Will Bitcoin hit $45k? It’s up to the short-term holders

- If history repeats itself, Bitcoin’s distribution may take place around $45,000.

- The coin’s price may decrease below $37,000 before another major uptrend.

The $35,000 region may have become the new accumulation area for Bitcoin’s [BTC] short-term holders (STH), according to Axel Adler Jr. Adler mentioned this in a post on X (formerly Twitter), on the 26th of November.

The data analyst and research expert used historical data from the one-week to 12-month Bitcoin supply ratio to arrive at his conclusion. From the chart shared by Adler, STH started accumulating $18,000 around February.

Short-term players eye the upside

However, it was not until BTC hit $28,000 that these holders started to take profits. On-chain data shown by the metric revealed that STHs began accumulating at $35,000 around the first week of November.

So, if history repeats itself, widespread distribution would only occur when Bitcoin hits $45,000.

The $35K level is the new start level for Short-Term Holders accumulation. It's calculated as the Ratio Supply 1w-6m/6m-12m.

If the condition repeats, then distribution will begin at the $45K level. pic.twitter.com/d6OICIoeUU

— Axel ?? Adler Jr (@AxelAdlerJr) November 26, 2023

But what are the chances of Bitcoin hitting the price before the year ends? To assess this potential, AMBCrypto checked the Bitcoin supply in profit, which stood at 83.13% at press time, as per CryptoQuant. This metric decreased from the 25th of November, when it stood at 84.36%.

An increasing trend of the metric means investors are beginning to take profits. This could result in sell pressure, which could trigger a drop in Bitcoin’s price.

But since the supply in profit decreased, it means that BTC has a chance of recovering before the year ends. While $45,000 seems a little far off, BTC may have a chance at reaching $40,000. But for that to happen, the coin needs to retest $38,000 before November comes to a close.

BTC’s decrease provides an opportunity

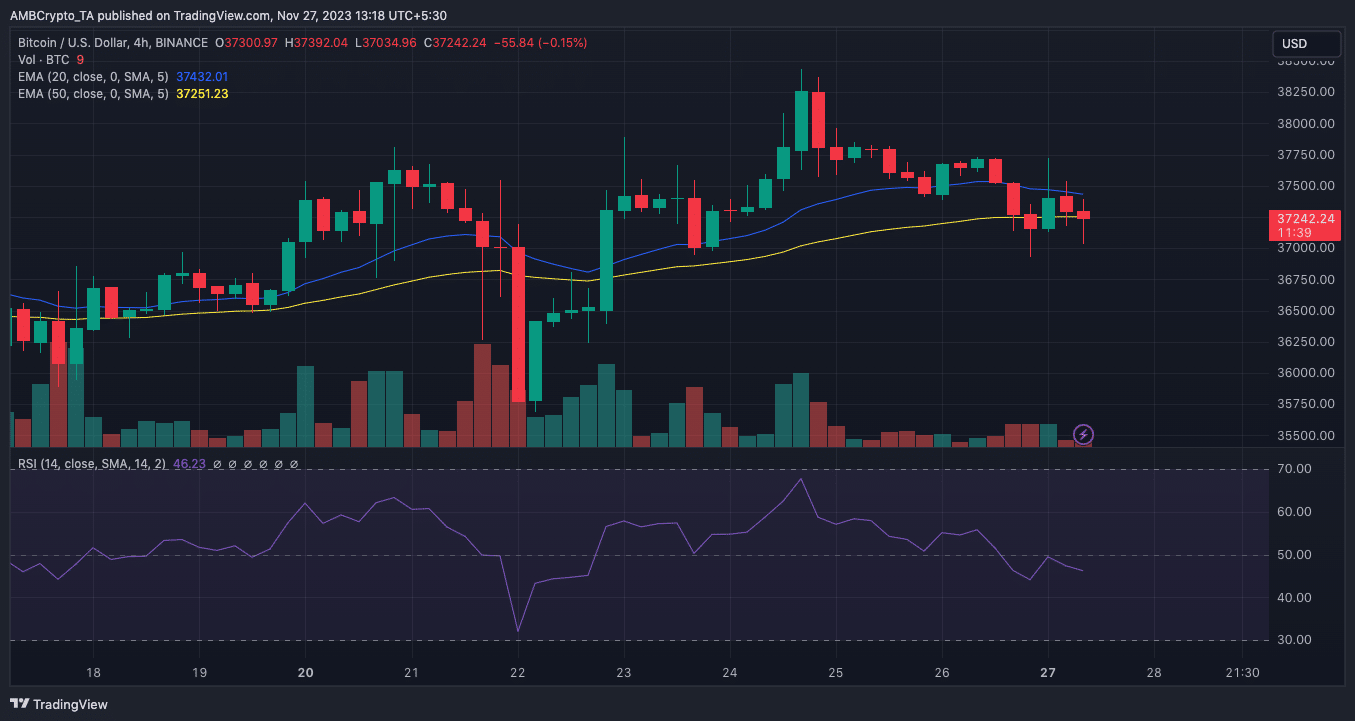

From the technical outlook, BTC/USD’s H4 chart showed that the Relative Strength Index (RSI) had fallen to 46.23. This reading indicates that sellers were dominant in the market. So, it is unlikely for BTC to reclaim $38,000.

However, if the RSI reading drops below 40.00, market players can see this as an opportunity to buy Bitcoin at a discount. Should accumulation begin around this point, then buying pressure may push BTC in the $40,000 direction.

This bullish thesis was also confirmed by the Exponential Moving Average (EMA). At press time, the 20 EMA (blue) was above the 50 EMA (yellow), suggesting that in some weeks, BTC could be trading well above the $37,000 region.

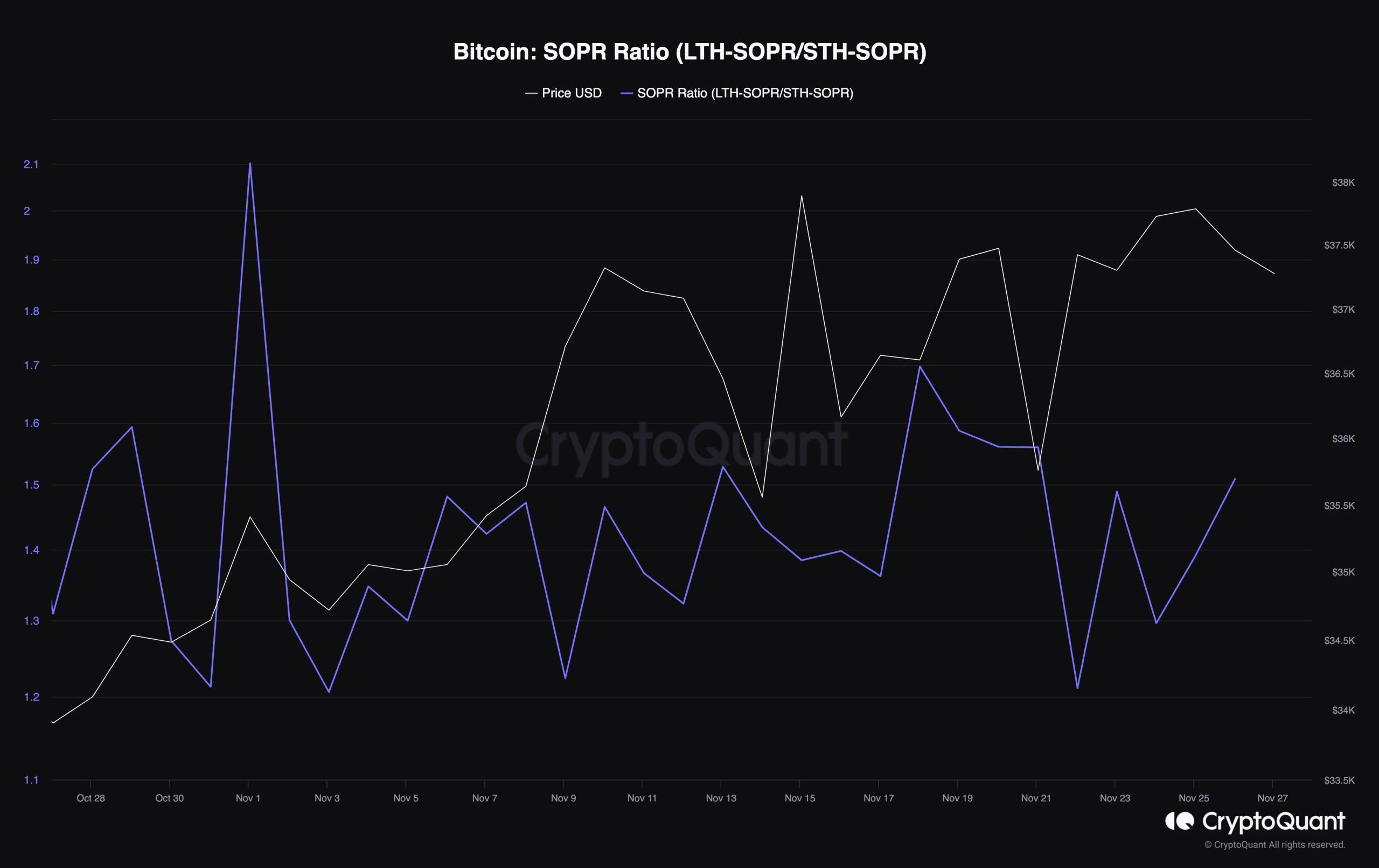

Another metric worthy of attention is the Spent Output Profit Ratio (SOPR). The SOPR shows the degree of profits realized by both Long-Term Holders (LTH) and STH. Higher values of the ratio indicate that there have been higher profits spent by LTH than STH.

Is your portfolio green? Check out the BTC Profit Calculator

If this is the case, it is a sign of a local market top. When it is the other way around, it means a coin has the potential for more upside. At the time of writing, the SOPR had increased. But it was still nowhere near the highs tapped on the 1st of November.

Therefore, if short-term holders keep maintaining their stead with regard to supply and profit ratio, BTC might trend upwards soon.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)