WIF’s 18% drop: Identifying if the price bubble is popping now

- WIF has become less popular after erasing a sizable part of its gains.

- Price analysis showed that the token might gain 33.54% if money flow increases.

Dogwifhat [WIF] posted one of the heaviest losses as the price plummeted by 18.12% in the last seven days. At press time, WIF exchanged hands at $2.25, proof that it had erased a chunk of its gains despite hitting $3.50 one week ago.

WIF’s decline could be linked to intense selling pressure considering the kind of upswing the memecoin had earlier. Another reason the value declined could be connected to capital rotation in the market.

Previously, a lot of liquidity went into memecoins. But after the tokens produced incredible gains, traders booked profits.

Furthermore, many are looking away, and finding the next narrative or token that can deliver a mind-blowing uptrend within a short time. Considering the kind of volume WIF had at press time, it does not look like it is one of the options.

It does not have the buzz anymore

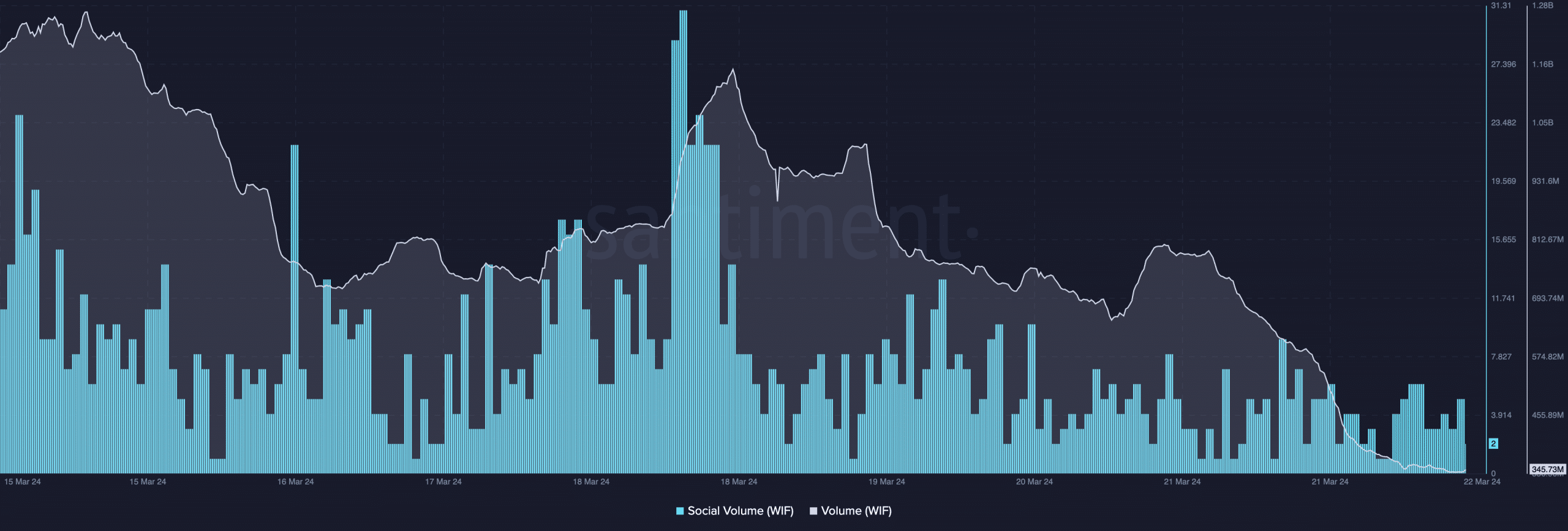

According to AMBCrypto’s on-chain analysis using Santiment, WIF’s volume was down to 345.73 million. On the 15th of March, this same metric was 1.26 billion.

A decrease like this was evidence of waning interest in the token. If the volume continues to decrease, the price might also drop below $2.25. However, a rebound might be likely if WIF’s selling pressure gets too much.

Beyond the confines of the price, we looked at the social data around the token. At press time, dogwifhat’s social volume had fallen compared to the heights it reached a few days back.

For those unaccustomed to the ins and outs of the market, social volume considers search terms and documents related to a cryptocurrency. Therefore, the decrease in the metric implied that the token had become less popular among market participants.

GoogleTrends also corroborated this data. As of the 17th of March, WIF’s GoogeTrends score was 100. But at press time, the reading had decreased to 42.

WIF is not here to bite the dust

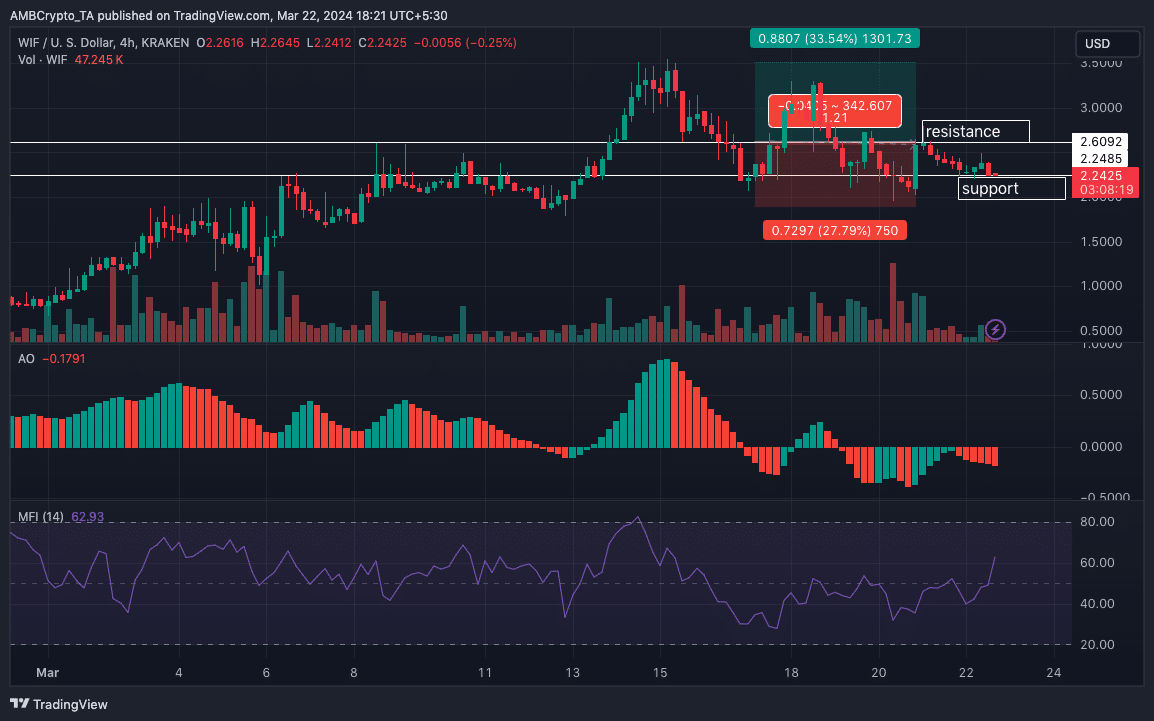

From a technical perspective, bulls might find an underlying support at $2.24. But this has not been validated yet. However, if buying pressure comes in at this point, WIF’s price might try to retest $2.90.

However, the attempt might not be smooth considering the overhead resistance at $2.60. If bears reject the attempt, WIF might experience a 27.79% decrease to $1.87.

On the other hand, a successful break through the resistance could drive a 33.54% hike which could place WIF at $3.49. As of this writing, the Awesome Oscillator (AO) was negative, indicating increasing downward momentum.

Is your portfolio green? Check the dogwifhat Profit Calculator

But the Money Flow Index (MFI) resumed upwards. This increase in the MFI reading was a sign that capital had begun to flow into WIF gain.

Should the flow continue to increase, other indicators might align, and WIF’s price might be able to reverse the bearish trend.