Will EOS rise above its Q3 hurdles?

- Q3 was marked by a decline in network activity on the EOS network.

- Despite the steady fall in EOS’ price, the futures market continued to see positive funding rates.

Delegated proof-of-stake (DPoS) Layer 1 (L1) blockchain EOS Network [EOS] saw a decline in network activity and revenue between July and September, Messari found in a new report.

Is your portfolio green? Check out the EOS Profit Calculator

In the report titled “State of EOS Q3 2023,” the on-chain data provider found that the quarter was marked by a general decline in ecosystem growth metrics for the L1 network.

It was quiet on EOS

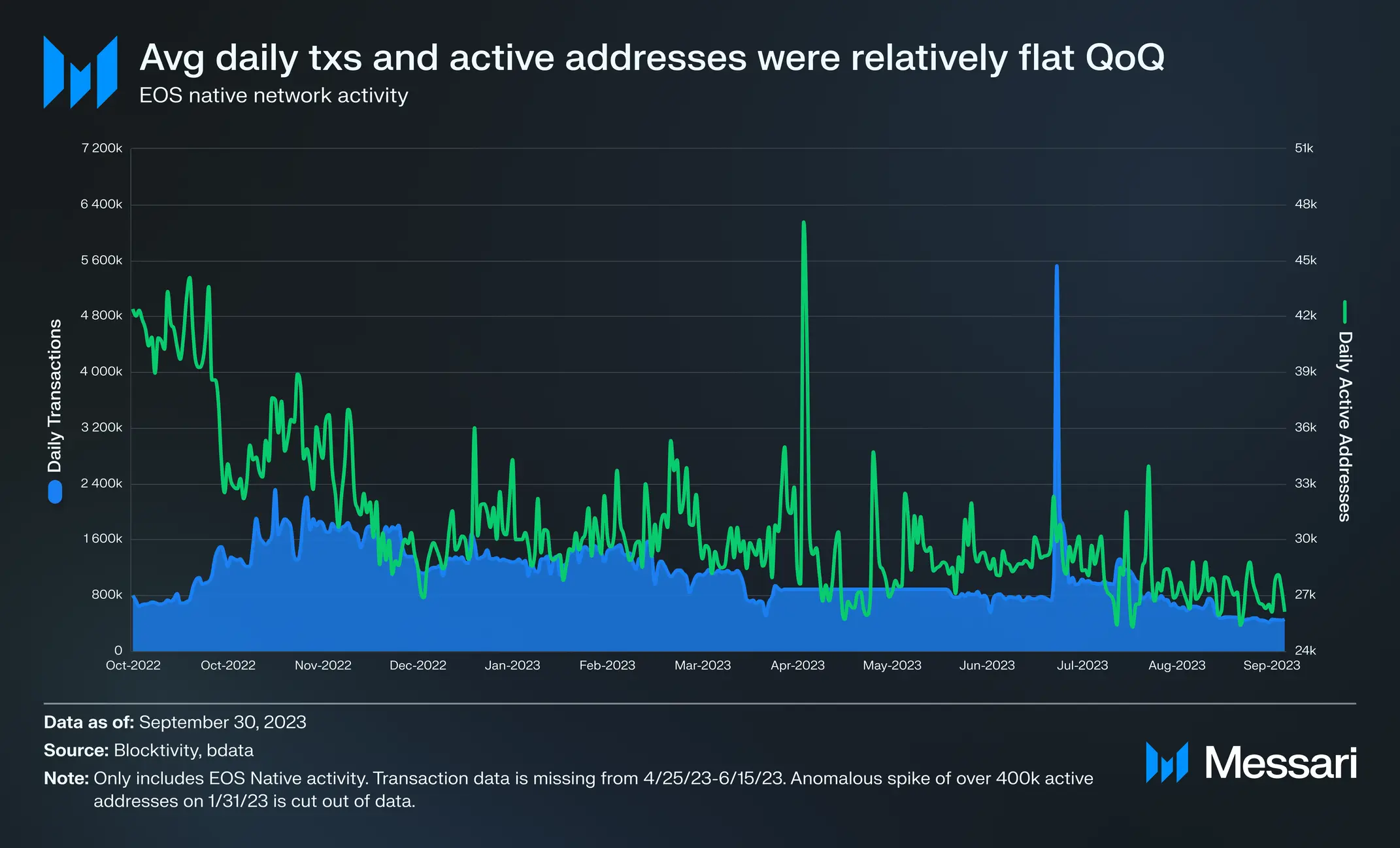

According to Messari, EOS recorded an average daily transaction count of 800,000 during the period under review. This represented a 6.3% decline from the 900,000 recorded in daily transaction count between April and June.

Messari further found that on 20 July, daily transactions on EOS rallied above 5.5 million, surpassing the year’s previous high.

Interestingly, there was no corresponding spike in active address count on the same day, causing Messari to opine that the surge in transactions count was “likely anomalous.”

Regarding addresses that completed transactions on the blockchain within the period under review, EOS registered a daily average count of 28,000 addresses, a 5% fall from the 29,000 daily average witnessed in Q2.

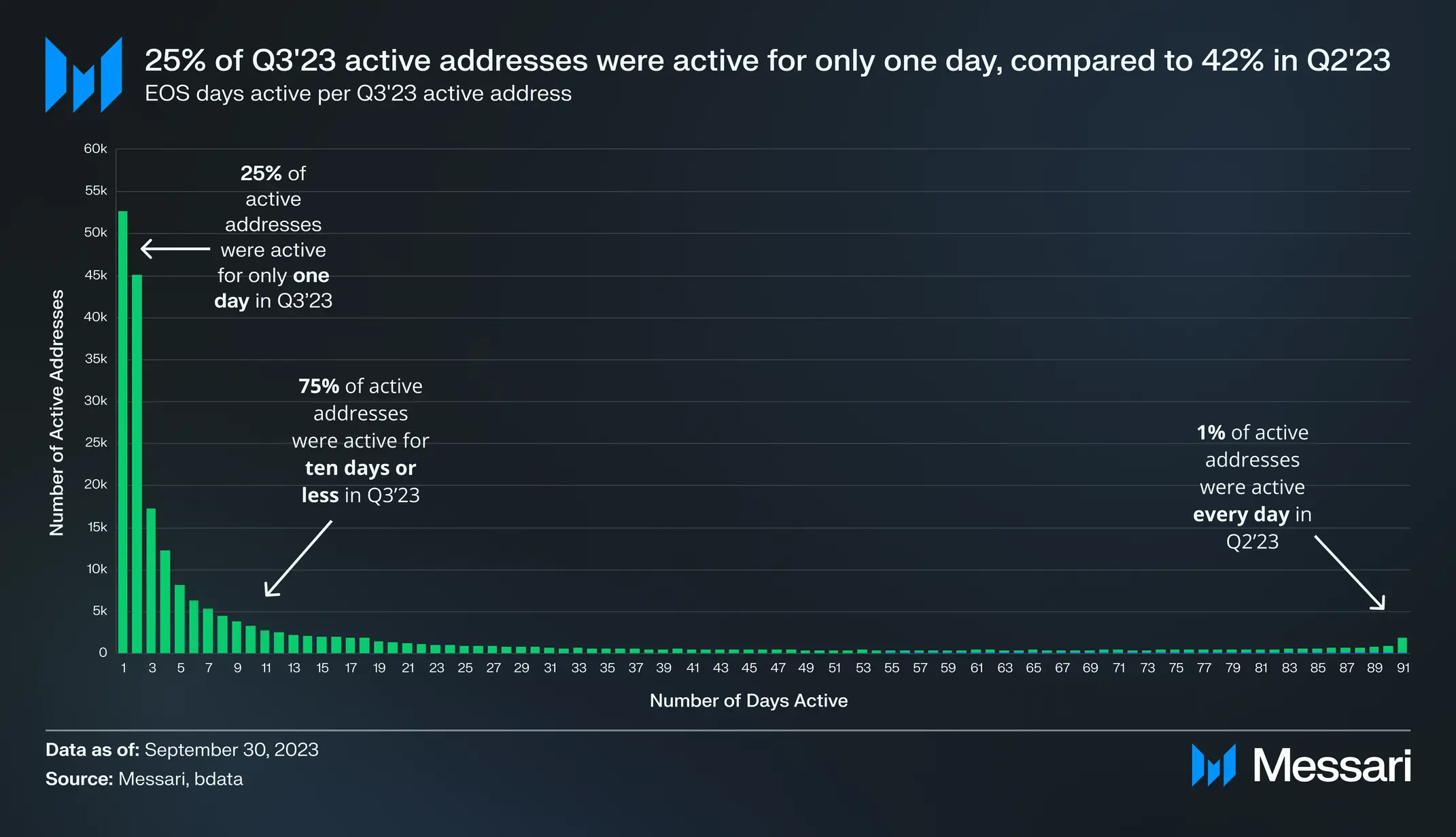

Moreover, the cumulative count of unique active addresses on EOS in Q3 was 212,000, declining by 39% quarter-over-quarter (QoQ). However, despite this shortfall, these addresses displayed a higher level of engagement when compared to Q2.

Messari assessed the duration of activity for each address and found that last quarter, only 25% of active addresses remained active for just one day, a notable contrast to the 42% recorded between April and May.

The report noted,

“75% of active addresses were active for ten days or less in Q3’23, compared to four days or less in Q2’23.”

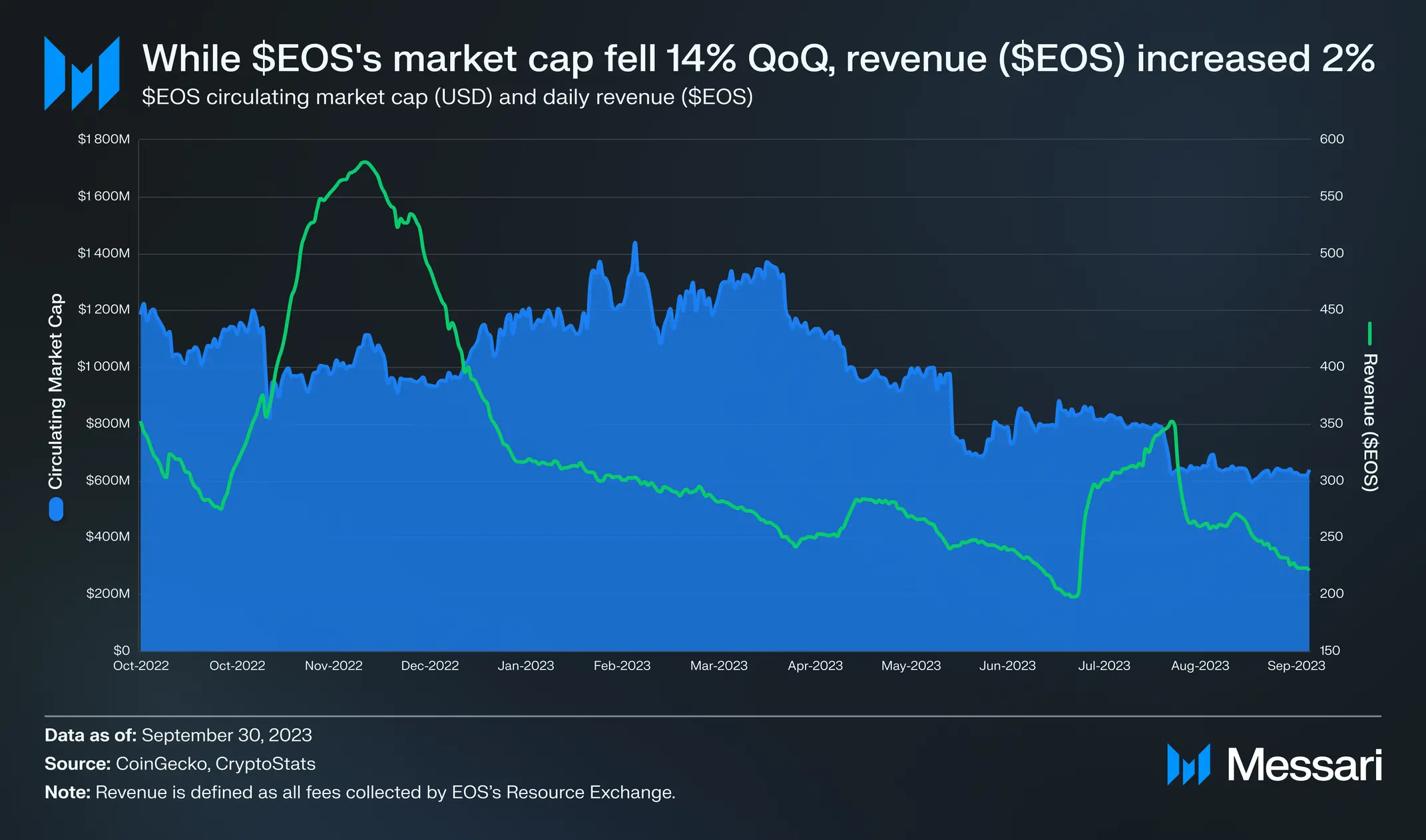

As for network revenue denominated in dollars, this fell by 29% in Q3. In the three-month period, EOS recorded only $16,000 in dollar-denominated revenue.

However, quarterly revenue denominated in the network’s native coin EOS grew by 2% despite the decline in the coin’s market capitalization and a drop in its value in Q3.

Realistic or not, here’s EOS’ market cap in BTC’s terms

Futures traders remain steadfast

On a YTD, EOS’ price has declined by almost 35%. At press time, the coin exchanged hands at $0.57, according to data from CoinMarketCap.

However, despite the steady drop in value in the past few quarters, traders in the alt’s futures market have mostly placed bets in favor of a price rally.

According to Coinglass, the year so far has been marked mainly by positive funding rates for EOS, signaling the persistence of bullish sentiments in the market in spite of the value decline.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)