Will Ethena [ENA] start 2025 with a 50% drop to $4.5? Assessing…

![Will Ethena [ENA] start 2025 with a 50% drop to $4.5? Assessing...](https://ambcrypto.com/wp-content/uploads/2025/01/ena-1200x675.webp)

- ENA has formed a head and shoulders pattern on its price chart, highlighting increased selling activity.

- An upcoming ENA token unlock is expected to amplify this pressure, potentially driving the asset’s value even lower.

Over the past week, Ethena [ENA] has already shed 11.89% of its market value, with losses extending into the last 24 hours as the token dropped another 2.01%.

Given the current market structure and prevailing bearish trends, ENA is likely to face further declines, with the price possibly establishing new lows.

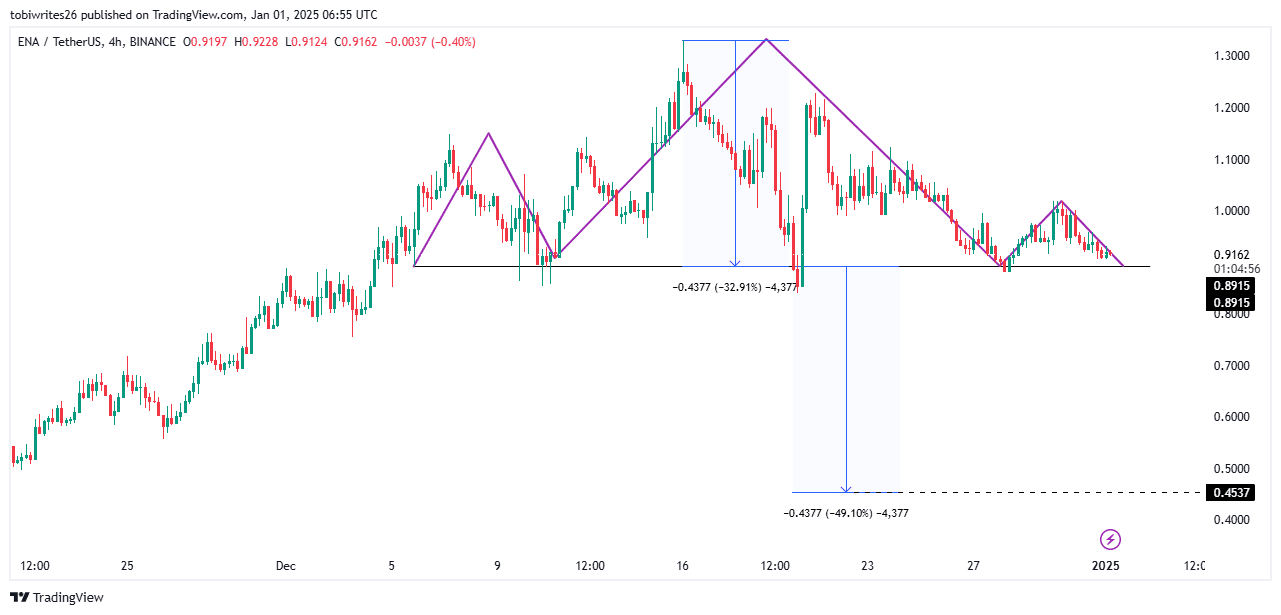

Head and shoulders pattern emerging on ENA chart

On the 4-hour chart, ENA appeared to be forming a head and shoulders pattern, a bearish technical signal. The pattern is nearly complete, potentially just one candlestick away from confirmation.

If the pattern fully forms, ENA could enter another bearish phase. A drop below the support level, commonly referred to as the neckline, would likely trigger a significant decline in price.

The chart indicates that ENA could fall to $0.454, representing a steep 49.10% drop from its current price of $0.92. Without a strong support to absorb the selling pressure at this level, the token could face even deeper losses.

Market activity has further contributed to the bearish outlook, with traders intensifying the ongoing selling pressure.

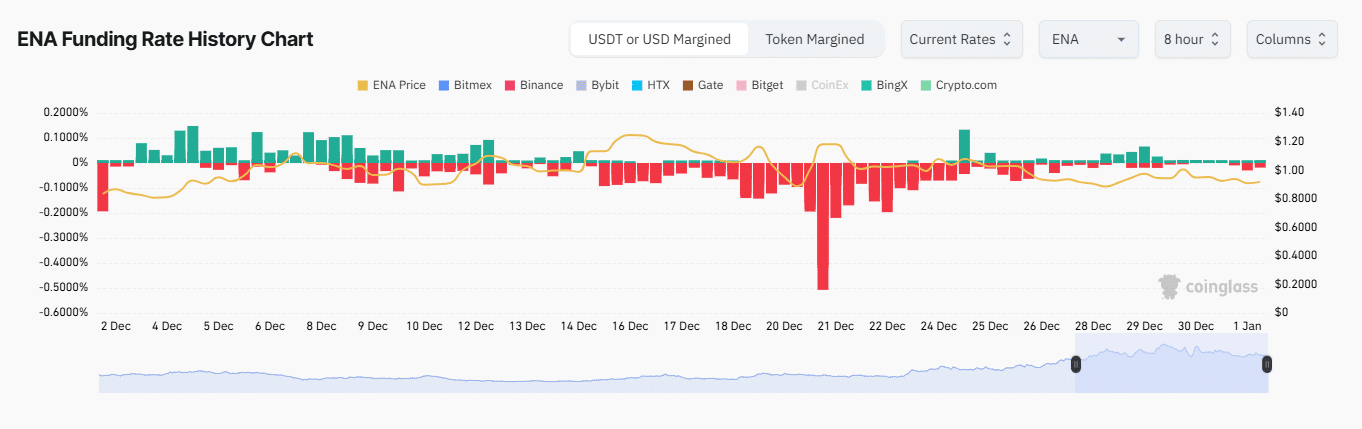

Selling pressure intensifies in the derivative market

The derivative market was experiencing high selling pressure, with sellers dominating trading activity.

As of press time, the Funding Rate stood at -0.0019%, firmly in negative territory.

A negative Funding Rate means that short traders are paying a premium to maintain their positions, reflecting a bearish sentiment in the market.

Should the Funding Rate decline further, ENA’s price could likely to face additional downward pressure, potentially reaching $4.5 as indicated on the chart.

ENA’s Open Interest has also dropped over the past 24 hours, decreasing by 2.43% to $558.53 million. This indicates a reduction in active positions, as market participants close trades amid mounting selling pressure.

This behavior is often a show of efforts to avoid liquidation and limit further losses, a key sign of diminishing confidence in the market.

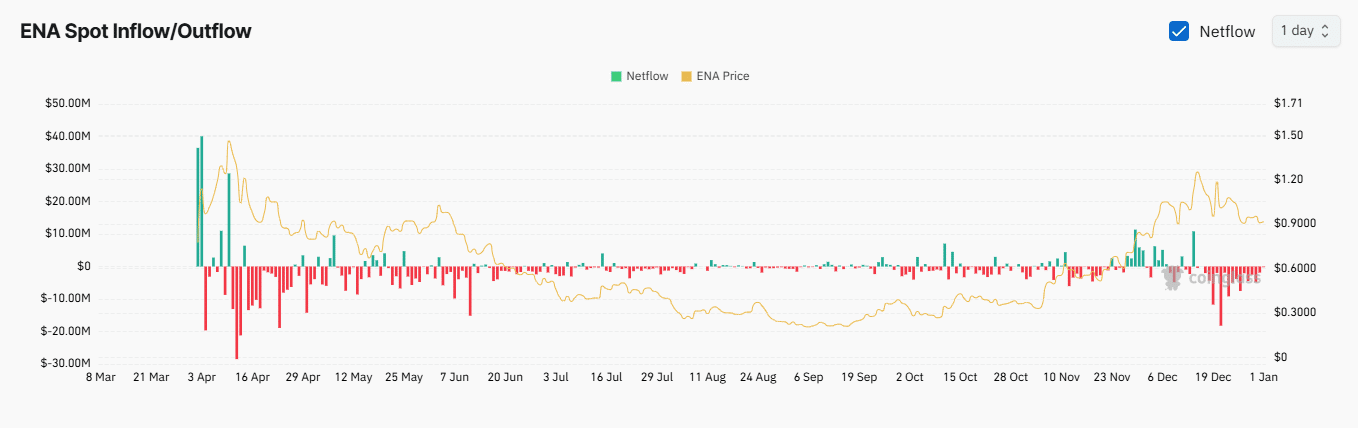

The Exchange NetFlow data supports this bearish outlook. Over the past four days, there has been a noticeable decrease in the volume of ENA tokens leaving exchanges.

A continued reduction in outward token flows means that more ENA tokens are remaining on exchanges, increasing the available supply. This surplus can add to selling pressure and further drive down the asset’s price.

ENA supply set to increase

According to Layergg, 12 million ENA tokens are scheduled to be unlocked and released into the market on the 1st of January. This will significantly increase the circulating supply of ENA.

Read Ethena’s [ENA] Price Prediction 2025–2026

The additional supply, combined with the prevailing bearish sentiment, could accelerate a price decline if there is insufficient demand to stabilize the market.

This scenario appears increasingly likely for ENA, given current market conditions.