WIF’s upside potential – Here’s how high the memecoin can REALLY go

- The sharp price dip saw a quick turnaround, although recovery was not complete

- The higher timeframe trend since April was bearish, but this uptrend could be the beginning of a rally

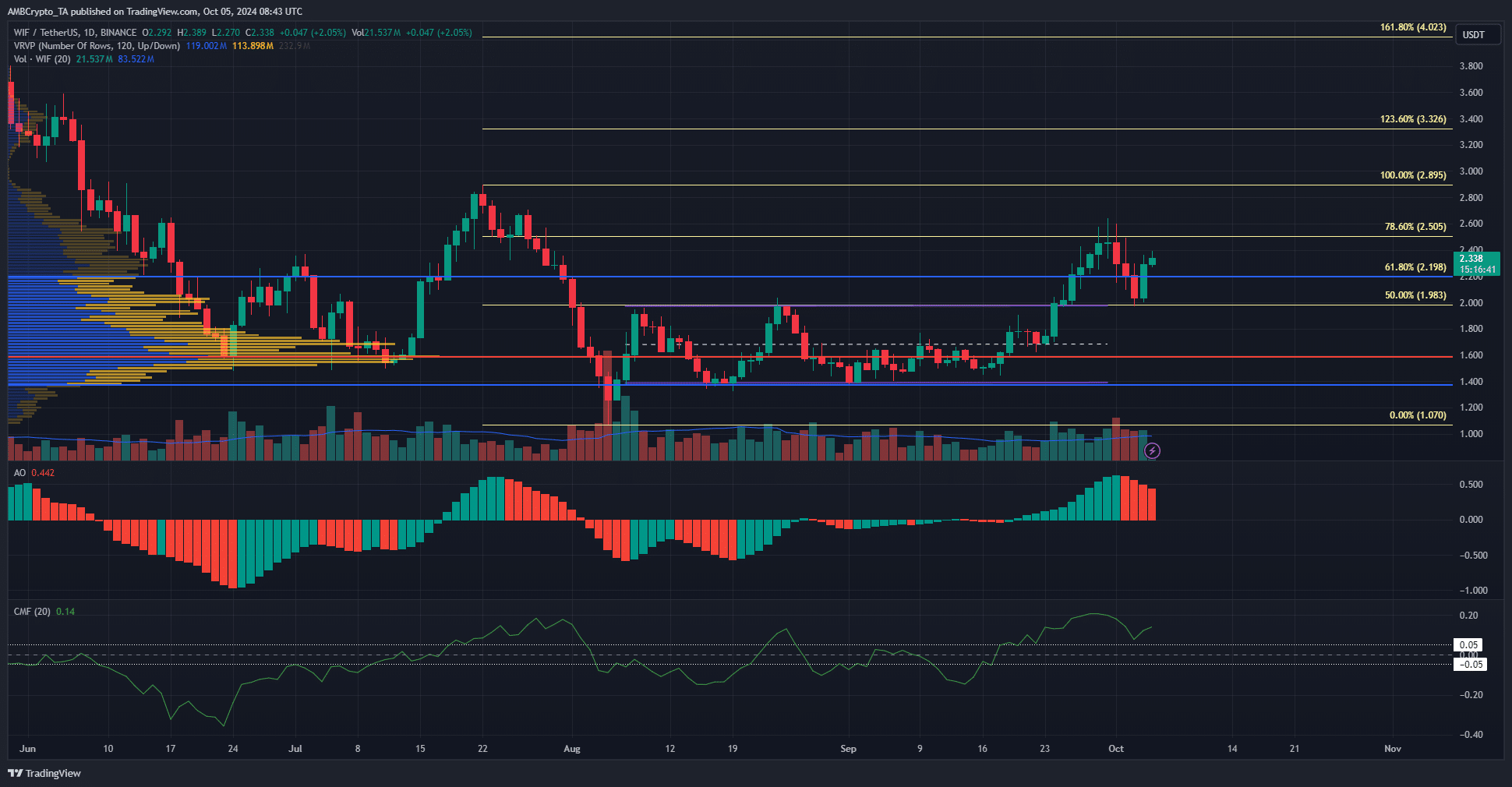

dogwifhat [WIF] saw a 25.4% price correction from Monday, 30 September’s highs to Thursday, 3 October’s lows. This deep correction also happened to retest the former range highs at $1.98, but the bulls have defended the level as support.

The memecoin’s buyers have forced the price to bounce by 18.9% since then – An encouraging first step toward recovery. And yet, the $2.5 resistance looms large, and it is unclear if the bulls can break this level.

The importance of $2.5

The Visible Range Volume Profile revealed that the trading since June has been concentrated between $1.38 and $2.25. The price breakout past $2.25 once again after the dip was a sign of bullish intent.

The CMF was at +0.14. It remained above +0.05 despite the recent volatility, showing that the buying pressure was steady. The Awesome Oscillator also indicated bullish strength.

Based on the downward slump in July and early August, a set of Fibonacci retracement levels were plotted. It revealed that the $2.5 level was the 78.6% retracement level and a key resistance.

A daily session close above $2.5 would be a positive sign that WIF is preparing for a larger rally. It acted as a resistance zone in June and early July. To the north, the $2.5 and $2.9 levels are the immediate bullish targets.

Bullish sentiment on WIF’s speculative front

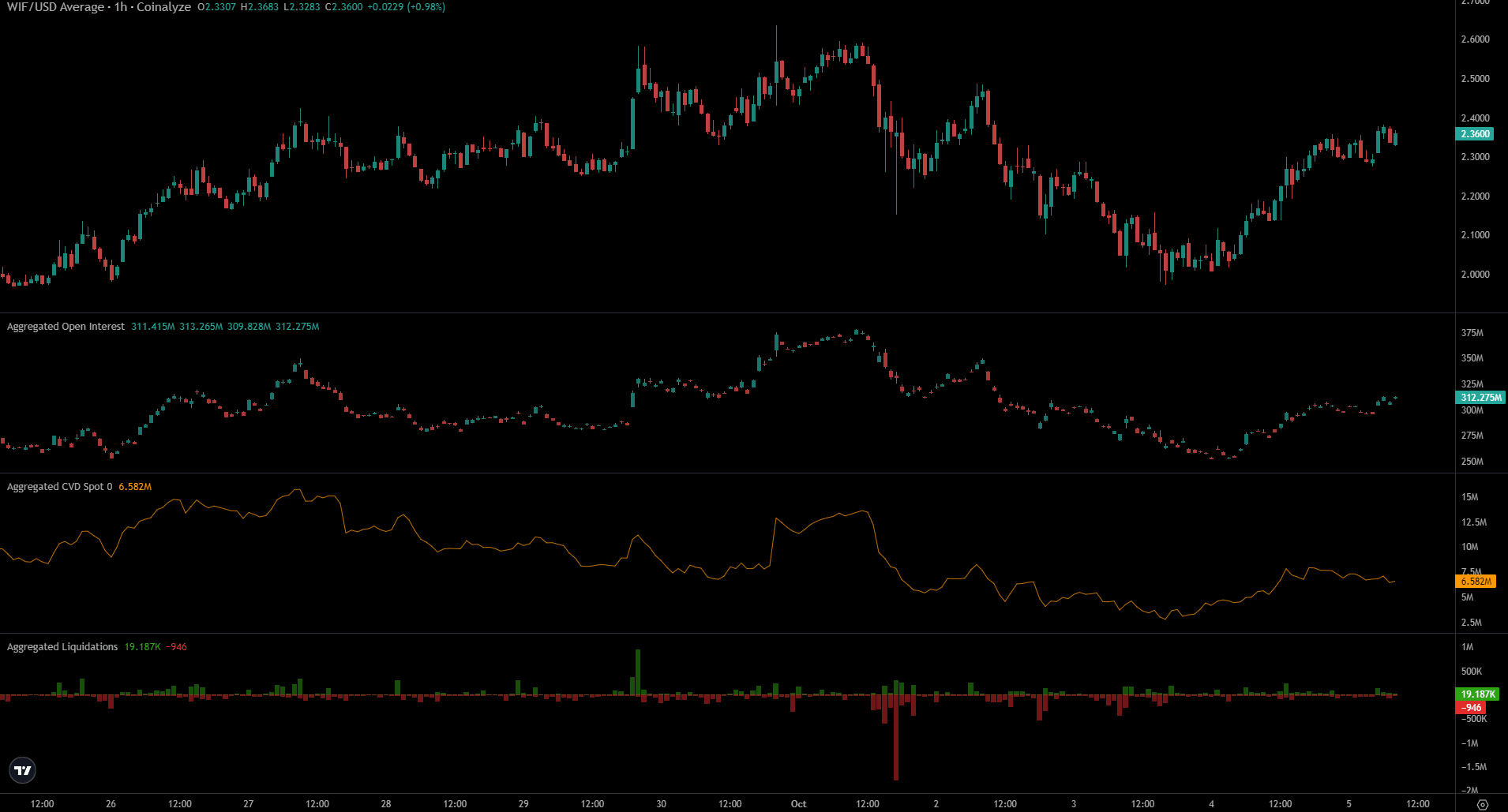

Source: Coinalyze

The Futures market showed firm bullish belief. This inference was derived from the rising Open Interest. The hike in spot CVD added to the bullish bias as it showed genuine demand behind the uptrend.

Is your portfolio green? Check the dogwifhat Profit Calculator

Over the past two days, the liquidations were low compared to 1 October. Trader liquidations were small in recent hours, but it would be interesting to see if the short liquidations rise noticeably as WIF approaches the $2.5 zone. Especially as it would mean a liquidity pocket was swept and could see another price dip afterwards.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion