Will dogwifhat crash to $1.25? Examining WIF’s future in a bearish market

- WIF was the worst-performing meme token of the top five in the past week

- The sentiment behind WIF was intensely bearish in the short-term

dogwifhat [WIF] was unable to scale past the psychological $2 level. Instead, the bulls were rebuffed from just beneath it a week ago, and the bearish outlook remained valid.

The quick gains of the past week were unsustainable.

The memecoin sector also posted double-digit percentage losses in the past seven days. WIF’s performance was the worst among the top five popular meme coins in this period.

Where is dogwifhat headed next?

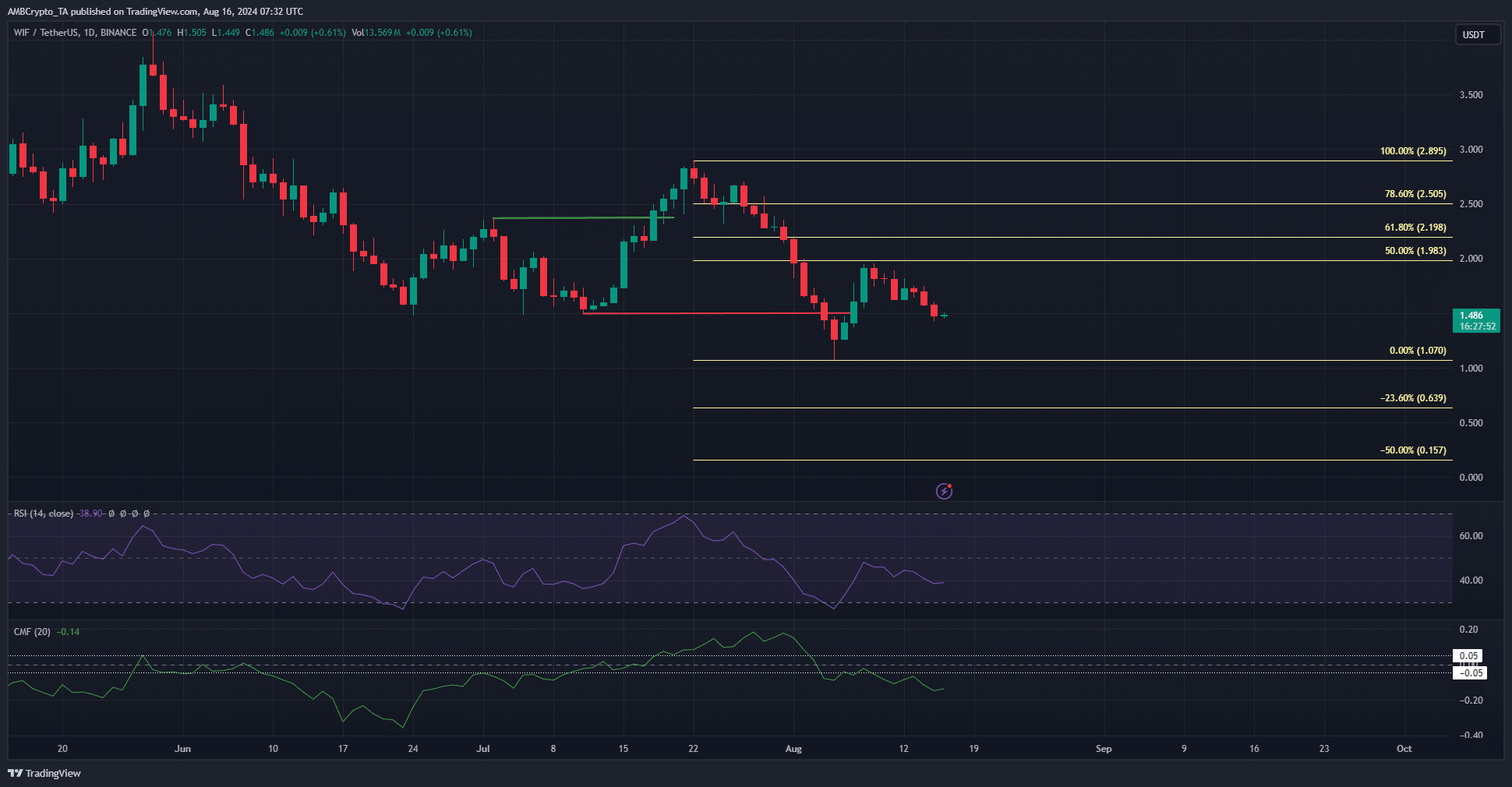

In July, WIF made a bullish market structure break (green). It formed a local top at $2.895 and proceeded to fall to $1.07 as Bitcoin [BTC] crashed from $69k to $49k. WIF has not begun to recover from these losses.

Its market structure was bearish, and it also saw a rejection from the 50% retracement level at $1.98. It appeared likely that the Fib extension levels below $1 are the next targets.

The daily RSI was at 38 to reflect a firm downward momentum. The CMF’s reading of -0.14 indicated sizeable capital flows out of the dogwifhat market over the past week.

Bearish sentiment in the Futures market

Source: Coinalyze

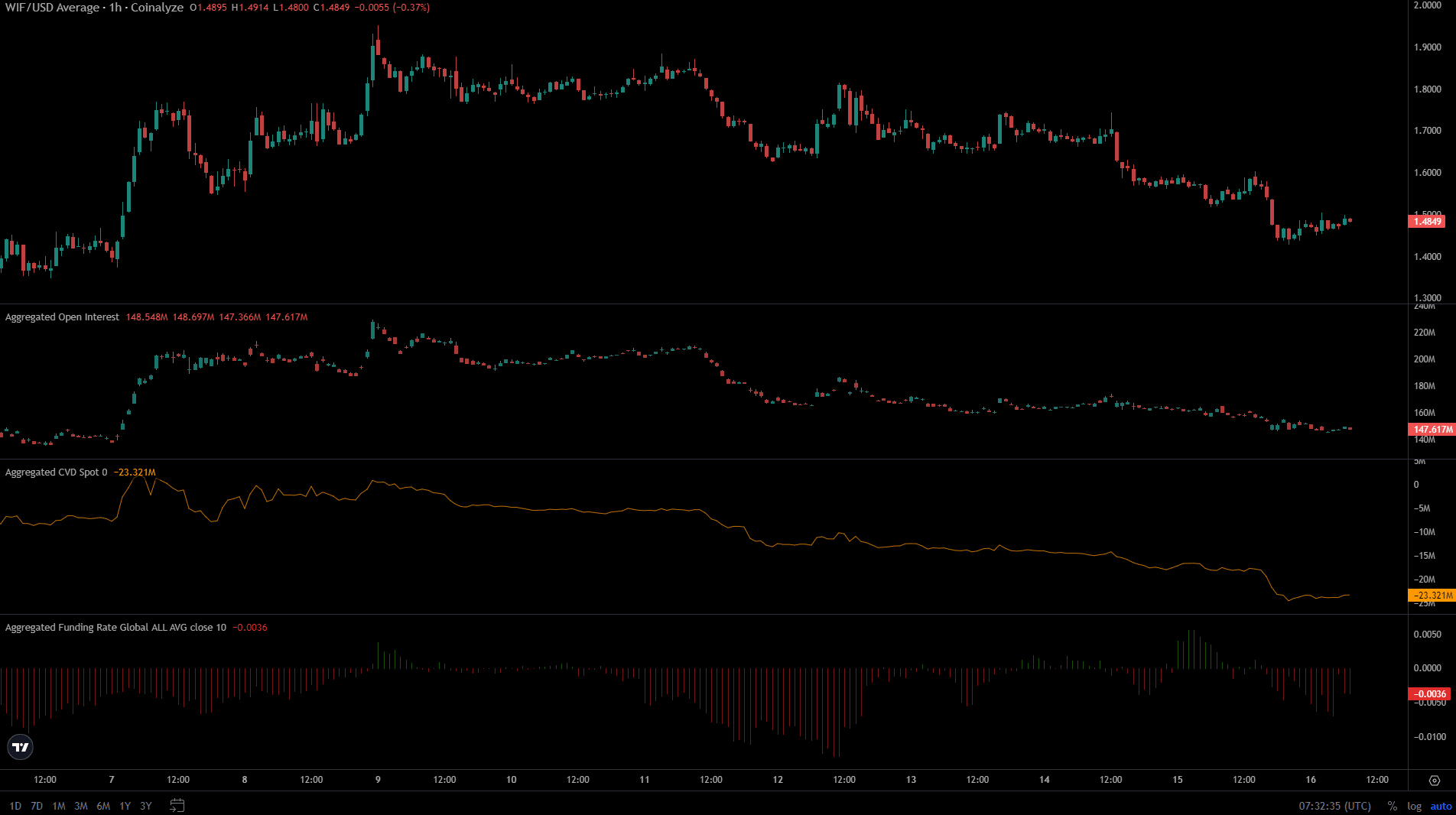

The data from the Futures market showed seller dominance. The Funding Rate was negative, indicating rampant short-selling. Also, the Open Interest has been in decline over the past week alongside the price.

Realistic or not, here’s WIF’s market cap in BTC’s terms

Together, they captured the market participants’ willingness to sell WIF. The spot CVD’s downtrend reinforced this perspective.

Hence, a move toward the local lows at $1.25 is likely to commence over the weekend.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion