Will Cardano see a near term dip to $0.3? Keep an eye out for THIS!

- Cardano is likely to fall toward $0.3 in the near term to collect liquidity.

- The downtrend of the MDIA could be a powerful signal for bulls to re-enter.

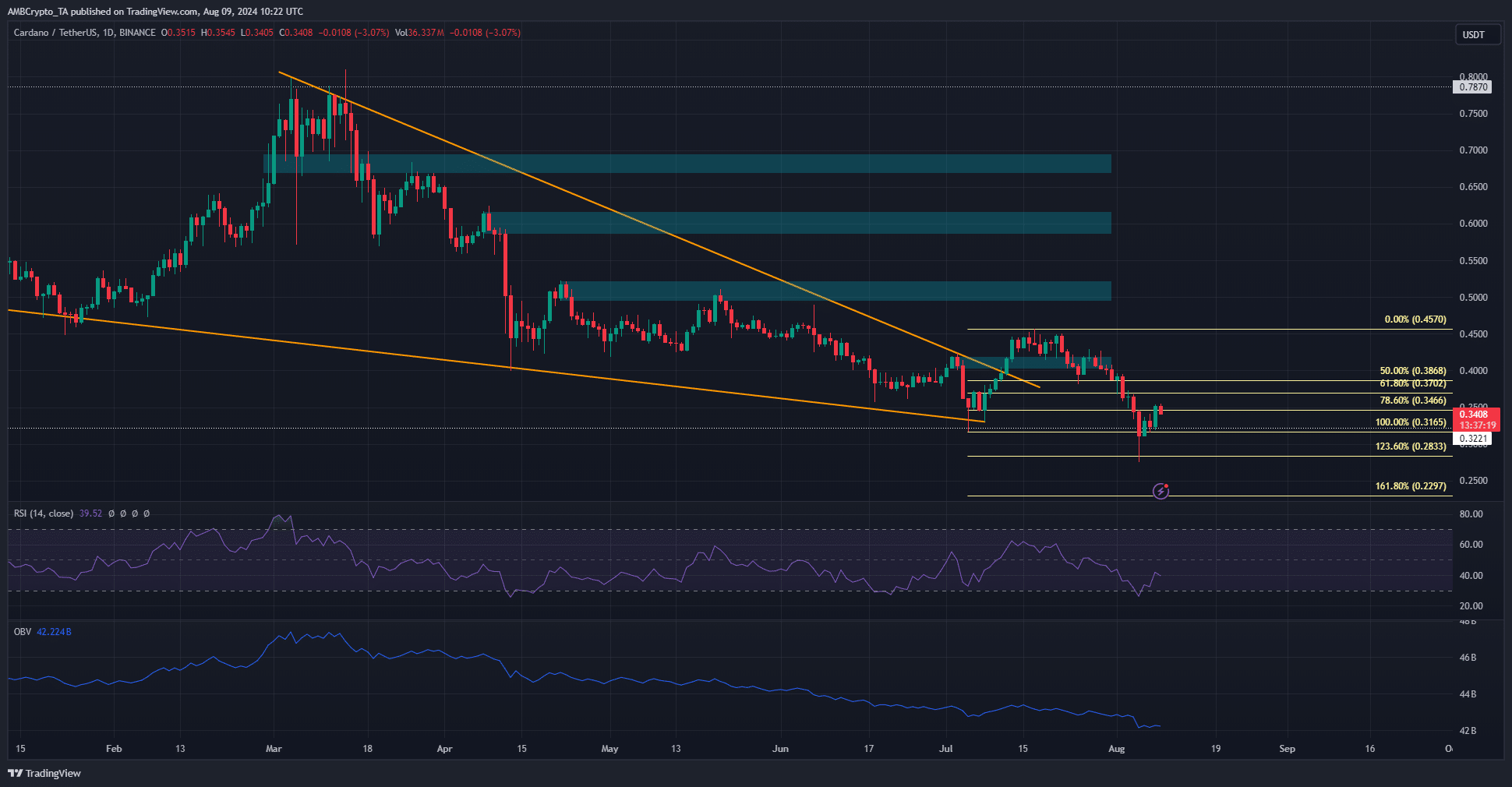

Cardano [ADA] saw a breakout past the descending wedge formation in mid-July, but its progress was halted before the uptrend was properly.

If that wasn’t discouraging enough, the Bitcoin [BTC] sell-off and market-wide panic earlier this week saw ADA slump to $0.275.

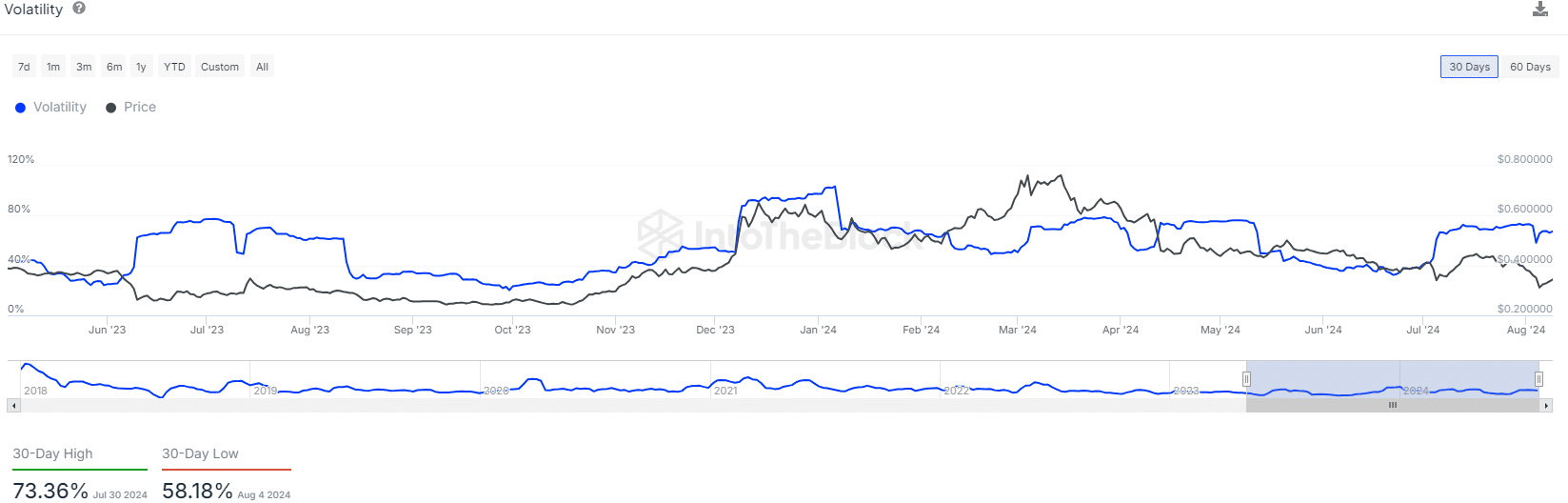

Data showed that the asset has been quite volatile in recent weeks. The other metrics were mixed but favored the bears more than the bulls. Despite the price drop, social media sentiment remained strong.

Is ADA a good investment?

Source: IntoTheBlock

The 30-day variations in the Cardano volatility showed high price swings in July. The persistent price drop in the first week of August saw this metric drop to a low of 58.18%.

Ideally, long-term investors want to see low volatility for a prolonged period to indicate steady, persistent accumulation.

AMBCrypto looked at another metric, the Beta coefficient, comparing Cardano’s volatility to Bitcoin’s. It showed a value of 0.86 at press time, meaning its price moves are less volatile.

It also showed that ADA is likely preferred by more conservative investors.

More aggressive ones would likely target higher returns, and be willing to stomach the chosen asset’s greater volatility relative to BTC.

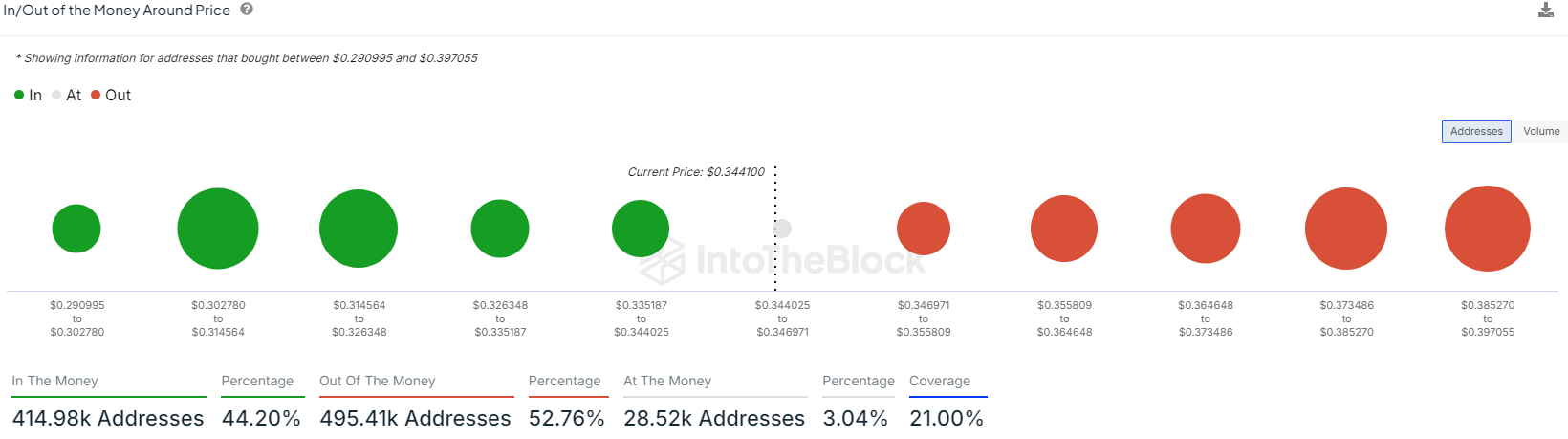

Source: IntoTheBlock

The $0.3-$0.326 was highlighted as the biggest support zone around the price. This region had confluence with the July lows but was breached on Monday.

Gathering more clues for the next price trend

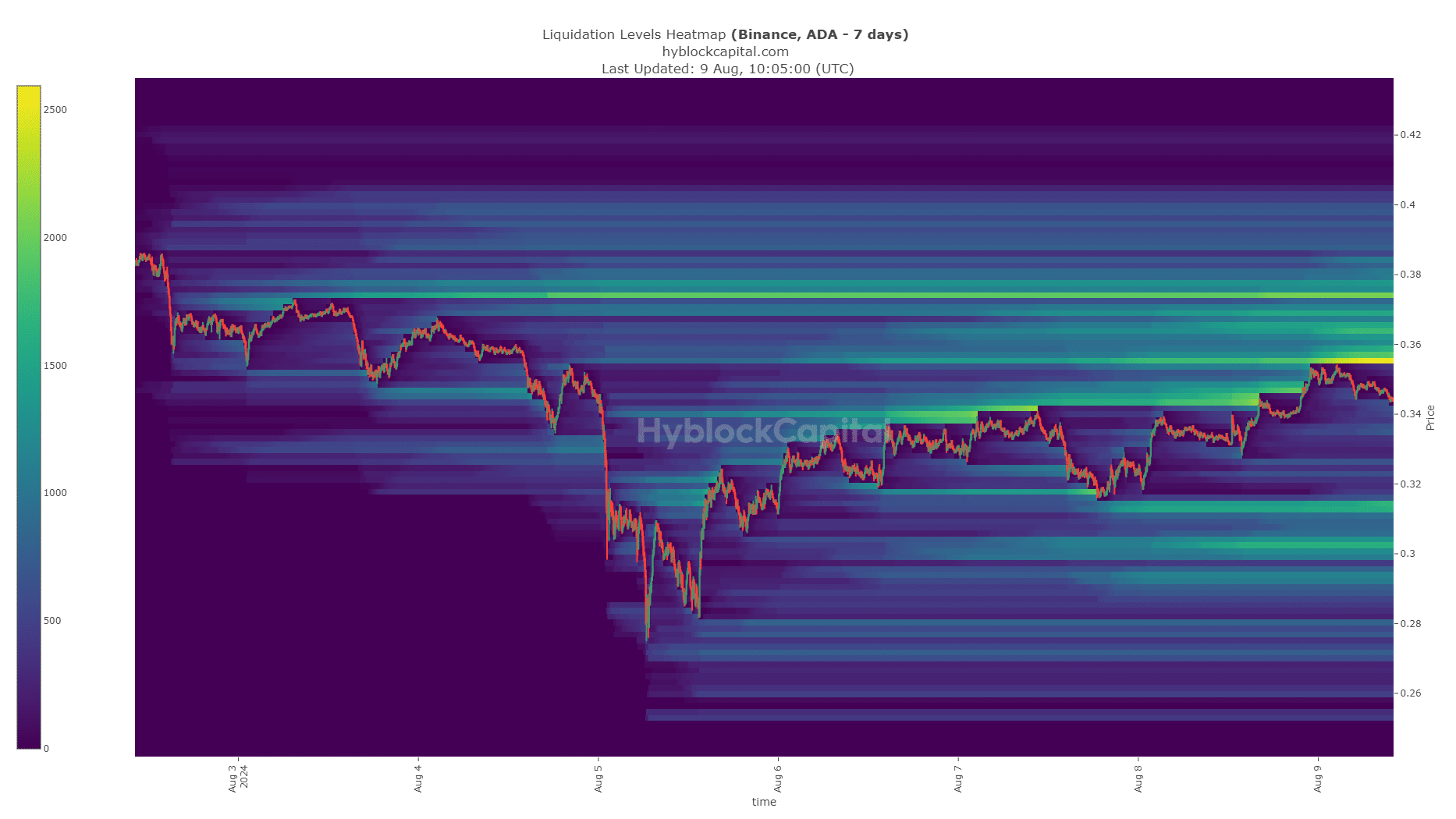

Source: Hyblock

The 7-day lookback period showed that the $0.3-$0.314 zone had a cluster of liquidation levels that could affect a reversal.

However, due to the recent crash, there was not enough time for a large swathe of liquidity to be built up, which would be an obvious higher timeframe target.

It supports the technical findings and the in/out of the money data.

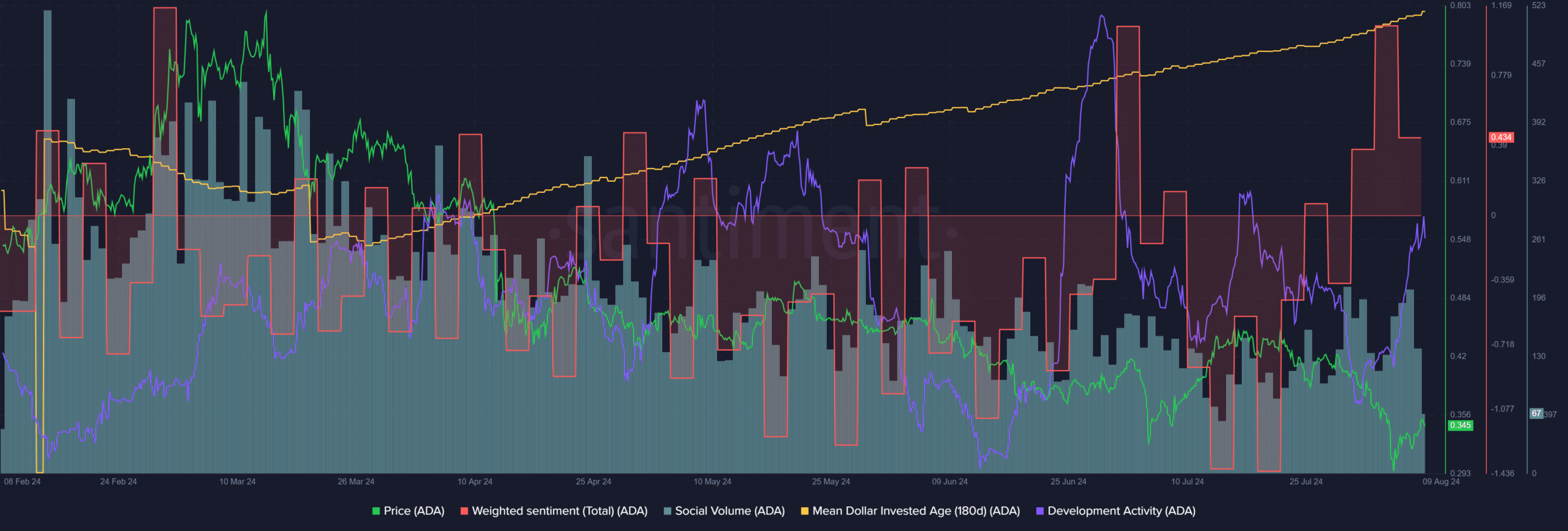

Source: Santiment

The Weighted Sentiment was positive, a surprising development after the price crash below $0.3. It suggested panic has not seized investors.

The development activity was on par with earlier months, another inspiring sight for long-term holders.

Read Cardano’s [ADA] Price Prediction 2024-25

Yet, the mean dollar invested age continued to trend higher. The 180-day MDIA has climbed higher since March and is nearly at the October 2023 levels. It indicated stagnancy and a lack of new capital flowing in.

If the metric begins to trend downward, it would be a strong sign that ADA is ready for a sustained rally.