Will Chainlink’s [LINK] latest retest flip support into resistance?

![Will Chainlink's [LINK] retest flip support into resistance?](https://ambcrypto.com/wp-content/uploads/2025/04/Renuka-57-1200x675.webp)

- LINK’s retest of its $12.5 breakout zone hinted at a possible bearish continuation

- On-chain and liquidation data supported further downside potential towards the $10 and $7.5 levels

After a week of consistent decline, Chainlink [LINK] has been testing a key resistance zone around $12.5 — A level that previously acted as a key support. The altcoin’s price action appeared to be a retest of the breakout zone that might now flip into resistance. In fact, it also alluded to a lack of conviction on the bullish side.

However, LINK may see a more significant pullback if the bulls do not maintain this critical price level. The broader market remains indecisive and Chainlink (LINK)’s recent retracement has been within expectations.

Additionally, the price has not managed to post a higher high after topping near $16.

Retesting the descending trendline at around $12.5 without bouncing convincingly is a sign of a weakening structure.

LINK’s bearish setup bolstered by on-chain data

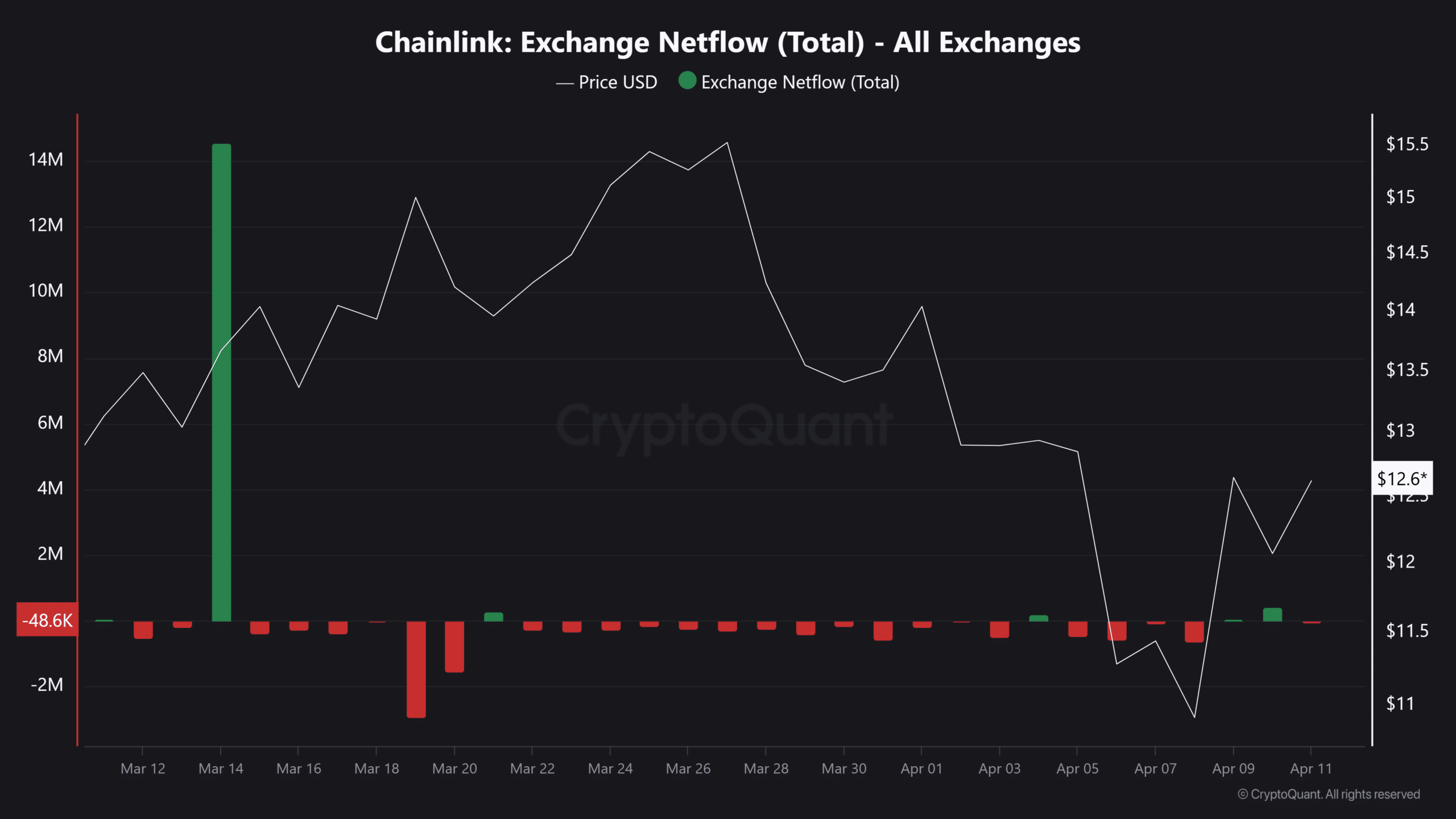

At the time of writing, on-chain data seemed to give little reassurance to LINK’s bulls.

According to CryptoQuant, the net deposits for the altcoin on exchanges are only slightly above their 7-day average. That is usually a sign of heightened selling pressure.

Higher net deposits generally represent investors pulling funds from decentralized exchanges and sending them over to centralized exchanges with a view to sell.

Now, although the uptick did not exceed the limits, it did coincide with a bearish technical outlook. This convergence may justify LINK’s bearish bias on the charts.

Liquidation clusters hint a further drop past $10

Finally, leveraged traders may further influence LINK’s price trajectory.

Liquidation heatmaps also revealed a cluster of long liquidation levels near the $10-mark. Market makers like to hunt these liquidity zones during periods of uncertainty.

If LINK moves towards $10, triggering liquidations, that selling pressure could trigger a cascade of events. Then, another push to $7.5 — Q4 2023’s previous high — would become probable.

The $12.5 zone must hold to avoid deeper losses. With elevated exchange deposits and visible liquidation pools below, the path of least resistance is south for now.