WIF’s price could soar by 20% to hit $3 IF it closes daily candle above…

- At press time, 63% of WIF traders across the exchanges held long positions, while 37% held short positions

- WIF seemed to be mirroring Ethereum’s (ETH) daily chart

It appears that the crypto bull run has officially begun, with a majority of the market’s digital assets noting an upside rally on the charts. One of the market’s popular memecoins, Solana-based Dogwifhat (WIF), remained stable for a while. However, it too is now poised for a rally.

Why is WIF’s price increasing?

Few of the potential reasons for this bullish speculation are the memecoin’s price action pattern, heightened traders’ interest, and the shift in the sentiment from a downtrend to an uptrend.

Additionally, WIF seemed to be mirroring Ethereum’s (ETH) daily chart – A sign that a notable upside rally may be coming in the next few days.

Price analysis and key levels

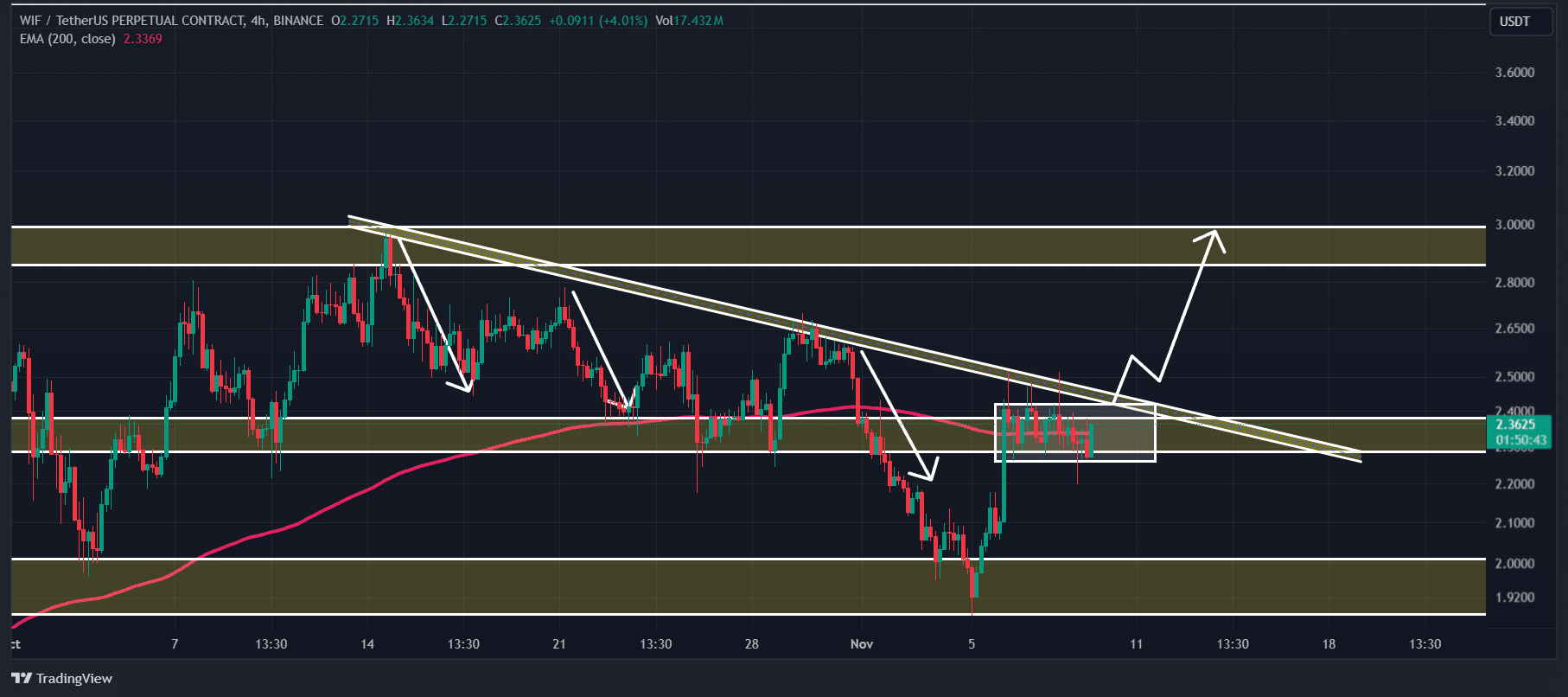

According to AMBCrypto’s technical analysis, WIF has reached a level where it has historically faced a lot of selling pressure. Now, the altcoin has already retested this level multiple times. Owing to these repeated retests, it would seem now that this level has been significantly weakened.

Meanwhile, thanks to its ongoing consolidation, there is a high possibility that WIF could breach this resistance level this time.

Based on its recent price action and historical momentum, if WIF breaches this level and closes a daily or four-hour candle above the $2.5-level, there is a strong possibility it could soar by 20% to hit the $3 level in the coming days. Or even higher if the sentiment remains unchanged.

However, it’s worth pointing out that WIF continues to trade above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating an uptrend.

WIF’s bullish on-chain metrics

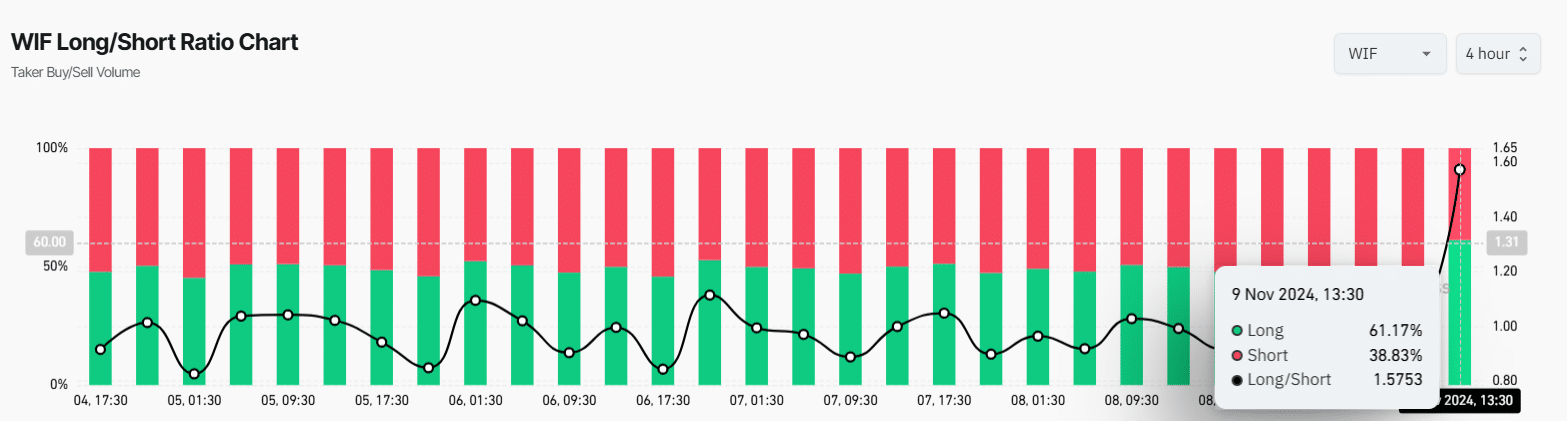

On-chain metrics further supported the memecoins’ positive outlook. According to the on-chain analytics firm Coinglass, WIF’s Long/Short ratio value had a value of 1.62 at press time, indicating strong bullish sentiment among traders.

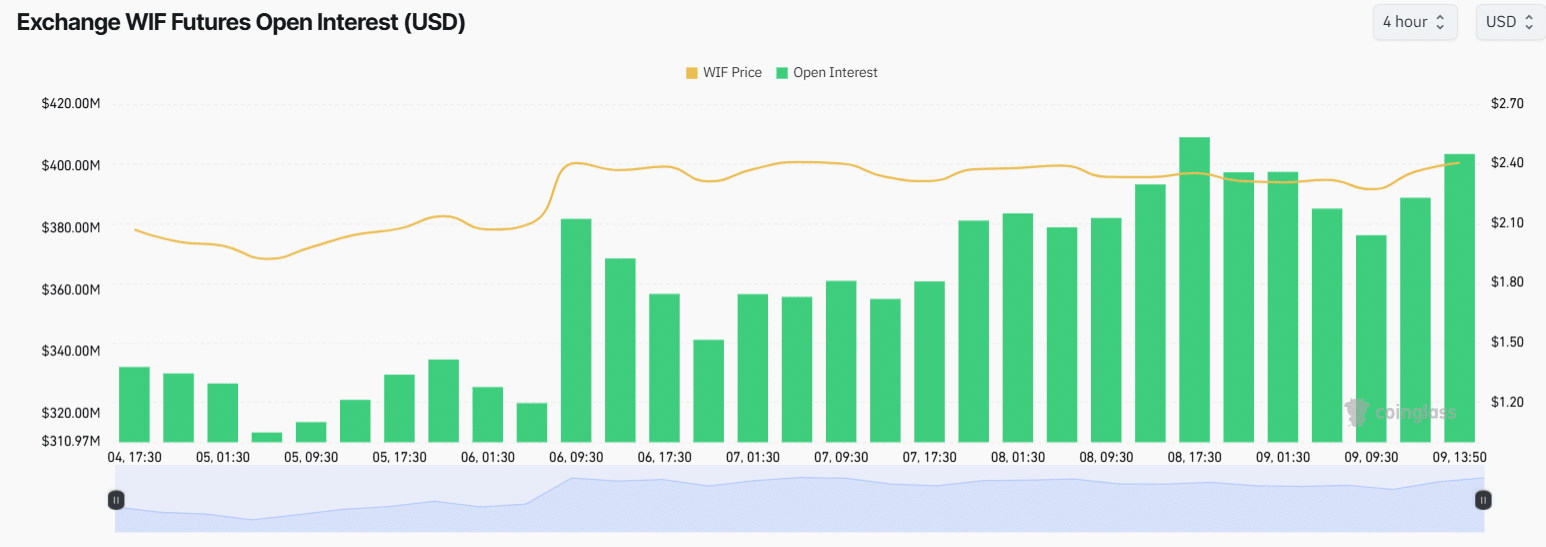

Additionally, traders appeared to be more optimistic as they continued to increase their open positions.

Consider this -WIF’s Open Interest soared by 7% over the last 24 hours and by 9.5% over the last four hours – Another bullish indication.

At the time of writing, 63% of top traders were holding long positions, while 37% held short positions.

With the combination of these on-chain metrics and technical analysis, it would seem that bulls are dominating the asset and could support its potential upside rally.

At press time, WIF was trading near $2.44 following a hike of 5.6% over the last 24 hours. During the same period, its trading volume climbed by 10%, indicating heightened participation from traders and investors.