Will Bitcoin crash to $40K? Why investors are in a state of panic

- Bitcoin neared a decline below $50k for the first time since February.

- Global stock markets plummeted amidst Japan and Taiwan’s stock market crash.

The crypto market has witnessed a massive decline over the past 24 hrs. With the market dip, Bitcoin [BTC] has experienced the largest hit.

As of this writing, BTC is trading at $50436 after a 16.21% decline on daily charts, with a 27% drop on weekly charts.

This massive decline has left traders and analysts speculating over BTC’s future and the cause of the massive price drop.

Bitcoin to drop below $50k?

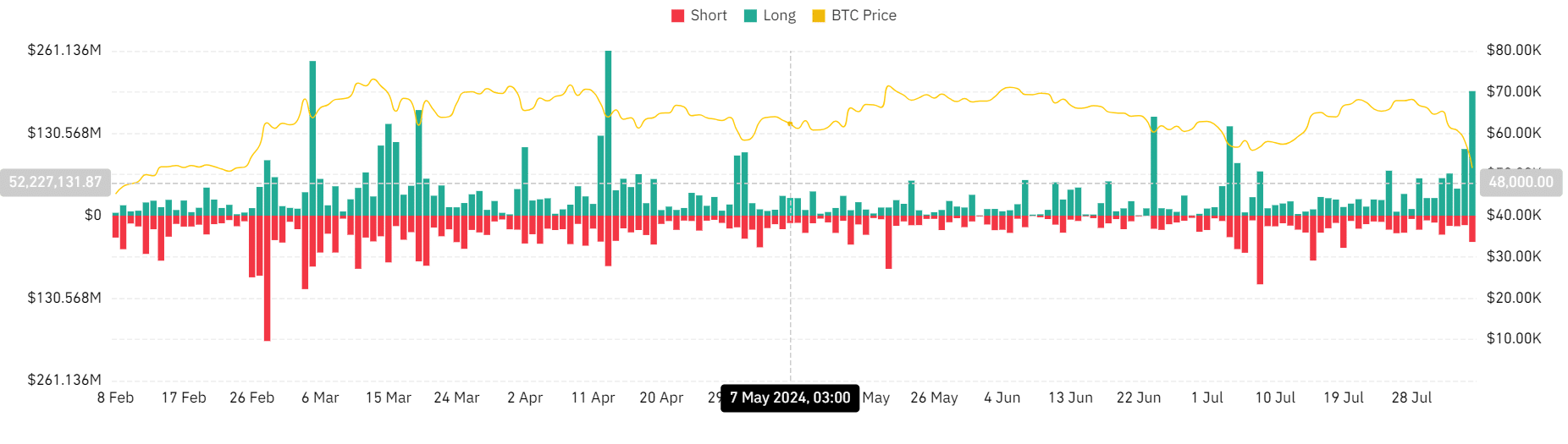

After dropping at $53k, investors holding long positions of over $600 million were forced out, resulting in a massive $300B in total crypto market decline.

In a further decline to $50k, more than $6B long positions were forced out of their positions. The price decline has heightened bearish sentiment, with traders scrambling to buy the dip.

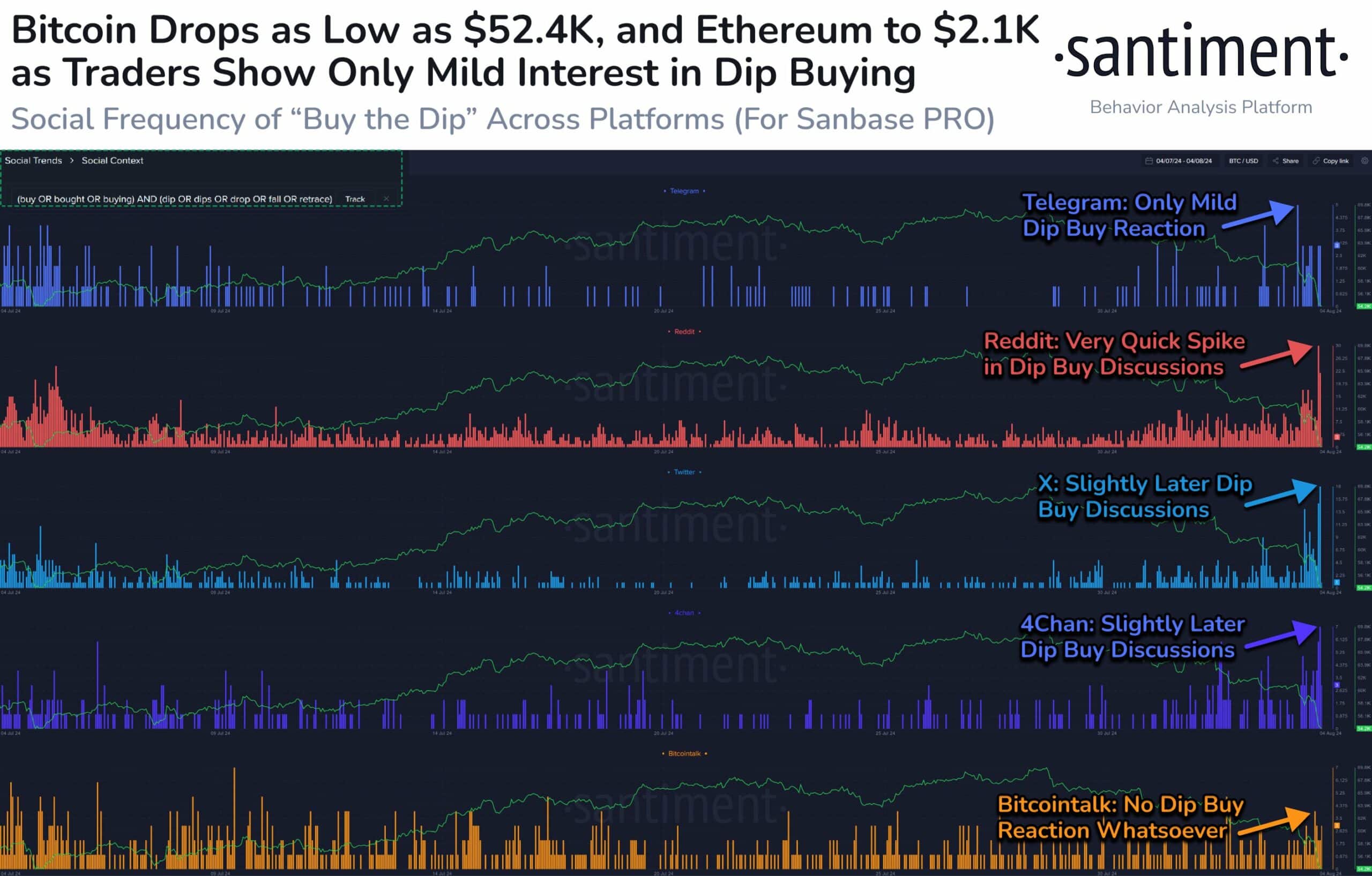

According to data from sentiment, the discussion of buying the dip has spiked. However, the data shows investors and traders are less interested in the dip.

The decline has increased trading volume by 127.75%, further pushing prices down. The increased trading volume results from massive sell-offs as holders sell and close their positions.

Increased sales result in pressure, which negatively impacts price charts. Thus, emotional selling and fear of further decline are pushing traders to close their positions at a loss.

External macroeconomics driving BTC

Over the past seven days, global markets have faced fear of recession following Federal Reversal’s failure to cut rates.

With the rising U.S. debts, the crypto markets have experienced higher outflow, especially from ETFs resulting from market uncertainty.

Additionally, the Japanese market has sent shock waves to the crypto market following a crash of over 8% in 24 hrs. Analysts like Marty Party noted on X that,

“Japan rugpulled the world.”

Therefore, although the crypto market has tried to hold strong over the past weeks, the plunging global stock markets have pushed BTC down. Spectator Index reported the situation in Japan reporting that,

“Japan’s stock market falls over 4,000 points, the biggest single-day drop.”

For instance, Japan bought up the Magnificent 7 and the SPY; thus, such a market crash would have a massive impact on BTC and the whole crypto market.

Apart from Japan, Taiwan’s stock market has suffered its worst day in 57 years. With increased fears of a recession in the U.S. economy, futures are plummeting.

What price charts suggest

Over the past 24 hrs, BTC has declined by 17%, thus continuing a month-long decline. Over the past 30 days, BTC has declined by 5%, resulting in a market cap drop below $1T to $990B, according to CoinMarketCap.

Thus, AMBCrypto’s analysis showed that BTC was experiencing a strong downward momentum.

The crypto’s Directional Movement Index (DMI) showed a sustained downtrend, with the positive index at 26 sitting below the negative index at 29.

Also, On Balance Volume has declined over the 24 hrs, suggesting the crypto was experiencing strong selling pressure.

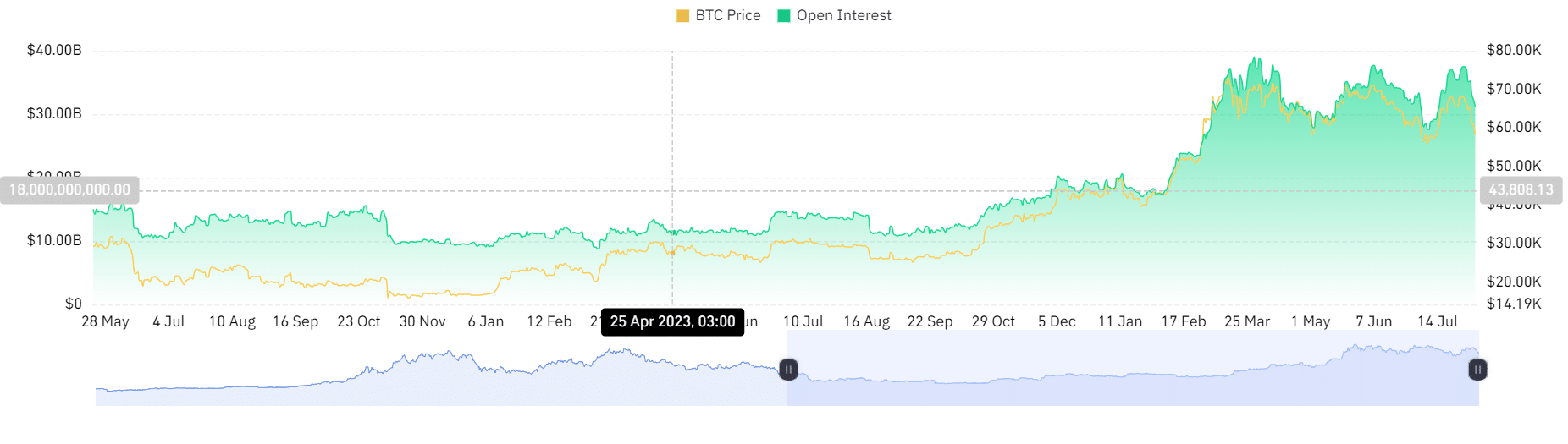

Looking further, ABCrypto’s analysis of Coinglass showed that its Open Interest had declined from $37B to $31B. Such a decline in Open Interest shows that leveraged positions are forcefully closed.

Investors betting on price increases are closing their positions at a loss without opening new ones.

This phenomenon is further strengthened by increased liquidation for long positions. Liquidation for long positions has increased from $105M to %200M on daily charts.

This suggested that the holders are unwilling to hold their positions as they lack confidence in BTC’s current direction.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Will BTC decline below $50k?

BTC has declined from $66k to $50k over the last week. With increased financial market concerns and bearish sentiment, the crypto market is set for a volatile August.

Therefore, if the prevailing market conditions persist and BTC closes below $50670 on daily charts, it will find its next support around $47779.