WIF loses 12% in 24 hours – How can traders make sense of it all?

- WIF’s value has dropped by over 10% in the last 24 hours

- Derivatives market performance highlighted the presence of significant bearish sentiments

The price of Solana-based memecoin dogwifhat [WIF] has fallen by double-digits in the last 24 hours alone. Owing to the same, it’s now one of the market’s top losers over the aforementioned period, according to CoinMarketCap’s data.

At the time of writing, the altcoin was valued at $2.69, having shed 12% of its value in 24 hours. Over the same period, daily trading volume also declined by 38%.

WIF traders begin to lose bullish conviction

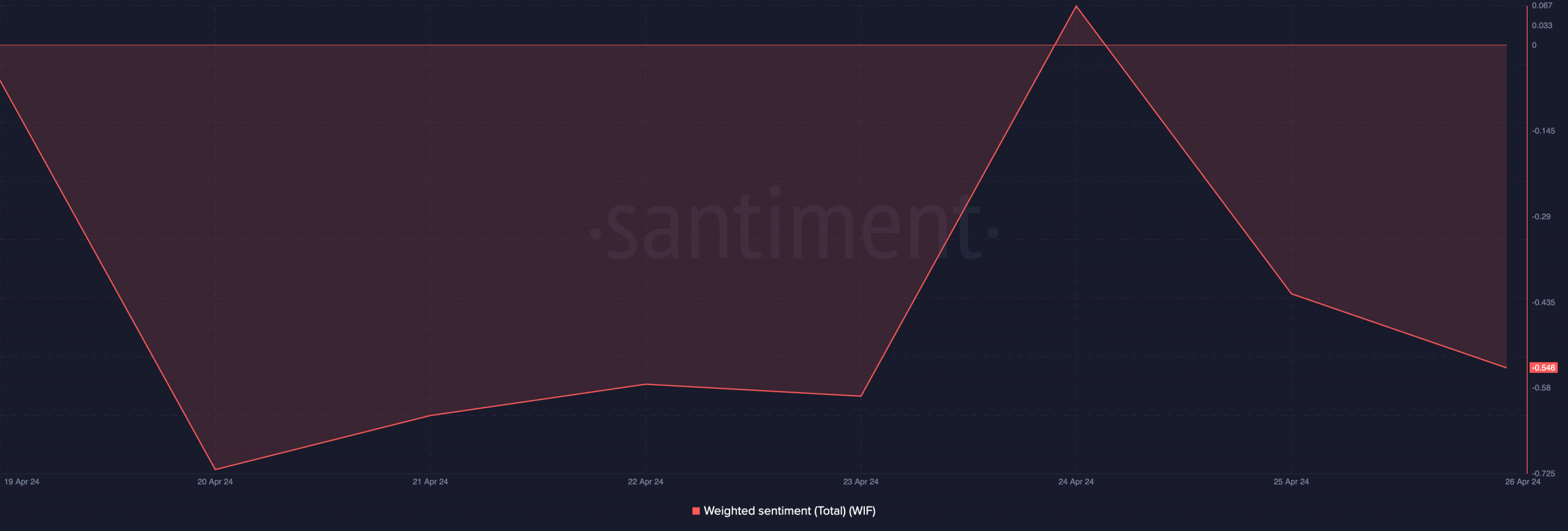

An assessment of WIF’s market activity revealed a spike in negative sentiments over the past few days. In fact, at press time, the memecoin’s weighted sentiment was -0.546, according to Santiment. This metric’s negative value highlighted that bearish sentiment outweighed bullish feelings among WIF’s market participants.

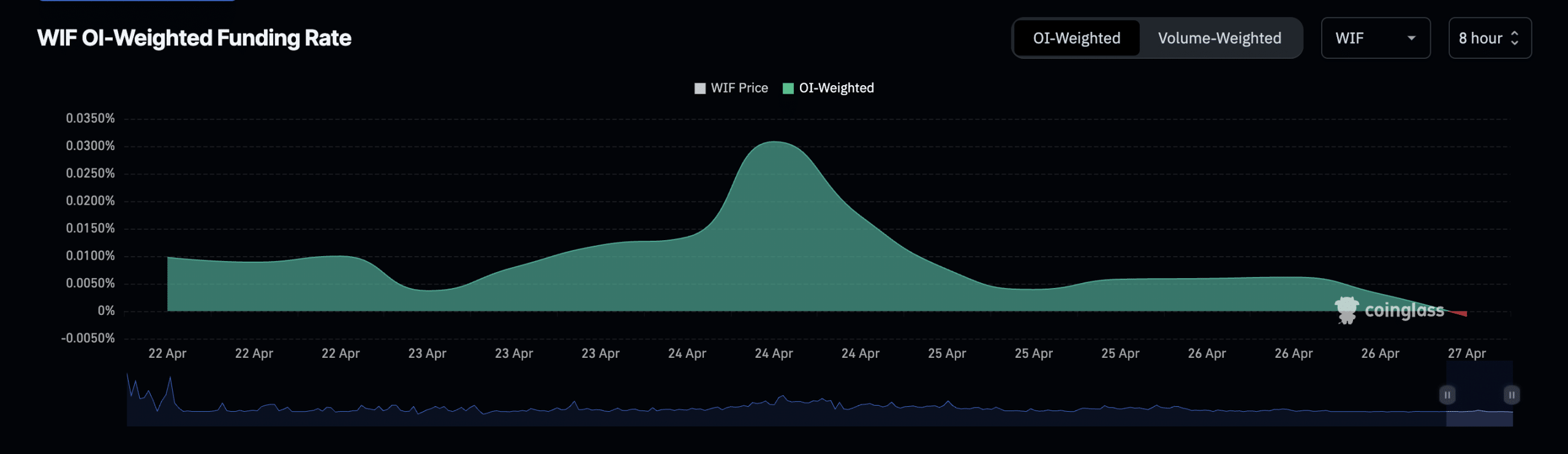

Confirming the bearish trend, WIF’s funding rate was negative too. According to Coinglass’ data, the token’s funding rate across cryptocurrency exchanges was -0.0009%. This is significant because it is the second time the token’s funding rate will be negative since 8 February.

Funding rates are a mechanism used in perpetual futures contracts to ensure that the contract price stays close to the spot price.

The value of an asset’s funding rate is positive when its contract price is higher than its spot price, and traders who hold long positions pay a fee to traders shorting the asset.

Is your portfolio green? Check out the dogwifhat Profit Calculator

Conversely, it returns a negative value when its contract price is lower than the spot price and short traders pay a fee to traders holding long positions,

When an asset’s funding rate is negative like this, more traders are holding short positions. This means that more traders are expecting the asset’s price to fall than there are traders buying the asset with the expectation of selling at a higher price.

In addition to a negative funding rate, WIF’s Futures open interest has steadily declined since 9 April as well. With a value of $302.45 million at press time, it has since fallen by 41%.

Thanks to WIF’s steady price drop, its long traders have suffered more liquidations than those with short positions over the past week. In fact, as of 26 April, long liquidations totalled $1.7 million, while the amount of short positions forcefully closed was ‘just’ $1 million.