Will Bitcoin rally again? MVRV ratio shows where BTC could head next

- Bitcoin MVRV ratio suggested potential market shifts, with a crucial support level to watch at 1.75.

- Retail and whale activity showed mixed signals, with active addresses rising but large transactions slightly declining.

Bitcoin [BTC] recently surged above $66,000, marking a brief rally that excited investors and analysts about a potential bullish trend for October, referred to as “Uptober.”

However, this price jump was short-lived, as Bitcoin encountered a significant correction shortly thereafter.

Over the past week, the leading cryptocurrency has seen a downward trajectory, declining by 6.6% and trading below $62,000 at the time of writing, with an additional dip of 0.4% in the last 24 hours.

Amid this fluctuation, a CryptoQuant analyst known has shed light on a critical trend occurring in the background. According to the analyst, this emerging pattern could potentially have notable implications for Bitcoin’s future market behavior.

MVRV ratio suggests a major move for BTC

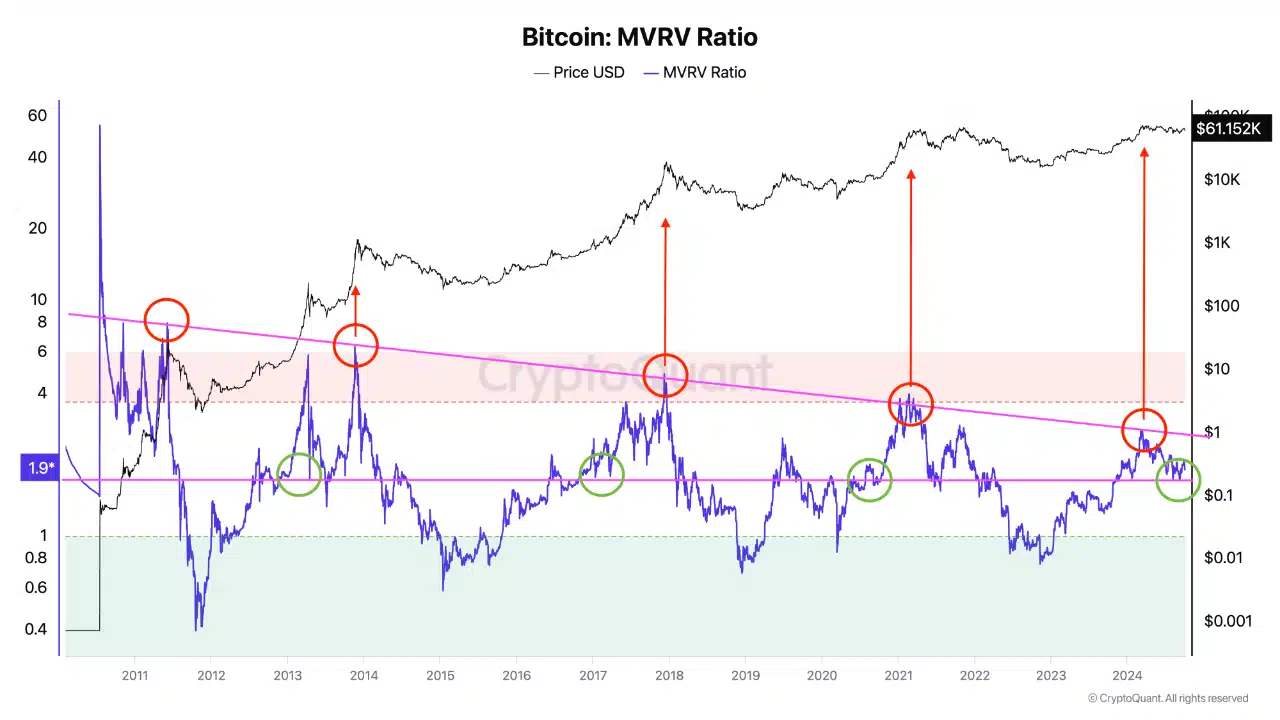

The CryptoQuant analyst’s focus was on Bitcoin’s Market Value to Realized Value (MVRV) ratio. This is a key metric that assesses whether BTC is currently overvalued or undervalued by comparing its market value to the price at which all coins last moved.

The MVRV ratio has been useful historically in identifying significant market highs and lows across Bitcoin’s halving cycles.

The MVRV ratio, as explained by the analyst, has been in a downward trend, with a crucial support level identified at 1.75.

Currently, the ratio stands at 1.9. This raises a pivotal question: if the MVRV ratio breaks out of this historical downtrend and reverses direction, could it rise to a range between 4 and 6?

Such a range has historically indicated a market peak for Bitcoin, as observed in prior cycles. The analyst’s focus on the MVRV metric highlights its importance in providing a gauge for potential market sentiment and future price movements.

Other metrics show mixed trends

Given this potential shift in market conditions, it is worth exploring other indicators that could offer insight into Bitcoin’s future trajectory.

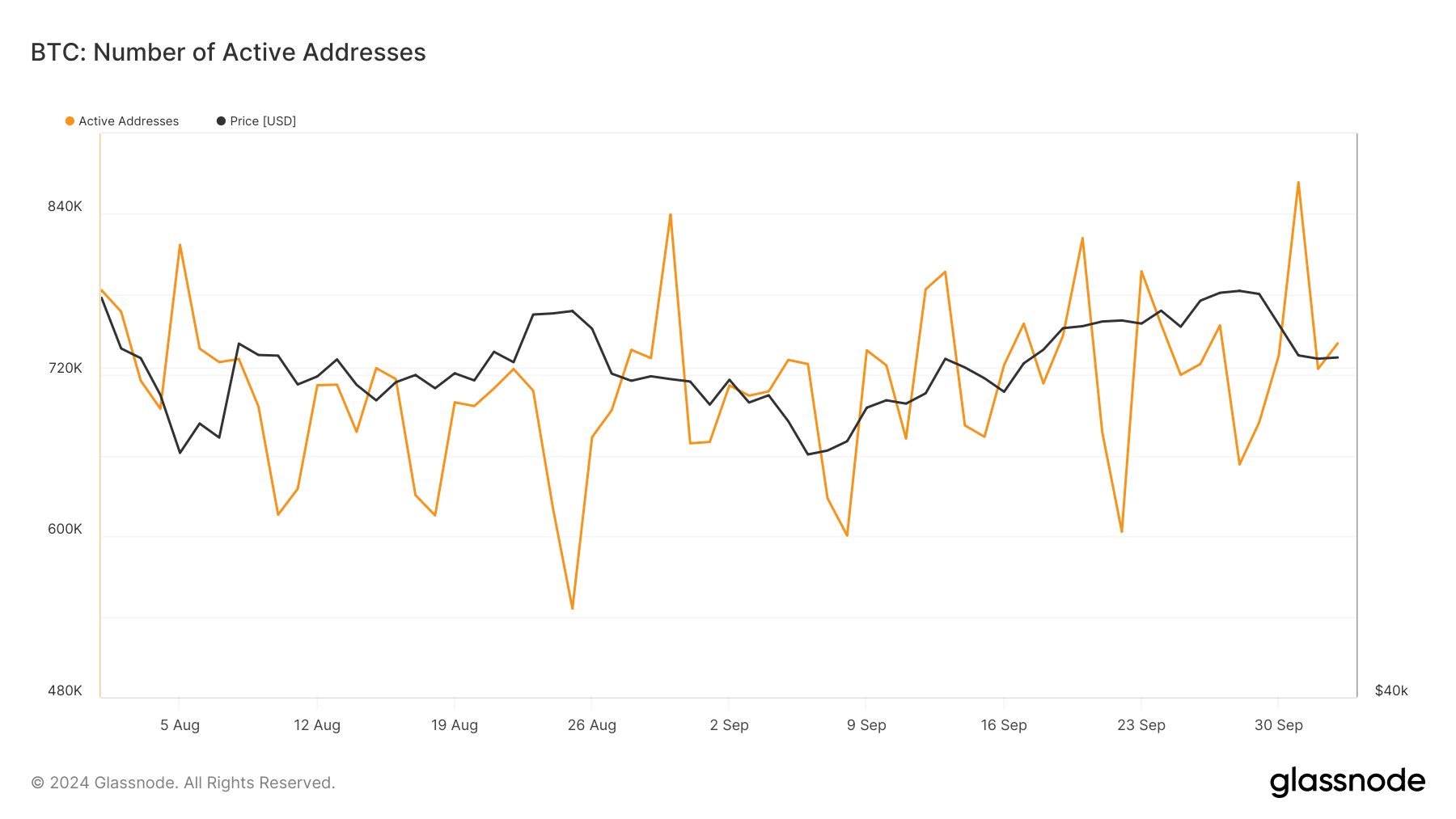

For instance, one key metric to watch is Retail Investor Activity, which is often reflected in the number of active addresses. According to data from Glassnode, this metric has been on a steady rise month-over-month.

After reaching 832,000 addresses in August and slightly declining to 822,000 in September, Bitcoin’s active addresses have continued to grow, currently standing at over 863,000.

This growing trend suggests renewed retail interest and involvement in the Bitcoin market, even amid recent price volatility.

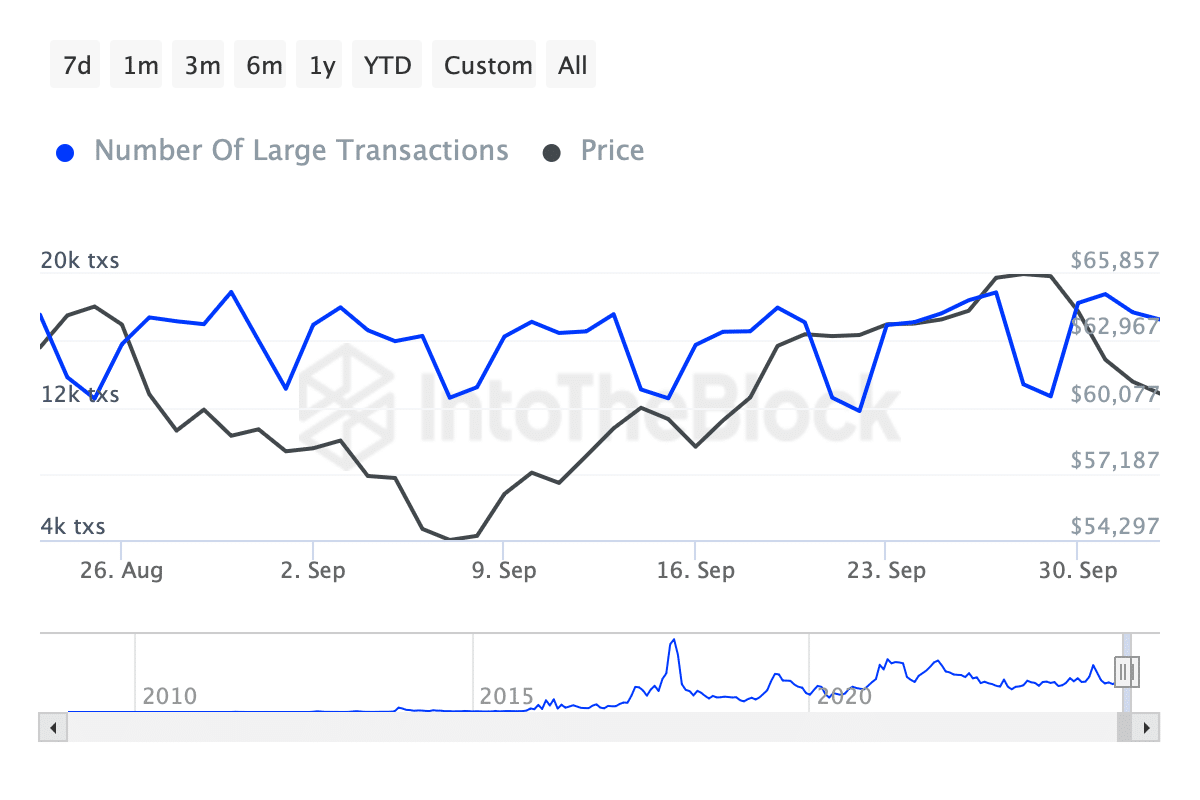

While retail interest provides one side of the picture, understanding the activity of larger investors, often termed “whales,” is equally crucial. An important indicator in this regard is the volume of transactions exceeding $100,000, as tracked by data from IntoTheBlock.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This metric saw a noticeable uptick between August and September, increasing from below 14,000 transactions to over 18,000.

However, since that surge, there has been a gradual tapering, with whale transactions recently decreasing to around 17,700.