WIF set for potential 2x surge to $4.80 – HERE’s what’s driving it!

- WIF has been trading within a symmetrical triangle pattern – A technical setup that suggests a growing push from market participants

- Analysis of key metrics indicated that market participants are actively positioning for WIF to shift into bullish territory

Over the past week, dogwifhat [WIF] has faced volatility, recording a 6.65% decline to its press time price of $2.44. This level was previously exceeded during an October rally before strong resistance triggered a pullback.

Now, WIF is making another attempt to break higher, with a chance of breaching the resistance that previously capped its upside. Should it succeed, WIF could be primed for a major move towards the $4.80 mark.

Key pattern signals potential rally

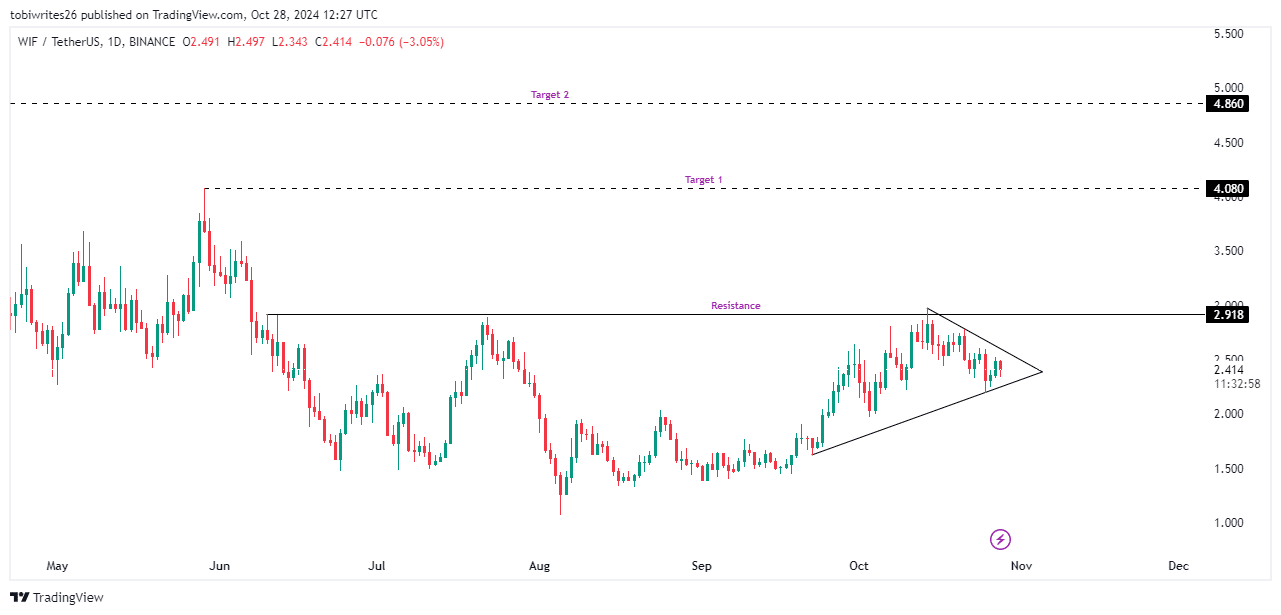

WIF has been trading within a symmetrical triangle, a technical pattern that is often considered a major catalyst for upward rallies. This pattern forms when converging support and resistance lines create a narrowing price range.

If this pattern materializes with strong momentum, WIF could break through the resistance level at $2.918 – A level that has repeatedly capped price movement on previous attempts.

Should the rally ignite, WIF could potentially double, aiming for a long-term target of $4.860, with an intermediate target of $4.080.

To assess market sentiment and its alignment with this bullish formation, AMBCrypto analyzed on-chain metrics, finding additional bullish signals that reinforced this outlook.

Bullish pattern supported by rising trader activity

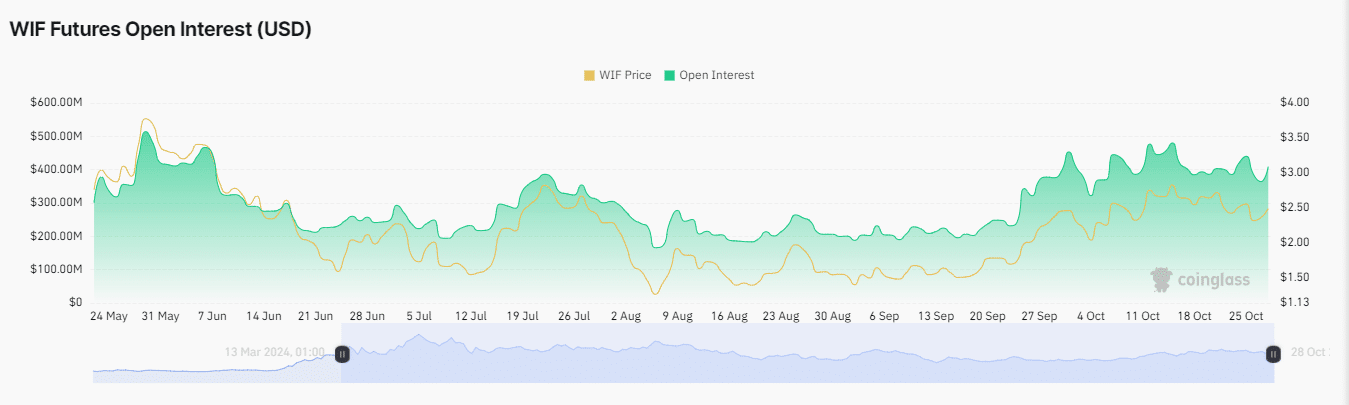

According to Coinglass, Open Interest (OI), a metric which measures the number of unsettled derivatives contracts, specifically in the Futures market, underlined a hike in buying activity.

At press time, the OI had risen by 3.95%, reaching $396.52 million, with its chart showing an uptrend. This hike aligned with WIF’s volume uptick of 40.8%, pushing the total trading volume to $857.60 million.

In addition to the OI hike, the funding rate also increased, with a press time value of 0.0065%. This suggested that long traders have been actively funding positions to support price stability, indicating bullish sentiment around WIF.

If both indicators continue trending positively, a WIF rally will be increasingly probable.

Hike in liquidity flow

Finally, on-chain activity alluded to a growing buying trend as traders continued to open long positions, with significant liquidity flowing into WIF purchases.

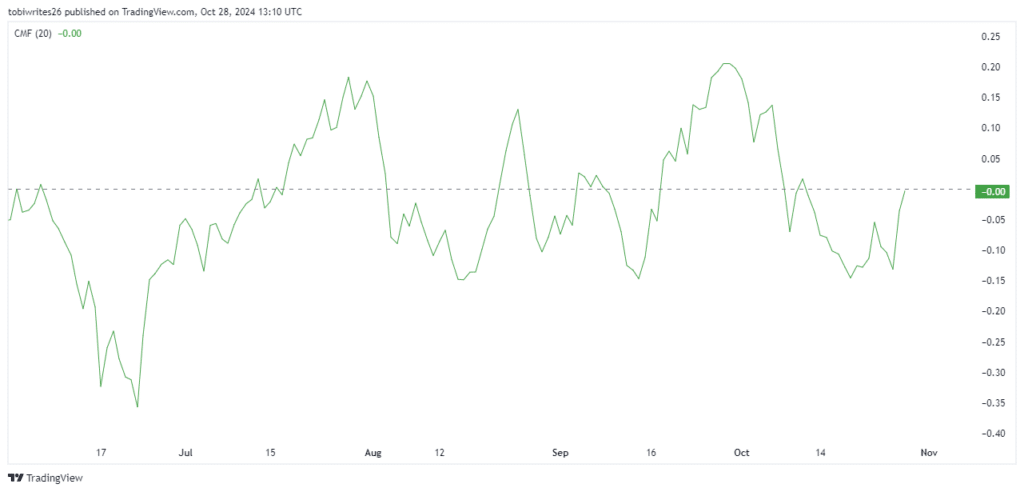

The Chaikin Money Flow (CMF) indicator also highlighted a significant uptick, moving from negative territory to a neutral reading of 0.00.

This swift shift from negative to neutral implied strong liquidity acceptance in the market – A sign of sustained bullish momentum.