Will Bitcoin repeat its 2017, 2021 patterns? Assessing…

- Analysts predicted that Bitcoin could repeat its 2017 and 2021 bull run pattern, hinting at an upcoming surge.

- Despite recent dips, 75% of BTC holders remained profitable, with whales controlling 12% of the supply.

Bitcoin [BTC] has experienced a notable decline in value over the past 24 hours. Starting at around $60,890, Bitcoin showed brief signs of resilience, with some upward momentum early on.

However, it soon faced a sharp drop, falling below the $59,000 threshold.

As of press time, Bitcoin traded at $58,315.93, reflecting a 4.21% decrease over the last 24 hours. Despite this, Bitcoin has seen a 1.96% price increase in the past week.

With a circulating supply of 20 million BTC, Bitcoin’s market capitalization stood at $1.15 trillion.

Bitcoin’s recent performance has drawn comparisons to previous bull markets, particularly those of 2017 and 2021.

According to analyst Moustache on X (formerly), Bitcoin’s current trajectory is similar to these past cycles, albeit at a faster pace.

Moustache noted,

“If you think the bull market is over, open the charts. BTC is doing the same as in 2017 and 2021, it’s just happening faster in terms of timing. The last time the ROC & SROC indicator changed from red to green was in 2016. A massive wave is coming imo.”

The historical pattern in Bitcoin’s price shows recurring bullish cup-and-handle formations that have preceded major rallies in 2017 and 2020, with another potential rally expected in 2024.

These patterns included a “retest” phase, where the price consolidates before breaking out to new highs.

In fact, this historical trend suggested that Bitcoin might be preparing for another significant upward movement as it approached the next retest in 2024.

Market sentiment and price support

Despite the recent decline, market sentiment around Bitcoin remained largely optimistic. Moustache added,

“It’s always funny to see the bears coming out and posting horror scenarios even though BTC is down just 5%. They probably haven’t realized that Bitcoin has already been above the 2021 ATH for 7 months. That’s called support. Very, very strong support.”

Current technical indicators provided mixed signals. The Bollinger Bands suggested decreasing volatility, as the price remained close to the middle band.

The MACD histogram was in the negative zone at press time, indicating bearish momentum, but this momentum appeared to be weakening.

However, the MACD line was approaching a potential bullish crossover, which could signal a reversal in the current trend.

Overall, Bitcoin was consolidating within a range, and a breakout could define the next major move.

Bitcoin summary and market signals

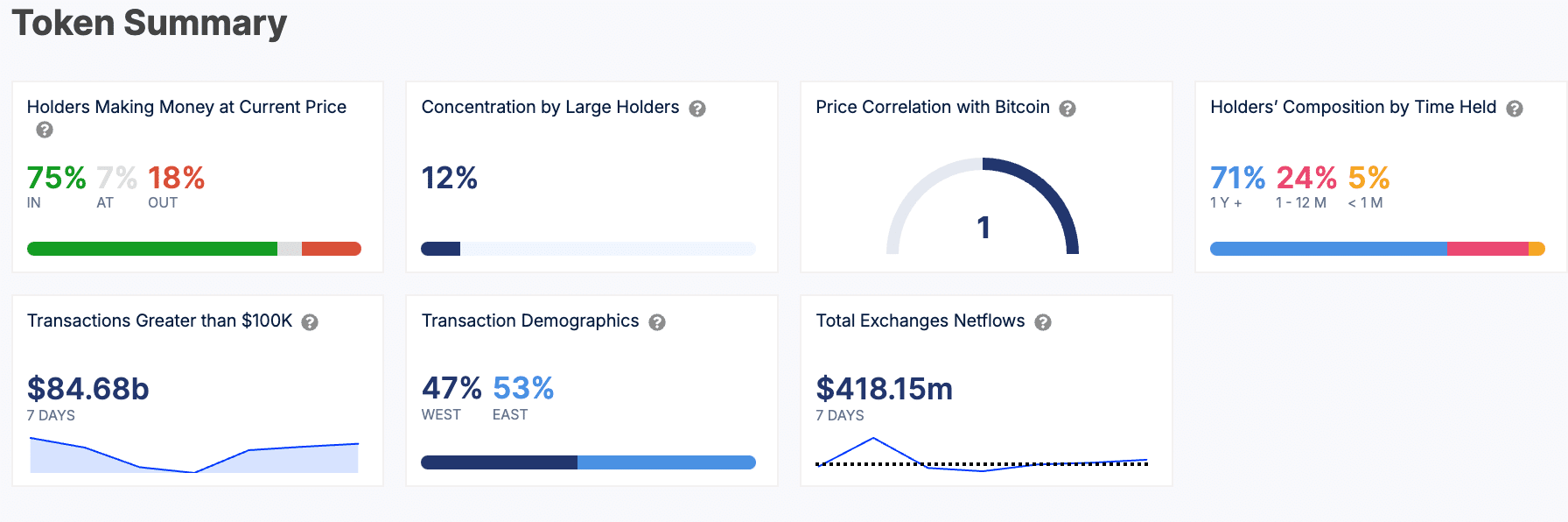

According to IntoTheBlock data, Bitcoin’s token summary revealed that 75% of holders were profiting at its current price. 18% were at a loss, while 7% broke even. Whales controlled 12% of the total supply.

Regarding holders’ composition, 71% have held Bitcoin for over a year, 24% for 1–12 months, and 5% for less than a month.

Over the past seven days, transactions exceeding $100,000 totaled $84.68 billion, with 53% of these transactions originating from the East and 47% from the West.

Additionally, total exchange netflows amounted to $418.15 million during this period.

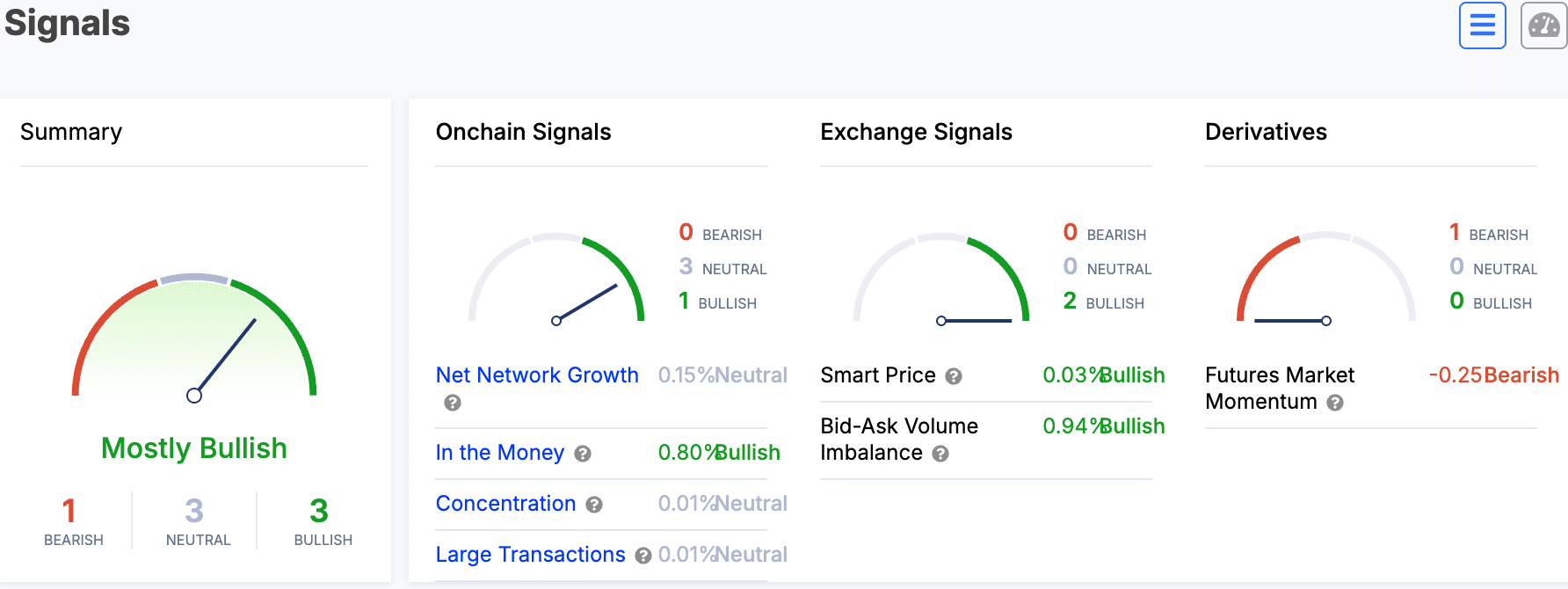

Market signals indicated an overall “mostly bullish” sentiment. On-chain signals showed three neutral indicators and one bullish, with net network growth at 0.15%, categorized as neutral.

Meanwhile, 0.80% of holders were “in the money,” a bullish indicator. Exchange signals were entirely bullish, with a 0.06% increase in smart price and a 2.13% bid-ask volume imbalance.

However, the derivatives market reflected some bearish sentiment, with Futures market momentum at -0.25%.

Is your portfolio green? Check out the BTC Profit Calculator

According to AMBCrypto’s look at DefiLlama data, Bitcoin had a Total Value Locked of $620.01 million at press time, with a 24-hour volume of $201,892 and 662,757 active addresses.

This analysis suggested that, despite short-term fluctuations, Bitcoin may be gearing up for another significant upward movement, reminiscent of previous bull markets.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)