WIF ahead of Dogecoin? Analyzing dogwifhat’s 21% surge

- WIF soars by 21% on weekly charts.

- Dogwifhat’s open interest has increased by 51.5% over the past week.

Over the past two weeks, crypto markets have experienced extreme volatility. Since the market crash a week ago, most cryptos are recovering.

Amidst this recovery, meme-coins have taken the lead, with WIF leading. The Solana-based memecoin dogwifhat [WIF] is outpacing other memecoins, recording significant gains.

Dogwifhat leads the memecoin market

WIF has outpaced most memecoins on weekly charts with substantial gains.

For starters, SHIB has recorded 3.17% over the past seven days while DOGE reported low gains of 3.47% on weekly charts, and PEPE was enjoying a hike of 5.41%.

While the crypto markets have experienced considerable recovery, most memecoins have gained on daily and weekly charts, with WIF at the forefront.

The surge has left analysts betting on WIF to lead the memecoin industry. On the X page, Platinum Capital shared that,

“If the market holds and #wif can hold 1.8, we are in for a move on #dogwifhat. $wif could lead this #memecoin next leg.”

What price charts suggest

As of this writing, WIF was trading at $1.86 after recording a 21.34% surge over the past week. Equally, the memecoin has increased its market cap by 3.17% to $1.8 billion.

However, while the altcoin has experienced a price surge, it has declined in trading volume by 37.51% over the past 24 hours to $255.5 million.

Looking at the Altcoins’ Advance decline ratio (ADR), which is 1.15, suggests the asset is experiencing more gains in value than losses. This indicates a bullish market sentiment.

Also, the RVGI has experienced an uptrend from -0.4 to -0.12 over the past week. Although it’s still below zero, the uptrend shows the upward movement is gaining momentum as the market sentiment shifts.

Additionally, the Relative Strength Index (RSI) has experienced an uptrend from 29.6 to 47.14 over the past week. This shows that WIF has been experiencing sustained buying pressure over the past week, thus driving prices up.

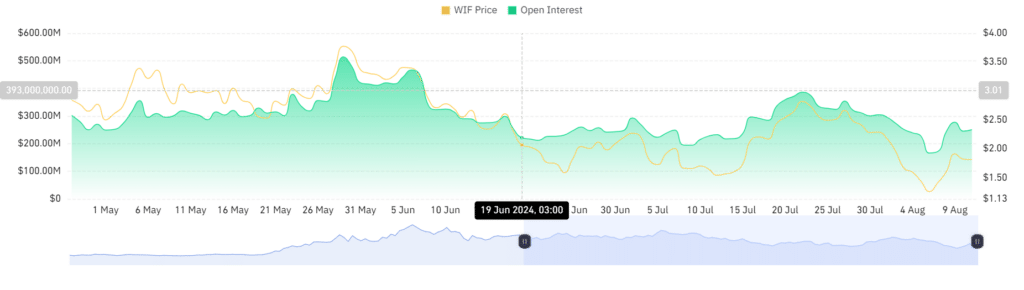

Source: Coinglass

Looking further, AMBCrypto’s analysis of Coinglass shows that WIF open interest has surged by 51.1% over the past week. Open interest has increased by 51.5% over the past week from $165m to $250m.

This shows that investors are opening more new positions while holding the existing ones.

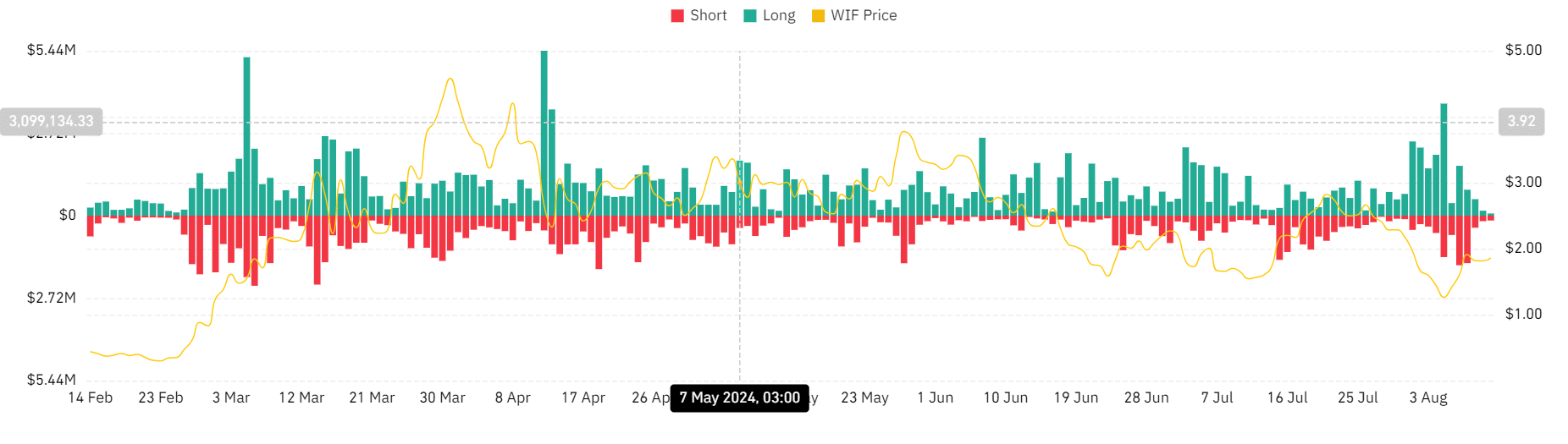

These phenomena are further proved by low liquidation for long positions over the past 48 hours. WIF liquidation for long positions has declined from a high of $3.7 million to $71.8k over the past week.

Realistic or not, here’s WIF’s market cap in BTC’s terms

This shows that long-position holders are willing to pay a premium to hold their positions.

Therefore, if the current market conditions and sentiment hold, WIF will challenge the next significant level at $2.3. Especially if the daily candle stick closes above $1.89.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)