WIF price dips despite whale’s multi-million dollar bet – Here’s why

- $4.6 million worth of dogwifhat was recently accumulated.

- The address that accumulated these tokens is the highest holder.

Recently, dogwifhat [WIF] experienced significant accumulation by a notable whale address, coinciding with positive trends in its price over the last two days.

However, the excitement seen in direct market transactions doesn’t seem to be uniformly reflected in the derivatives market.

WIF whales add to holdings

Recent data from Lookonchain revealed that a whale address has made significant moves in the dogwifhat market. This address invested $4.65 million to purchase 2.3 million WIF tokens, priced over $2 each.

This recent acquisition has established this address as holding the largest volume of the memecoin.

With this latest purchase, the address now possesses a total of 23.39 million WIF tokens, valued at over $49 million. The address’s holdings represented a substantial profit of over $83 million at press time.

Such substantial activity from a single whale can have a significant impact on market dynamics, potentially influencing token price and investor sentiment.

It also highlights the role of large holders in shaping the trajectory.

WIF falls after accumulation

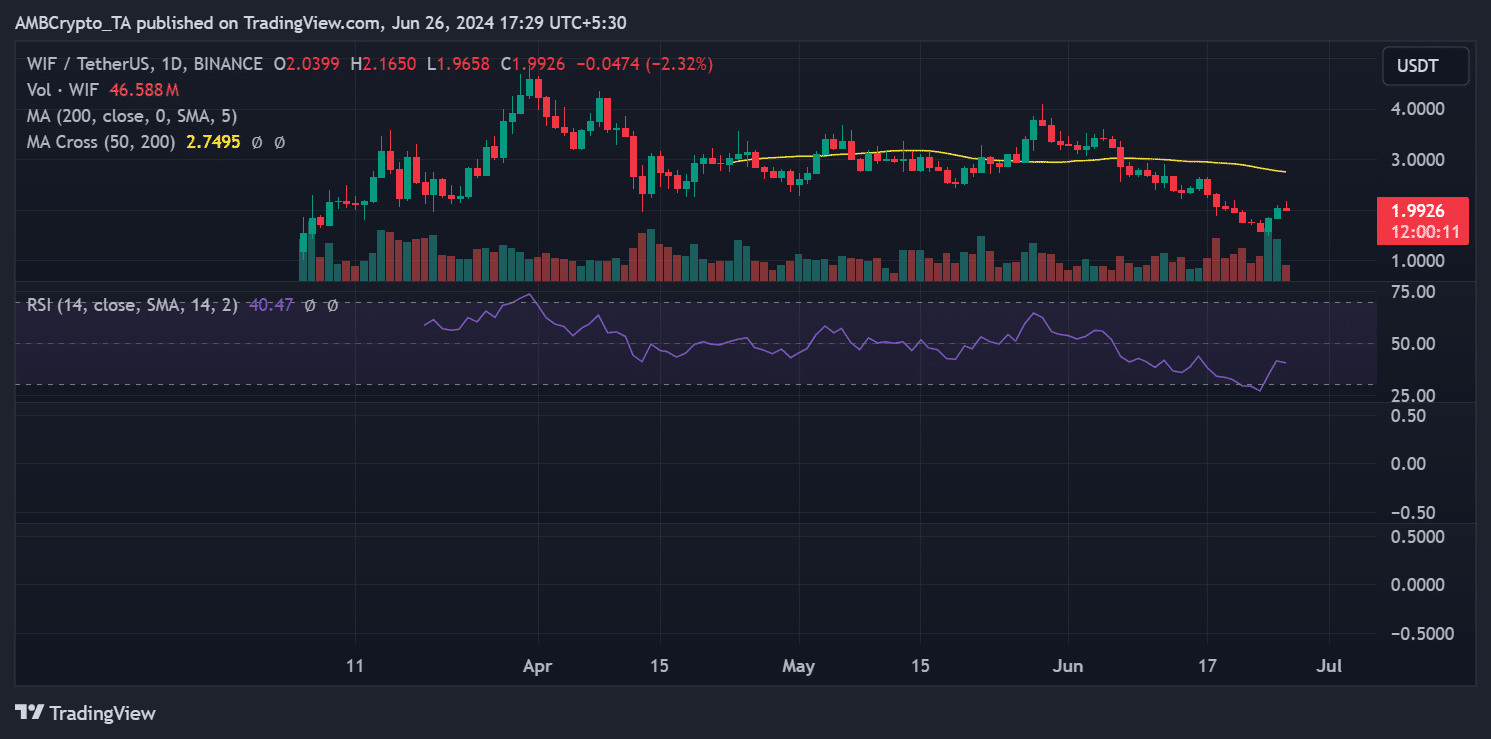

AMBCrypto’s analysis indicated that although the whale address accumulated WIF tokens at around $2, the price has seen a slight decline in the market.

WIF was trading at around $1.9 at press time, having fallen by over 2%

In the previous trading session, the token experienced a significant rise, trading over $2 after gaining over 11%. This increase built on a prior surge of over 15%, which elevated its price to the $1.8 range on the 23rd of June.

Despite these recent uptrends, WIF remained in a bearish trend. The Relative Strength Index (RSI), which was below the neutral line, supported this assessment.

While the RSI suggested a bear trend, it also indicated that this trend had somewhat weakened following the recent price increase, suggesting a potential shift in momentum or investor sentiment.

Derivatives see slow trends

AMBCrypto’s look at WIF’s Open Interest for revealed a relatively stable market condition, with only minor changes.

As of this writing, the Open Interest was around $260 million, marking a slight increase from $246 million in the previous trading session. This modest rise indicated a somewhat stagnant market activity level for WIF derivatives.

Additionally, the Weighted Funding Rate showed a slight increase, suggesting a marginal shift in market dynamics.

Is your portfolio green? Check out the WIF Profit Calculator

However, the overall stability of this rate in recent days pointed to a lack of significant momentum or shifts in trader sentiment.

These indicators suggested that while sellers continued to have a dominant presence in the market, their activity has been subdued recently, reflecting a period of consolidation or lack of strong market-moving information.