Will Bitcoin defend $60K as $6.6 billion options expire?

- BTC’s hold on $60K range-low at stake as $6.6 billion options expire.

- However, QCP Capital was confident that the level would be defended.

The ongoing negative market sentiment in June eventually dragged Bitcoin [BTC] back to the range-lows at $60K. This was the fifth time BTC retested the level, and it has retreated even lower to $56K and $58K on some occasions.

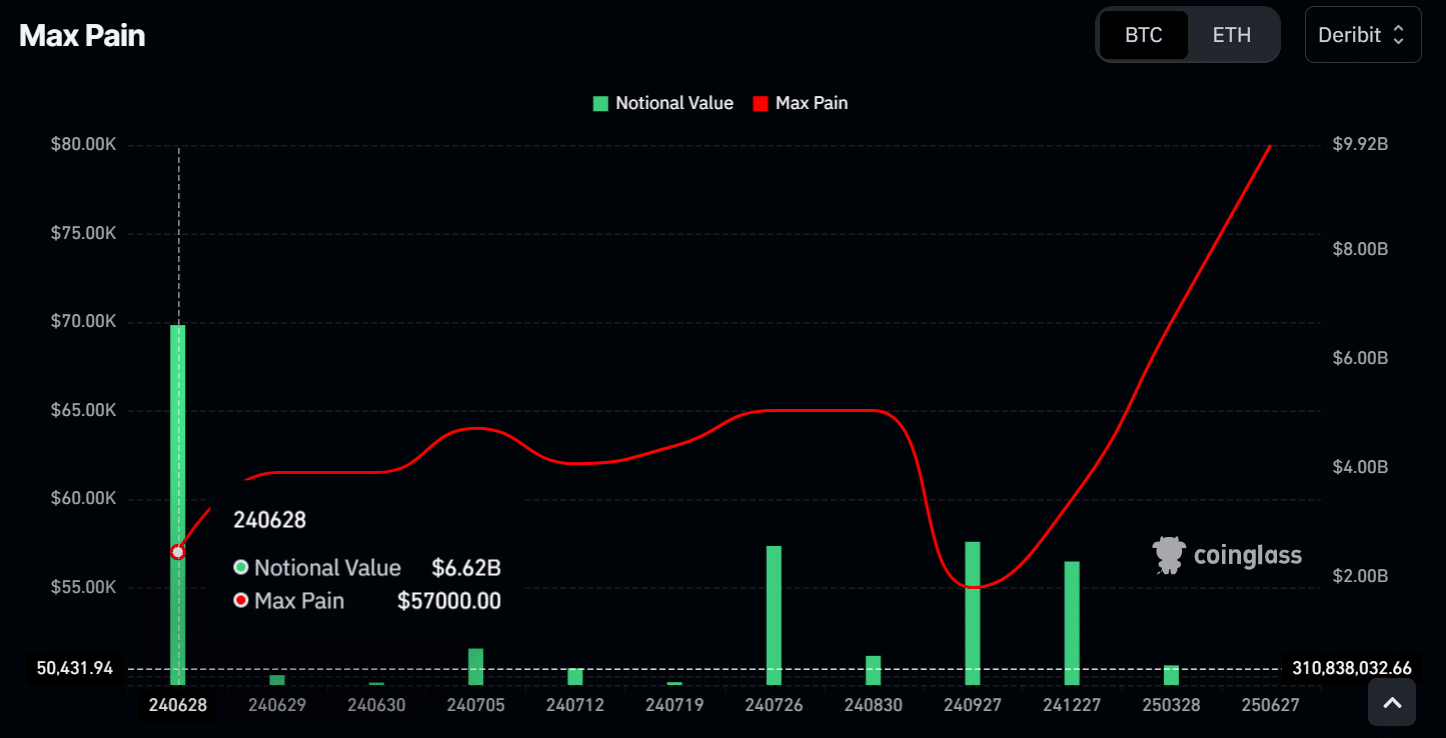

However, over $10 billion of crypto options are set to expire on the 28th of June, about $6.6 billion of which are BTC options. So, more volatility was expected, and BTC’s range-low support could break.

The max pain for BTC options was at $57K, which typically is the level with the least financial risk to market markers (options sellers) before the options expiry.

Put differently, market makers tend to induce prices toward the max pain level to reduce losses.

BTC prices always tend to move to this level, but other factors were at play, too. So, based on the options market, BTC could slide below $60K.

BTC to defend $60K?

However, despite the expected volatility, crypto trading and hedge firm QCP Capital maintained that BTC would defend the $60K support.

‘We think the 60k support will be defended’

The firm cited easing sell pressure from the German government and improving the pace of inflows on US BTC ETFs. Per Soso Value data, BTC ETFs broke the 7-day streak of outflows on Tuesday and have recorded positive net flows in the past 3 days.

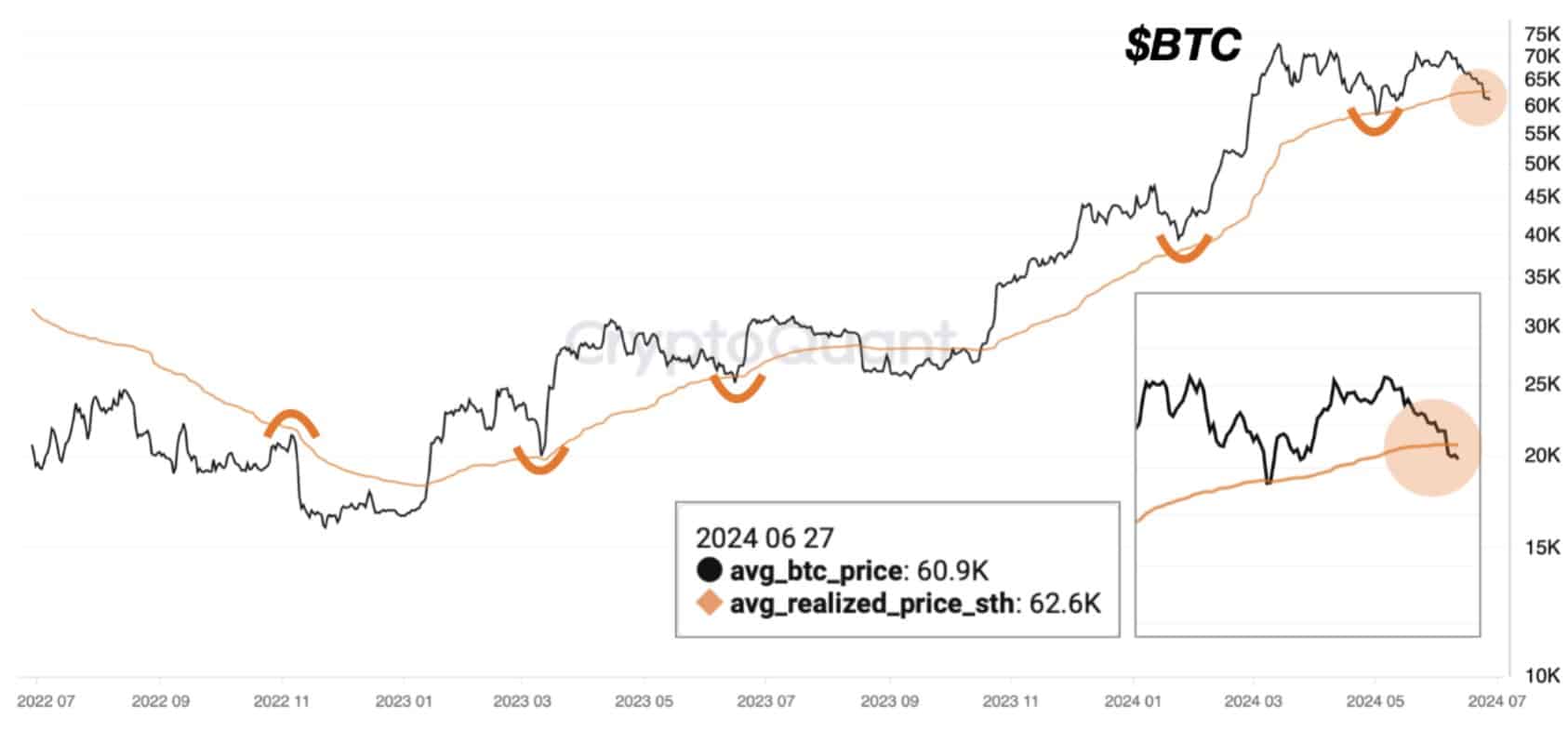

However, the above optimistic outlook could also be dented by BTC short-term investors holding BTC at a loss and could panic sell if BTC dropped further.

A pseudonymous CryptoQuant analyst noted that BTC had dropped below the short-term realized price of $62.6K, which could increase sell pressure.

‘If the price does not move above the sth price quickly, it will likely turn into a resistance level for the price going forward.’

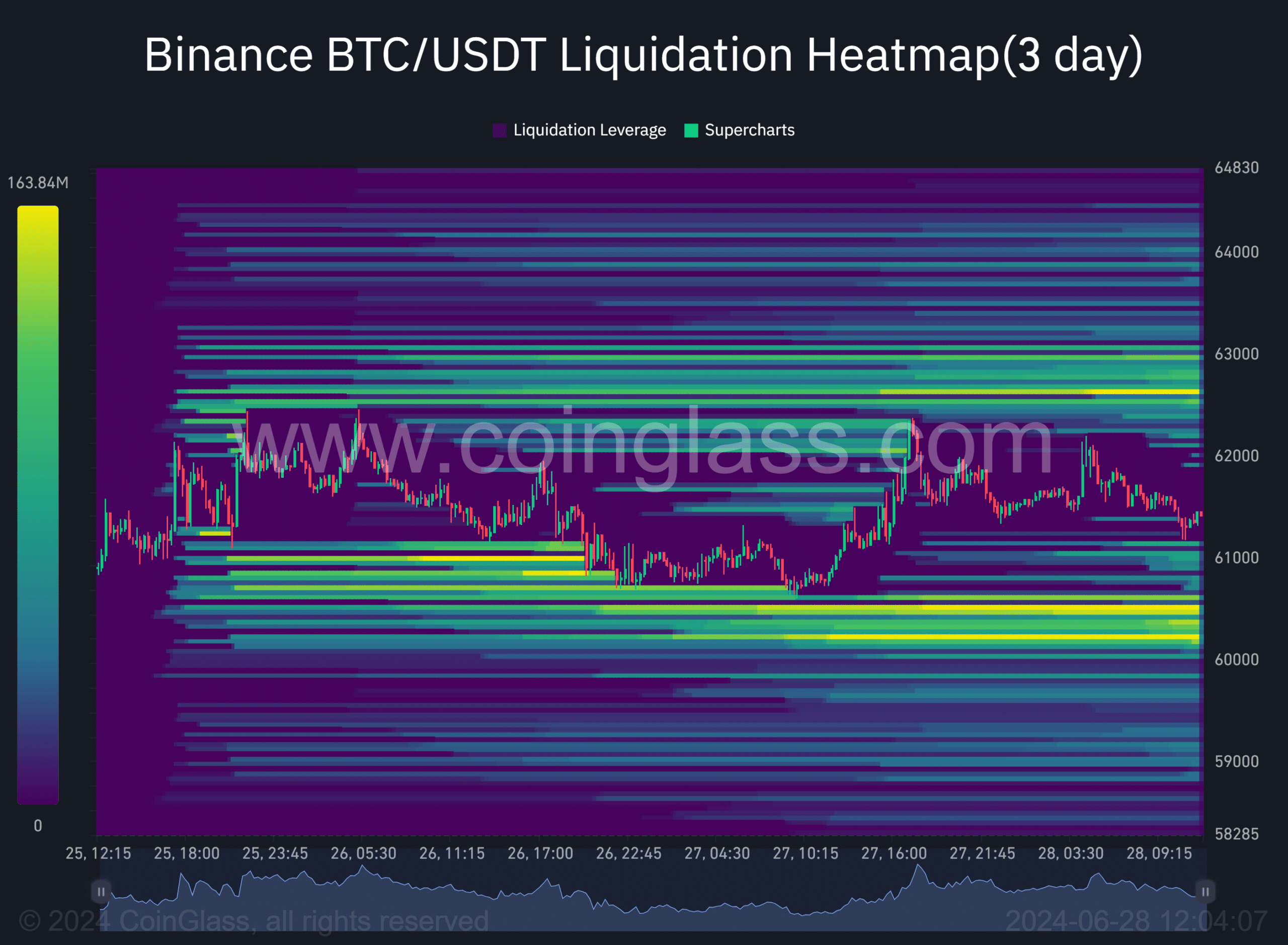

On the other hand, AMBCrypto analysis of the liquidation heatmap showed key liquidity clusters (marked orange) on either side of the price action. But liquidity was a little skewed towards $60.2K and $60.4K.

On the upper side of price action, a key cluster was at $62.6K, which coincided with the short-term realized price. Price action also tends to move to massive liquidity areas.

Collectively, the data suggested that despite a possible market manipulation towards $57K, BTC could reclaim $60K and retest $62.6K.