Altcoin

Why’s Litecoin’s hype culling as halving nears?

Litecoin’s halving buzz fades, on-chain activity wanes, and traders grapple with uncertainty. Nevertheless, LTC sparks hope as it gains momentum amidst mixed sentiments.

- Litecoin’s active and new addresses have reduced in the past few weeks.

- LTC funding rate showed mixed signs as traders were undecided.

Up until now, Litecoin [LTC] was bustling with on-chain activity as it geared up for its halving event. But as the weeks passed, it seemed like the energy was starting to wane. The post-halving effect, which was once anticipated to bring positive trends to LTC, now faces uncertainty.

Is your portfolio green? Check out the Litecoin Profit Calculator

Litecoin’s halving excitement fades

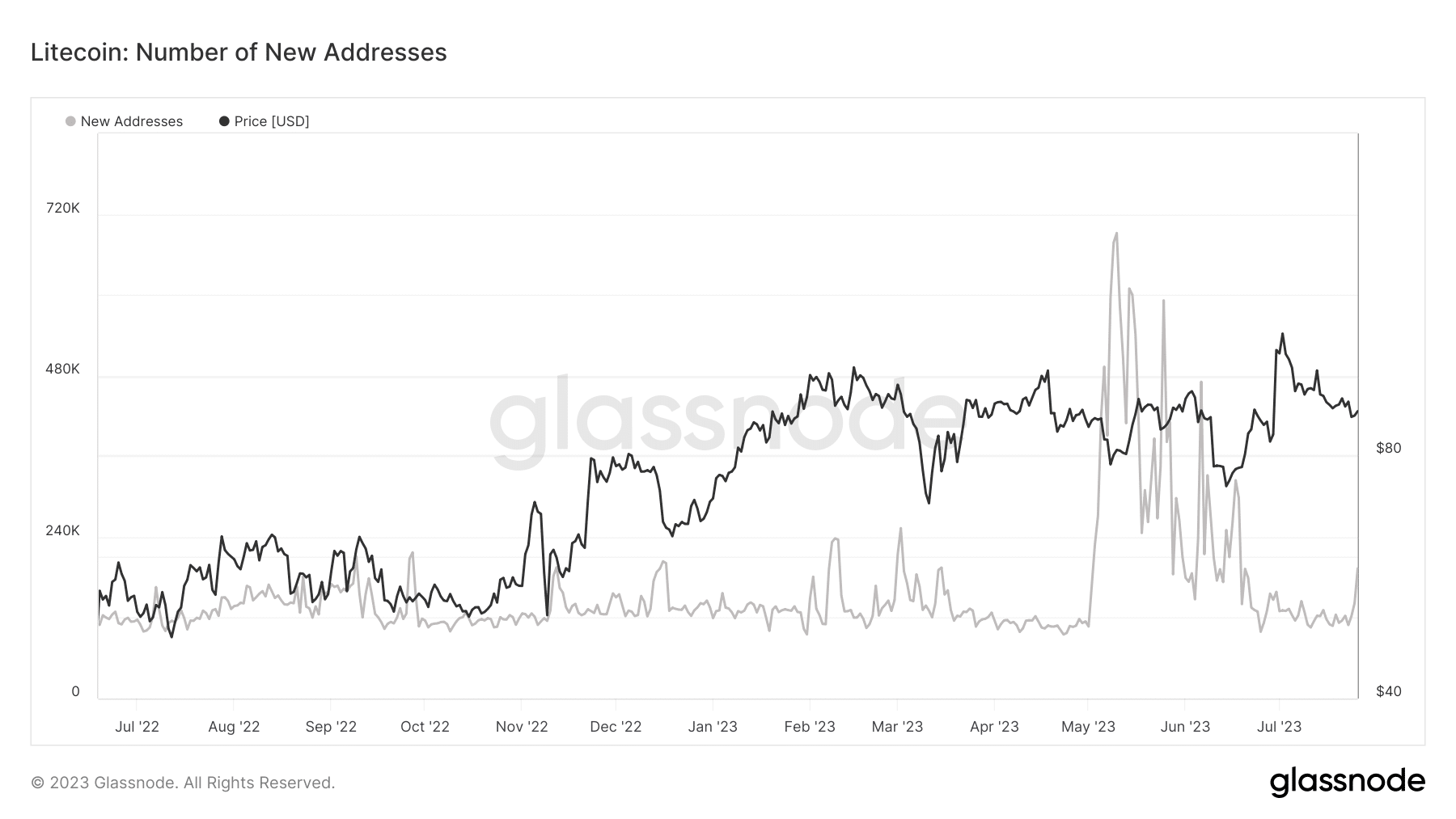

Before Litecoin’s halving event, two metrics – active addresses and new addresses – showcased the vibrant on-chain activities the network was experiencing. These metrics were clear indicators of users’ enthusiasm and hinted at a potential uptrend following the halving.

However, in recent days, both metrics have taken a downturn.

According to Glassnode’s data on new addresses, a decline in their creation was observed from the end of June. Daily new addresses that once ranged between 300,000 and 200,000 around 17 and 18 June eventually dropped to the 100,000 range in July.

Although there was a slight increase at the time of writing, the number only reached slightly above 190,000.

Similarly, the number of active addresses has dwindled in the past few weeks. From its peak of over 400,000 in June, it decreased to around 200,000. Nonetheless, a small surge occurred at the time of writing, pushing the number above 300,000 for the first time in July.

While the initial uptrend between these two metrics pointed towards a resurgence of interest, the excitement seems to have diminished over the past few weeks. The future remains uncertain as the network’s activity continues to fluctuate.

Litecoin sees mixed funding rate

According to data from Coinglass, the market sentiment surrounding Litecoin

was rather mixed. Looking at the funding rate at the time of observation, it oscillated between negative and positive values.Although the positive funding rate had gained prominence by then, it signaled that traders were grappling with uncertainty regarding Litecoin’s trajectory.

This indecision among traders indicated that the price trend of LTC might experience some level of volatility. With traders unable to reach a consensus on which position to fund – long or short – the market was likely to witness fluctuations and unpredictability in Litecoin’s value.

LTC gains momentum

Amidst the mixed sentiment displayed by traders through the funding rate, Litecoin

managed to make gains on a daily timeframe chart. As of this writing, it was trading at approximately $91, reflecting an almost 1% increase in value.Realistic or not, here’s LTC’s market cap in BTC’s terms

The Moving Average Convergence Divergence (MACD) indicated a weakening of the bearish sentiment, although the overall trend remained bearish.

Encouragingly, this price surge had managed to flip its short Moving Average back into support. The move showed that there was potential for future gains.