Will Chainlink hit the $16.5 level? Here’s where LINK is headed

- 54 new wallets withdrew 2.08 million LINK tokens worth $30.28M.

- LINK looked bullish at press time, with a golden crossover spotted on an hourly time frame.

The overall cryptocurrency market is currently choppy, and top assets including Bitcoin [BTC], Ethereum [ETH], and Binance Coin [BNB] were in red.

Amid this struggling situation, nearly 54 newly created wallets withdrew 2.08 million ChainLink [LINK] tokens worth $30.28M, according to an on-chain analytic firm Lookonchain.

This massive accumulation happened on the world’s biggest cryptocurrency exchange over a period of seven days.

Lookonchain in an X (formerly Twitter) post, shared that whales and institutions have potentially executed this massive accumulation.

This notable $30.28 million LINK accumulation by these whales and institutions signals their interest and confidence as the price reaches the resistance level.

ChainLink: key levels

According to expert technical analysis, LINK was looking bullish, with a golden crossover spotted (50 EMA crosses 200 EMA) spotted on an hourly time frame and the price nearing a resistance level of $14.8.

However, the recent accumulation data and golden crossover indicated a bullishness in the chart.

At press time, LINK iwas consolidating near the resistance level and open interest (OI) has surged nearly 2% in the last four hours, potentially signaling investors’ and traders’ interest in the token.

If the LINK 4-hour candle closes strongly above the $14.9 level, we may see possible targets at $15.5 and $16.5 in the coming days.

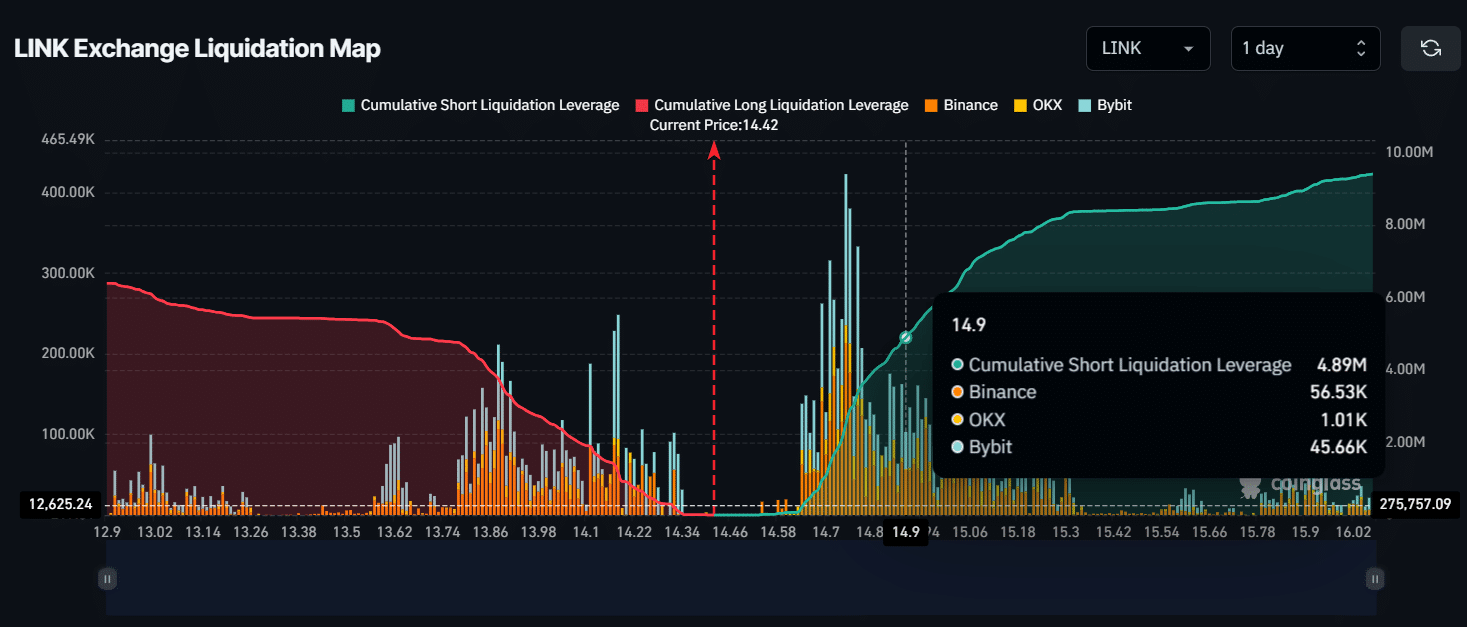

If LINK breaches and gives a candle closing above the $14.9 level, then we may see $4.9 million worth of short liquidations, according to on-chain analytic firm Coinglass.

However, data also indicates that short sellers are more active than long buyers.

LINK price-performance analysis

Despite this bullish outlook, LINK was trading near the $14.40 level at the time of writing. In the last 24 hours, it experienced a 1% price drop and reached a high of $14.71 level, according to CoinMarketCap.

Realistic or not, here’s LINK’s market cap in BTC’s terms

However, the 24-hour trading volume jumped by 2%, signaling a lower level of investors’ and traders’ participation.

In the last seven days, LINK has remained stable due to continuous consolidation, experiencing a 1.3% upside move. Whereas, in the last 30 days, LINK has lost over 20% of its gains.