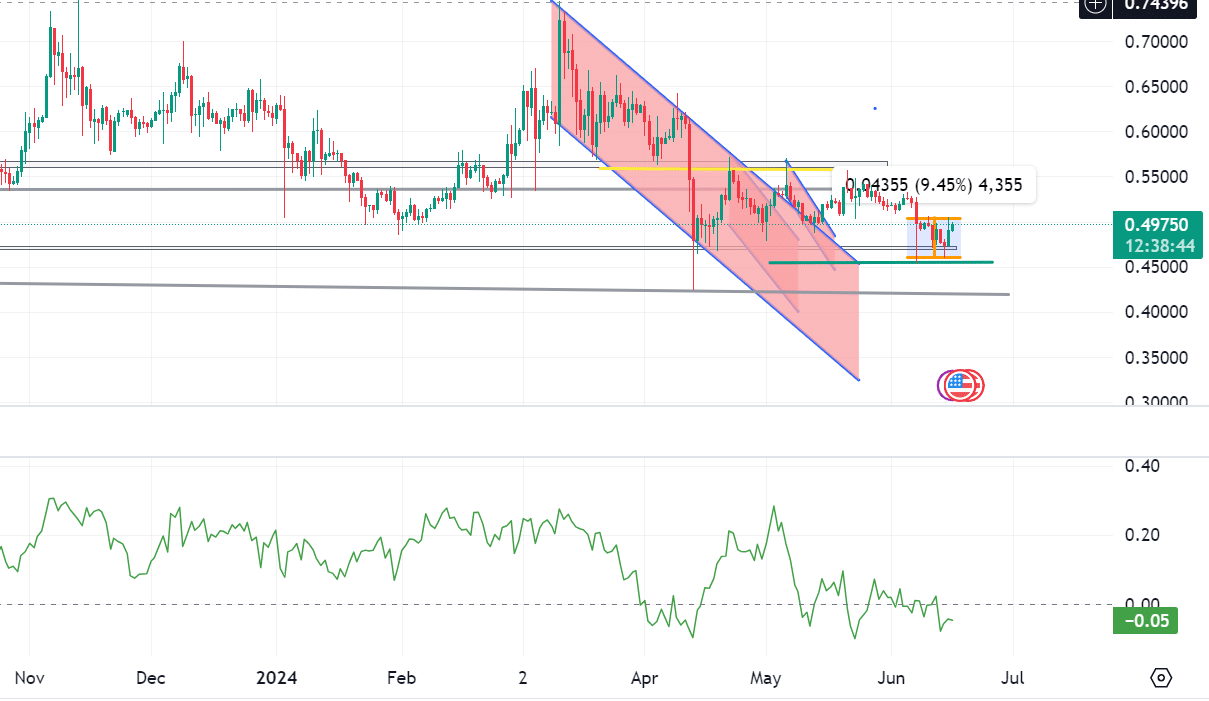

In fact, RSI at 45 showed that there were more sales than purchases. This RSI index implied that the prices will go down because of selling pressure. Overall, a higher selling pressure results in a price decline.

Equally, a negative CMF of -0.05 showed the continued bearish trend. In a sense, a CMF below 0 supports a downtrend. Thus, despite the current price surge, the overall market is positioned for a further decline.

What do metrics indicate?

Looking further, various indicators support a continued bearish trend.

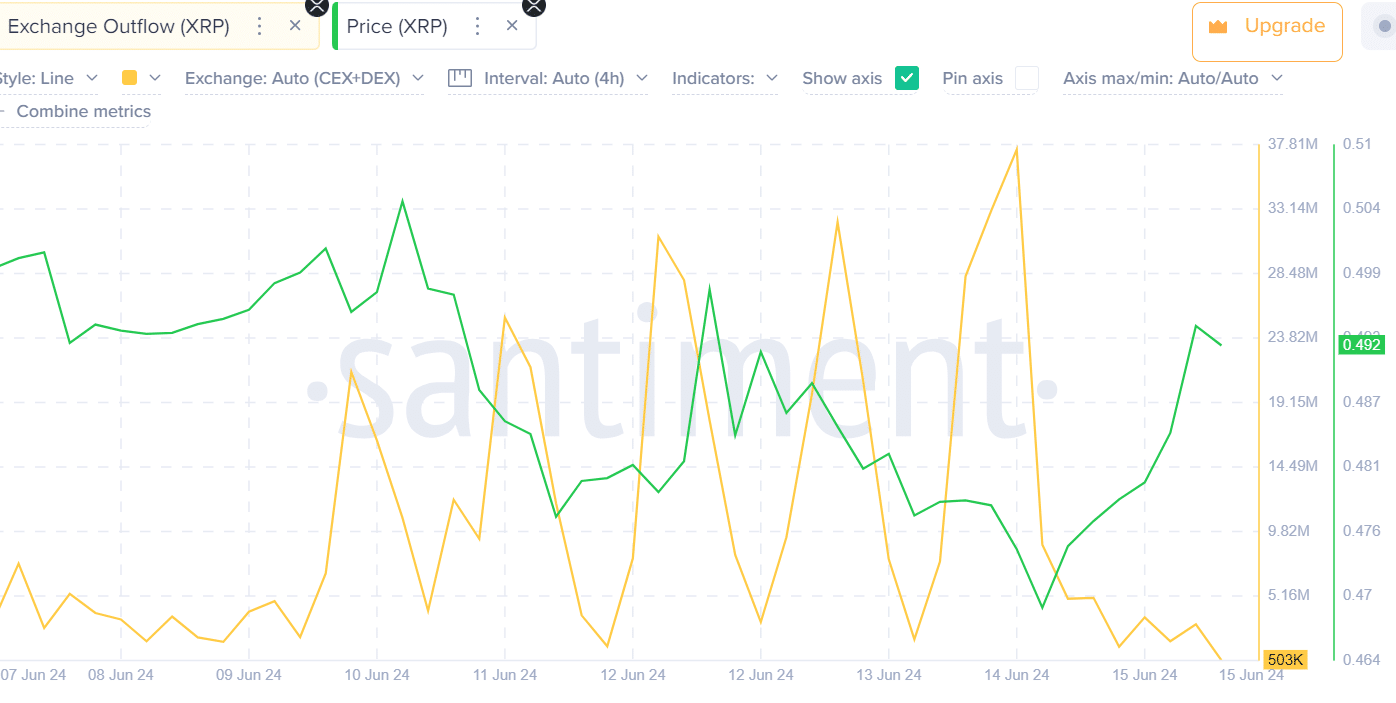

According to Santiment’s data, XRP has reported a continued decline in exchange outflow. A decline in exchange flow means XRP withdrawal from exchanges to wallets is reduced.

When there is a high outflow, crypto prices rise because of scarcity, while reduced outflow means lower prices.

Further, according to Santiment, XRP has recorded a higher supply of stablecoins held by whales. In press time, whales with over $5 million of XRP held $27M, which is 52% of the total supply.

The accumulation of exchanges in a few holders increases price volatility, which is witnessed by the bearish trend even with the recent price increase.

Realistic or not, here’s XRP’s market cap in BTC terms

What’s next for XRP?

As of the time of writing, XRP was recording a 3% increase in the last 24 hrs. However, the price increase seems to consolidate with a bearish market trend. Various metrics showed that the bearish trend is set to continue.

The exchange outflow indicated a continuous bear market trend. Equally, a negative CMF indicated a further downtrend, while a 45 RSI index indicated a selling pressure that was likely to push the market down further.