Bitcoin

Will Bitcoin whales help BTC cross $60K?

Whales continue to show interest in Bitcoin, with buyers making large moves.

- Whale purchases affirmed ongoing institutional interest, defying speculation of exhaustion.

- iShares Bitcoin ETF hits $1 billion daily volume.

Bitcoin [BTC] has been on a consistent upward trajectory in recent weeks, prompting speculation about the sustainability of institutional interest and its potential to drive BTC to all-time highs.

Whales still looking for more

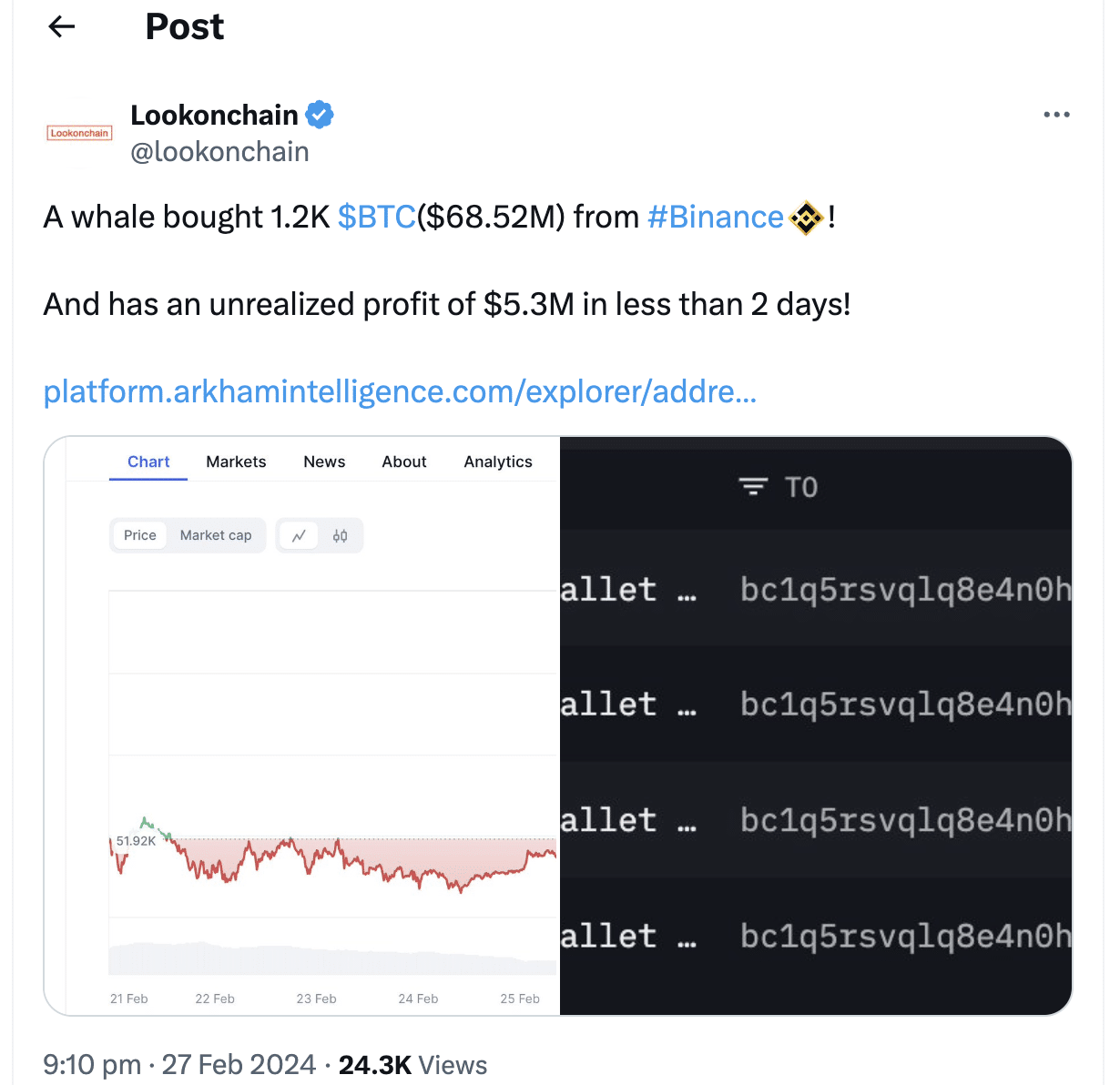

One striking instance of institutional involvement is evidenced by a whale’s recent purchase of 1,200 BTC, amounting to $68.52 million, from Binance [BNB]

.The whale achieved an impressive unrealized profit of $5.3 million in less than two days, underscoring the continuing allure of BTC for significant investors.

Further solidifying institutional interest is the notable success of the iShares Bitcoin ETF ($IBIT). With a trading volume reaching $1 billion, $IBIT ranked 11th among all ETFs (Top 0.3%) at press time.

This achievement is particularly remarkable for a new ETF amidst stiff competition, emphasizing substantial institutional involvement and confidence, as evident in its robust daily trading volume.

Large-scale investments and the popularity of BTC-related financial products also contributed to increased liquidity, market stability, and potential upward price movements.

There are some concerns about Bitcoin

However, the concentration of BTC holdings among a few large entities could raise concerns about centralization.

While institutional interest bolsters market dynamics, an overly centralized ownership structure could lead to increased volatility and potential market manipulation.

Striking a balance between institutional involvement and maintaining the decentralized ethos of cryptocurrencies will become crucial for the long-term health of the BTC ecosystem.

As of press time, BTC was trading at $56,308.79, displaying a growth of 4.41% in the last 24 hours. This price reflected the ongoing positive sentiment and demand for BTC in the market.

Examining the broader Bitcoin ecosystem also revealed insights into user engagement.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite the positive price movement, interest in Inscriptions and Ordinals, unique digital assets inscribed on satoshis, has seen a decline.

This trend indicated that users might be more focused on traditional aspects of Bitcoin rather than exploring newer dimensions like Ordinals and Inscriptions.