Will 30% Dogecoin HODLers face losses? DOGE’s fortunes say…

- DOGE struggled to pull itself back from the consolidation phase at press time.

- On-chain metrics highlighted a deteriorating trend, suggesting that the path ahead for DOGE might face further challenges.

Dogecoin [DOGE] has been in a consolidation phase over the last two weeks, with its price moving within a defined range of $0.101 — $0.104, triggered by Bitcoin’s [BTC] August downturn.

At press time, DOGE was priced at $0.10370, reflecting a 0.90% decline from the previous day’s close.

However, in a turbulent market where even Bitcoin bulls faltered, Dogecoin’s ability to hold a steady pattern might be a hidden strength rather than a setback.

So, the idea that Dogecoin could be gearing up for a rebound seems entirely rational — or does it? AMBCrypto investigates.

Potential rebound hinges on key market factors

On the two-hour chart, DOGE made a notable move on the 20th of August, surging past the $0.102 support level. However, before the bulls could capitalize on this, Bitcoin dipped below the critical $60k support line.

In the aftermath, it drifted back into consolidation phase. Nevertheless, by the time of writing, DOGE had surged past $0.104, potentially reigniting hopes for a price recovery.

According to AMBCrypto’s analysis, to realize this rebound, two critical factors needed to align: Bitcoin’s price movement and the overall market condition for Dogecoin.

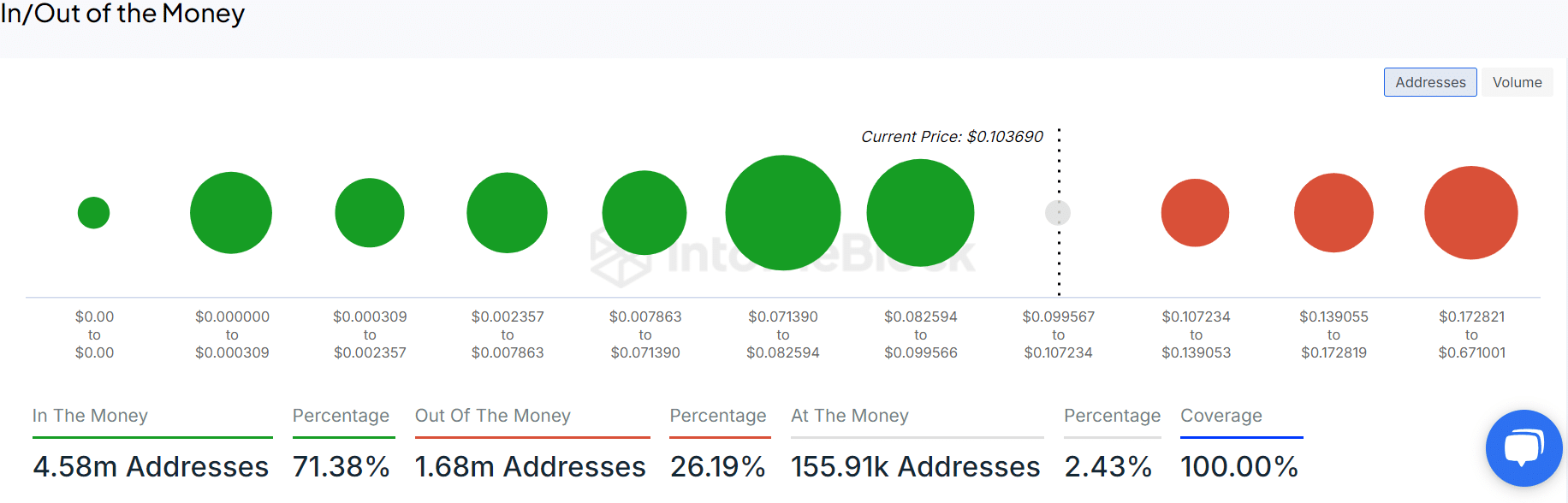

The In/Out of the Money metric from IntoTheBlock showed addresses holding DOGE that are in profit or loss depending on the current market price.

As DOGE traded around $0.10370 recently, as many as 5 million addresses were in profit. Conversely, about 30% of the address holders would incur loss if they chose to sell.

Therefore, an imminent price recovery could benefit both sides. It could incentivize traders to back the recovery by keeping hold of their profits while also protecting the losing side.

To determine if a recovery was on the horizon, AMBCrypto analyzed the latest market trends, and uncovered the following insight.

Lack of support for DOGE

For a memecoin, it’s no surprise that strong community backing can make all the difference.

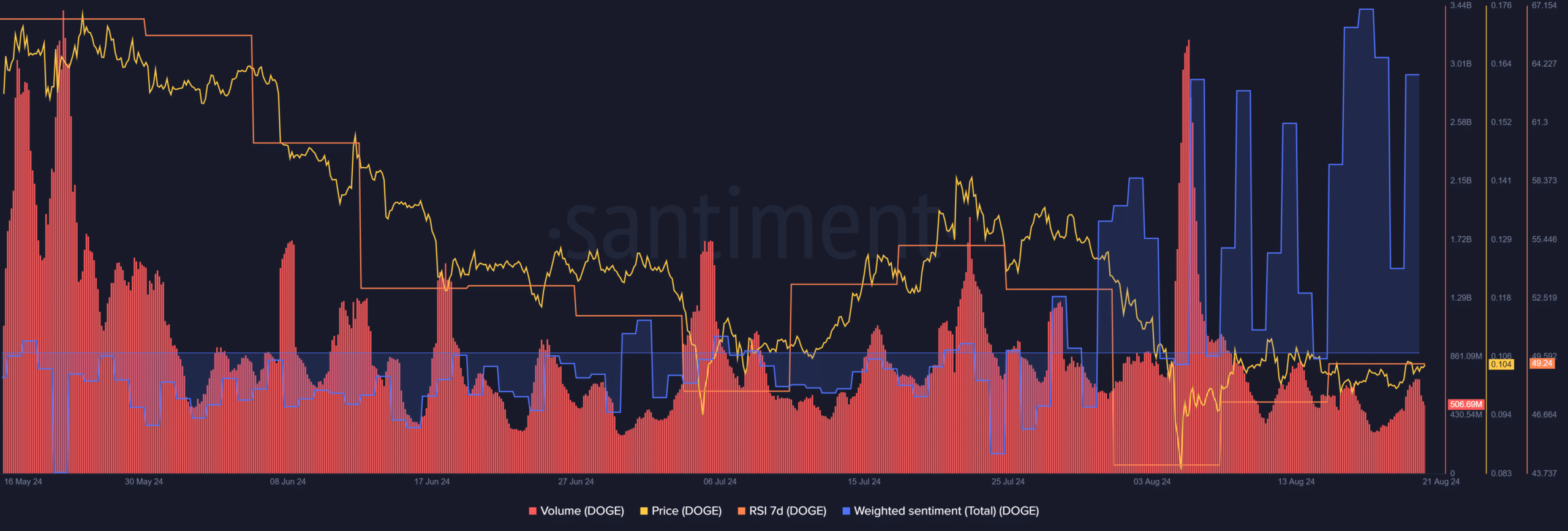

On the 90-day chart, DOGE’s Weighted Sentiment remained positive, while trading volume doubled since the 8th of August, reaching $506 million.

This means that despite market fluctuations, the DOGE community’s optimism remained intact. Meanwhile, the 7-day RSI stayed in an oversold position throughout August, consistently hovering below the 50 zone.

Surprisingly, despite the positive sentiment, there wasn’t an uptick in buying activity—a clear sign of consolidation.

Read Dogecoin’s [DOGE] Price Prediction 2024-2025

Conversely, during periods when trading volume spiked and the RSI climbed above 65, DOGE tested the $0.170 resistance line.

Simply put, the on-chain data signals a lack of support for Dogecoin to break through the $0.190 ceiling.