Altcoin

Will Altcoins challenge Bitcoin dominance? Analyst projects…

Here’s the status of altcoin season as Bitcoin dominance faces key roadblock…

- Altcoin season seems closer than most think amid strong market shifts.

- Savvy traders are reportedly shifting focus to altcoins from BTC.

Bitcoin [BTC] made a remarkable recovery in September, rallying from $52.5K to $65K.

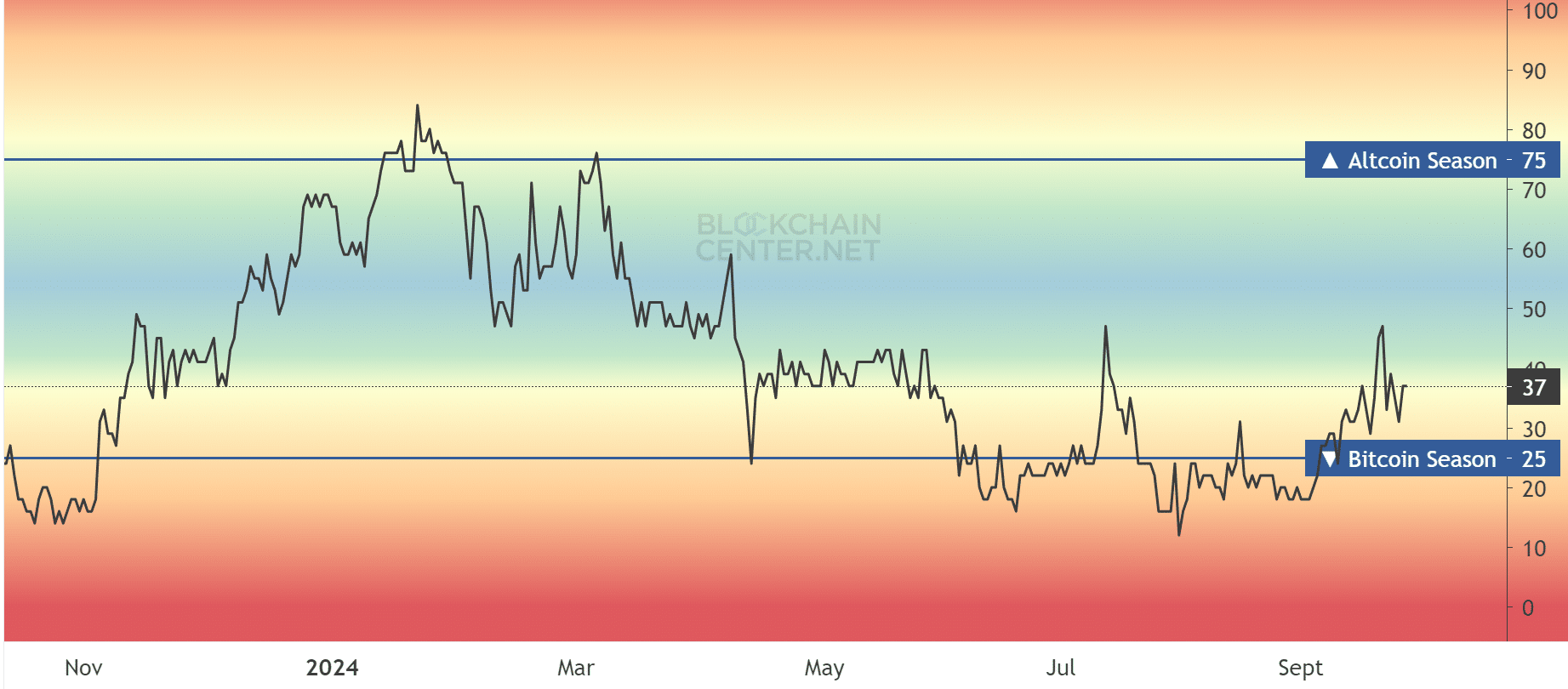

The recovery also boosted altcoins, as the Altcoin Season Index climbed to July levels. Select altcoins saw massive gains during the rally, especially amongst AI and memecoin segments.

However, the Alt season was not yet in full swing, as shown by the Altcoin Season Index reading of 37.

Altseason setting stage?

However, key signals indicated a positive outlook for a wild altcoin season. For example, Bitcoin dominance (BTC.D), which has increased in 2024, faced crucial resistance around the 58% level.

A drop in BTC.D value could signal a breather for altcoins to pick up greater momentum.

Another positive outlook was from the altcoin’s market cap, excluding BTC and

ETH. According to Henrik Zeberg, Head Macro Economist at Swissblock, the Altcoin sector was primed to explode to a $3 trillion market cap.“Bull flag and momentum indicators tell us, that Altcoins market could be heading for ~$3 trillion in market capitalization”

Presto Research also noted a potential shift, citing a surge in ETH gas prices that could signal increasing positioning to capture a potential windfall from an altcoin rally.

The research firm added that ETH has outperformed BTC since the Fed pivot.

The crypto research firm added that some speculators might be positioned to capitalize on the massive asymmetric risk profile since most altcoins were at yearly lows after recent headwinds.

ETHBTC ratio recovered nearly 10% and hiked from a low of 0.038 to 0.042 after the Fed rate cuts. However, it has since retraced slightly at the time of writing.

This meant that ETH’s value gained ground relative to BTC. Since it’s also a barometer of the altcoin market’s health, it suggested that altcoins saw a massive relief rally.

10X Research’s Mark Thielsen also shared a similar trajectory for altcoins. He noted a significant shift by savvy Korean and overall traders from BTC to altcoins.

“As Bitcoin soared above $60,000 and set its sights on breaking through $65,000, savvy traders have been accruing undervalued altcoins, a list consisting of TAO, ENA, SEI, APT, SUI, NEAR, and GRT.”