WIF struggles in a stagnant market: Bearish sentiment looms

- WIF could not find the buyers it needed to break out past the six-week range.

- More losses could follow due to weak demand.

dogwifhat [WIF] was not part of the meme coin resurgence that other tokens such as Pepe [PEPE] or Bonk [BONK] witnessed in the past few days. Instead, WIF continued to battle a lower timeframe downtrend.

Buying pressure has been weak and speculators were not convinced that WIF would rally. Hence, dogwifhat investors must exercise patience. Should they look to buy the coming dip, or will their fortunes change soon?

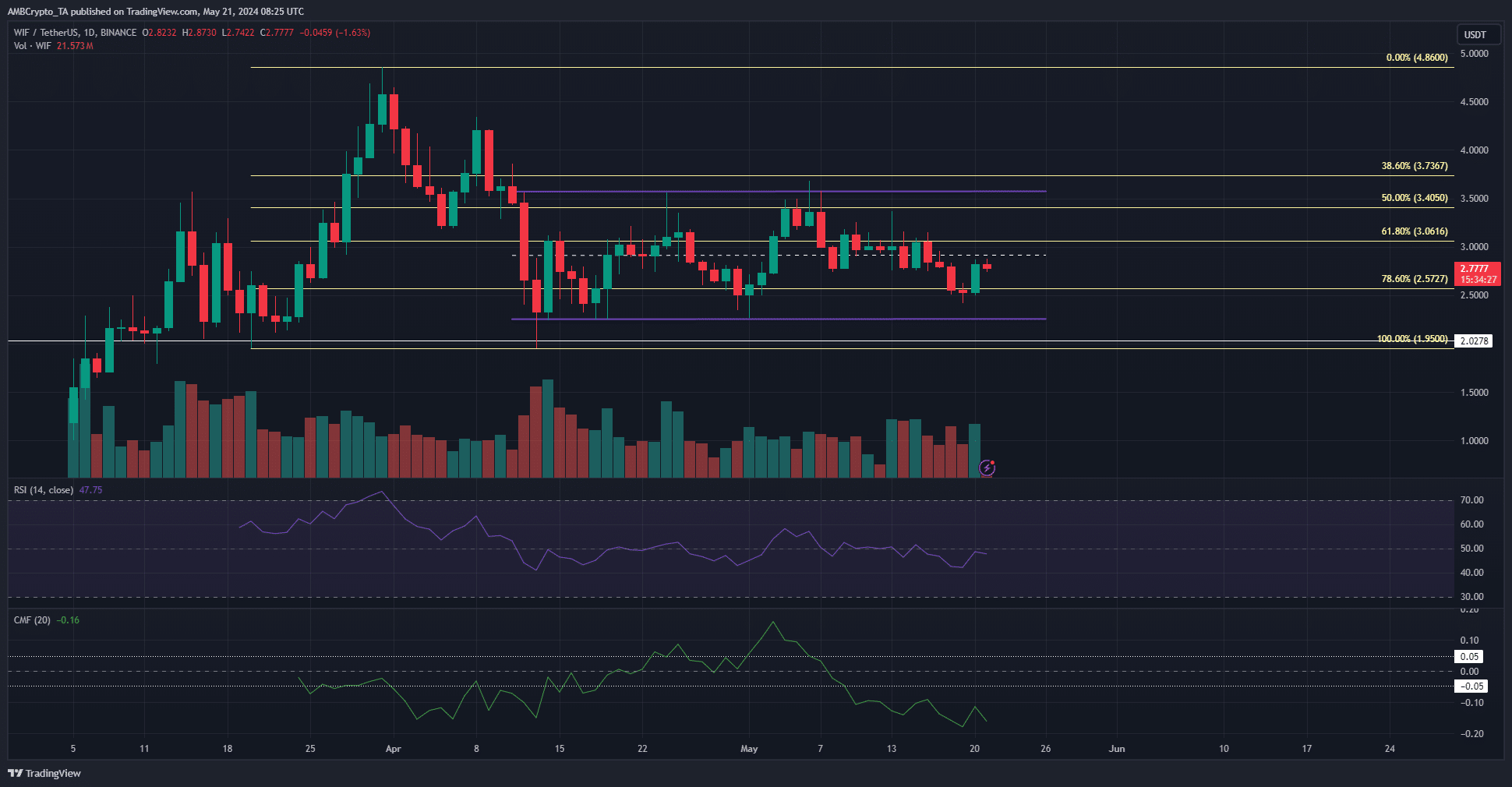

The mid-range level was an obstacle once more

WIF continued to trade within the six-week range highlighted in purple. The range extended from $2.25 to $3.58.

The mid-range level at $2.91 has served as both resistance and support during the rangebound price action.

The Fibonacci retracement levels (pale yellow) underlined the $2.57 level as critical support, but it has been breached in the past six months. This is why the bearish bias on the longer timeframe still held sway.

The inability of the bulls to defend the mid-range support earlier this month was a sign that the bears had the advantage.

The RSI was also below neutral 50 at press time, serving as an early sign that momentum was downward. The CMF was at -0.16 to indicate significant selling pressure.

To overpower the bearish outlook, the bulls must drive prices above the range highs and reclaim the area as support.

Clues that the bulls have begun to fight back

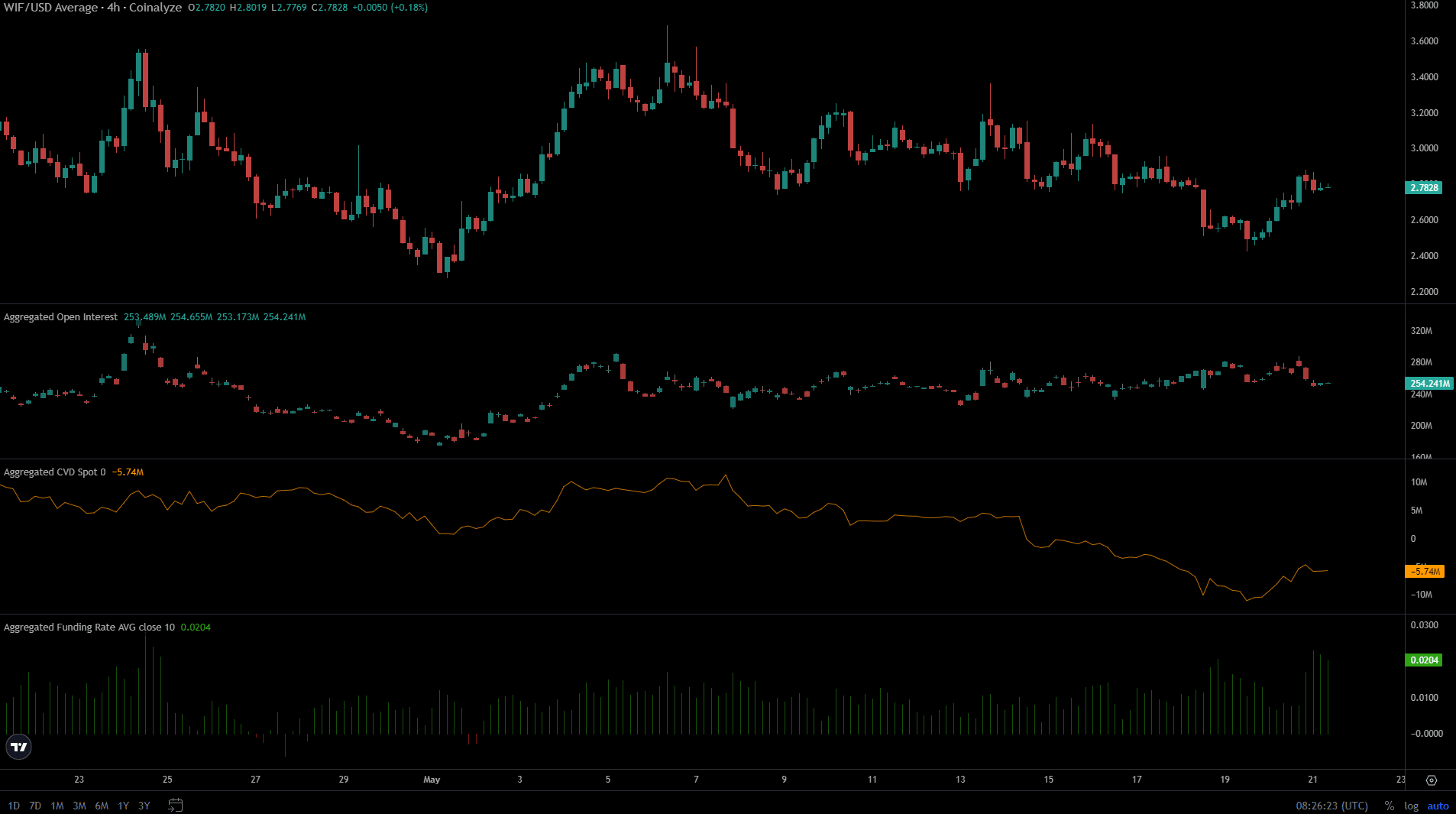

Source: Coinalyze

From the 13th to the 19th of May, the prices had been trending slowly downward. On certain days, such as the 17th, the Funding Rate was at +0.01% while the Open Interest climbed higher while prices fell.

This indicated that some short sellers were entering the market, but it was not overwhelming since the funding rate was not negative. It reflected bearish sentiment. The spot CVD had also been in decline.

Read dogwifhat’s [WIF] Price Prediction 2024-25

A lot of this changed over the past two days. The spot CVD picked up to reflect increased demand and the funding rate jumped higher.

The Open Interest tried and failed to climb higher, which suggested speculative activity was still sidelined. However, the other two indicators showed early signs of a bullish reversal.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.