Will Chainlink find enough momentum for a recovery run?

Chainlink’s price has risen exponentially since the start of 2021, both independently and on Bitcoin’s own coattails. However, LINK’s correlation being a double-edged sword has ended up hurting the crypto’s price aspirations after the coin fell by close to 35 percent over the week.

While the said drop is insignificant when compared to LINK’s growth this year, the coin’s price depreciation after having sustained a prolonged uptrend may be concerning for traders who have invested and supported its rally.

Interestingly, since the aforementioned drop, LINK has been facing resistance in its attempt to go on a solid recovery run. In the case of the crypto-market, while it is hard to ascertain in which direction the market will move, it is judicious to look at a few indicators and parameters to give us a better understanding of the coin’s fundamentals and its near-term price trends.

With sellers lower in number and buyers likely to enter the market, LINK will be able to maintain its current position and will look at initiating a bull run that can cover the losses it faced over the past week.

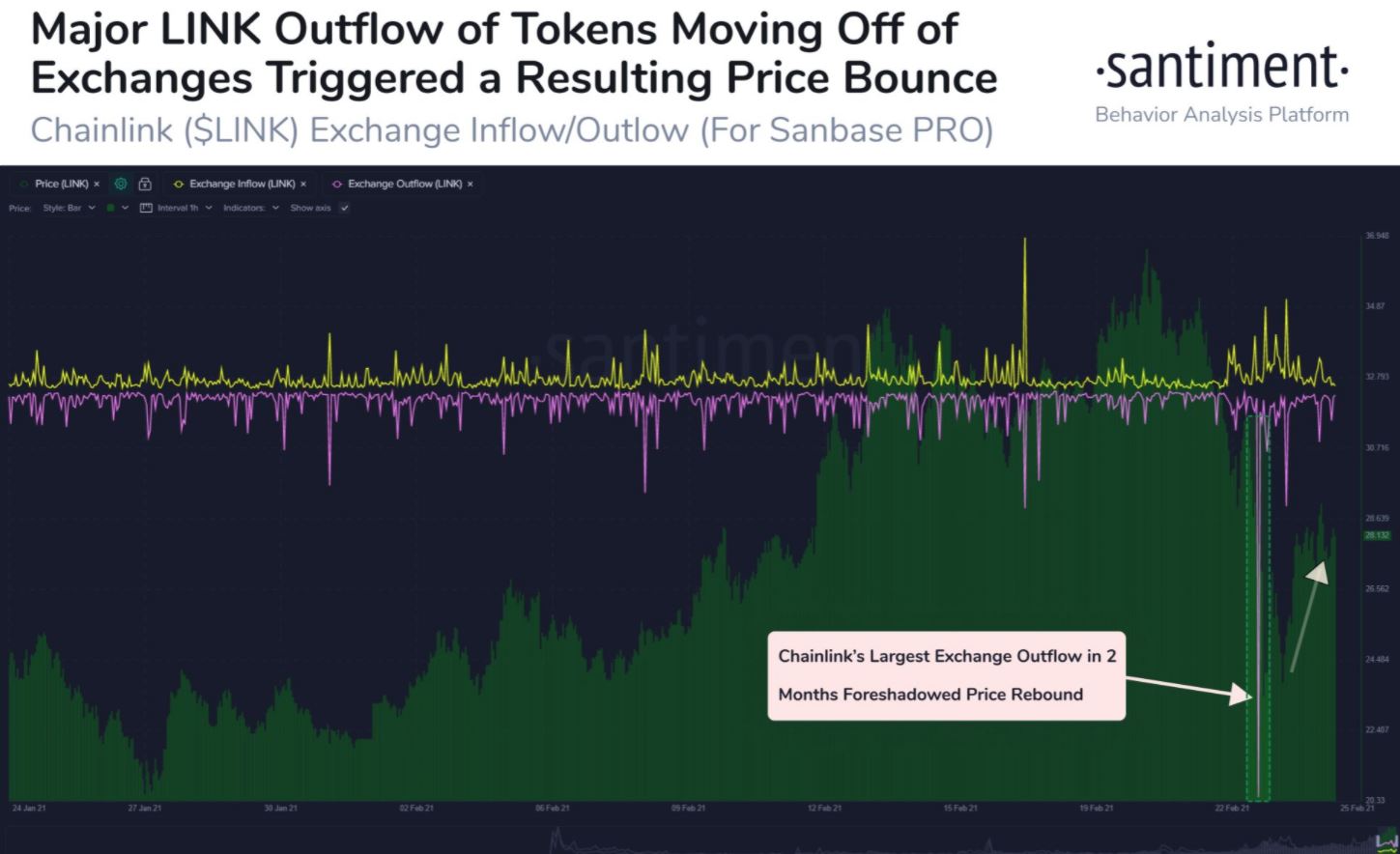

Source: Santiment

In such a scenario, it is important to understand whether coins are flowing in or out of popular exchanges. If LINK is now entering exchanges, one can argue that sellers are still willing to sell their tokens before the price falls even further. In the case of LINK, the opposite seems to be true, which in turn, is a positive sign for the coin and its price action.

According to data provided by Santiment, a major spike in exchange outflows for LINK has taken place over the past ~42 hours, with the same foreshadowing the price moving upwards. However, since then, LINK has been unable to go past key levels of resistance and has remained range-bound.

This is not unique to LINK as the entire crypto-market has had to endure bearish pressure thanks to the price slump Bitcoin has been subjected to. With the king coin having fallen below the crucial $50k-mark, many altcoins too have seen much of their gains disappear.

LINK’s correlation with Bitcoin is quite interesting to look at. According to market data, the BTC-LINK correlation is quite high with a value of 0.81, at the time of the writing, and this high correlation with BTC may also be the reason why LINK has been unable to fully initiate a recovery run.

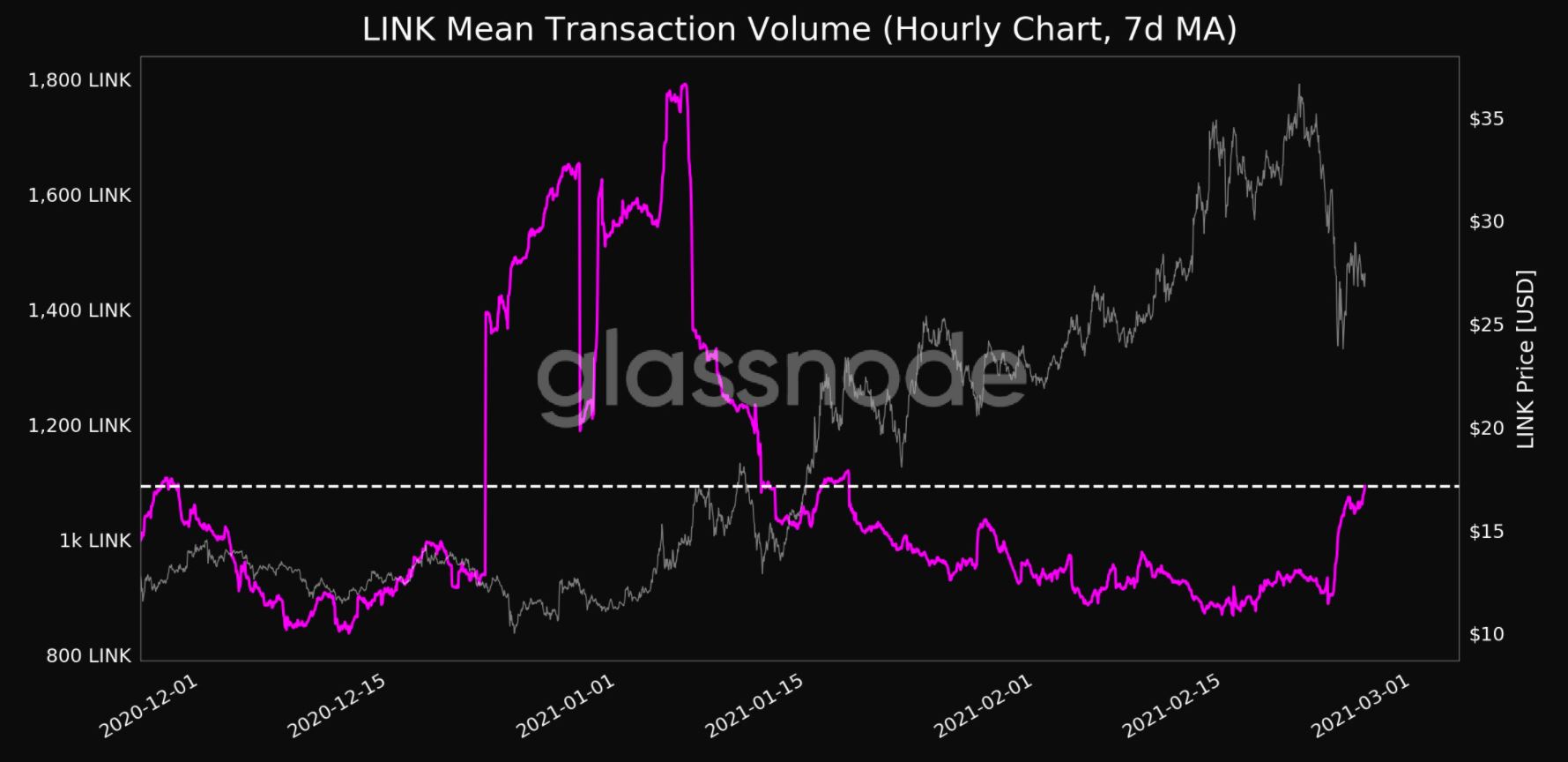

Source: Glassnode

However, on the bright side, LINK’s fundamentals are still strong and make the possibility of a price rebound very probable. Transfer volume for Chainlink, for instance, continues to be extremely positive, with the same hitting a 2 year high yesterday. Finally, network data revealed that LINK’s transfer data was at a 1-month high with a value of 1,093.533 LINK.

Supplementing LINK’s bullish prospects, the token has also been able to establish an ATH of 56.189 percent with regard to the supply in smart contracts, according to data provided by Glassnode. The healthy state the network finds itself in can be taken as a sign that the price drop was temporary, and while the high correlation with BTC is still a limiting factor (such is the case with the general altcoin market), LINK may be able to build enough momentum to recover its losses.