Will Dogecoin finally break THIS level after BTC’s surge to $71K?

- Dogecoin approached critical resistance; a break above $0.16460 could trigger a rally toward $0.20.

- Overbought signals hinted at a potential DOGE pullback, while whale activity pointed to increased volatility.

Dogecoin [DOGE] saw a rapid surge of 16.93% over the past day. This strong move came after the coin retested the $0.14080 support level, indicating a solid base and driving it toward a critical resistance at $0.16460.

At press time, DOGE was priced at $0.1654 with a 24-hour trading volume of $4.37 billion. The circulating supply was 150 billion DOGE, and the market cap stood at $24.24 billion.

As DOGE nears the $0.16460 resistance, it closes in a mid-range target of $0.20745. Breaching this resistance could lead to further price gains.

If DOGE fails to move past the $0.16460 level, it could revisit support at $0.14080.

A more substantial decline could test the lower support at the $0.12650 mark. The mid-range target remains in sight, but breaking above the $0.16460 level is key to any further rally.

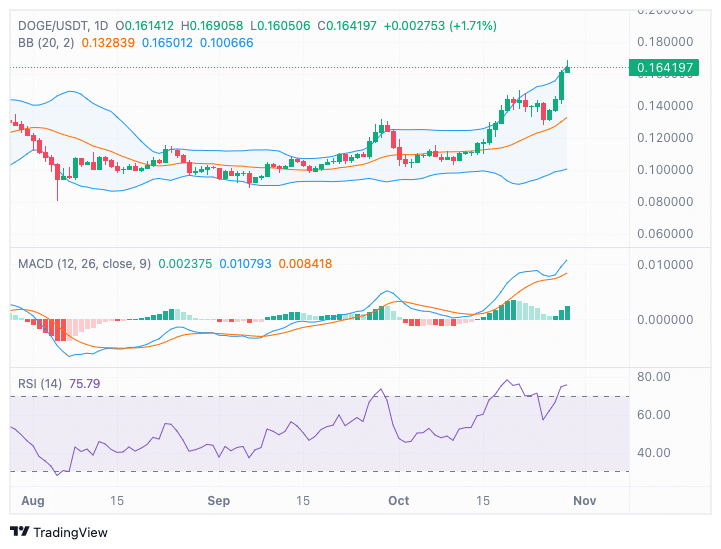

Overbought signals from technical indicators

Dogecoin’s price has risen beyond the upper Bollinger Band, reflecting strong upward pressure. While this indicates bullish momentum, breakouts above the upper band can also mean that the coin is overbought.

This raises the chance of a short-term pullback or a period of consolidation. Should DOGE dip, the middle Bollinger Band standing at $0.1328 may act as a support zone.

The MACD showed positive momentum, with both the MACD line and the signal line trending upward. The histogram’s growth further indicate increased buying activity.

As long as the MACD stays positive, the bullish trend remains intact, potentially driving DOGE higher.

Meanwhile, the RSI reached 75.79, at the time of writing, which also suggested that DOGE was in the overbought territory.

While this could signal a potential short-term correction, strong RSI levels are common in strong uptrends.

If RSI continues to hold at elevated levels, DOGE may push toward the next resistance at $0.18.

DOGE’s on-chain metrics

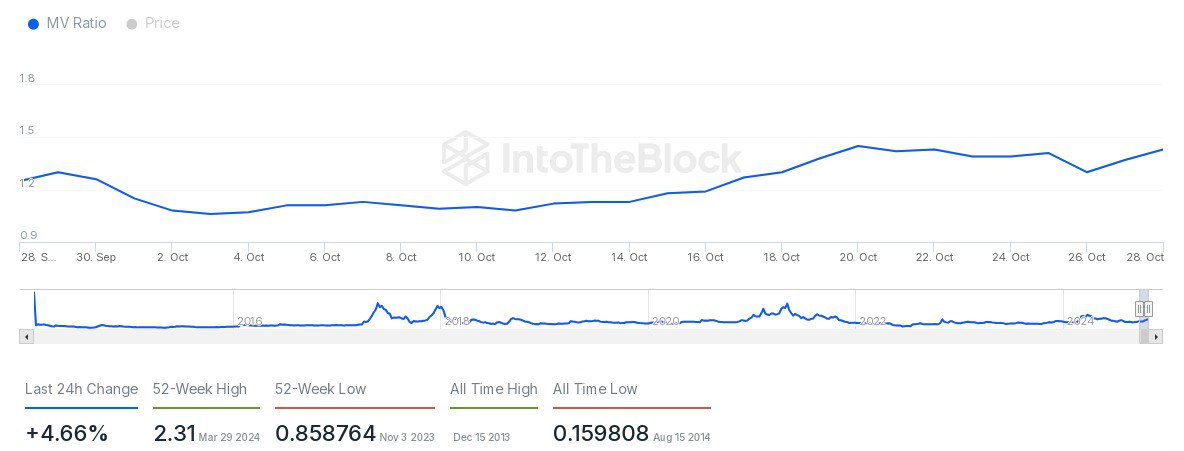

The Market Value to Realized Value (MVRV) Ratio for DOGE increased by 4.66% in the past 24 hours and was hovering around the 1.5 mark. The MVRV ratio gauges profitability for holders.

A higher MVRV generally means more holders are in profit, which can lead to selling pressure as traders lock in gains. Historically, when MVRV exceeds 2.0, there is often an uptick in selling.

At the current level, MVRV is below its 52-week high of 2.31, suggesting a potential room for further gains before notable selling pressure emerges.

However, if MVRV continues to rise, the risk of profit-taking grows, which could put downward pressure on DOGE’s price.

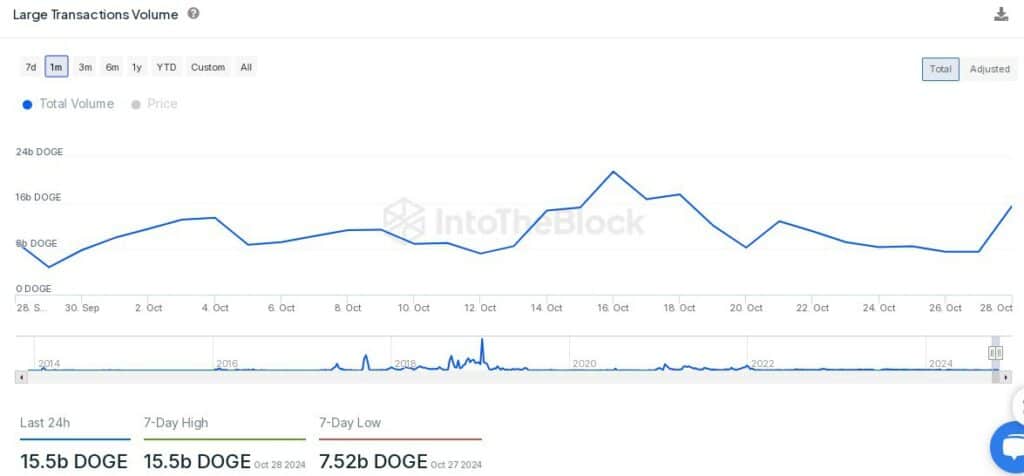

Whale activity on the rise

The volume of large DOGE transactions has reached 15.5 billion DOGE in the past 24 hours, marking the highest level in October.

Source: IntoTheBlock

Read Dogecoin’s [DOGE] Price Prediction: 2024-2025

This increase points to heightened interest from whales and institutional players, who influence price direction regularly. Increased whale activity can mean accumulation, distribution, or preparations for larger market moves.

Recently, large transaction volume had dropped to 7.52 billion DOGE, making this spike significant.